In the world of personal finance and career aspirations, the phrase “six figures” carries a weighty significance. It’s a benchmark that many strive to achieve, a milestone signaling financial success and stability.

But what exactly does it mean to earn six figures? More specifically, how much is 6 figures?

Simply put, 6 figures refers to a number with six digits. 6 figures covers the amounts from $100,000 to $999,999.

But, the question “how much is 6 figures?” is more complicated than just the simple answer.

In this article, we look at the intricacies of this term, demystifying what lies within the definition of six figures.

From its numerical definition to its implications on earnings and lifestyle, let’s explore the ins and outs of “how much is 6 figures?”

What is 1 Figure?

In salary discussions, the term “figure” takes on a specific meaning. While in mathematics, a figure denotes any digit or number, in the context of earnings, only the dollar amount on your paycheck is considered.

Let’s break it down with examples:

Suppose your annual income amounts to $57,500. In this case, your salary falls within the five-figure range, earning you the title of a five-figure earner.

In another example, if your yearly earnings soar to $1,250,000, congratulations, you’ve entered the illustrious world of seven figures or 1 million dollars a year, making you a seven-figure earner.

If you have a net worth of $500,000, you have a six-figure net worth.

How Much is 6 Figures?

Understanding the term “6 figures” is pivotal in grasping the scale of earnings it encompasses. Essentially, when we say “6 figures,” we’re referring to numerical values comprised of six digits.

This range spans from $100,000, the starting point, to $999,999, the upper limit.

To illustrate further, let’s consider a few examples:

- $100,000: At the lower end of the spectrum, we have $100,000, which marks the threshold for entering the realm of 6 figures. Individuals earning this amount annually fall within the bracket of six-figure earners.

- $500,000: Halfway through the range, we find $500,000. Those who earn this figure annually enjoy substantial financial stability, comfortably nestled within the six-figure bracket.

- $999,999: At the upper boundary of 6 figures lies $999,999. Earnings reaching this pinnacle still remain within the six-figure domain, although they approach the cusp of entering the illustrious realm of seven figures.

In essence, “6 figures” encapsulates a range of earnings that denote significant financial achievement and stability, spanning from $100,000 to just shy of $1 million.

How Much is 6 Figures After Taxes

Understanding your take-home pay is crucial when planning your finances. The amount you receive after taxes depends on various factors, including your tax filing status, deductions, and the state you reside in.

On average, individuals can expect to pay around 20-30% or more of their income in federal and state income taxes. Let’s take some data from the IRS website on what your tax rate will be according to your income. This does not account for any of the factors listed above.

- 37% for incomes over $578,125 ($693,750 for married couples filing jointly)

- 35% for incomes over $231,250 ($462,500 for married couples filing jointly)

- 32% for incomes over $182,100 ($364,200 for married couples filing jointly)

- 24% for incomes over $95,375 ($190,750 for married couples filing jointly)

- 22% for incomes over $44,725 ($89,450 for married couples filing jointly)

- 12% for incomes over $11,000 ($22,000 for married couples filing jointly)

If you are making 6 figures, then you will be in the higher tax brackets.

Below are a few examples of different tax situations based on level of income in the 6 figure range.

- $100,000 Income:

- Assuming a single filer, let’s estimate the tax rate at around 24% based on the IRS data.

- After applying this tax rate, the estimated after-tax income would be around $76,000.

- $200,000 Income:

- For this income level, the tax rate could be around 32%.

- After taxes, the estimated take-home pay would be approximately $136,000.

- $500,000 Income:

- At this higher income bracket, the tax rate may fall around 35%.

- After accounting for taxes, the estimated after-tax income would be roughly $325,000.

These estimates provide a general idea of the take-home pay for individuals earning six-figure incomes after taxes. However, it’s important to note that actual amounts may vary depending on individual circumstances, deductions, and other factors.

Additionally, the progressive nature of the tax system means that higher incomes are subject to higher tax rates, resulting in a lower percentage of income retained after taxes compared to lower income levels.

How Much a Month is 6 Figures a Year?

Determining the monthly income equivalent of a six-figure annual salary is essential for budgeting and financial planning.

To calculate this, we’ll divide the annual income by 12 months to find the monthly amount.

