In the world of personal finance and career aspirations, the phrase “five figures” carries a weighty significance. It’s a benchmark that many strive to achieve, a milestone signaling financial success and stability.

But what exactly does it mean to earn five figures? More specifically, how much is 5 figures?

Simply put, 5 figures refers to a number with five digits. 5 figures covers the amounts from $10,000 to $99,999.

But, the question “how much is 5 figures?” is more complicated than just the simple answer.

In this article, we look at the intricacies of this term, demystifying what lies within the definition of five figures.

From its numerical definition to its implications on earnings and lifestyle, let’s explore the ins and outs of “how much is 5 figures?”

What is 5 Figures?

In salary discussions, the term “figure” takes on a specific meaning. While in mathematics, a figure denotes any digit or number, in the context of earnings, only the dollar amount on your paycheck is considered.

Let’s break it down with examples:

Suppose your annual income amounts to $73,500. In this case, your salary falls within the five-figure range, earning you the title of a five-figure earner.

In another example, if your yearly earnings soar to $1,250,000, congratulations, you’ve entered the illustrious world of seven figures or 1 million dollars a year, making you a seven-figure earner.

If you have a net worth of $500,000, you have a six-figure net worth.

How Much is 5 Figures?

Understanding the term “5 figures” is pivotal in grasping the scale of earnings it encompasses. Essentially, when we say “5 figures,” we’re referring to numerical values comprised of five digits.

This range spans from $10,000, the starting point, to $99,999, the upper limit. This range encompasses various income levels and is a common milestone for individuals in their careers.

Let’s explore some examples:

- A graphic designer earning $60,000 per year has a five-figure income. This income level reflects the designer’s expertise and experience in the field, positioning them within the five-figure bracket and providing financial stability in their career.

- A registered nurse with an annual salary of $75,000 falls within the five-figure bracket. As healthcare professionals, registered nurses play a crucial role in patient care, and their earnings reflect the value they bring to their profession.

- A marketing manager making $90,000 annually also earns a five-figure income. Marketing managers are responsible for developing and implementing strategies to promote products or services, and their salary reflects their leadership and expertise in driving business growth.

These examples demonstrate the diverse range of occupations that fall within the five-figure income bracket, showcasing the value of skills, experience, and expertise in achieving financial success.

How Much is 5 Figures After Taxes

Understanding your take-home pay is crucial when planning your finances. The amount you receive after taxes depends on various factors, including your tax filing status, deductions, and the state you reside in.

On average, individuals can expect to pay around 20-30% or more of their income in federal and state income taxes. Let’s take some data from the IRS website on what your tax rate will be according to your income. This does not account for any of the factors listed above.

- 37% for incomes over $578,125 ($693,750 for married couples filing jointly)

- 35% for incomes over $231,250 ($462,500 for married couples filing jointly)

- 32% for incomes over $182,100 ($364,200 for married couples filing jointly)

- 24% for incomes over $95,375 ($190,750 for married couples filing jointly)

- 22% for incomes over $44,725 ($89,450 for married couples filing jointly)

- 12% for incomes over $11,000 ($22,000 for married couples filing jointly)

If you are making 5 figures, then you will be in the lower tax brackets.

Below are a few examples of different tax situations based on level of income in the 5 figure range.

- Annual Income: $40,000

- Tax Bracket: 12%

- Estimated Tax: $4,800

- Take-Home Pay: $35,200

- Annual Income: $75,000

- Tax Bracket: 22%

- Estimated Tax: $18,000

- Take-Home Pay: $57,000

- Annual Income: $97,000

- Tax Bracket: 24%

- Estimated Tax: $23,280

- Take-Home Pay: $73,720

These estimates provide a general idea of the take-home pay for individuals earning five-figure incomes after taxes. However, it’s important to note that actual amounts may vary depending on individual circumstances, deductions, and other factors.

Additionally, the progressive nature of the tax system means that higher incomes are subject to higher tax rates, resulting in a lower percentage of income retained after taxes compared to lower income levels.

How Much a Month is 5 Figures a Year?

Determining the monthly income equivalent of a five-figure annual salary is essential for budgeting and financial planning.

To calculate this, we’ll divide the annual income by 12 months to find the monthly amount.

Let’s explore detailed examples for different five-figure salary levels:

- Annual Income: $60,000

- Monthly Income: $60,000/12 = $5,000

- Annual Income: $75,000

- Monthly Income: $75,000/12 = $6,250

- Annual Income: $90,000

- Monthly Income: $90,000/12 = $7,500

These examples highlight how the monthly income from a five-figure annual salary varies depending on the specific earnings level. It’s important to note that these figures represent gross income before taxes and deductions.

As we looked at in the previous section, actual take-home pay may differ based on factors such as tax withholding, retirement contributions, and other deductions.

Understanding the monthly equivalent of a five-figure salary is crucial for budgeting, saving, and planning expenses effectively.

Is it Good if You Make 5 Figures?

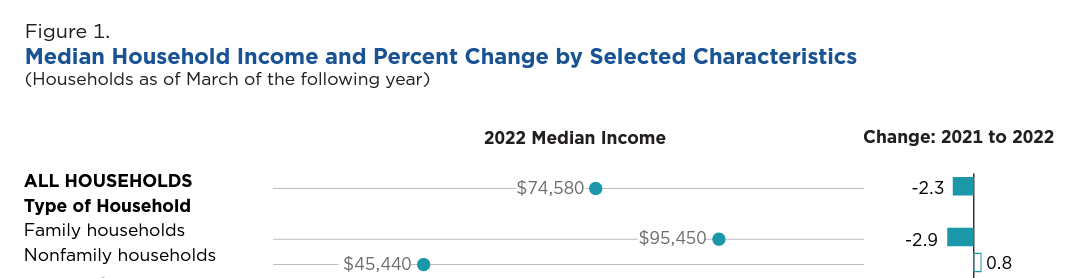

According to data from the US Census Bureau for 2022, the median income for Nonfamily households in the United States was approximately $45,440 – which means that half of all individuals earned more than this amount, and half earned less.

So, if you have a salary of 5 figures, you might be doing well but need to compare yourself to the chart above.

Examples of 5 Figure Salary Jobs

For jobs, there exists a diverse array of occupations that offer salaries falling within the five-figure range, typically ranging from $50,000 to $90,000 annually. Let’s explore five examples of such jobs:

- Software Developer:

- Software developers play a pivotal role in designing, testing, and maintaining computer programs and applications. With the increasing demand for technological solutions across industries, software developers command salaries in the five-figure range. Depending on experience and expertise, software developers can earn between $60,000 to $90,000 annually.

- Registered Nurse:

- Registered nurses provide critical healthcare services, including patient care, medication administration, and treatment coordination. Due to the essential nature of their work and the ongoing demand for healthcare professionals, registered nurses typically earn salaries ranging from $50,000 to $80,000 annually.

- Marketing Manager:

- Marketing managers are responsible for developing and implementing marketing strategies to promote products or services, drive sales, and enhance brand visibility. With their leadership skills and expertise in market analysis, marketing managers command salaries in the five-figure range, often ranging from $60,000 to $90,000 annually.

- