Finding your dream house, whether in the US or elsewhere, is an exciting journey. Imagine a home with the perfect porch swing and a backyard that brings to mind summer barbecues. However, between that dream and reality lies the often-daunting process of securing a mortgage. This is where mortgage companies step in, acting as your trusted guide through the complex network of homeownership.

Gone are the days when mortgage companies were simply loan providers. Today, they’re a one-stop shop offering a wealth of resources and expertise to empower you on your home-buying journey. Don’t believe it?

In this article, we’ll explain how mortgage companies are making a big difference in the housing market, particularly in Florida. So, without any further ado, let’s get started!

1. Financial Guidance

Traditionally, securing a mortgage felt like navigating a financial maze. But thanks to modern Florida mortgages service providers, the brokers now act as your personal finance assistants. They’ll sit down with you to understand your complete financial picture – income, debts, savings goals, and more. This isn’t just about approving you for a loan; it’s ensuring you can comfortably afford your dream home.

Think of them as financial translators, explaining complex mortgage options like fixed rates, adjustable rates, and down payment requirements in clear terms. They’ll help you create a realistic budget that considers not just the monthly mortgage payment but also property taxes, homeowner’s insurance, and potential maintenance costs. This financial guidance empowers you to make informed decisions and avoid feeling overwhelmed by the numbers.

2. Competitive Rates and Programs

The mortgage market is dynamic, with lenders competing for your business. This translates to benefits for you: a wider range of loan options and potentially significant cost savings. Here’s how mortgage companies can help you find the best deal:

Competitive Interest Rates: Mortgage companies negotiate with lenders to secure competitive interest rates on your behalf. By comparing rates from multiple lenders, they ensure you’re not overpaying on your mortgage – saving you money throughout the life of your loan.

Veteran Loans (VA): Veterans and eligible service members can qualify for VA loans with competitive interest rates, no down payment required, and often less stringent credit score requirements.

USDA Loans: This program is designed for rural homeownership. It offers zero down payment options for eligible individuals buying in designated rural areas.

Low-to-Moderate Income Programs: These programs can offer lower interest rates, down payment assistance, or relaxed credit score requirements for borrowers who meet income limitations.

By working with a mortgage company, you get the most affordable loans possible, setting you up for long-term financial success in your new home.

3. Educational Resources

The home-buying journey can be filled with unfamiliar terms and complex paperwork. To empower you, many mortgage companies provide a wealth of free educational resources. These resources go beyond simply explaining different loan options. They might include:

- Online guides: Step-by-step explanations of the process, from pre-approval to closing.

- Interactive tools: Calculators to estimate your monthly payment, down payment needs, and potential closing costs.

- Educational videos: Clear explanations of terminology, different loan types, and homeowner responsibilities.

- Workshops or webinars: Live sessions led by professionals covering various home-buying topics.

By utilizing these resources, you will gain a strong understanding of the mortgage process. This knowledge will empower you to ask insightful questions, make informed decisions, and approach the home-buying journey with confidence.

4. Closing Coordination

The closing on your new home can feel overwhelming with all the paperwork and legalities involved. However, a mortgage company’s closing coordinator acts as your personal guide through this final step. They handle the following:

- Document Collection and Review: They ensure all necessary documents, from loan applications to appraisals, are collected, reviewed for accuracy, and completed on time.

- Communication Hub: They act as your central contact point, addressing any questions you have about closing costs, escrow accounts, or title insurance.

- Ensuring a Smooth Signing: They meticulously review all closing documents to ensure everything is in order before you sign on the dotted line.

5. Post-Closing Support

Many reputable lenders offer post-closing support to help you navigate the realities of homeownership. This might include resources for managing your monthly mortgage payments, creating a budget that factors in property taxes and homeowner’s insurance, or even connecting you with reputable homeowners insurance providers. This ensures a smooth transition into your new home and empowers you to be a financially responsible homeowner.

Choosing the Right Mortgage Company

With so many mortgage companies out there, it’s important to find one that’s a good fit for you. Here are some things to consider:

- Research the company’s reputation online and read customer reviews. Look for a company with a history of satisfied clients and ethical practices.

- Choose a company offering a variety of loan programs to suit your specific needs and financial situation.

- Find a company with loan officers who are patient, knowledgeable, and available to answer your questions in a way you understand.

The Bottom Line

The homebuying journey can be overwhelming, but it doesn’t have to be. Mortgage companies, with their focus on education, guidance, and technology, can be your invaluable partner in achieving the dream of homeownership. So, take a deep breath, leverage the resources available, and embark on this exciting chapter with a knowledgeable guide by your side.

Taking a career break at 35 can be a daunting yet rewarding decision. Whether you are seeking personal growth, exploring new opportunities, or simply in need of a break, careful financial planning is essential to ensure a smooth transition.

In this guide, we will explore key steps to help you navigate this important phase in your life. From evaluating your financial situation to maximizing the benefits of your career break, we will provide valuable insights to support you in making the most of this time off while maintaining a healthy financial outlook.

Let’s dive into the essential aspects of taking a career break at 35 and how you can effectively manage your finances during this period.

Evaluating Your Financial Situation

Before embarking on a career break at 35, it is crucial to thoroughly evaluate your financial situation to ensure a smooth transition and successful return to the workforce. Assessing your financial health will help you make informed decisions and set realistic goals for your time off.

Start by calculating your current savings, investments, and any outstanding debts. Determine your monthly expenses and compare them to your income to understand your cash flow. Consider factors such as emergency savings, retirement accounts, and any other financial obligations you may have.

For example, if you have $50,000 in savings, $20,000 in investments, and $10,000 in student loans, you have a net worth of $60,000. Knowing your net worth gives you a clear picture of your financial standing and can guide your decision-making process.

Additionally, analyze your current income sources and any potential financial risks associated with taking a career break. Consider how long you plan to be on break and how it will impact your overall financial stability.

For instance, if you earn $60,000 annually and plan to take a one-year career break, you will forgo $60,000 in income. Understanding the financial impact of your decision will help you prepare financially and make necessary adjustments to your budget.

By evaluating your financial situation thoroughly, you can make informed choices about taking a career break at 35. This assessment will provide you with a solid foundation to plan your time off effectively and ensure a successful return to the workforce when the time comes.

Setting Clear Goals for Your Career Break

Before embarking on a career break at 35, it is crucial to set clear and achievable goals to make the most of this time off. Setting specific objectives will help you stay focused, motivated, and ensure that you make the most of this opportunity for personal and professional growth.

One important goal to consider is skill development. Use this time to enhance your skills or learn new ones that can benefit your career in the long run. For example, you may decide to pursue a certification in a relevant field, such as project management or digital marketing.

Another goal could be to improve your work-life balance. Use this break to prioritize self-care, spend quality time with loved ones, and engage in activities that bring you joy and fulfillment.

Financial goals are also essential during a career break. Set a target for your savings, emergency fund, and any additional income streams you plan to explore. For instance, aim to save at least six months’ worth of living expenses to provide a financial cushion during your break.

By setting clear goals for your career break, you can make the most of this time off and ensure that you return to work feeling refreshed, motivated, and ready to take on new challenges.

Creating a Budget for Your Time Off

Taking a career break at 35 can be a fulfilling and rejuvenating experience, but it’s crucial to plan your finances carefully to ensure a smooth transition. One of the first steps in preparing for your time off is creating a detailed budget that accounts for all your expenses and income sources during the break.

Start by calculating your total savings and any additional funds you may have set aside for this period. Consider your fixed expenses such as rent or mortgage payments, utilities, insurance premiums, and loan repayments. Next, factor in variable expenses like groceries, transportation, entertainment, and healthcare costs. It’s essential to be realistic and conservative in estimating your expenses to avoid any financial strain during your career break.

For example, if your monthly expenses amount to $3,000, and you plan to take a six-month break, your total budget for the period would be $18,000. Additionally, consider setting aside an emergency fund equivalent to at least three to six months’ worth of expenses to cover any unexpected costs that may arise.

To supplement your budget, explore alternative income sources such as freelance work, part-time gigs, or rental income. Generating an extra $500 per month through side hustles can significantly ease your financial burden and provide additional flexibility during your time off.

Regularly review and adjust your budget as needed to stay on track with your financial goals. By carefully planning and monitoring your expenses, you can make the most of your career break while maintaining financial stability and peace of mind.

Exploring Alternative Income Sources

Taking a career break at 35 can be a fulfilling and enriching experience, but it’s essential to consider alternative income sources to support yourself financially during this period. Exploring various ways to generate income can help alleviate financial stress and provide you with the flexibility to focus on personal growth and exploration.

One alternative income source to consider is freelancing or consulting in your field of expertise. With the rise of the gig economy, there are ample opportunities to offer your skills and services on platforms like Upwork, Fiverr, or Freelancer. By leveraging your professional experience, you can secure projects and assignments that align with your interests and schedule.

Another option is to monetize your hobbies or passions. Whether you have a knack for photography, writing, crafting, or cooking, there are numerous ways to turn your hobbies into income streams.

For example, you could sell your handmade crafts on Etsy, offer photography services for events, or start a blog or YouTube channel to share your expertise and earn ad revenue. The global handmade crafts market is expected to reach over $1 trillion by 2027, indicating a lucrative opportunity for creative individuals!

Additionally, you could explore rental income by listing your property on platforms like Airbnb or renting out a room in your home. Renting out space can provide a steady stream of passive income while allowing you to meet new people and network.

By diversifying your income sources during your career break, you can maintain financial stability and pursue your personal goals with confidence.

Managing Your Investments During the Break

Taking a career break at 35 can be a rewarding experience, but it’s essential to ensure that your investments continue to work for you during this time. Managing your investments effectively can help you maintain financial stability and potentially grow your wealth even while you’re not actively working.

One key strategy for managing your investments during a career break is to diversify your portfolio. By spreading your investments across different asset classes such as stocks, bonds, real estate, and commodities, you can reduce risk and increase the likelihood of positive returns.

For example, allocating a portion of your portfolio to low-risk investments like bonds can provide stability during market fluctuations.

Another important aspect of managing your investments during a career break is to regularly review and rebalance your portfolio. Market conditions can change rapidly, and your investment mix may need adjustments to align with your financial goals and risk tolerance. Rebalancing involves selling overperforming assets and buying underperforming ones to maintain your desired asset allocation.

Additionally, consider the tax implications of your investment decisions during your career break. For example, if you have investments in taxable accounts, be mindful of capital gains taxes when making changes to your portfolio. Utilizing tax-efficient investment strategies can help minimize the impact of taxes on your investment returns.

Overall, staying informed about market trends, seeking professional advice when needed, and staying disciplined in your investment approach can help you effectively manage your investments during a career break and position yourself for financial success in the long run.

Maintaining a Healthy Financial Mindset

Taking a career break at 35 can be a significant decision that may impact your financial stability and future goals. It is crucial to maintain a healthy financial mindset throughout this period to ensure you stay on track with your financial well-being.

Here are some key strategies to help you maintain a positive financial mindset during your career break:

- Practice Mindful Spending: Be conscious of your spending habits and prioritize your expenses based on your needs rather than wants. Set a budget and stick to it to avoid unnecessary financial stress. For example, tracking your expenses using budgeting apps can help you stay on top of your finances.

- Focus on Financial Goals: Use this career break as an opportunity to reassess your financial goals and make any necessary adjustments. Whether it’s saving for retirement, paying off debt, or investing in your future, having clear financial objectives can help you stay motivated and focused. For instance, setting specific savings targets, such as saving 20% of your income each month, can give you a concrete goal to work towards.

- Stay Informed: Keep yourself updated on financial news and trends to make informed decisions about your money. Understanding market fluctuations, interest rates, and investment opportunities can help you make smart financial choices. For example, staying informed about the performance of your investments and adjusting your portfolio accordingly can help you protect and grow your wealth.

By maintaining a healthy financial mindset, you can navigate your career break with confidence and set yourself up for a successful return to work. Remember that financial well-being is not just about the numbers but also about your mindset and habits towards money.

Planning for Your Return to Work

Taking a career break at 35 can be a rewarding experience, but it’s essential to plan for your return to work to ensure a smooth transition back into the workforce. Planning ahead can help you make the most of your time off and set yourself up for success when you decide to re-enter the job market.

One crucial aspect of planning for your return to work is staying connected to your industry and network during your career break. This can involve attending industry events, participating in online forums, or even taking on short-term projects or freelance work related to your field. By staying engaged, you can keep your skills sharp and demonstrate to potential employers that you are committed to your career.

Another important consideration is updating your resume and online professional profiles. Make sure to highlight any new skills or experiences you gained during your career break, such as volunteering, taking courses, or learning new technologies.

Networking is also key when planning for your return to work. Reach out to former colleagues, mentors, and industry contacts to let them know you will be re-entering the job market. Networking can lead to job opportunities and referrals, with studies showing that up to 85% of jobs are filled through networking.

Lastly, consider seeking out career counseling or coaching to help you navigate your return to work. A professional can provide guidance on updating your job search strategies, improving your interview skills, and negotiating job offers. Investing in career support can increase your chances of landing a fulfilling job after your career break.

By proactively planning for your return to work, you can make the most of your career break and position yourself for success in the future job market.

Maximizing the Benefits of Your Career Break

Taking a career break at 35 can offer numerous benefits beyond just a temporary pause in your professional life. By strategically utilizing this time off, you can enhance your skills, broaden your perspective, and ultimately boost your long-term career prospects.

Here are some key strategies to help you maximize the benefits of your career break:

- Skill Development: Use your career break to acquire new skills or enhance existing ones. Consider taking online courses, attending workshops, or pursuing certifications relevant to your field. For example, learning a new programming language or obtaining a project management certification can significantly increase your marketability when you return to work.

- Networking Opportunities: While on your career break, make an effort to expand your professional network. Attend industry events, join online forums, or participate in virtual networking sessions. Building connections during this time can open up new opportunities and potential collaborations in the future.

- Volunteer Work: Engaging in volunteer work can not only make a positive impact on your community but also provide valuable experience and skills that can be transferable to your professional life. For instance, volunteering for a non-profit organization can help you develop leadership, communication, and project management skills.

- Personal Growth: Use this time to focus on personal development and self-care. Engage in activities that promote mental and physical well-being, such as meditation, exercise, or hobbies that bring you joy. A healthy work-life balance is essential for long-term career success.

By actively pursuing these strategies during your career break, you can ensure that you not only recharge and rejuvenate but also emerge stronger and more prepared for the next phase of your professional journey. Remember, a well-utilized career break can be a valuable investment in your future success.