Let’s explore detailed examples for different six-figure salary levels:

- $100,000 Annual Salary:

- Dividing $100,000 by 12 months gives us approximately $8,333.33 per month.

- This means that someone earning a $100,000 annual salary brings in around $8,333.33 each month before taxes and deductions.

- $200,000 Annual Salary:

- For a $200,000 annual salary, dividing by 12 yields roughly $16,666.67 per month.

- Individuals earning $200,000 annually receive approximately $16,666.67 each month, providing a higher monthly income compared to the $100,000 salary level.

- $500,000 Annual Salary:

- Dividing $500,000 by 12 months results in approximately $41,666.67 per month.

- Those earning $500,000 annually enjoy a significantly higher monthly income of around $41,666.67, reflecting the substantial earning potential of a six-figure salary at this level.

These examples highlight how the monthly income from a six-figure annual salary varies depending on the specific earnings level. It’s important to note that these figures represent gross income before taxes and deductions.

As we looked at in the previous section, actual take-home pay may differ based on factors such as tax withholding, retirement contributions, and other deductions.

Understanding the monthly equivalent of a six-figure salary is crucial for budgeting, saving, and planning expenses effectively.

Is it Good if You Make 6 Figures?

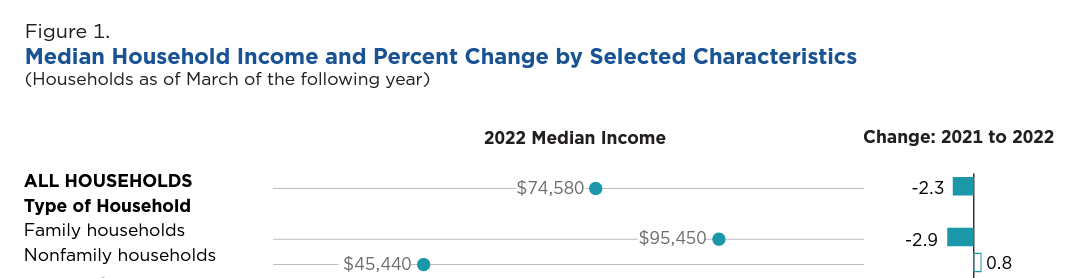

According to data from the US Census Bureau for 2022, the median income for Nonfamily households in the United States was approximately $45,440 – which means that half of all individuals earned more than this amount, and half earned less.

So, if you have a salary of 6 figures, you have a salary that is in the top 50 percent of all earners in the United States.

With a salary of 6 figures, you are doing very well and in the top echelon of earners in the United States.

Is it Good if You Have a Six-Figure Net Worth?

Having a six-figure net worth can indeed represent a noteworthy milestone in your financial journey, but its adequacy depends significantly on your specific circumstances and the benchmarks set by your peers. Let’s examine this concept through a comparative lens:

- Early Career Accumulation:

- For individuals just starting their careers, reaching a six-figure net worth can signal commendable financial discipline and early success. However, it’s essential to gauge this achievement relative to your age and career stage.

- Mid-Career Progression:

- In the midst of your professional journey, a six-figure net worth can reflect substantial progress toward financial stability and long-term goals. Yet, it’s crucial to consider where you stand compared to your peers and industry standards.

- Retirement Readiness:

- When planning for retirement, a six-figure net worth can provide a sense of financial security. However, its sufficiency hinges on various factors such as age, lifestyle expectations, and retirement goals. Therefore, it’s crucial to evaluate whether it aligns with the retirement savings targets recommended for your age group and desired standard of living in retirement.

In essence, while attaining a six-figure net worth is undoubtedly a commendable accomplishment, its significance is best understood in comparison to peer standards and established financial goals.

Whether it’s early in your career, midway through your professional journey, as an entrepreneur, or nearing retirement age, evaluating your net worth relative to others in similar circumstances can provide valuable insights into your financial progress and help guide your future wealth-building endeavors.

Examples of 6 Figure Salary Jobs

Securing a six-figure job is a significant achievement that often comes with specialized skills, advanced education, or substantial experience.

Let’s explore specific examples of careers that commonly offer six-figure salaries:

1. Software Developer/Engineer

Software developers and engineers are highly sought after in today’s technology-driven world. They design, develop, and maintain software applications and systems.

