If you are simply reading the news lately and following social media it would be easy to think that the American Dream has passed us by. The focus is constantly on the increased levels of debt, high house prices and the frozen job market. Stats are skewed to focus on the depressing and there is a growing fatalism in people under 40 that a future with a home and a family is simply not an option.

Obviously, there wouldn’t be all this bad press out there if there wasn’t truth in it. The American Dream is definitely under assault from the forces of inflation and the highest home prices in history. A college degree isn’t seen as an automatic pass to a stable future anymore either.

However, all this negative news is simply exposing trends that have actually been true for quite a while. The journey to the American Dream has been perilous for decades and has to be treated that way to find success. The great lie is believing that success in America has ever really been that easy. There have obviously been seasons where it was simpler to find a home and build a life, but every generation has faced serious headwinds.

Lost in all the focus on negativity is the fact that there are plenty of people quietly carving out a life. It’s not post worthy to figure out a tight budget to stay out of debt during the years when you are paying for childcare. A small home from the 1970s that needs fresh paint and new flooring isn’t something you celebrate outside your friends and family. All the steps that eventually lead to a financial breakthrough in your 40s look like a grind in your 20s and 30s, but if you talk to most retired people you will find that its pretty much always been this way.

The Myth of the Easy American Dream

It has always been a small fraction of people who have access to an easy path to a beautiful home and growing wealth. This is essentially what separates the upper class from the various flavors of the middle class. For the middle class, getting established has been a scrap even for the baby boomers. People in their 70s faces a terrible economy and double digit inflation in the 70s. Wages stagnated all through the 80s and 90s, so while home prices were low it wasn’t incredibly easy to get established. Gen X has been identified recently as the “Real Loser Generation” according the the Economist. This is largely due to the stock market stagnating in the early 2000s which cut them off from accumulating wealth.

There have been periodic recessions and stock market crashes through the past 50 years and so there have been plenty of periods where it looked equally bleak to the current state if not worse. Its good to talk to retired family about how their early years of marriage and kids because there are a lot of stories of pinching every penny, DIY home projects and worrying about the future.

The true story of the American Dream is that it is a battle. Its a battle to get established in a career, to find a place you want to settle down and for most its scrapping to make it work with kids. This was my parents experience, it was definitely how it went for my family and its what I’ll tell my kids to expect.

Fatalism towards the Future can be a self fulfilling prophecy

The biggest challenge I’m seeing for anyone looking to get established and build a life is that there is so much energy focusing on how impossible everything is. If people don’t believe that they will be able to make smart financial choices pay off, then it makes more sense to live for now. This has led to an epidemic of gambling, hyper risky investing and wasteful spending.

Why not get Doordash all week? Why not have fun putting some money on the football games over the weekend? Thanks to the tech economy, all these whims are easily realized on a phone.

The scary thing is that all of these convenient ways to pull money away are what can sink Gen Z’s future more than just the challenges they are facing in the housing market.

If you add $30K in credit card debt to an existing student load balance, then it can push the situation over the edge.

It’s okay to be figuring things out in your 20s and 30s

So what are people supposed to do? The first thing is to keep moving. Most people feel pretty lost in their career when they are starting out. Entry level roles are a grind and it is tough to see a vision of where things can go. The arc of the modern career is longer than it was in previous generations and that has to be accepted. Feeling pressure to buy a house at 30 simply isn’t realistic for most people. 30 is likely a time to still be getting experience and learning an industry. Its a great time to still be a a major hub city renting a small apartment.

There is so much internet conversation about early retirement or getting out of the 9 to 5, that it can be lost that most people grow their wealth through a normal career path. Its likely not going to make you super wealthy, but making the standard 401K contributions over the course of 30-40 years will most likely set you up for a comfortable retirement.

The key to the early years of a career is to be gaining skills to make you increasingly more marketable and moving around to find opportunities. Its now standard practice, that to get a legitimate raise you need to move to a new company. 3% is a pretty common annual raise and you might get close to 10% for a promotion, but companies will often give a larger bump when you are new. This is a huge reason why people shouldn’t stress to get a home by 30 because its most likely that the potential job that makes a home affordable is going to involve moving to a new city.

40 Might be the Right Time to Buy a First Home

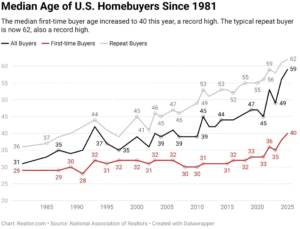

It seems pretty bleak that the median first time home buyer was 40 years old in 2025. However, if you think about what a modern career looks like, this is probably the right age to think about. This allows for keeping expenses lower as you grow your career and focus on investing a bit in the stock market. It allows for easy movement in the critical years for making advancement.

This also is a realistic timeline for when kids may be starting school which is realistically a great time to really put roots in one place for at least 5-10 years. Its really the season of life where it make sense settle in and that takes a lot of the risk out of the volatility that I forsee in the housing market. If you are comfortable staying in a house long term, then its still a great investment.

While the biggest cities are crushingly expensive, there continue to be plenty of areas in the US that are approachable for a couple on a middle class income. As I’ve mentioned in a previous piece, when cities like Buffalo show up on the hottest housing markets, you can bet its people looking for an affordable place to settle down.

Increasingly Challenging, but Possible

I’m writing this piece as someone who was pretty down on my prospects as a 30 year old. My career was still just getting rolling and I already had two young kids. I was like many people today and felt completely behind. I didn’t see a path for the long term, but my wife and I buckled down during the little kid years and stayed out of debt even if we weren’t investing much.

Careers kept moving along and we kept our lifestyle under control and then around 40 things really turned and we’ve seen our ability to save increase dramatically. Now I look back and can see how much those early years were building towards this, but it just doesn’t show up in the bank account in a linear fashion.

I am quite encouraged when I see that Gen Z invests in stocks at a higher rate than older generations because I think there will be many who see themselves get traction in 10 years despite things looking dire in the current moment.

At least here’s hoping.