Conclusion

Taking a career break at 35 can be a rewarding and transformative experience if approached thoughtfully.

By evaluating your financial situation, setting clear goals, creating a budget, exploring alternative income sources, managing investments, maintaining a healthy financial mindset, planning for your return to work, and maximizing the benefits of your break, you can make the most of this time off.

Remember, a career break is not just about stepping away from work; it’s about investing in yourself and your future. With careful planning and a positive attitude towards your finances, you can come back stronger and more fulfilled in your career.

Taking a career break at the age of 40 can be a daunting yet rewarding decision. Whether you are seeking a sabbatical to recharge, pursue a passion, or address personal commitments, careful planning and preparation are essential for a successful transition. In this guide, we will explore key steps to consider when contemplating a career break at 40.

From evaluating your current situation to reentering the workforce after your break, we will dive into financial planning, goal setting, alternative income sources, and more.

By embracing the benefits of taking a career break and maintaining a healthy work-life balance, you can navigate this pivotal stage in your professional journey with confidence and clarity.

Evaluating Your Current Situation

Before embarking on a career break at 40, it is crucial to thoroughly evaluate your current situation to ensure a smooth transition and successful outcome. This assessment involves taking stock of various aspects of your life, including your career satisfaction, financial stability, personal goals, and overall well-being.

One key consideration is your level of job satisfaction and fulfillment in your current role. If you find yourself among the dissatisfied majority, it may be a sign that a career break is necessary to reassess your professional goals and priorities.

Financial stability is another critical factor to evaluate before taking a career break. It is essential to have a clear understanding of your current financial situation, including savings, investments, debts, and monthly expenses.

Assessing your financial readiness for a career break will help you make informed decisions about budgeting and planning for the future.

Additionally, consider your personal goals and aspirations when evaluating your current situation. Are there any unfulfilled dreams or passions that you have been putting on hold? Taking a career break at 40 can provide the opportunity to pursue these interests and rediscover your sense of purpose.

By conducting a comprehensive evaluation of your current situation, you can gain clarity on your motivations for taking a career break and identify areas that may require attention or improvement. This self-assessment will serve as a solid foundation for planning and preparing for a successful career break at 40.

Financial Planning for Your Career Break

Taking a career break at 40 can be a significant decision that requires careful financial planning to ensure a smooth transition and sustainable period of time away from work.

Here are some key steps to consider when planning your finances for a career break:

- Assess Your Current Financial Situation: Before embarking on a career break, it’s essential to evaluate your current financial standing. Calculate your savings, investments, and any outstanding debts. Determine how much you will need to cover your expenses during the break, including living costs, healthcare, and any additional expenses.

- Create a Budget: Develop a detailed budget outlining your expected expenses during the career break. Consider cutting back on non-essential spending to free up more funds for your break. Having a clear budget will help you stay on track and avoid financial stress during this period.

- Build an Emergency Fund: It’s crucial to have an emergency fund in place before taking a career break. Aim to have at least three to six months’ worth of living expenses saved up to cover any unexpected costs that may arise.

- Explore Part-Time Work or Freelancing: If you’re looking to supplement your income during the career break, consider taking on part-time work or freelancing opportunities. This can help you maintain a source of income while allowing for flexibility in your schedule.

- Consider Health Insurance: Make sure you have adequate health insurance coverage during your career break. Look into options such as COBRA or purchasing a private health insurance plan to ensure you are protected in case of any medical emergencies.

By carefully planning your finances for a career break, you can set yourself up for a successful and fulfilling time away from work while maintaining financial stability.

Exploring Alternative Income Sources

When considering taking a career break at 40, exploring alternative income sources can provide financial stability and flexibility during this period. Diversifying your income streams can help you maintain your lifestyle and cover expenses while you are not actively working in your primary career.

Here are some alternative income sources to consider:

- Freelancing: Freelancing offers the flexibility to work on projects that interest you while earning an income. According to a report by Upwork, the freelance workforce in the U.S. grew to 59 million people in 2020, representing 36% of the total workforce.

- Online Business: Starting an online business, such as an e-commerce store, blog, or consulting service, can generate passive income streams. E-commerce sales are projected to reach $4.2 trillion by the end of 2020, highlighting the growth potential in this sector.

- Rental Income: Renting out property or a spare room on platforms like Airbnb can provide a steady source of income. In the U.S., the average Airbnb host earns around $924 per month, making it a viable option for generating additional income.

- Investment Income: Investing in stocks, bonds, real estate, or other assets can generate passive income through dividends, interest, or capital gains. The S&P 500 has historically provided an average annual return of around 10%, showcasing the potential for long-term wealth accumulation.

By exploring these alternative income sources, you can supplement your finances during a career break and ensure financial stability while pursuing personal or professional growth opportunities. It is essential to assess your skills, interests, and resources to determine the most suitable income streams for your situation.

Setting Clear Goals and Objectives

Setting clear goals and objectives is crucial when planning a career break at 40. This step will help you stay focused, motivated, and on track throughout your break. By defining what you want to achieve during your time off, you can make the most of this opportunity for personal and professional growth.

One important aspect of setting clear goals is to make them specific, measurable, achievable, relevant, and time-bound (SMART).

For example, instead of setting a vague goal like “improve my skills,” you could set a SMART goal like “complete a certification course in digital marketing within six months.” This way, you have a clear target to work towards and can track your progress effectively.

Another key aspect of setting goals is to prioritize them based on their importance and feasibility. You may have multiple goals you want to achieve during your career break, but it’s essential to focus on the ones that align most closely with your long-term objectives. By prioritizing your goals, you can allocate your time and resources effectively to achieve the best outcomes.

Moreover, setting clear goals and objectives can also help you measure the success of your career break. By establishing specific milestones and metrics to track your progress, you can evaluate how well you are meeting your goals and make adjustments as needed.

For example, if your goal is to start a side business during your career break, you could set objectives such as “launch the business website within two months” or “reach 100 customers within the first year.” These specific targets will give you a clear roadmap to follow and enable you to assess your achievements accurately.

In conclusion, setting clear goals and objectives is essential for making the most of your career break at 40. By defining your goals, making them SMART, prioritizing them effectively, and tracking your progress, you can ensure a successful and fulfilling break that sets you up for future success.

Developing a Support Network

Taking a career break at 40 can be a significant decision that requires a strong support network to navigate successfully. Building a support system of friends, family, mentors, and like-minded individuals can provide you with the encouragement, guidance, and resources needed to make the most of your career break.

One key aspect of developing a support network is seeking out individuals who have gone through a similar experience or possess expertise in areas you may need assistance with.

For example, joining online communities or attending networking events geared towards career break professionals can connect you with valuable resources and insights. According to a survey by LinkedIn, 85% of professionals found networking to be crucial for career success.

Additionally, having a mentor or coach during your career break can offer personalized guidance and advice tailored to your specific goals and challenges. Studies have shown that individuals with mentors are more likely to achieve their career objectives and experience greater job satisfaction.

Furthermore, don’t underestimate the power of emotional support from friends and family during this transitional period. Surrounding yourself with positive and understanding individuals can help alleviate stress and boost your confidence as you navigate the uncertainties of a career break. Research has shown that having a strong social support network can improve mental health and overall well-being.

By actively cultivating a diverse and reliable support network, you can enhance your resilience, gain valuable insights, and stay motivated throughout your career break journey. Remember, you don’t have to go through this alone – leverage the power of your support system to make the most of this transformative experience.

Maintaining a Work-Life Balance

Achieving a work-life balance is crucial, especially when taking a career break at 40. It’s essential to prioritize self-care, family time, and personal interests alongside any professional pursuits.

Research shows that maintaining a healthy work-life balance can lead to increased productivity, improved mental health, and overall life satisfaction.

One effective strategy for maintaining a work-life balance is to establish boundaries between work and personal life. Set specific work hours and stick to them, avoiding the temptation to check emails or work on projects during personal time. Creating a designated workspace can also help separate work from home life, reducing distractions and promoting focus during work hours.

Another important aspect of work-life balance is prioritizing self-care activities. This can include regular exercise, meditation, hobbies, or spending quality time with loved ones. Studies have shown that engaging in self-care activities can reduce stress levels, improve overall well-being, and enhance productivity when returning to work.

Additionally, technology can be both a blessing and a curse when it comes to work-life balance. While advancements in technology have made remote work more accessible, it has also blurred the lines between work and personal life.

Setting boundaries around technology use, such as implementing digital detox periods or turning off notifications during non-work hours, can help create a healthier balance.

By prioritizing self-care, setting boundaries, and managing technology use, individuals can maintain a healthy work-life balance during their career break at 40. This balance is essential for overall well-being and can contribute to a successful transition back into the workforce when the time comes.

Reentering the Workforce After Your Break

After taking a career break at 40, reentering the workforce can feel daunting, but with proper planning and preparation, you can successfully transition back into the professional world.

Here are some key steps to consider when reentering the workforce after your break:

- Update Your Skills: The job market is constantly evolving, so it’s essential to update your skills to remain competitive. Consider taking online courses, attending workshops, or obtaining certifications relevant to your field.

- Network: Networking is crucial when reentering the workforce. Attend industry events, connect with former colleagues, and utilize online platforms like LinkedIn to expand your professional network.

- Consider Part-Time or Freelance Work: If you’re looking to ease back into the workforce, consider starting with part-time or freelance opportunities. This can help you regain confidence, update your skills, and explore different industries or roles.

- Be Transparent About Your Career Break: During interviews, be honest about your career break and highlight the skills and experiences you gained during that time. Employers value honesty and authenticity, and showcasing how your break positively impacted your personal and professional growth can be a compelling narrative.

By following these steps and staying proactive in your job search, you can successfully reenter the workforce after taking a career break at 40. Remember, your break can be seen as an asset rather than a liability, showcasing your resilience, adaptability, and commitment to personal growth.

Embracing the Benefits of Taking a Career Break

Taking a career break at 40 can seem daunting, but it also presents a unique opportunity for personal growth and self-discovery. Embracing the benefits of this decision can lead to a more fulfilling and balanced life in the long run.

Here are some key advantages of taking a career break:

- Renewed Perspective: Stepping away from your career can provide you with a fresh outlook on life. It allows you to reassess your priorities, explore new interests, and gain clarity on what truly matters to you.

- Improved Mental Health: Research shows that taking a break from work can significantly reduce stress levels and improve overall mental well-being. Vacations and breaks from work can lead to lower levels of burnout and higher job satisfaction.

- Enhanced Creativity: Giving yourself the time and space to relax and recharge can boost your creativity and problem-solving skills. Taking a career break can inspire new ideas and innovative thinking that can benefit you when you return to the workforce.

- Increased Productivity: Contrary to popular belief, taking a break from work can actually increase your productivity in the long term. Employees who take regular breaks are more focused, engaged, and efficient at work.

- Stronger Relationships: A career break can also strengthen your relationships with family and friends. Spending quality time with loved ones can deepen your connections and create lasting memories that you may have missed out on while fully immersed in your career.

By embracing the benefits of taking a career break, you can pave the way for a more balanced, fulfilling, and successful future both personally and professionally.

Conclusion

Taking a career break at 40 can be a transformative experience if approached thoughtfully.

By evaluating your current situation, planning financially, exploring alternative income sources, setting clear goals, developing a support network, and maintaining a work-life balance, you can make the most of this time for personal growth and rejuvenation. When it’s time to reenter the workforce, remember to highlight the benefits of your break, such as newfound skills and perspectives.

Embrace the positive impact this break can have on your life and career, and step back into the professional world with confidence and renewed energy. A career break at 40 can be a valuable investment in yourself and your future.

In the world of personal finance and career aspirations, the phrase “six figures” carries a weighty significance. It’s a benchmark that many strive to achieve, a milestone signaling financial success and stability.

But what exactly does it mean to earn six figures? More specifically, how much is 6 figures?

Simply put, 6 figures refers to a number with six digits. 6 figures covers the amounts from $100,000 to $999,999.

But, the question “how much is 6 figures?” is more complicated than just the simple answer.

In this article, we look at the intricacies of this term, demystifying what lies within the definition of six figures.

From its numerical definition to its implications on earnings and lifestyle, let’s explore the ins and outs of “how much is 6 figures?”

What is 1 Figure?

In salary discussions, the term “figure” takes on a specific meaning. While in mathematics, a figure denotes any digit or number, in the context of earnings, only the dollar amount on your paycheck is considered.

Let’s break it down with examples:

Suppose your annual income amounts to $57,500. In this case, your salary falls within the five-figure range, earning you the title of a five-figure earner.

In another example, if your yearly earnings soar to $1,250,000, congratulations, you’ve entered the illustrious world of seven figures or 1 million dollars a year, making you a seven-figure earner.

If you have a net worth of $500,000, you have a six-figure net worth.

How Much is 6 Figures?

Understanding the term “6 figures” is pivotal in grasping the scale of earnings it encompasses. Essentially, when we say “6 figures,” we’re referring to numerical values comprised of six digits.

This range spans from $100,000, the starting point, to $999,999, the upper limit.

To illustrate further, let’s consider a few examples:

- $100,000: At the lower end of the spectrum, we have $100,000, which marks the threshold for entering the realm of 6 figures. Individuals earning this amount annually fall within the bracket of six-figure earners.

- $500,000: Halfway through the range, we find $500,000. Those who earn this figure annually enjoy substantial financial stability, comfortably nestled within the six-figure bracket.

- $999,999: At the upper boundary of 6 figures lies $999,999. Earnings reaching this pinnacle still remain within the six-figure domain, although they approach the cusp of entering the illustrious realm of seven figures.

In essence, “6 figures” encapsulates a range of earnings that denote significant financial achievement and stability, spanning from $100,000 to just shy of $1 million.

How Much is 6 Figures After Taxes

Understanding your take-home pay is crucial when planning your finances. The amount you receive after taxes depends on various factors, including your tax filing status, deductions, and the state you reside in.

On average, individuals can expect to pay around 20-30% or more of their income in federal and state income taxes. Let’s take some data from the IRS website on what your tax rate will be according to your income. This does not account for any of the factors listed above.

- 37% for incomes over $578,125 ($693,750 for married couples filing jointly)

- 35% for incomes over $231,250 ($462,500 for married couples filing jointly)

- 32% for incomes over $182,100 ($364,200 for married couples filing jointly)

- 24% for incomes over $95,375 ($190,750 for married couples filing jointly)

- 22% for incomes over $44,725 ($89,450 for married couples filing jointly)

- 12% for incomes over $11,000 ($22,000 for married couples filing jointly)

If you are making 6 figures, then you will be in the higher tax brackets.

Below are a few examples of different tax situations based on level of income in the 6 figure range.

- $100,000 Income:

- Assuming a single filer, let’s estimate the tax rate at around 24% based on the IRS data.

- After applying this tax rate, the estimated after-tax income would be around $76,000.

- $200,000 Income:

- For this income level, the tax rate could be around 32%.

- After taxes, the estimated take-home pay would be approximately $136,000.

- $500,000 Income:

- At this higher income bracket, the tax rate may fall around 35%.

- After accounting for taxes, the estimated after-tax income would be roughly $325,000.

These estimates provide a general idea of the take-home pay for individuals earning six-figure incomes after taxes. However, it’s important to note that actual amounts may vary depending on individual circumstances, deductions, and other factors.

Additionally, the progressive nature of the tax system means that higher incomes are subject to higher tax rates, resulting in a lower percentage of income retained after taxes compared to lower income levels.

How Much a Month is 6 Figures a Year?

Determining the monthly income equivalent of a six-figure annual salary is essential for budgeting and financial planning.

To calculate this, we’ll divide the annual income by 12 months to find the monthly amount.

Let’s explore detailed examples for different six-figure salary levels:

- $100,000 Annual Salary:

- Dividing $100,000 by 12 months gives us approximately $8,333.33 per month.

- This means that someone earning a $100,000 annual salary brings in around $8,333.33 each month before taxes and deductions.

- $200,000 Annual Salary:

- For a $200,000 annual salary, dividing by 12 yields roughly $16,666.67 per month.

- Individuals earning $200,000 annually receive approximately $16,666.67 each month, providing a higher monthly income compared to the $100,000 salary level.

- $500,000 Annual Salary:

- Dividing $500,000 by 12 months results in approximately $41,666.67 per month.

- Those earning $500,000 annually enjoy a significantly higher monthly income of around $41,666.67, reflecting the substantial earning potential of a six-figure salary at this level.

These examples highlight how the monthly income from a six-figure annual salary varies depending on the specific earnings level. It’s important to note that these figures represent gross income before taxes and deductions.

As we looked at in the previous section, actual take-home pay may differ based on factors such as tax withholding, retirement contributions, and other deductions.

Understanding the monthly equivalent of a six-figure salary is crucial for budgeting, saving, and planning expenses effectively.

Is it Good if You Make 6 Figures?

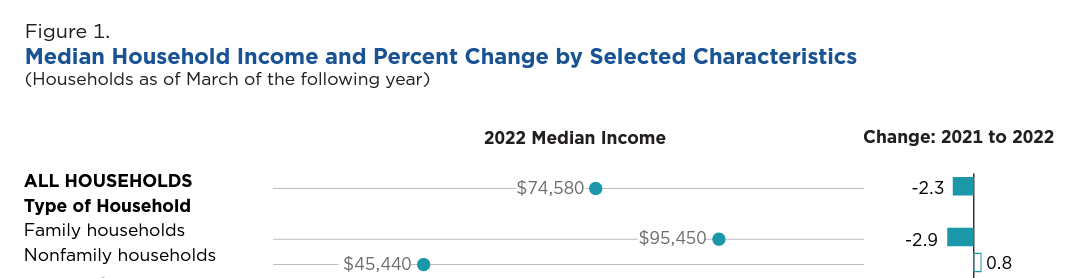

According to data from the US Census Bureau for 2022, the median income for Nonfamily households in the United States was approximately $45,440 – which means that half of all individuals earned more than this amount, and half earned less.

So, if you have a salary of 6 figures, you have a salary that is in the top 50 percent of all earners in the United States.

With a salary of 6 figures, you are doing very well and in the top echelon of earners in the United States.

Is it Good if You Have a Six-Figure Net Worth?

Having a six-figure net worth can indeed represent a noteworthy milestone in your financial journey, but its adequacy depends significantly on your specific circumstances and the benchmarks set by your peers. Let’s examine this concept through a comparative lens:

- Early Career Accumulation:

- For individuals just starting their careers, reaching a six-figure net worth can signal commendable financial discipline and early success. However, it’s essential to gauge this achievement relative to your age and career stage.

- Mid-Career Progression:

- In the midst of your professional journey, a six-figure net worth can reflect substantial progress toward financial stability and long-term goals. Yet, it’s crucial to consider where you stand compared to your peers and industry standards.

- Retirement Readiness:

- When planning for retirement, a six-figure net worth can provide a sense of financial security. However, its sufficiency hinges on various factors such as age, lifestyle expectations, and retirement goals. Therefore, it’s crucial to evaluate whether it aligns with the retirement savings targets recommended for your age group and desired standard of living in retirement.

In essence, while attaining a six-figure net worth is undoubtedly a commendable accomplishment, its significance is best understood in comparison to peer standards and established financial goals.

Whether it’s early in your career, midway through your professional journey, as an entrepreneur, or nearing retirement age, evaluating your net worth relative to others in similar circumstances can provide valuable insights into your financial progress and help guide your future wealth-building endeavors.

Examples of 6 Figure Salary Jobs

Securing a six-figure job is a significant achievement that often comes with specialized skills, advanced education, or substantial experience.

Let’s explore specific examples of careers that commonly offer six-figure salaries:

1. Software Developer/Engineer

Software developers and engineers are highly sought after in today’s technology-driven world. They design, develop, and maintain software applications and systems.

Positions in this field often require a bachelor’s degree in computer science or a related field, along with proficiency in programming languages such as Java, Python, or C++. Experienced software developers can easily command six-figure salaries, especially in tech hubs like Silicon Valley or Seattle.

A senior software engineer at a leading tech company can earn well over $100,000 annually, with salaries reaching $150,000 or more, depending on experience and location.

2. Medical Doctor

Physicians, including surgeons, specialists, and general practitioners, play a crucial role in healthcare, diagnosing and treating patients’ medical conditions.

Becoming a doctor requires extensive education, including a bachelor’s degree, medical school, and residency training. While the path to becoming a doctor is lengthy and rigorous, it can lead to lucrative six-figure salaries, particularly for specialists in high-demand fields.

A practicing surgeon in the United States typically earns between $250,000 to $500,000 annually, with some specialties like orthopedic surgery or neurosurgery commanding even higher salaries.

3. Corporate Lawyer

Corporate lawyers provide legal advice and representation to businesses on various matters, including mergers and acquisitions, contracts, intellectual property, and corporate governance.

To become a corporate lawyer, individuals must complete law school and pass the bar exam. Experienced corporate lawyers, especially those working at prestigious law firms or in corporate legal departments, often earn six-figure salaries.

Partners at top-tier law firms in major metropolitan areas can earn annual incomes well into the six-figure range, with some partners earning millions of dollars per year, depending on their client base and billing rates.

4. Financial Analyst/Manager

Financial analysts and managers analyze financial data, prepare reports, and provide recommendations to businesses and individuals regarding investment decisions, budgeting, and financial planning.

Positions in finance often require a bachelor’s degree in finance, accounting, economics, or a related field, along with relevant certifications such as the Chartered Financial Analyst (CFA) designation. Experienced professionals in finance can earn substantial six-figure salaries, particularly in roles such as investment banking, hedge fund management, or corporate finance.

A senior financial analyst at a multinational corporation or investment firm can earn a salary exceeding $100,000 annually, with bonuses and performance incentives further boosting their total compensation.

5. Petroleum Engineer

Petroleum engineers play a crucial role in the exploration, extraction, and production of oil and gas resources. They design and oversee drilling operations, develop new technologies to maximize production efficiency, and ensure compliance with safety and environmental regulations.

To become a petroleum engineer, individuals typically need a bachelor’s degree in petroleum engineering or a related field. Due to the specialized nature of their work and the demand for energy resources, petroleum engineers often enjoy lucrative six-figure salaries.

A senior petroleum engineer working for an oil and gas company can earn an annual salary ranging from $120,000 to $200,000, depending on experience and location, with potential for higher earnings through bonuses and profit-sharing.

6. Dentist

Dentists specialize in diagnosing and treating oral health issues, including tooth decay, gum disease, and oral infections. They perform dental procedures such as cleanings, fillings, and extractions, and may also provide cosmetic dental services like teeth whitening and veneers.

Becoming a dentist requires a doctoral degree in dentistry (Doctor of Dental Surgery or Doctor of Dental Medicine) and licensure. Dentists often have the potential to earn six-figure salaries, particularly those in private practice or specialized fields like orthodontics or oral surgery.

A general dentist in private practice can earn an annual income ranging from $120,000 to $200,000, depending on factors such as location, patient volume, and services offered. Specialists such as orthodontists or oral surgeons may earn even higher salaries.

7. Airline Pilot

Airline pilots are responsible for safely operating commercial aircraft, transporting passengers and cargo to destinations worldwide. They undergo extensive training and certification through flight schools, followed by gaining experience as a commercial pilot.

Pilots must also obtain an Airline Transport Pilot (ATP) certificate and pass regular medical exams to maintain licensure. Due to the demanding nature of their work and the responsibility involved, airline pilots often enjoy six-figure salaries, particularly those employed by major airlines.

Captains (pilots-in-command) flying for major commercial airlines can earn annual salaries ranging from $100,000 to $300,000 or more, depending on factors such as seniority, aircraft type, and flight hours. Additionally, pilots may receive benefits such as flight allowances, bonuses, and retirement plans.

These are just a few examples of many jobs that can lead to a 6 figure income.

Next, let’s talk about how you can increase your income to 6 figures if you aren’t making 6 figures.

How to Increase Your Income to 6 Figures

If you’re aiming to elevate your income to six figures, there are various effective strategies you can explore:

- Skill Development: Invest in enhancing your existing skills or acquiring new ones that are highly sought after in your industry. Continuous learning and skill improvement can significantly boost your earning potential.

- Negotiation: Don’t underestimate the power of negotiation when it comes to your salary. Whether you’re starting a new job or undergoing performance evaluations, confidently advocate for fair compensation that aligns with your value and contributions.

- Further Education: Consider pursuing advanced degrees, certifications, or specialized training programs that can enhance your qualifications and increase your marketability in the job market. Higher levels of education often correlate with higher earning potential.

- Job Switch: Sometimes, transitioning to a different job or company can result in a substantial salary increase. Explore opportunities in your field or related industries that offer competitive compensation packages and room for career growth.

- Freelancing or Part-Time Work: Supplement your primary income by taking on freelance projects or part-time work opportunities. Online platforms like Fiverr, Upwork, and TaskRabbit offer a plethora of gigs across various industries that allow you to leverage your skills and expertise for additional income.

- Start a Side Hustle: Launching a side hustle can be a lucrative way to generate extra income outside of your regular job. Explore a range of gig economy opportunities, such as dog walking/sitting, food delivery, photography, mystery shopping, and more.

By implementing these strategies and actively seeking opportunities to increase your income, you can work towards achieving your goal of earning a six-figure salary and securing financial stability for the future.

Can You Get Rich Making 6 Figures?

Earning a six-figure income can serve as a solid foundation for wealth building and financial success.

However, whether it leads to true wealth, or what some may consider being ‘rich,’ hinges on several crucial factors.

Let’s dive into these considerations:

- Financial Goals:

- Defining what “rich” means to you is essential. For some, it’s about achieving financial security and having enough to cover living expenses and retirement comfortably. For others, it may involve accumulating significant wealth. Your unique financial goals will shape your perception of wealth.

- Lifestyle Choices:

- Your spending habits and lifestyle choices profoundly impact your ability to accumulate wealth. Regardless of your income level, excessive spending or accumulating debt can impede your journey toward financial prosperity. Adopting budgeting techniques, practicing mindful spending, and living within your means are pivotal.

- Savings and Investments:

- Building wealth necessitates saving a substantial portion of your income and making astute investments. A higher income affords you the opportunity to save and invest more, accelerating your wealth accumulation. Consider contributing to retirement accounts, looking at stocks or real estate, and diversifying your investment portfolio.

- Debt Management:

- Managing and reducing debt, whether it’s student loans, credit card debt, or mortgages, is critical for building wealth. High-interest debt can impede your financial progress, so prioritizing debt repayment is crucial.

- Cost of Living:

- The cost of living in your area significantly influences your ability to save and invest. In regions with a high cost of living, it may be more challenging to accumulate wealth, even with a substantial income.

- Investment Strategy:

- Your investment strategy, including asset allocation, risk tolerance, and long-term planning, plays a pivotal role in wealth accumulation. Seeking guidance from a financial advisor can aid in making informed investment decisions aligned with your financial goals.

- Time Horizon:

- Building significant wealth requires time and consistent effort. The longer your investment horizon, the greater the potential for wealth accumulation through compounding returns.

In summary, a 6-figure income provides a solid foundation for building wealth, but it’s not the salary alone that determines your financial success.

Becoming ‘rich’ is a subjective goal, so it’s essential to define what it means for you and create a financial plan to pursue it.

Final Thoughts

In conclusion, understanding the concept of “six figures” is not merely about numbers but signifies a significant milestone in one’s financial journey.

From the starting point of $100,000 to just shy of $1 million, a six-figure income represents substantial earning potential and financial stability for individuals across various professions and industries.

Whether it’s through specialized skills, advanced education, or years of experience, attaining a six-figure salary is a testament to dedication and hard work.

However, it’s essential to recognize that earning six figures is not the ultimate measure of success, and financial well-being encompasses more than just income. Effective budgeting, prudent financial management, and pursuing passions and interests beyond monetary gains are equally important aspects of a fulfilling life.

By understanding the significance of six figures and embracing a holistic approach to finances, individuals can strive for both prosperity and fulfillment in their personal and professional endeavors.

Taking a career break at the age of 25 may seem like a daunting decision, but it can be a transformative experience that sets the stage for personal and professional growth. In today’s fast-paced world, the concept of pausing your career to reassess your goals and priorities is gaining popularity among young professionals.

Understanding the importance of a career break at 25 and how to navigate the financial aspects of this decision is crucial for a successful hiatus.

This article will guide you through the process of planning, managing finances, and leveraging your career break to emerge stronger and more focused on your journey ahead.

Understanding the Importance of a Career Break at 25

Taking a career break at the age of 25 can be a significant decision that offers numerous benefits for personal and professional development. In today’s fast-paced world, where burnout and stress are prevalent among young professionals, a career break can provide the necessary time and space to recharge, reflect, and refocus on one’s goals and aspirations.

At 25, individuals are often at a critical juncture in their careers, where they may be feeling overwhelmed or unsure about their chosen path.

A career break can offer the opportunity to step back, reassess priorities, and gain clarity on what they truly want to achieve in their professional lives. It can also serve as a time for self-discovery, allowing individuals to explore new interests, hobbies, or even potential career paths they may not have considered before.

