Roth IRAs have become an increasingly popular retirement savings option due to their tax advantages and flexibility. However, many individuals wonder if they can have multiple Roth IRAs and how this might impact their financial strategies.

How many roth IRAs can you have?

The simple answer is that yes, you can have multiple Roth IRAs. The number of Roth IRAs you can have is unlimited.

However, there is more to Roth IRAs than you might realize and understand.

In this article, we will explore the basics of Roth IRAs, contribution limits, advantages and disadvantages of having multiple accounts, strategies for maximizing contributions, rules for rollovers and transfers, tax implications, and factors to consider when deciding on multiple Roth IRAs.

What is a Roth IRA?

A Roth Individual Retirement Account, or Roth IRA, is a type of retirement account that offers tax advantages to individuals who meet certain income requirements. Unlike traditional IRAs, contributions to a Roth IRA are not tax-deductible. However, the key benefit of a Roth IRA lies in the fact that qualified withdrawals made during retirement are tax-free. This means that any earnings on contributions, as well as the contributed amount itself, can be withdrawn without incurring any additional taxes.

To open a Roth IRA, individuals must have earned income in 2024, the contribution limit for a Roth IRA is $7,000 for those under the age of 50, and $8,000 for individuals aged 50 and older, known as the catch-up contribution.

Contribution Limits for Roth IRAs

Understanding the contribution limits for Roth IRAs is crucial to maximize the benefits of this retirement account. As mentioned earlier, the contribution limit for 2024 is $7,000 for individuals under the age of 50. However, it is essential to note that there are certain income restrictions when it comes to contributions.

For single filers, the ability to contribute to a Roth IRA gradually phases out once their adjusted gross income (AGI) exceeds $146,000. Once the AGI reaches $161,000 or higher, no contribution can be made. Similarly, for married individuals filing jointly, the phase-out range begins at $230,000 and contributions are completely disallowed above $240,000.

It is important to consult with a financial advisor or tax professional to determine the specific contribution limits that apply to your individual circumstances. By staying within the designated limits, you can ensure that your contributions remain eligible for the tax advantages associated with Roth IRAs.

Can I Have Multiple Roth IRAs?

Yes, you can have multiple Roth IRAs. The IRS does not limit the number of Roth IRA accounts one individual can maintain. This flexibility allows potential retirement savers to diversify their investments and explore various financial institutions or brokerage firms.

Having multiple Roth IRAs can provide certain advantages, including the ability to take advantage of different investment opportunities or access to a wider range of financial services. For example, it may be beneficial to have one Roth IRA invested in stocks and another focused on real estate or bonds. Furthermore, having multiple accounts can provide an added layer of security, as they may be held at different financial institutions, safeguarding against potential account closures or disruptions.

However, it is essential to keep in mind that the contribution limits still apply across all of your Roth IRAs. This means that the combined total of your annual contributions across all accounts must not exceed the annual limit set by the IRS. Proper record-keeping and adherence to contribution limits is vital to avoid potential penalties or interest charges.

Advantages and Disadvantages of Having Multiple Roth IRAs

Having multiple Roth IRAs offers several advantages. First, it allows you to diversify your investments across different accounts, spreading the risk and potentially maximizing returns. By investing in various asset classes or choosing different financial institutions, you can ensure a balanced portfolio and reduce the impact of market fluctuations on your overall retirement savings.

Additionally, having multiple Roth IRAs can provide increased flexibility and control over your retirement funds. It allows you to tailor each account to specific financial goals or investment strategies. For example, you may want one Roth IRA to focus on long-term growth while another IRA could be designated for more conservative investments that generate regular income.

On the other hand, there are some disadvantages to consider when deciding to have multiple Roth IRAs. One potential downside is the administrative complexity of managing multiple accounts. This includes keeping track of contributions, earnings, and required minimum distributions (RMDs) – once you reach the age of 72 – for each account separately.

Moreover, maintaining multiple Roth IRAs may result in additional account fees, especially if each account has a minimum balance requirement or charges recurring maintenance fees. These costs can eat into your overall investment returns and impact the growth of your retirement savings.

Strategies for Maximizing Roth IRA Contributions

Maximizing your contributions to Roth IRAs is crucial to make the most of this retirement savings vehicle. Here are a few strategies to help you optimize your Roth IRA savings:

Firstly, start contributing early and contribute consistently. By contributing the maximum allowed amount each year, you can take full advantage of compound interest and the potential for long-term growth. Even if you can’t contribute the maximum amount, making regular contributions can still have a significant impact on your retirement savings.

Another effective strategy is to automate your contributions. Set up automatic transfers or payroll deductions to ensure that your contributions are made consistently. This eliminates the need for manual transfers and makes it easier to stick to your savings goals.

If you receive a raise or a bonus, consider allocating a portion of those additional earnings towards your Roth IRA. By redirecting windfalls or increased income towards your retirement savings, you can accelerate your progress and increase your contributions without affecting your day-to-day expenses.

Navigating the Rules for Roth IRA Rollovers and Transfers

Transferring or rolling over funds from one Roth IRA to another can provide greater investment opportunities or consolidate accounts for easier management. It’s important to understand the rules and requirements when it comes to Roth IRA rollovers and transfers.

The IRS allows individuals to complete direct transfers between qualifying Roth IRAs without incurring tax consequences, as long as the funds are transferred directly from one custodian to another. This can be done as often as desired and is typically a simple process facilitated between financial institutions.

Alternatively, individuals may choose to complete a rollover, which involves taking a distribution from one Roth IRA and depositing it into another Roth IRA account within 60 days. It’s important to note that in this case, there may be tax implications if not completed within the specified timeframe, and withholding requirements may apply.

Before initiating a transfer or rollover, consult with a financial advisor or tax professional to ensure compliance with IRS regulations and to understand any potential tax implications or penalties associated with the process.

Tax Implications of Multiple Roth IRAs

One of the key advantages of a Roth IRA is its tax-free growth and tax-free qualified withdrawals in retirement. However, it’s important to understand the tax implications of having multiple Roth IRAs.

Since contributions to a Roth IRA are made with after-tax dollars, you can generally withdraw your contributions at any time without incurring taxes or penalties. However, the earnings on those contributions are subject to specific rules for tax-free withdrawal.

When it comes to tax-free qualified withdrawals, the IRS aggregates the earnings from all of your Roth IRAs. This means that to be considered a qualified withdrawal, you must meet certain criteria based on the combined balance of all your accounts. The five-year rule also applies, which requires at least five years to have passed since your initial Roth IRA contribution before any earnings can be withdrawn tax-free.

By understanding these rules and keeping proper records, you can effectively manage your multiple Roth IRAs and ensure that your withdrawals align with the necessary requirements for tax-free treatment.

Planning for Retirement: Factors to Consider When Deciding on Multiple Roth IRAs

Deciding whether to have multiple Roth IRAs is a personal choice that depends on your individual financial goals and circumstances. Consider the following factors when planning for retirement and deciding on multiple Roth IRAs:

- Diversification: Having multiple Roth IRAs allows you to diversify your investments, reducing risk and potentially maximizing returns. Consider spreading your investments across different asset classes or financial institutions to create a well-balanced portfolio.

- Investment Opportunities: Different financial institutions may offer unique investment options or access to specialized funds. Evaluate different providers to identify the opportunities that align with your investment strategy.

- Administrative Complexity: Managing multiple accounts may result in increased administrative tasks, such as record keeping and tracking RMDs for each account. Assess your ability to handle these tasks effectively and consider the potential added complexity.

- Account Fees: Maintain a clear understanding of the fees associated with each Roth IRA account. Watch out for maintenance fees, transaction fees, or any other charges that may impact your overall investment returns.

- Financial Goals: Consider your retirement savings goals and how multiple Roth IRAs can help you achieve them. Review your long-term plans and assess whether having multiple accounts aligns with your objectives.

Conclusion

In conclusion, while there is no limit to the number of Roth IRAs you can have, the total contributions across all accounts must adhere to the IRS annual contribution limits. Having multiple Roth IRAs can provide diversification and flexibility in retirement planning but also involves added complexities.

By understanding the rules, tax implications, and considering your individual circumstances, you can determine whether having multiple Roth IRAs aligns with your financial goals and aspirations for a secure retirement.

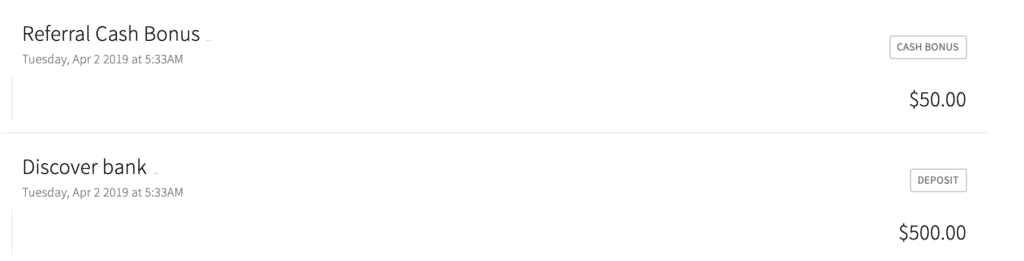

M1 Finance is a free investing app that I highly recommend. It’s my favorite fintech/robo-advisor investing app and one that is great for anyone looking to start investing and that wants to make sure they’re doing it correctly. M1 Finance is also currently offering a $100 referral bonus if you sign up using a referral link. To earn your M1 Finance referral bonus, you have to do the following:

- Open an M1 Finance account using a referral link (here is my referral link). You can open either a taxable brokerage account or a retirement account such as an IRA or Roth IRA. I recommend opening a taxable M1 Finance brokerage account, as it will make earning the bonus easier. Annoyingly, the referral link doesn’t show the bonus terms, but you can see the current referral terms here: https://m1.com/100-referral/. That’s where I got my referral link that is in this post.