Positions in this field often require a bachelor’s degree in computer science or a related field, along with proficiency in programming languages such as Java, Python, or C++. Experienced software developers can easily command six-figure salaries, especially in tech hubs like Silicon Valley or Seattle.

A senior software engineer at a leading tech company can earn well over $100,000 annually, with salaries reaching $150,000 or more, depending on experience and location.

2. Medical Doctor

Physicians, including surgeons, specialists, and general practitioners, play a crucial role in healthcare, diagnosing and treating patients’ medical conditions.

Becoming a doctor requires extensive education, including a bachelor’s degree, medical school, and residency training. While the path to becoming a doctor is lengthy and rigorous, it can lead to lucrative six-figure salaries, particularly for specialists in high-demand fields.

A practicing surgeon in the United States typically earns between $250,000 to $500,000 annually, with some specialties like orthopedic surgery or neurosurgery commanding even higher salaries.

3. Corporate Lawyer

Corporate lawyers provide legal advice and representation to businesses on various matters, including mergers and acquisitions, contracts, intellectual property, and corporate governance.

To become a corporate lawyer, individuals must complete law school and pass the bar exam. Experienced corporate lawyers, especially those working at prestigious law firms or in corporate legal departments, often earn six-figure salaries.

Partners at top-tier law firms in major metropolitan areas can earn annual incomes well into the six-figure range, with some partners earning millions of dollars per year, depending on their client base and billing rates.

4. Financial Analyst/Manager

Financial analysts and managers analyze financial data, prepare reports, and provide recommendations to businesses and individuals regarding investment decisions, budgeting, and financial planning.

Positions in finance often require a bachelor’s degree in finance, accounting, economics, or a related field, along with relevant certifications such as the Chartered Financial Analyst (CFA) designation. Experienced professionals in finance can earn substantial six-figure salaries, particularly in roles such as investment banking, hedge fund management, or corporate finance.

A senior financial analyst at a multinational corporation or investment firm can earn a salary exceeding $100,000 annually, with bonuses and performance incentives further boosting their total compensation.

5. Petroleum Engineer

Petroleum engineers play a crucial role in the exploration, extraction, and production of oil and gas resources. They design and oversee drilling operations, develop new technologies to maximize production efficiency, and ensure compliance with safety and environmental regulations.

To become a petroleum engineer, individuals typically need a bachelor’s degree in petroleum engineering or a related field. Due to the specialized nature of their work and the demand for energy resources, petroleum engineers often enjoy lucrative six-figure salaries.

A senior petroleum engineer working for an oil and gas company can earn an annual salary ranging from $120,000 to $200,000, depending on experience and location, with potential for higher earnings through bonuses and profit-sharing.

6. Dentist

Dentists specialize in diagnosing and treating oral health issues, including tooth decay, gum disease, and oral infections. They perform dental procedures such as cleanings, fillings, and extractions, and may also provide cosmetic dental services like teeth whitening and veneers.

Becoming a dentist requires a doctoral degree in dentistry (Doctor of Dental Surgery or Doctor of Dental Medicine) and licensure. Dentists often have the potential to earn six-figure salaries, particularly those in private practice or specialized fields like orthodontics or oral surgery.

A general dentist in private practice can earn an annual income ranging from $120,000 to $200,000, depending on factors such as location, patient volume, and services offered. Specialists such as orthodontists or oral surgeons may earn even higher salaries.

7. Airline Pilot

Airline pilots are responsible for safely operating commercial aircraft, transporting passengers and cargo to destinations worldwide. They undergo extensive training and certification through flight schools, followed by gaining experience as a commercial pilot.

Pilots must also obtain an Airline Transport Pilot (ATP) certificate and pass regular medical exams to maintain licensure. Due to the demanding nature of their work and the responsibility involved, airline pilots often enjoy six-figure salaries, particularly those employed by major airlines.

Captains (pilots-in-command) flying for major commercial airlines can earn annual salaries ranging from $100,000 to $300,000 or more, depending on factors such as seniority, aircraft type, and flight hours. Additionally, pilots may receive benefits such as flight allowances, bonuses, and retirement plans.

These are just a few examples of many jobs that can lead to a 6 figure income.

Next, let’s talk about how you can increase your income to 6 figures if you aren’t making 6 figures.

How to Increase Your Income to 6 Figures

If you’re aiming to elevate your income to six figures, there are various effective strategies you can explore:

- Skill Development: Invest in enhancing your existing skills or acquiring new ones that are highly sought after in your industry. Continuous learning and skill improvement can significantly boost your earning potential.

- Negotiation: Don’t underestimate the power of negotiation when it comes to your salary. Whether you’re starting a new job or undergoing performance evaluations, confidently advocate for fair compensation that aligns with your value and contributions.

- Further Education: Consider pursuing advanced degrees, certifications, or specialized training programs that can enhance your qualifications and increase your marketability in the job market. Higher levels of education often correlate with higher earning potential.

- Job Switch: Sometimes, transitioning to a different job or company can result in a substantial salary increase. Explore opportunities in your field or related industries that offer competitive compensation packages and room for career growth.

- Freelancing or Part-Time Work: Supplement your primary income by taking on freelance projects or part-time work opportunities. Online platforms like Fiverr, Upwork, and TaskRabbit offer a plethora of gigs across various industries that allow you to leverage your skills and expertise for additional income.

- Start a Side Hustle: Launching a side hustle can be a lucrative way to generate extra income outside of your regular job. Explore a range of gig economy opportunities, such as dog walking/sitting, food delivery, photography, mystery shopping, and more.

By implementing these strategies and actively seeking opportunities to increase your income, you can work towards achieving your goal of earning a six-figure salary and securing financial stability for the future.

Can You Get Rich Making 6 Figures?

Earning a six-figure income can serve as a solid foundation for wealth building and financial success.

However, whether it leads to true wealth, or what some may consider being ‘rich,’ hinges on several crucial factors.

Let’s dive into these considerations:

- Financial Goals:

- Defining what “rich” means to you is essential. For some, it’s about achieving financial security and having enough to cover living expenses and retirement comfortably. For others, it may involve accumulating significant wealth. Your unique financial goals will shape your perception of wealth.

- Lifestyle Choices:

- Your spending habits and lifestyle choices profoundly impact your ability to accumulate wealth. Regardless of your income level, excessive spending or accumulating debt can impede your journey toward financial prosperity. Adopting budgeting techniques, practicing mindful spending, and living within your means are pivotal.

- Savings and Investments:

- Building wealth necessitates saving a substantial portion of your income and making astute investments. A higher income affords you the opportunity to save and invest more, accelerating your wealth accumulation. Consider contributing to retirement accounts, looking at stocks or real estate, and diversifying your investment portfolio.

- Debt Management:

- Managing and reducing debt, whether it’s student loans, credit card debt, or mortgages, is critical for building wealth. High-interest debt can impede your financial progress, so prioritizing debt repayment is crucial.

- Cost of Living:

- The cost of living in your area significantly influences your ability to save and invest. In regions with a high cost of living, it may be more challenging to accumulate wealth, even with a substantial income.

- Investment Strategy:

- Your investment strategy, including asset allocation, risk tolerance, and long-term planning, plays a pivotal role in wealth accumulation. Seeking guidance from a financial advisor can aid in making informed investment decisions aligned with your financial goals.

- Time Horizon:

- Building significant wealth requires time and consistent effort. The longer your investment horizon, the greater the potential for wealth accumulation through compounding returns.

In summary, a 6-figure income provides a solid foundation for building wealth, but it’s not the salary alone that determines your financial success.

Becoming ‘rich’ is a subjective goal, so it’s essential to define what it means for you and create a financial plan to pursue it.

Final Thoughts

In conclusion, understanding the concept of “six figures” is not merely about numbers but signifies a significant milestone in one’s financial journey.

From the starting point of $100,000 to just shy of $1 million, a six-figure income represents substantial earning potential and financial stability for individuals across various professions and industries.

Whether it’s through specialized skills, advanced education, or years of experience, attaining a six-figure salary is a testament to dedication and hard work.

However, it’s essential to recognize that earning six figures is not the ultimate measure of success, and financial well-being encompasses more than just income. Effective budgeting, prudent financial management, and pursuing passions and interests beyond monetary gains are equally important aspects of a fulfilling life.

By understanding the significance of six figures and embracing a holistic approach to finances, individuals can strive for both prosperity and fulfillment in their personal and professional endeavors.