Statistics show that young people are increasingly prioritizing work-life balance and personal well-being over traditional career advancement. Taking a career break at 25 aligns with this mindset, as it allows individuals to focus on their personal growth and well-being, which can ultimately lead to greater job satisfaction and long-term success.

Moreover, a career break at 25 can also be a strategic move to avoid burnout and prevent long-term negative impacts on mental and physical health. Research has shown that chronic stress and overwork can lead to a variety of health issues, including anxiety, depression, and even cardiovascular problems.

By taking a proactive approach to self-care and well-being through a career break, individuals can mitigate these risks and set themselves up for a healthier and more sustainable future.

Assessing Your Financial Situation Before Taking a Career Break

Before embarking on a career break at the age of 25, it is crucial to thoroughly assess your financial situation to ensure a smooth transition and a successful break. Understanding your financial standing will help you make informed decisions and plan effectively for the time off.

Here are some key factors to consider when assessing your financial situation:

- Savings and Emergency Fund: Evaluate your current savings and emergency fund. Experts recommend having at least three to six months’ worth of living expenses saved up before taking a career break. Calculate your monthly expenses and compare them to your savings to determine if you have enough to sustain yourself during the break.

- Debt Obligations: Take stock of any outstanding debts you have, such as student loans, credit card debt, or car loans. Consider how your career break may impact your ability to make regular debt payments and plan accordingly. It may be wise to pay off high-interest debts or negotiate more favorable repayment terms before taking a break.

- Income Sources: Assess any potential income sources you may have during your career break, such as part-time work, freelancing, or passive income streams. Having additional sources of income can help supplement your savings and maintain financial stability during your time off.

- Budgeting and Expenses: Review your current budget and identify areas where you can cut back on expenses to stretch your savings further. Create a detailed budget for your career break period, including all anticipated expenses, to ensure you stay within your financial limits.

By carefully evaluating these financial aspects before taking a career break at 25, you can better prepare yourself for the financial challenges that may arise and set yourself up for a successful and fulfilling break.

Planning Your Career Break: Setting Goals and Objectives

Before embarking on a career break at the age of 25, it is crucial to have a clear plan in place that outlines your goals and objectives for this period of time.

Setting specific goals will not only give your break a sense of purpose but also help you stay focused and motivated throughout the journey.

- Define Your Purpose: Start by identifying the reasons behind your decision to take a career break. Whether it’s to travel, pursue further education, explore a new industry, or simply take a breather, understanding your purpose will guide your goal-setting process.

- Set SMART Goals: When setting goals for your career break, make sure they are Specific, Measurable, Achievable, Relevant, and Time-bound. For example, if your goal is to travel, you could set a target of visiting a certain number of countries or experiencing different cultures within a specific timeframe.

- Financial Objectives: Consider setting financial goals to ensure you have a clear understanding of how much you need to save or earn during your career break. This could include setting a budget for your expenses, identifying alternative income sources, or saving a specific amount for your future plans.

- Personal Development Goals: Use this time to focus on personal growth and development. Whether it’s learning a new skill, volunteering for a cause you’re passionate about, or improving your physical and mental well-being, setting personal development goals can enrich your career break experience.

- Career Exploration Objectives: If one of your objectives is to explore different career paths or industries, set goals that align with this objective. This could involve networking with professionals in your areas of interest, attending workshops or conferences, or gaining relevant experience through internships or part-time work.

By setting clear and achievable goals for your career break, you can make the most of this valuable time and come out of it with a renewed sense of purpose and direction for your future endeavors.

Leveraging Your Career Break for Personal and Professional Growth

Taking a career break at 25 can be a transformative experience that not only allows you to recharge and refocus but also presents unique opportunities for personal and professional growth. During your time off, you have the chance to explore new interests, develop valuable skills, and gain a fresh perspective on your career path.

One way to leverage your career break for personal growth is to pursue activities that align with your passions and interests. Whether it’s traveling, volunteering, or taking up a new hobby, engaging in activities outside of your usual routine can help you discover new talents and interests.

For example, volunteering abroad can provide you with valuable cross-cultural experiences and enhance your communication and leadership skills.

On the professional front, your career break can be a valuable time to upskill and invest in your professional development. Consider taking online courses, attending workshops, or pursuing certifications that can enhance your skill set and make you more marketable to employers.

For instance, learning a new programming language or acquiring project management certification can significantly boost your career prospects.

Moreover, leveraging your career break for personal and professional growth can also involve networking and building relationships within your industry. Attend industry events, connect with professionals on LinkedIn, and seek mentorship opportunities to expand your professional network. Building strong relationships can open doors to new opportunities and provide valuable insights into your chosen field.

By actively seeking personal and professional growth opportunities during your career break, you can emerge from the experience with a renewed sense of purpose, enhanced skills, and a broader network of contacts that can propel your career forward.

Remember, a career break at 25 is not just about taking time off but also about investing in yourself for a brighter future.

Embracing the Benefits of Taking a Career Break at a Young Age

Taking a career break at the age of 25 can offer numerous benefits that can positively impact your personal and professional development in the long run. Embracing this decision can lead to valuable experiences and opportunities that may not be as easily accessible later in life.

One significant benefit of taking a career break at a young age is the opportunity for personal growth and self-discovery. This period of time off can allow you to explore your interests, passions, and values, helping you gain clarity on your career goals and aspirations.

Moreover, a career break at 25 can provide you with the chance to gain new skills and experiences that can enhance your resume and make you a more well-rounded candidate in the future. Whether you choose to travel, volunteer, or pursue further education during your break, these experiences can set you apart from your peers and demonstrate your adaptability and willingness to learn.

Additionally, taking a career break at a young age can help prevent burnout and improve your overall well-being. Research has shown that millennials who prioritize work-life balance are more engaged and productive at work. By taking time off to recharge and focus on your personal wellness, you can return to the workforce with renewed energy and motivation.

Summing up, embracing the benefits of taking a career break at 25 can lead to personal growth, skill development, and improved well-being, setting you up for long-term success in your career.

By seizing this opportunity for self-discovery and exploration, you can pave the way for a fulfilling and rewarding professional journey.

Reentering the Workforce After Your Career Break

After taking a career break at 25, reentering the workforce can be both exciting and challenging. It’s essential to approach this transition strategically to ensure a smooth reintegration into the professional world.

Here are some key steps to consider:

- Update Your Skills: During your career break, make sure to stay relevant by updating your skills and knowledge in your field. Consider taking online courses, attending workshops, or obtaining certifications to showcase your commitment to professional development.

- Network: Networking is crucial when reentering the workforce. Reach out to former colleagues, attend industry events, and connect with professionals on platforms like LinkedIn. Building and maintaining relationships can open up new opportunities and help you stay informed about job openings.

- Tailor Your Resume: Update your resume to highlight the skills and experiences gained during your career break. Focus on any freelance work, volunteer activities, or personal projects that demonstrate your continued engagement and growth during your time off.

- Be Transparent: When discussing your career break in interviews, be honest and transparent about your reasons for taking time off. Emphasize how the break has positively impacted your personal and professional development and how you are now eager to rejoin the workforce with renewed energy and enthusiasm.

- Consider Flexible Options: If you’re finding it challenging to secure a full-time position immediately, consider exploring part-time, freelance, or contract opportunities to ease back into the workforce. These flexible options can help you regain confidence and build momentum in your career.