- Fund your account with at least $10,000.

- Leave the $10,000 in your account for at least 30 days.

- You’ll receive your $100 bonus 14 business days after meeting these requirements. Note that you’ll need to have a taxable M1 Finance brokerage account to get the bonus (M1 Finance can’t put money into a tax-advantaged account like an IRA or Roth IRA).

In this post, I’ll walk you through exactly what you need to do to earn your M1 Finance referral bonus and give you my thoughts as to why I think M1 Finance is an investing platform that’s worth using.

One important thing to know is that you do not have to invest the funds that you deposit into your M1 Finance account to be eligible for the referral bonus. So, if you only want to get the bonus and don’t actually want to invest using M1 Finance, your best bet is to open a taxable account, fund it with $10,000, and then leave it in your account in cash for 30 days. We’ll talk about this tactic more later in this post.

What Is M1 Finance?

M1 Finance is an investing app that offers taxable investment accounts, as well as tax-advantaged retirement accounts in the form of IRAs, Roth IRAs, and SEP IRAs. The app is what you could call a roboadvisor. Rather than manually choosing each investment, M1 Finance instead uses a pie-based interface. When you invest, you select your pie and M1 Finance will automatically distribute your contributions in the percentages you’ve set up in your pies.

There are two ways to create a pie. You can either create your own custom pie or you can use M1 Finance’s expert pies. I generally recommend using M1 Finance’s expert pies if you aren’t exactly sure what you’re doing or if you aren’t comfortable creating your own pie. Even if you create your own pie, remember that when it comes to investing, simpler is often better.

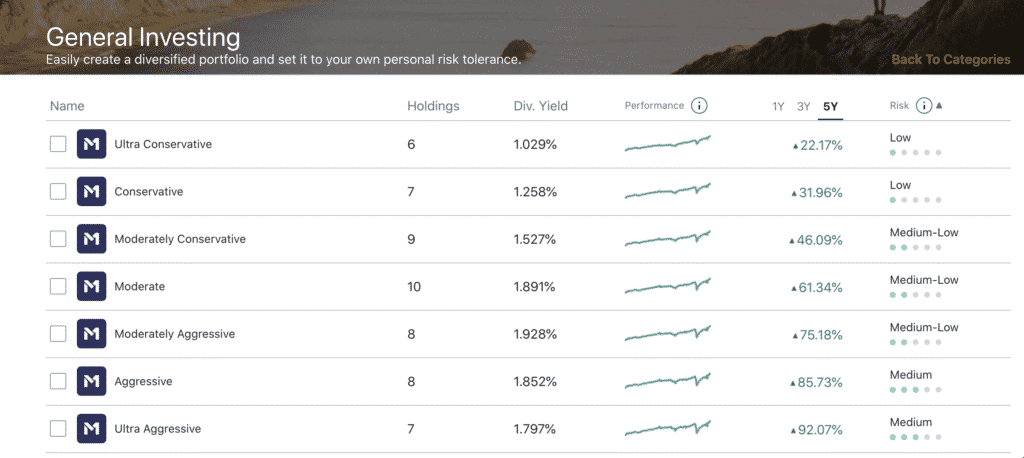

M1 Finance has a lot of expert pies. For example, under general investing, you can pick your investment pie based on how aggressive or conservative you want to be. Each pie consists of low-cost Vanguard index fund ETFs, which are empirically one of the best ways to invest.

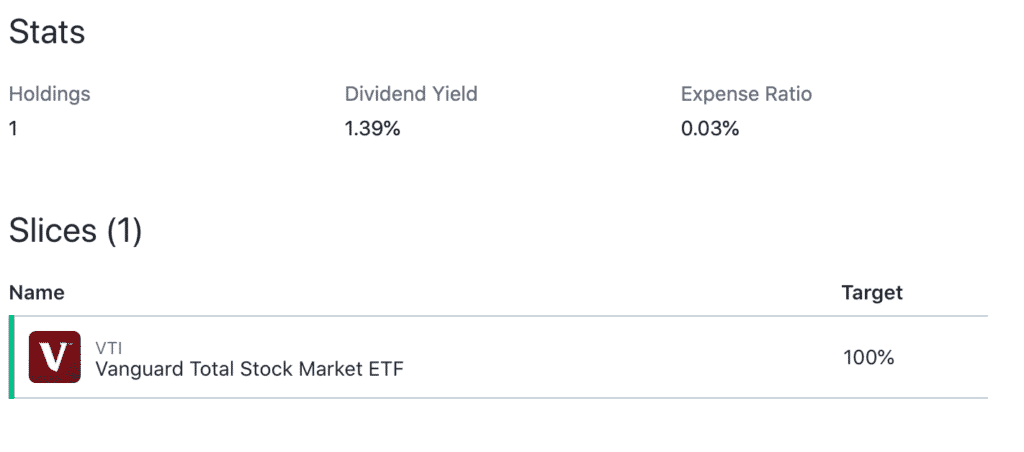

I like to keep things simple when I invest, so my pie consists of a single investment, the Vanguard Total Stock Market ETF (VTI). This is a highly diversified index ETF that invests in every publicly traded company in the United States. Since I’m young and still have a long investing horizon, it’s fine for me to invest in this single ETF.

What makes M1 Finance unique among roboadvisors is that they charge no management fees of any kind. Other roboadvisors such as Betterment or Wealthfront typically charge a management fee of 0.25%. This makes M1 Finance one of the only free roboadvisors currently on the market.

What makes M1 Finance unique among roboadvisors is that they charge no management fees of any kind. Other roboadvisors such as Betterment or Wealthfront typically charge a management fee of 0.25%. This makes M1 Finance one of the only free roboadvisors currently on the market.

M1 Finance Referral Bonus Step-By-Step Directions

M1 Finance is an excellent option if you’re looking to invest in either a taxable account or a tax-advantaged retirement account. I invest directly with Vanguard for my Roth IRA, but I use M1 Finance as a taxable account that I contribute to every month.

Even if you have no interest in investing using M1 Finance, it can still be worth opening an M1 Finance account simply to collect the referral bonus. Importantly, M1 Finance has no fees, so you can easily open an account, earn your bonus, and then take your money out. In addition, earning the M1 Finance referral bonus doesn’t require you to actually invest your money once you contribute to your account. If you want, you can simply opt not to create an investment pie and leave your money as cash.

That said, here are the step-by-step directions you can follow to earn your M1 Finance referral bonus:

1. Open An M1 Finance Account Using A Referral Link. To earn your $100 M1 Finance Referral bonus, first open an M1 Finance account using a referral link. Here is my M1 Finance referral link. The referral link stupidly doesn’t show the terms or even provide any indication that it is a referral link, but you can see the referral bonus terms at this link: https://m1.com/100-referral/. That link is where I generated my referral link.

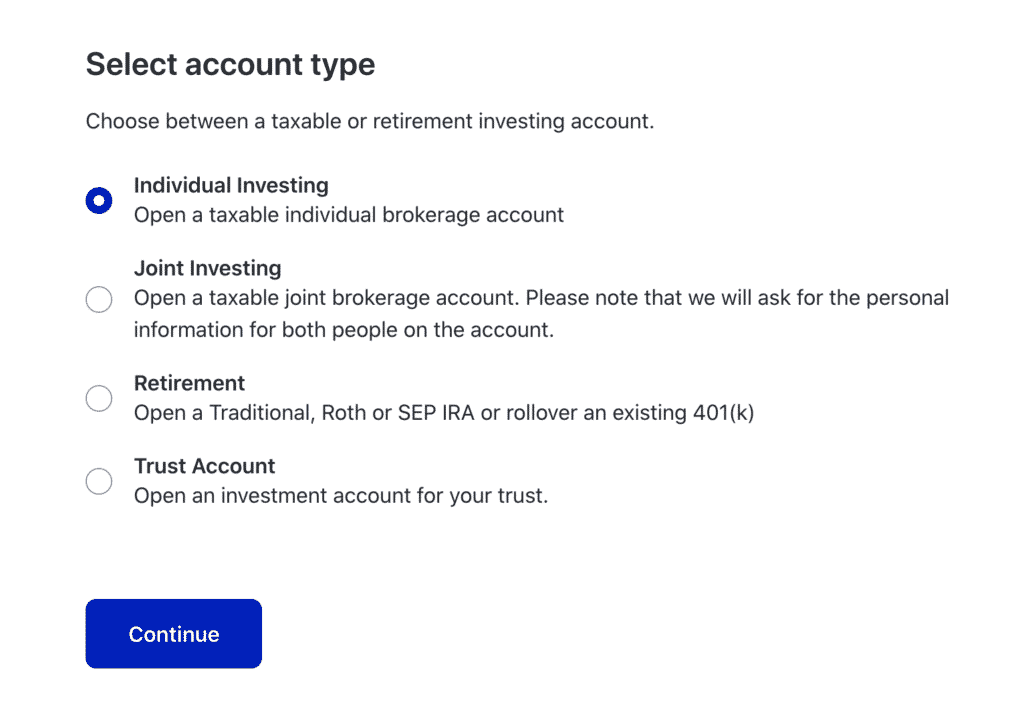

I recommend opening an Individual Investing account, as shown below.

![]()

2. Fund Your Account With $10,000 Or More. Next, deposit $10,000 or more into your new M1 Finance account. Remember that you do not have to actually invest the money you put into the account. You can simply opt not to create a pie. Your money will then sit as cash in your account, which you can then withdraw later without any risk of loss.

3. Leave $10,000 In Your M1 Finance Account For 30 Days. The referral bonus terms require you to leave at least $10,000 in your M1 Finance account for 30 days. I recommend setting a calendar reminder 30 days into the future so you remember to check your account.

4. Your Bonus Will Post 14 Business Days After Meeting The Above Requirements. If you left $10,000 or more in your M1 Finance account, your bonus will post within 14 business days after the 30 days have passed. In my experience, the bonus usually posts sooner than that, but the terms do state it will take 14 business days.

Refer Your Friends For Additional Bonuses

M1 Finance also allows you to refer your friends and family members, which means you can earn more money by referring people that you know. You can find your referral link in the settings section of the app.

The referral bonus is normally $10, but occasionally, M1 Finance increases the referral bonus to higher amounts. There’s no way to predict when the referral bonus will increase or decrease, unfortunately. If you’re reading this and the referral bonus is more than $10, I’d recommend jumping on it right away. Whether or not it’s worth waiting for a potentially larger bonus is up to you – just be aware you might be waiting a while if you do wait for a higher bonus.

If you want to earn additional referral bonuses, consider sending your friends and family your M1 Finance link and walking them through the process. You can even copy and paste the directions in this post if you’d like.

Final Thoughts

M1 Finance is an excellent investing app that I personally use. It’s especially good for beginning investors who want to make sure their investments are properly diversified and that they have an appropriate asset allocation.

What makes M1 Finance particularly good is its fees. They charge no management fees and all their investment options are low-cost, index ETFs from Vanguard. There’s really no downside to M1 Finance, in my opinion.

The fact that you can earn a referral bonus for opening an M1 Finance account is the cherry on top that makes M1 Finance, in my opinion, the best roboadvisor and best investing app out there.

Moomoo is a free stock trading app that allows users to buy and sell stocks with no fees or commissions. It’s an app very similar to Webull, with almost the same interface. The Moomoo referral bonus offer seems to change slightly every month. We will update this post every month to make sure we try to have the latest promotion showing.

Moomoo is currently offering new users a different bonus offer depending on how much they deposit. See the chart below.

See the current terms here.

Here’s what you need to do to earn your Moomoo referral bonus:

- Open a Moomoo account using a referral link (here is my Moomoo referral link).

- Deposit $100 into your Moomoo account and you’ll 5 free stocks (worth between $2 and $2,000 each).

OR, Deposit $1,000 into your Moomoo account and you’ll 15 free stocks (worth between $2 and $2,000 each).

In the remainder of this post, I’ll walk you through exactly how to earn your Moomoo referral bonus and provide some more information about what Moomoo is and how the app works.

What Is Moomoo?

Moomoo is a free brokerage app that allows you to invest in individual stocks and exchange-traded funds (ETFs). The app is very similar to other stock trading apps like WeBull, Robinhood, and Public (as well as apps like SoFi Invest). Like those apps, Moomoo doesn’t charge any commission or management fees. That means you can use Moomoo to buy and sell stocks for free.

As a brokerage app, I think Moomoo is fine and can get the job done, but I find the interface too complicated to use. I personally use M1 Finance as my primary investing app because they have more of an emphasis on index investing and have what I think is a better interface.

That being said, even though I don’t use Moomoo as my primary investing app, it’s still worth opening a Moomoo account for the signup bonus. It’s a free investing app, so there’s really no downside to opening an account and getting your bonus.

With that being said, let’s get into how to earn your Moomoo referral bonus.

Moomoo Referral Bonus Step-By-Step Instructions

Here are the step-by-step instructions to earn your Moomoo referral bonus:

1. Open Your Moomoo Account Using A Referral Link

The first thing you’ll need to do is open a Moomoo account using a referral link. Here’s my Moomoo referral link which you can use if you’d like to earn your Moomoo referral bonus.

Opening a Moomoo account is straightforward, so I won’t go into detail about that process here. Moomoo doesn’t do any credit checks, so opening an account won’t have any impact on your credit. Just follow the directions in the app.

2. Fund Your Moomoo Account With $100 Or More

Once you’ve opened your account, you’ll next need to link your bank to Moomoo, then fund your account with whatever amount you want. To maximize your bonus, you should fund your account with $5,000 or more.

It’ll take several business days for your deposit to clear your account. After your deposit clears, you’ll be able to “draw” your stocks based on the amount of money you deposit.

Deposit $100 to receive 5 stocks,

OR Deposit $1,000 to receive 15 stocks

Remember, you don’t have to invest your funds to earn your free stocks. You only have to deposit the money into your Moomoo account. That way, you don’t risk losing any money.

3. Keep the Money in Your Account for 60 days to Unlock Your Stocks.

You’ll be eligible to “draw” your free stocks after your deposit clears. It’s important that you claim your free stocks in the app. The stocks do not automatically post into your account and if you do not claim them, they will eventually expire.

The option to claim your free stocks should automatically pop up within the Moomoo app, but if not, you’ll need to go to the “Me” section of the app and search for the section that lets you claim your free stock. This goes to the confusing nature of this app – you’ll have to play around in the app for a bit to figure out how it works and where to find everything.

Here’s what it looked like when I was able to draw one of my stocks:

The most important thing is that you will need to maintain your deposit amount for 60 days to unlock the stocks you drew. So if you deposit $1,000, you must maintain a balance of $1,000 for 60 days to unlock the 15 stocks you drew.

Once you get your free stocks, you can either keep them or sell them. I personally sold all my free stocks, then withdrew my money a week later.

Refer Your Friends For More Moomoo Referral Bonuses

In addition to opening a Moomoo account for the Moomoo referral bonus, I also recommend opening a Moomoo account so you can refer other people using your own referral link. You’ll find your referral link in the “Me” section of the app. There’s a big button in that section that says “Invite Friends.”

If you have a spouse or partner, this is an easy way to make even more from Moomoo. What you’ll do is first open your Moomoo account and get your referral bonus, then you’ll refer your spouse or partner. You’ll get a bonus for referring them and they’ll get a bonus for using your link. If you do this, you’ll essentially end up getting 3 bonuses without having to do much work.

Final Thoughts

Moomoo is the newest of these investing apps that offer commission-free trades. It seems like these apps are getting a lot of funding and are using that funding to attract customers. Whether or not you want to use these apps, it’s worth taking advantage of them to get your free stocks. There’s money being spent out there to acquire new users – so you might as well get your share of it.

Since Moomoo is a free brokerage app, there’s no real downside to opening a Moomoo account to earn the referral bonus. Yes, the app is clunky and not very intuitive, but it doesn’t really matter if you’re only opening the account to earn the referral bonus.

At a minimum, you’ll earn a decent amount of free stocks, sell it all, then withdraw all your money. In a better scenario, you’ll even have a few people you can refer to Moomoo with your link.

I hope this information helps! Feel free to use my referral link and leave a comment below if you have any questions.

Webull is a free stock trading app that allows you to buy and sell stocks with no fees or commissions. The app makes buying and selling stocks very easy for the average investor. The Webull referral bonus offer seems to change slightly every month. We will update this post every month to make sure we try to have the latest promotion showing.

Currently, Webull is offering a referral bonus where you can get up to 3, 30 or 75 free shares of stocks after opening a Webull account and making a deposit into your account. To earn your Webull referral bonus, you have to do the following:

- Open a Webull account using a referral link (here is my Webull referral link).

- If you deposit anything into your account, you will receive 3 free fractional shares of stock worth between $3 and $3,000 each.

- If you deposit at least $500 into your account, you will receive 30 free fractional shares of stock worth between $3 and $3,000 each.

- If you deposit at least $25,000 into your account, you will receive 75 free fractional shares of stock worth between $3 and $3,000 each.

At a minimum, you’ll receive $9 worth of free stock after your deposit. In my experience, the stocks you receive are more valuable than that, so you should ideally earn more for your deposit.

In the remainder of this post, I’ll walk you through exactly how to earn your Webull referral bonus and provide some more information about what Webull is and how it works.

What Is Webull?

Webull is a free brokerage app that allows you to invest in both individual stocks and exchange-traded funds (ETFs). The app offers both taxable brokerage accounts and tax-advantaged accounts in the form of IRAs and Roth IRAs.

Importantly, Webull charges no commission fees or management fees, which means you can use Webull to buy and sell stocks for free. There are several similar apps like this on the market – Moomoo, Robinhood, and SoFi Invest come to mind and work in essentially the same manner.

If you’re looking for a brokerage account to buy and sell individual stocks and ETFs, Webull is fine for this, but not one I would particularly recommend as a primary investment account. My main issue with Webull is that I find the interface confusing and not particularly user-friendly.

That said, I do think it’s worth opening an account with Webull solely to get the signup bonus and give yourself the option to earn more bonuses by referring friends and family members. Since it’s free, there’s really no downside.

Webull Referral Bonus Step-By-Step Instructions

Here are the step-by-step instructions you can follow to earn your Webull referral bonus:

1. Open Your Webull Account Using A Referral Link

The first step to earn your Webull referral bonus is to open a Webull account using a referral link. Here’s my referral link if you want to earn your Webull bonus and support this site.

You’ll need to open an individual taxable account. I believe Webull calls this a cash account. Do not open an IRA or Roth IRA, as those types of accounts are not eligible for the signup bonus.

Note that Webull does not do any credit checks, so opening a Webull account has no impact on your credit.

2. Fund Your Webull Account Any Amount

Once you’ve opened your Webull account, fund it. Be sure to do this right away so that you don’t forget. It takes 5 business days for your deposit to settle.

The important thing to know is that you don’t actually have to invest the funds that you deposit. If you’re not planning to actually use Webull and are just looking to get the free stocks, then you should leave your deposit as cash in your Webull account. That way, you can withdraw it later without any risk that your deposit loses value.

3. Once Your Funds Settle, You’ll Get Your Free Stocks Within 15 Trading Days

After you make your deposit, you’ll have to wait a few days for your funds to settle (Webull states it takes 5 business days for your funds to settle). Once your deposit settles, you’ll get your free stocks within 15 trading days.

4. Claim Your Free Stocks In The App

The annoying thing about Webull is that they make you claim your free stocks, rather than posting them automatically in your account. You can only claim your free stocks via the Webull app, so you’ll need to download the app to claim your stocks. When your free stocks are available, you should receive an email and a push notification telling you to claim them.

To claim your free stocks, open the Webull app, click the “menu” button (this should be in the bottom right corner of the app), click “my free stock”, then click the “get” button. Your free stocks will post into your account within 10 business days. After that, you can either keep the stocks or sell them and withdraw your funds.

As to the type of stocks you’ll receive, Webull has different odds based on the value of the stock. You essentially have a 1% chance of getting a very high-value stock such as Google or Facebook. Much more likely, you’ll get a lower value share of a stock. In my experience, it seems like most of the shares you will get tend to be in the $3 to $5 range, but let me know in the comments if you’re seeing differently.

Refer Your Friends For More Webull Referral Bonuses

One reason I recommend opening a Webull account is so that you can use your own referral link to refer people and make some more money (while also helping your friends and family too). When you open a Webull account, you will receive a referral link that allows you to refer other people.

To find your referral link, go to the section in the app where you can claim your free stock (click menu, then click my free stock). At the top of the page, you’ll see a button that says “invitation bonus.” Click that, then click “invite now” to get your referral link.

If you have a spouse or partner, this is an easy way to make Webull work for you even more. Open your own Webull account first and get your referral bonus. Then refer your spouse or partner. You’ll get a bonus for referring them and they’ll get a bonus for using your link. If you do this, you’ll end up getting 3 bonuses without having to do much work.

Final Thoughts

I consider Webull an average investing app. If you’re looking to invest in individual stocks or ETFs, it does the job. Importantly, it’s free and charges no fees or commissions, so there’s no real downside to using Webull as your investment app.

My main problem with Webull is that I find the app clunky and not particularly intuitive. I consider myself knowledgeable when it comes to investing and even I have difficulty figuring out where everything is within the Webull app. I’m also not a fan of investing in individual stocks, so apps like Robinhood and Webull don’t really fit within my investment philosophy. Instead, I’m a fan of passive index investing, so an app like M1 Finance makes more sense for me.

That said, Webull does offer free stocks simply for depositing a small amount into the account, which you can then pull out immediately. As a result, I do recommend using Webull to at least get your free stocks. They’ve been doing this promotion for years and I have no idea when they’ll stop giving away free stocks, but it’s best to take advantage of these things while you can.

I’m always on the lookout for good high-yield savings accounts and I recently found one that I think is the best high-yield savings account option currently out there. It’s called Raisin and when you open a Raisin account, you gain access to 40 banks and credit unions, most of which are offering high-yield savings accounts with 5% interest or more (Current highest rate: 5.32%). Perhaps most important, Raisin is free and all of your funds in Raisin are FDIC-insured or NCUA-insured. This makes Raisin a no-brainer account that – in my view – everyone should open.

Taking advantage of these mega-high-yield savings accounts is one of the first things I recommend people do when setting up their money system. Years ago (back when high-yield savings accounts offered interest rates of about 1%), I wrote about how I maximize my cash savings by using 5% interest savings accounts from Netspend, DCU, and others. These accounts still exist today, but their value is fairly muted at this point. With all of the better options out there, I no longer recommend anyone jump through the hoops of opening multiple 5% interest accounts to maximize their cash savings.

The great thing about Raisin, however, is that, unlike the original 5% interest accounts that I used to recommend, Raisin doesn’t require jumping through any hoops. Opening a Raisin account takes minutes to complete and as I mentioned before, it’s free and all of your funds are FDIC-insured.

With all that said, in this Raisin review, I want to go over what Raisin is, discuss how it works, and explain why I’m now using Raisin to store my emergency fund and any other cash savings I have.

What Is Raisin?

At the outset, when I first discovered Raisin, I was really confused about what it was. It advertised itself as a one-stop savings marketplace for different banks and credit unions, which in itself, doesn’t really tell me anything. Was this a bank account or was it some sort of list that showed you the banks paying the highest interest rates? I wasn’t quite sure.

Once I opened my Raisin account though, it became far more clear to me what Raisin is. The short of it is that Raisin is a platform that allows you to save money in different banks and credit unions from a single website. Here’s what Raisin says on their website:

Raisin is not a bank. It is a digital savings marketplace where you can fund federally insured deposit products with a wide range of maturities and APYs (annual percentage yield) offered by our partner banks and credit unions, allowing you to design a savings strategy customized to your earning and liquidity needs.

Source: https://www.raisin.com/en-us/faq

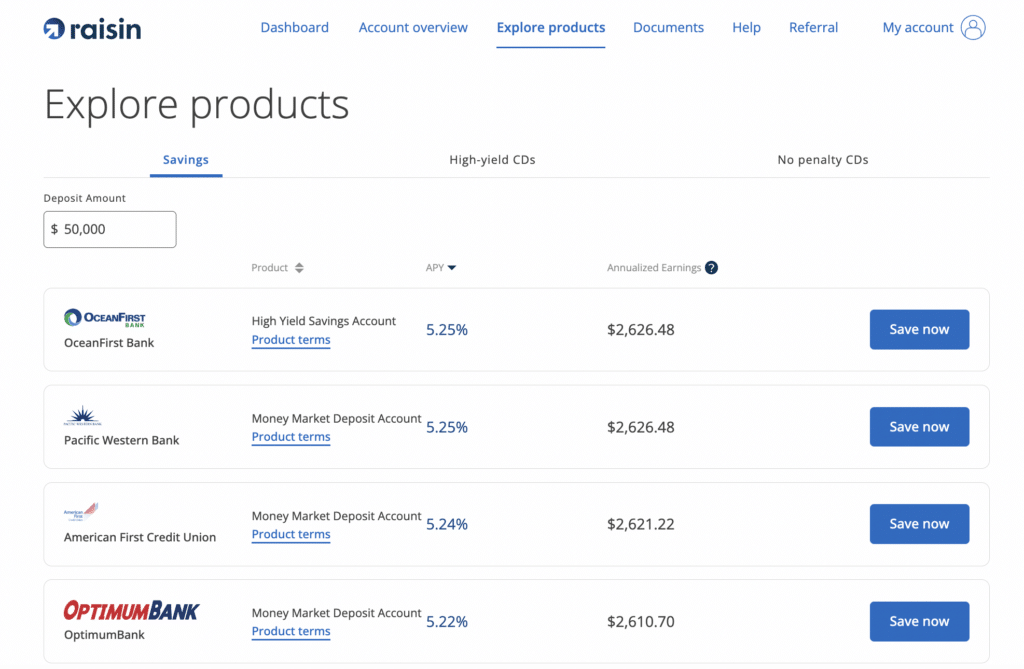

When you sign up for Raisin, you’ll be able to choose from different savings accounts offered by banks and credit unions that are on the Raisin platform. At the time I’m writing this, the majority of banks and credit unions on Raisin are offering high-yield savings accounts with 5% interest or higher.

To use Raisin, you first create a free account, then pick one of the partner banks on the Raisin platform. This becomes the bank that you store your funds in. Below is a screenshot from my Raisin account with some of the partner banks.

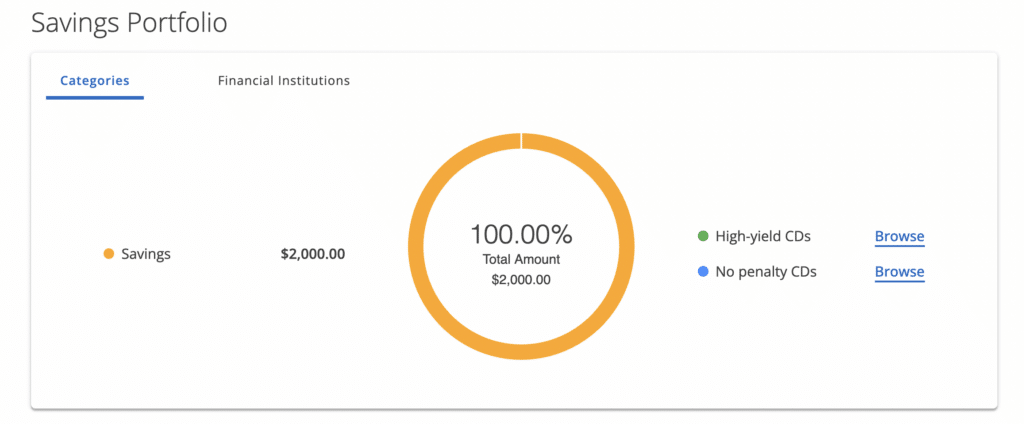

Once you pick a bank, you deposit your funds directly onto the Raisin platform. These funds are then kept in a custodial account with whatever bank you chose.

Your Raisin account functions exactly the same as any high-yield savings account and you can see your balance and withdraw your money from Raisin at any time. If you’d like, you can also open savings accounts with multiple banks, but you’ll still be able to see all your money in one central place via your Raisin dashboard.

How Raisin Works

When you deposit funds in Raisin, all of your funds are kept in a custodial account at whichever bank (or banks) you choose on the Raisin platform. All of your funds are FDIC or NCUA-insured, which means your funds are insured up to $250,000 at each bank.

Raisin has a helpful FAQ on its website that makes it clear that even in custodial accounts, funds are insured via pass-through coverage. Specifically, Raisin states the following:

Although Raisin customers’ deposits are pooled in omnibus custodial accounts, there is no impact on the eligible deposit insurance coverage you receive from the financial institution holding your savings. This is because the government entities providing federal deposit insurance — the FDIC for banks and NCUA for credit unions — permit pass-through coverage. So your money has the same coverage in a custodial account as if it were held in an individual account in your name.

Source: https://www.raisin.com/en-us/faq

Importantly, what makes Raisin a winner for me beyond being easy to use is that it charges no fees. So how exactly can Raisin offer their product with no fees?

Raisin explains it clearly on their website. The partner banks and credit unions pay Raisin to market their products to customers. For banks, this is part of their marketing expense. In return, they gain more deposits to their banks when customers find them on Raisin and choose their bank to save their money into.

Which Bank Should You Choose?

To get started with Raisin, you do have to pick a bank to put your money into. And with 40 banks and credit unions, it can be a bit confusing.

When I first opened my account, Western Alliance Bank had the highest interest rate, so I opted to use them. They’re also a large regional bank, so I figured it was probably a good option. That being said, I don’t think it really matters which bank you pick, as for the most part, all of the banks on the Raisin platform offer about the same interest rate.

It looks like Western Alliance Bank stopped taking new customers on Raisin, but there are still dozens of other banks offering 5% or more interest. Customers Bank is one option currently offering the highest rate (5.32%) on Raisin from what I can see.

But again, my suggestion is to not overthink it. The difference in interest rates between most of the banks on the Raisin platform is 0.05%. That’s an insignificant amount that won’t make any practical difference in how much interest you earn.

One question you might have is what happens if a bank offering a high-interest rate stops taking new customers. Interestingly enough, even if the bank stops offering the rate to new customers, you still keep the same rate. So while Western Alliance Bank stopped taking new customers at the moment, I’m still earning over 5% interest from them.

Using Multiple Banks On Raisin

Most people will probably only need to open a Raisin account using one bank – so pick a bank and go with that is what I’d say. That being said, there are three reasons why you might want to use multiple banks on Raisin.

The first is if you have a lot of money you want to set aside. Your funds are insured up to the federal limits (which is $250,000 per bank). To help protect your funds from possible bank failures, Raisin actually sets a $250,000 limit on how much you can deposit into each bank. So, if you have a lot of money to set aside, you’ll have to use multiple banks if you want to get all your money into Raisin.

The second reason you might want to use multiple banks is if you want to set up different sub-savings accounts. Raisin, unfortunately, doesn’t have a feature that lets you set up different sub-savings accounts. Instead, when you put your money into Raisin, it’s all shown to you as one big pool. However, if you want to differentiate your cash savings, you can use multiple banks, and then separate your money into each bank. You’ll be able to see how much money you have in each of the banks you’ve opened, which will make it easy for you to differentiate your savings into different buckets.

Finally, the last reason you might want to use multiple banks is if another bank ends up offering a higher interest rate than whichever bank you initially picked. However, I would only bother with this if the interest rate change was substantial. Most of the time, you won’t have to worry about this.

Raisin Review – Final Thoughts

Right now, with interest rates where they are, I think it makes sense for everyone to maximize their cash savings. I have no idea if this is the new normal and if interest rates will stay where they are, but if they do, you should take advantage of it. Banks should pay you for the money you keep in their accounts, and Raisin is a great way to make sure you’re getting the most out of your cash savings.

For me, Raisin is the perfect spot to put my emergency fund, allowing me to maximize my cash savings while still getting an excellent return on it. I haven’t yet used it to create different sub-savings accounts, but I’ll likely do that as well at some point.

For everyone, I absolutely recommend Raisin and think, at a minimum, this is where you should put your emergency fund. There are no fees, your money is safe and federally insured, and you can access your money at any time. My experience with Raisin has been great and I’m glad I found it.

If you want to sign up for Raisin, you can use this link to get started (this link will sign you up for Raisin using Customers Bank).

As always, if you have any questions, feel free to comment below or send me an email. I hope this Raisin review was helpful.

Chime is a free online bank that offers a $100 referral bonus if you open a new Chime account using a referral link. To earn the $100 referral bonus, you need to do the following:

- Open a new Chime bank account using a referral link (here’s my Chime referral link).

- Make a direct deposit of $200 or more within 45 days of opening your account.

- The $100 bonus posts to your Chime account within 2 business days of meeting the requirements, but typically posts instantly once the requirements are met.

When it comes to bank account bonuses, Chime is one of the easier banks out there and it’s one of the first banks I recommend for anyone new to the world of bank account bonuses. Here are the main reasons why:

- No Fees. Chime has no minimum balance requirement, as well as no monthly fees or maintenance fees. Since it has no fees, this makes it a very easy bank account to manage.

- Bonus Terms Are Easy To Meet. The terms you have to meet to earn the Chime referral bonus are pretty easy to meet, making this one of the easier bank account bonuses out there. The account requires a $200 direct deposit to earn the bonus, which at first glance might seem difficult. However, the direct deposit requirement can be triggered via ACH transfers from most banks (more about this later in the post)

- Bonus Posts Instantly (Or At Most, Within 2 Business Days). Some banks have a long waiting period before your bonus posts. Chime’s terms say your bonus will post within 2 business days of meeting the direct deposit requirement, but in my experience, the bonus almost always posts instantly.

- You Can Refer People With Your Referral Link. A big thing about Chime is that once you open a Chime account, you get your own Chime referral link. You’ll earn $100 for every person you refer to Chime and the person you refer will also earn $100 once they open a Chime account with your link and meet the bonus requirements. This makes Chime a very profitable bank account if you have people you can refer.

With all that said, in this post, I’ll walk you through exactly what you need to do to earn the $100 Chime referral bonus, as well as provide some additional strategies to make your bonus go even further.

But first, some background about Chime before we get started.

What Is Chime Bank?

Chime is an online bank account that you can access through the Chime app or Chime website. The most important thing about Chime is that it has no fees. This includes no minimum balance requirement, no monthly fees, no maintenance fees, and even no overdraft fees.

Chime is a fintech company, which also means that it has a good mobile app. Indeed, among banking apps, I’d consider Chime one of the nicest and most intuitive out there.

Another interesting feature of Chime is how fast it posts transactions. Direct deposits and transfers into the account post 2 days early, which is nice since it means you get access to your money sooner. Other banks have started to do this now too, but Chime was one of the pioneers of early deposits.

In the past, I’ve used Chime as a bank account for all my gig economy earnings. All of my earnings went into my Chime bank account and it was nice that my earnings were deposited faster.

Chime Bank $100 Referral Bonus: Step-By-Step Directions

With that background out of the way, let’s look at how to earn your Chime referral bonus. The process should only take you a few minutes to complete, making this well worth your time – after all, it’s $100 for just a few minutes of work.

Here are the step-by-step directions to earn your $100 Chime referral bonus.

1. Open Your Chime Account Using A Referral Link. To earn the $100 Chime referral bonus, first, you need to open a Chime account using a referral link. Here’s my referral link to open your Chime account. Opening a Chime account should only take you a few minutes.

2. Complete A Direct Deposit Of $200 Or More Within 45 Days Of Account Opening. The next step is to complete a direct deposit of $200 or more within 45 days of opening your Chime account If your employer allows you to change your direct deposit for your paycheck easily, then I recommend doing that. My wife uses Gusto for her payroll, which makes it really easy for us to switch banks for direct deposits (we just log into the Gusto website and add whatever bank we want).

While the terms do say a direct deposit is required, in practice, there are a lot of ways to make Chime think you met this requirement, even if you don’t do a “real” direct deposit. In the past, an ACH transfer from almost any bank account would immediately trigger the bonus, but unfortunately, it seems like Chime has tightened up this requirement a little bit. Back when I did the bonus, I did an ACH transfer from Discover Bank, which instantly triggered the bonus. Some people online have said Discover still works but others have said it doesn’t. If you have a Discover Bank account already, I’d recommend doing an ACH push from Discover to your Chime account to see if it works.

Another data point from Reddit suggests that doing an ACH push from Novo will trigger the direct deposit requirement. This is good because Novo is a business checking account that I personally use and recommend. Even better, Novo has a referral bonus too, so you can open a Novo account, earn the bonus from it, and use it to trigger the direct deposit requirement with Chime. Here’s a post I wrote about Novo and how to earn the referral bonus they offer: Novo Bank $40 Referral Bonus – Step By Step Guide.

Finally, I’ve seen data points that say an ACH push from Wells Fargo works to trigger the bonus. Transfers from brokerage accounts may also work, so if you can do a transfer from Fidelity, Wealthfront, Webull, SoFi Invest, or other similar brokerage accounts, it can be worth a shot.

If the method you use works, the bonus should post very quickly (usually immediately after you complete the transfer). If you don’t see the bonus right away, that means your method likely didn’t work, so try again with something else.

Remember, do not contact Chime to ask them about the bonus if you didn’t do a real direct deposit.

3. Once The Requirements Are Met, The Bonus Should Post Within 2 Business Days. Once you trigger the direct deposit requirement, the bonus should post either instantly or within 2 business days. The majority of the time, it should post immediately. However, since the terms say it can take 2 business days, you might need to wait 2 business days to be sure. If you don’t see the bonus within that time frame, it means the method you used to trigger the direct deposit requirement didn’t work, so try doing a transfer from another bank.

Remember, you need to do an ACH push into your Chime account to trigger the direct deposit requirement. This means logging into your non-Chime bank account, linking Chime to that account, and then pushing the money into Chime from that external account. You don’t do anything from the Chime interface when trying to meet the direct deposit requirement.

Pro-Tip: Refer Your Friends And Earn More Chime Referral Bonuses

When you open your Chime account, you also get your own referral link that you can use to refer other people to Chime. You can currently get $100 for every person that you refer to Chime, up to $1,000 per calendar year.

If you have a spouse or partner, you can refer them and have them follow the same process to earn the referral bonus. They’ll earn $100 for using your referral link and you’ll earn $100 for referring them.

Someone with a two-person household can currently earn $300 with just a few minutes of work. You get $100 for opening your account. Then you get $100 for referring your spouse or partner. And then your spouse or partner gets $100 for using your referral link. This makes Chime a very easy $300 net gain for a two-person household.

Final Thoughts

Chime is an easy bank account bonus that is a good introduction for beginners new to the world of bank account bonuses. Since it’s a completely free account, you don’t have to worry about managing the account or doing anything with it. I would typically recommend keeping your Chime account open forever so that you can use it for referring people.

The entire process to earn this bonus is really fast, so you should be able to earn your $100 Chime referral bonus with just a few minutes of work. You can open your Chime account and earn your bonus using my Chime referral link.

If you have two people, you’ll make $300 with just a few minutes of work. This makes this referral bonus well worth doing.

If you’re interested in diving deeper into the world of bank account bonuses, I highly recommend reading my Ultimate Guide To Bank Account Bonuses, which tells you everything you need to know about bank account bonuses and how they work.

Upgrade is a free checking account that’s currently offering a $200 referral bonus if you open an account using a referral link. To earn your Upgrade referral bonus, you have to do the following:

- Open an Upgrade checking account using a referral link (here is my Upgrade referral link).

- Receive direct deposit(s) of $1,000 or more within 45 days of opening your account.

These bonus terms are easy to meet, so it’s well worth doing this bonus as soon as you can. It’s unclear when this bonus will end or if it will get reduced to a smaller amount (that being said, I recommend signing up for it now while you can).

In this post, I’ll briefly go over what Upgrade is and walk you through exactly how to earn your Upgrade referral bonus.

What Is Upgrade?

We won’t go into too much detail about what Upgrade is, but a bit of background on it should be helpful so you know what you’re getting into.

The first thing you should know is that Upgrade is a fintech bank account. In this case, Upgrade partners with Cross River Bank, which is an FDIC-insured bank. Any funds you have in Upgrade are held for you with Cross River Bank, so your funds are safe and secure.

What makes Upgrade good for bank bonus purposes is that it has no fees or minimum balance requirements. This makes it a good bank bonus – especially for beginners – since you don’t have to worry about managing the account to avoid fees.

In terms of features, the most interesting to me is their high-yield Premier Savings Account. They currently offer a 4.81% interest savings account with no limit on how much you can have earning that rate. That makes Upgrade a bank you could use to store cash or your emergency fund.

Upgrade also offers cashback on their debit card, which could be useful, since most debit cards don’t offer cashback. Specifically, you’ll earn 1% cashback on all purchases and 2% cashback on purchases at convenience stores, gas stations, restaurants, monthly subscriptions, and utilities. There aren’t many bank accounts that offer cashback like that, which makes Upgrade a potential option if you have certain purchases that you can only pay with a debit card.

Upgrade Referral Bonus: Step By Step Directions

With that background out of the way, let’s look at how to earn your Upgrade referral bonus. Here’s what you need to do:

1. Open An Upgrade Account Using A Referral Link. The first thing you’ll need to do is open an account using a referral link. Here is my Upgrade referral link so you can earn your bonus.

When you click the referral link, you’ll see a screen like the one below.

Opening the account is straightforward. When I opened my account, it took me a day to get approved. A friend of mine opened it and was approved instantly. I’m not sure why mine took a day and his account was immediate.

I recommend downloading the Upgrade app, as that’s the easiest way to manage your account. You can also manage it on your computer if you prefer.

2. Complete Direct Deposit(s) Of $1,000 Or More Within 45 Days. The terms state the following:

An “Eligible Direct Deposit” is a recurring deposit to an account by Automated Clearing House (“ACH”) from the account holder’s employer, payroll, or benefits provider, or gig economy payer OR a deposit by Original Credit Transaction (“OCT”) from your gig economy payer. One-time direct deposits, including tax refunds, bank ACH transfers, bank verification or trial deposits, peer-to-peer transfers from services, such as PayPal or Venmo, merchant transactions, mobile check deposits, and cash loads or deposits are not “Eligible Direct Deposits.”

The plain language of the terms suggests that you would need to complete a real direct deposit to trigger the bonus. If you can do a real direct deposit, that is your best option to earn the bonus.

Refer Others To Upgrade

When you open your Upgrade account, you’ll also get a referral link that you can use to refer other people to Upgrade. You’ll find your referral link on the main page of the app.

Each person you refer will earn $200 if they meet the requirements. You’ll also earn $50 for each person you refer. If you’re a two-person household, that means you can earn an easy $450 with just a few minutes of work.

First, you’ll open your own Upgrade account using a referral link. Then you’ll want to refer your spouse or partner using your link. If you do this correctly, you’ll earn $200 for opening your account, your spouse will earn $200 for using your referral link, and you’ll earn another $50 for referring your spouse.

The terms state you can earn up to 10 referral bonuses per year, so there’s room to earn quite a bit if you have other people you can refer.

Final Thoughts

Upgrade is an interesting, free cashback checking account offering a good, easy referral bonus. The account has no fees or minimum balance requirements, which makes it a particularly easy bank bonus to earn. I recommend getting in on it as soon as you can. They keep extending this promotion, but it’s always possible that it will end eventually.

If you want to learn more about bank account bonuses and how they work, be sure to read my in-depth post, The Ultimate Guide to Bank Account Bonuses. This is required reading for anyone interested in learning how to make extra money from bank account bonuses.

I hope this post was helpful. Feel free to leave any questions or comments below and I’ll do my best to answer them.

SoFi Money is a free online bank that is currently offering a $25 referral bonus if you open a SoFi Money account using a SoFi Money referral link. You can earn your $25 SoFi Money referral bonus by doing the following:

- Open a SoFi Money account using a referral link (here’s my SoFi Money referral link).

- Fund your SoFi Money account with at least $10 within 5 days of opening the account.

When it comes to bank account bonuses, SoFi Money is currently one of the easiest bank account bonuses to earn. This makes SoFi Money an especially good bank account bonus for beginners looking to dip their toes into the world of earning bank account bonuses.

Specifically, the following reasons are why SoFi Money is a bank account worth opening to earn the referral bonus:

- No Fees. SoFi Money has no minimum balance requirement, no monthly fees, and no maintenance fees of any kind. Since there are no fees to worry about, this makes SoFi Money an easy bank account to manage.

- The Bonus Terms Are Easy To Meet. SoFi Money has really easy terms you have to meet to earn your referral bonus. All you have to do is download the SoFi app and create a SoFi Money account. Since SoFi Money has no maintenance fees or minimum balance requirements to worry about, you can keep the account open without having to do anything to keep it fee-free.

- The Bonus Posts Quickly. Most banks have a waiting period before your bonus posts – some longer than others. The SoFi Money bonus, on the other hand, posts immediately.

- You Can Refer People With Your Own SoFi Referral Link. When you open a SoFi Money account, you also get your own referral link that you can use to refer friends and family to SoFi Money. You’ll earn $50 for every person you refer to SoFi Money. The person you refer will earn $25. If you have people that you can refer, you can dramatically increase your bonus earnings via referrals.

In this post, I’ll walk you through the step-by-step directions you can follow to earn your $25 SoFi Money referral bonus. I’ll also give you some additional strategies you can use to earn even more from your SoFi Money account.

But before we get started, a little background about what SoFi Money is and how it works would be helpful.

What Is SoFi Money?

SoFi Money is an online-only bank account that you can access via the SoFi app or the SoFi website. The account has no monthly fees, no minimum balance requirement, and also provides free ATM transactions at over 55,000 ATMs worldwide. Since SoFi Money has no fees, this makes it a good bank account to use beyond just getting the referral bonus. And of course, all of your funds are FDIC insured.

Beyond being a good bank account, one of the little-known benefits of a SoFi Money account is that it makes you a SoFi member. This gives you access to all of the benefits that SoFi provides its members. And one of the best benefits has to be SoFi experiences.

In normal times, SoFi hosts free events for its members throughout the country. Tickets for these events are typically given out on a first-come, first-serve basis and you can sign up for these events via the SoFi app. I’ve gone to fancy dinners, attended fun parties, and have been to multiple sports events where I got to watch games in a suite with other SoFi members – and these events were all completely free because I’m a SoFi member.

For example, I’ve done the following:

- Attended multiple dinners at fancy restaurants in my city (each dinner would easily cost $100 per person)

- Went to a debt payoff party in New York City which was held in a great venue and included a catered dinner, free drinks, and an ice cream food truck

- Went to the Big Ten Championship twice in Indianapolis to watch my alma mater, the Wisconsin Badgers. The tickets included access to the game in the SoFi suite and free food and drinks in the VIP pre-game area.

- VIP tickets to watch the X-Games, along with free food and drinks in the VIP lounge.

- Tickets to see West Side Story, along with free drinks and food before the play.

I’ve written about my experience at these events in previous posts on the blog, which you can check out below:

- A Weekend In New York City, Compliments of Hyatt and SoFi

- How I’ve Received Thousands Of Dollars Worth Of Free Stuff From Refinancing My Student Loans With SoFi

- Combining SoFi Experiences And Travel Hacking For Free Flights And Free Events

Of course, things are very different right now given the state of the world and it’s unknown what the future of these in-person events will be like. At the moment, SoFi has shifted to online SoFi events, which are nice, but of course, don’t come with the benefit of going to cool events and getting free food and drinks. My hope is that SoFi eventually brings back these experiences.

SoFi Money Referral Bonus: Step-By-Step Directions

With that brief bit of background out of the way, here’s what you need to do to earn your SoFi Money referral bonus. These steps should only take you a few minutes to complete, so if you follow the steps, you’ll earn your SoFi Money referral bonus with just a few minutes of work.

Here are the step-by-step directions to earn your SoFi Money referral bonus.

1. Open A SoFi Money Account. Open a SoFi Money account using a SoFi Money referral link. Here’s my SoFi Money referral link.

2. Fund Your SoFi Money Account With At Least $10. You’ll need to fund your SoFi Money account with $10 or more within 5 days of opening your account. The terms state that you need to either link a bank account and transfer the $10 via an ACH transfer or via an instant transfer from a debit card. Your $25 SoFi Money referral bonus should post within two weeks after you fund your account with at least $10. In practice, I’ve found it posts faster than that.

After you earn your bonus, you can decide what you want to do with your SoFi Money account. It’s a free account with useful benefits, so I recommend keeping it, especially since it has no fees and won’t cost you anything to keep it open. Also, you’ll want to keep your SoFi Money account open because of the possibility of referring your friends and family, which you can only do when you have a SoFi Money account. More on that in the next section.

Refer Your Friends And Earn More SoFi Money Referral Bonuses

One key benefit of having a SoFi Money account is that it allows you to refer other people using your own referral link. You’ll earn $75 for every person you refer to SoFi Money.

To refer someone to SoFi Money, simply open your SoFi app and go to your SoFi Money account. From there, you’ll see an option to invite friends to SoFi Money.

On the next page, you’ll get an option to share your referral link. Share your referral link with anyone who you think might benefit from this account and the signup bonus.

The big thing you can do is refer your spouse or partner to open a SoFi Money account. If you do this, they’ll get $25 for opening a SoFi Money account and you’ll get $75 too. Together, that’s a net profit of $100 for a few minutes of work ($25 for opening a SoFi Money account, then $75 each for referring your spouse or partner).

How to Earn an Additional $50-$300 Bonus

After opening your SoFi Money account, you have the opportunity to earn either an extra $50 or $250 by setting up Direct Deposit. Here are the step-by-step directions to earn your additional SoFi Account referral bonus.

1. Open A SoFi Money Account. This is found in the first part of this post above.

2. Set up Direct Deposit and Wait For It To Hit Your Account. You’ll need to need to complete direct deposit(s) in order to earn an additional bonus. Here is the breakdown of how much you need to deposit and how long you have.

The terms state that you have 25 days from when the initial direct deposit hits your account to earn the maximum bonus. So you can have multiple direct deposits within the 25 day window and the aggregate of those deposits will determine the bonus amount you get. So for example, if you receive a direct deposit of $2,500 and then another one 2 weeks later, you will qualify for the $300 bonus.

So to recap,

Receive direct deposits totaling $1,000 or more within 25 days of the first direct deposit being received to earn a $50 bonus

OR

Receive direct deposits totaling $5,000 or more within 25 days of the first direct deposit being received to earn a $300 bonus

This money will be in addition to the $25 bonus you will receive for opening a SoFi Money account in the first part of this post (opening a SoFi Money account and depositing at least $10). So your total bonus amount will be either $75 or $325, depending on how much you direct deposit into your account.

The terms also state that you should receive your bonus within 7 business days after the 25-day evaluation period from receiving your first direct deposit. My experience has been that the bonus pays out pretty quickly after you meet the direct deposit requirements.

Final Thoughts

SoFi Money is an easy bank account bonus that is worth doing, especially if you are a beginner and new to the world of bank account bonuses. Because SoFi Money is completely free and has no minimum balance requirement, it’s an easy account to open and manage. I typically recommend everyone keep their SoFi Money account open forever so they can refer people and gain access to free SoFi experiences.

Earning this bonus is fast and easy, so you should be able to earn your SoFi Money referral bonus with just a little bit of work. You can open your SoFi Money account and earn your $25 referral bonus with my SoFi Money referral link.

If you’re interested in learning more advanced strategies about bank account bonuses, be sure to check out my post, The Ultimate Guide To Bank Account Bonuses. That is a massive post that goes into a lot of detail about how bank account bonuses work and how you can take advantage of them. Hit me up if you have any questions!

Gold, an enduring symbol of affluence and prosperity, has held humanity in awe for centuries. Its appeal goes beyond cultural significance; gold boasts intrinsic value within the intricate tapestry of the global economic landscape.

Have you ever pondered the worth of a substantial quantity, such as 6 tons of gold, in today’s market?

Currently, in March 2024, the price of one troy ounce of gold is roughly $2,050.

When hearing about physical gold movements and the escalating procurement of gold bullion by governments, you’ll frequently encounter terms like “gold ton” or “gold tonne.”

In the world of precious physical metals, a ton specifically refers to a metric tonne. For .999 fine physical gold bullion or any other precious metal, a metric tonne precisely translates to 32,150.7 troy ounces of gold or the equivalent amount in another precious metal. Understanding this metric is pivotal for those navigating the intricate dynamics of the precious metals market.

Therefore, to calculate how much 1 ton of gold is worth, you could multiply the current price of $2,050 by 32,150.7.

Then, multiply by 6 to get how much 6 tons of gold is worth. Therefore, the current value of 6 tons of gold is $395,453,610!

But the story doesn’t end there.

In this article, we will get into answering the question of “How Much is 6 Tons of Gold Worth?” and other relevant pieces of information related to how gold is priced.

Understanding Gold Pricing

First, let’s talk about how gold is priced.

Gold pricing is a complex interplay of various factors that collectively determine its value in the global market.

As investors and enthusiasts seek to comprehend the dynamics behind the glittering metal’s worth, it’s essential to learn about the intricate web of economic, geopolitical, and market-related influences.

- Economic Conditions: One of the primary drivers of gold prices is the prevailing economic climate. During periods of economic uncertainty or recession, investors often flock to gold as a safe-haven asset. The inverse relationship between the value of the U.S. dollar and gold prices further accentuates this trend. In times of economic instability, gold tends to retain its value, providing a reliable store of wealth.

- Inflation Rates: Gold has historically been viewed as a hedge against inflation. When inflation rates rise, the purchasing power of currencies diminishes. Investors turn to gold to preserve their wealth as it generally maintains its value even as the cost of living increases. Understanding the correlation between gold prices and inflation rates is crucial for predicting its value in different economic scenarios.

- Geopolitical Events: Geopolitical events can have a profound impact on gold prices. Wars, political instability, and diplomatic tensions can drive investors to seek the safety of gold, leading to an uptick in demand and subsequently, prices. Monitoring global events and their potential impact on geopolitical stability is integral to gauging the trajectory of gold prices.

- Interest Rates: Interest rates play a pivotal role in shaping gold prices. Central banks’ decisions on interest rate adjustments can influence the opportunity cost of holding gold. When interest rates are low, the appeal of non-interest-bearing assets like gold increases, driving up demand and, consequently, prices. Conversely, higher interest rates may lead to a decrease in gold prices as alternative investments become more attractive.

Weight and Measurement in the Gold Market

Understanding how gold is measured and the significance of weight in the gold market is fundamental for anyone navigating the intricacies of gold trading.

The unique measurement standards and the sheer weight of large gold quantities, such as a ton, contribute to the precious metal’s allure and value.

Gold is typically measured in troy ounces, distinct from the more familiar avoirdupois ounces used for everyday items. One troy ounce is equivalent to approximately 31.1035 grams. This specialized measurement unit is crucial in the gold market, ensuring standardization and uniformity in transactions globally.

When we speak of a ton of gold, we’re referring to the troy ton, which is distinct from the avoirdupois ton. A troy ton consists of approximately 32,150 troy ounces. The weight is not merely a numerical value; it signifies a substantial quantity of gold with immense value.

This division allows for more granular transactions in the gold market. Investors often encounter prices per troy ounce when assessing the value of gold, making it essential to grasp the relationship between troy pounds and ounces for accurate valuation and comparison.

How to Convert Troy Ounces and Troy Tons to Ounces and Tons

Converting troy ounces and troy tons to regular ounces and tons is as follows:

- Troy Ounces to Regular Ounces:

- 1 Troy Ounce (ozt): Equals approximately 31.1035 grams.

- 1 Regular Ounce (oz): Equals about 28.3495 grams.

- To convert troy ounces to regular ounces, multiply the troy ounces by the conversion factor of 1.09714 (28.3495 / 31.1035).

- Troy Tons to Regular Tons

- 1 Troy Ton (troy ton): Equals approximately 32,150 troy ounces.

- 1 Regular Ton (ton): Equals approximately 32,000 avoirdupois ounces.

- To convert Troy tons to regular tons, multiply the troy tons by the conversion factor of 0.907.

How Much is 6 Tons of Gold Worth Today?

Currently, in March 2024, the price of one troy ounce of gold is roughly $2,050.

To calculate how much one ton of gold is worth, you multiply the current price of $2,050 per troy ounce by 32,150.7 troy ounces.

Then, multiply by 6 to get the value of 6 tons.

Therefore, the current value of 6 ton of gold is $395,453,610!

Now that we’ve answered the question of how much is 6 ton of gold worth, let’s look at how much gold has been worth throughout history.

How Much has Gold Been Worth Throughout History?

Gold, a timeless symbol of wealth, has seen notable variations in value throughout history.

Examining specific periods provides a glimpse into the diverse influences on gold’s worth.

1. Gold During Ancient Civilizations

In ancient civilizations, spanning cultures from Egypt to Mesopotamia, gold held unparalleled cultural and monetary significance. Revered for its lustrous beauty and rarity, gold became a symbol of divine power, adorning temples, tombs, and the regalia of rulers.

In Ancient Egypt, gold transcended its material worth. The pharaohs adorned themselves with intricate gold jewelry, and the precious metal played a vital role in burial rituals, symbolizing the eternal and divine. The exact value of a ton of gold in ancient Egypt is difficult to estimate, but its cultural and symbolic importance was immeasurable.

Mesopotamian civilizations, such as the Sumerians and Babylonians, prized gold for its aesthetic qualities and rarity. It was used to craft artifacts, including religious items and royal insignia. The value of a ton of gold in Mesopotamia would have been a symbol of immense wealth, influencing trade and diplomatic relations.

2. Gold in the Middle Ages

As trade routes expanded and economies underwent transformations during the Middle Ages, gold continued to assert itself as a symbol of wealth and power.

In the Byzantine Empire, gold coins like the solidus were a stable currency for centuries. One solidus contained around 24 pure karats of gold. While the exact value of a ton of gold in Byzantium is challenging to quantify, the stability and prevalence of gold in commerce elevated its importance.

The Middle Ages saw the flourishing of trade along the Silk Road, connecting East and West. Gold, used as both currency and commodity, played a pivotal role in this commerce. The value of a ton of gold during Silk Road exchanges would have been a marker of considerable economic influence.

3. Gold in the 1700s and 1800s

The 1700s and 1800s were transformative periods in the history of gold, marked by significant economic shifts, technological advancements, and major geopolitical events. The role of gold during these centuries evolved, influencing global trade, shaping monetary systems, and sparking pivotal moments such as gold rushes.

During the 1700s, the Spanish colonies in the Americas were prolific producers of gold. Mines in present-day Mexico and Peru yielded substantial quantities, contributing to the economic expansion of Spain and fueling the global circulation of gold. The immense wealth extracted from these colonies played a crucial role in financing European wars and supporting the mercantilist ambitions of empires.

As the 1700s progressed, various nations began minting gold coins, laying the foundation for the gold standard. These coins, often depicting powerful rulers or national symbols, became a tangible representation of a country’s economic strength. The British Gold Sovereign, introduced in 1817, and the U.S. Double Eagle, minted from 1849, exemplify this era’s commitment to using gold as a standard of value.

While it’s challenging to provide precise price estimates for gold in the 1700s and 1800s due to the lack of standardized records and the variety of currencies used during that time, historical accounts and some benchmarks can offer insights into the approximate values:

- Spanish America:

- During the 1700s, the Spanish colonies, particularly in Mexico and Peru, were major gold producers. The extracted gold was primarily used to mint coins like the Spanish doubloon. The value of gold in these coins fluctuated based on purity and weight. For instance, a Spanish doubloon, containing around 27 grams of gold, might have had a value equivalent to several months’ wages for an average worker.

- Gold Standard Era:

- In the early to mid-1800s, as the gold standard gained prominence, specific values were assigned to gold coins. For example, the British Gold Sovereign, introduced in 1817, had a face value of one pound. In the United States, the Double Eagle, introduced in 1849, had a face value of $20. These face values, however, do not necessarily reflect the market value, which could be influenced by factors like scarcity and demand.

- California Gold Rush:

- During the California Gold Rush (1848–1855), the sudden influx of gold into the market had significant effects. While the exact market price varied, gold prices surged as a result of increased supply. In the early 1850s, gold prices reached approximately $18 to $20 per troy ounce.

It’s important to note that these estimates are based on historical accounts, and the actual values and purchasing power of gold during these periods can be challenging to precisely determine. The absence of a standardized global currency system during these centuries adds complexity to estimating the historical values of gold.

4. Post-War Period and the Bretton Woods Agreement (1940s-1970s)

Following World War II, the global economy sought stability, leading to the establishment of the Bretton Woods Agreement in 1944. Under this agreement, major currencies were pegged to the U.S. dollar, and the U.S. dollar, in turn, was pegged to gold at the fixed rate of $35 per ounce. This linkage had a profound impact on the value of a ton of gold, equating to $1,120,000.

The Bretton Woods system brought a sense of stability to international monetary relations, as currencies were anchored to a tangible asset—gold. However, the fixed exchange rate faced challenges as economies recovered and global trade expanded. The demand for the U.S. dollar grew, putting pressure on gold reserves.

The early 1970s witnessed a paradigm shift as economic dynamics strained the fixed exchange rate system. In 1971, President Richard Nixon announced the suspension of the dollar’s convertibility into gold, effectively ending the Bretton Woods Agreement. This marked a turning point, introducing a new era characterized by floating exchange rates and increased volatility in gold prices.

5. The Late 20th Century (1970s-1999)

Amid economic uncertainties and geopolitical tensions, the late 20th century saw remarkable fluctuations in gold prices, reflecting the metal’s role as a hedge against uncertainty.

The 1970s witnessed a surge in gold prices driven by a combination of factors, including oil crises, inflationary pressures, and geopolitical unrest. By 1980, gold reached a historic peak of $850 per ounce, making a ton of gold worth an astonishing $27,280,000. This period underscored gold’s resilience as a store of value during turbulent times.