By following these steps and staying proactive in your job search, you can successfully reenter the workforce after your career break and continue to progress in your professional journey.

Remember, taking a career break at 25 can be a valuable experience that enhances your skills and perspective, making you a more well-rounded and resilient professional.

Conclusion

Taking a career break at 25 can be a transformative experience that allows you to explore new opportunities, gain valuable insights, and recharge your passion for your career.

By understanding the importance of a career break, assessing your financial situation, setting goals, exploring alternative income sources, and maintaining financial stability, you can make the most of your time off.

Leveraging your career break for personal and professional growth will enhance your skills and perspective, while reentering the workforce with a fresh outlook can lead to exciting new opportunities. Embrace the benefits of taking a career break at a young age, as it can set you on a path towards a more fulfilling and successful future.

When you’re navigating the job market or budgeting for your future, knowing what your annual salary translates to in terms of a monthly wage can be incredibly helpful.

In this article, we’ll break down the math and explore what $145,000 a year means on a monthly basis after tax.

We’ll also dive into topics such as post-tax income and whether $145,000 a year can be considered a good salary. Plus, we’ll share tips on how you can potentially increase your hourly wage.

Let’s get into the details now of how much $145,000 a year is a month after taxes.

$145,000 a Year is How Much a Month After Taxes?

Understanding your take-home pay is crucial when planning your finances. The amount you receive after taxes depends on various factors, including your tax filing status, deductions, and the state you reside in.

On average, individuals can expect to pay around 20-30% or more of their income in federal and state income taxes. Let’s take some data from the IRS website on what your tax rate will be according to your income. This does not account for any of the factors listed above.

- 37% for incomes over $578,125 ($693,750 for married couples filing jointly)

- 35% for incomes over $231,250 ($462,500 for married couples filing jointly)

- 32% for incomes over $182,100 ($364,200 for married couples filing jointly)

- 24% for incomes over $95,375 ($190,750 for married couples filing jointly)

- 22% for incomes over $44,725 ($89,450 for married couples filing jointly)

- 12% for incomes over $11,000 ($22,000 for married couples filing jointly)

So at a $145,000 annual income, we will assume a tax rate of 24%.

$145,000 (annual income) x 24% (tax rate) = $34,800

So, after taxes, you would have approximately $110,200 left as your annual income.

To calculate your monthly income after taxes, you can divide $110,200 by 12 (since there are 12 months in a year):

$110,200 (annual income after tax) / 12 (months) = $9,183

So, at a yearly salary of $145,000, your monthly income after taxes would be approximately $9,183.

While this is a decent estimate, your monthly after-tax income can be different depending on a variety of factors.

Factors that Determine Your After-Tax Income

Your monthly after-tax income can vary depending on a multitude of factors, including:

- Tax Filing Status: Your filing status, such as single, married filing jointly, married filing separately, or head of household, can impact your tax liability and ultimately affect your after-tax income.

- Tax Deductions: The deductions you claim, such as the standard deduction or itemized deductions for expenses like mortgage interest, property taxes, and charitable contributions, can reduce your taxable income and lower your tax bill.

- Tax Credits: Tax credits directly reduce the amount of tax you owe, potentially leading to a lower tax liability and higher after-tax income. Common tax credits include the Earned Income Tax Credit (EITC), Child Tax Credit, and education-related credits.

- State and Local Taxes: The amount of state and local taxes you owe can vary based on your state of residence and local tax rates. Some states have no income tax, while others impose state income taxes in addition to federal taxes.

- Additional Withholdings: If you choose to have additional taxes withheld from your paycheck, either voluntarily or to cover other tax liabilities such as self-employment taxes, it can affect your after-tax income.

- Retirement Contributions: Contributions to retirement accounts such as a 401(k) or Traditional IRA can reduce your taxable income, potentially lowering your tax liability and increasing your after-tax income.

- Other Deductions and Adjustments: Various other deductions and adjustments to income, such as student loan interest deduction, tuition and fees deduction, or contributions to Health Savings Accounts (HSAs), can impact your taxable income and ultimately affect your after-tax income.

Overall, your monthly after-tax income is influenced by a complex interplay of factors related to your income, deductions, credits, and tax withholding preferences.

Understanding these factors and their implications can help you better manage your finances and plan for your financial future.

Next, let’s look at if $145,000 a year is a good salary.

Is $145,000 a Year a Good Salary?

Whether $145,000 a year is considered a good salary depends on various factors, including your location, cost of living, and personal financial goals. In some areas with a lower cost of living, $145,000 can provide a comfortable life. However, in more expensive cities, it may not stretch as far.

To determine if it’s sufficient for your needs, consider your monthly expenses, such as housing, utilities, transportation, groceries, and savings goals.

Additionally, factors like job benefits, opportunities for advancement, and job satisfaction play a significant role in evaluating the overall value of your wage.

Let’s take a look at how a $145,000 a year salary compares to others in the United States.

According to data from the US Census Bureau for 2022, the median income for Nonfamily households in the United States was approximately $45,440 – which means that half of all individuals earned more than this amount, and half earned less.

So, if you have a salary of $145,000, you have a salary that is in the top 50 percent of all earners in the United States. With annual pay of well over $45,400, you are doing very well and in the top echelon of earners in the United States..

How to Increase Your Income

When aiming to increase your income and bolster your financial resources, it’s crucial to consider a range of effective strategies:

- Skill Development: Invest in enhancing your existing skills or acquiring new ones that are highly valued in your industry. Keeping pace with evolving trends and technologies can significantly boost your marketability and earning potential.

- Negotiation: Don’t shy away from negotiating your wage when starting a new job or during performance evaluations. Demonstrating your value to employers and advocating for fair compensation can lead to substantial salary increases over time.

- Further Education: Explore opportunities for additional education or certifications that can augment your qualifications and increase your worth in the job market. Continuing education demonstrates your commitment to professional growth and can open doors to higher-paying roles.

- Job Switch: Consider transitioning to a different job or company if it presents opportunities for a significant salary bump. Assess the market demand for your skills and explore job openings that offer competitive compensation packages and room for advancement.

- Freelancing or Part-Time Work: Explore part-time job opportunities or freelance work to supplement your primary income. Online platforms like Fiverr and Upwork provide avenues to showcase your skills and secure freelance projects that align with your expertise and interests.

- Start a Side Hustle: Launching a side hustle can be a lucrative way to generate additional income streams. Explore a variety of gig economy apps and platforms that cater to different skill sets and interests. From dog walking and food delivery to photography and secret shopping, there’s a plethora of opportunities to leverage your talents and earn extra cash.

By diversifying your income sources and leveraging your skills and expertise, you can take proactive steps to increase your income after taxes and achieve greater financial stability and success.

Remember to assess each strategy’s feasibility and alignment with your long-term goals before taking action.

Will a Salary of $145,000 Help Me Become Rich?

Earning a salary of $145,000 annually can serve as a stepping stone toward building wealth and achieving financial stability.

However, whether this income level translates into being ‘rich’ depends on a multitude of factors that shape your financial journey.

Let’s dive into these considerations in detail:

- Financial Goals:

- Defining what “rich” means to you is paramount. It could entail achieving financial security to cover living expenses and retirement comfortably or accumulating substantial wealth. Your specific financial aspirations will dictate your perception of wealth and guide your financial decisions.

- Lifestyle Choices: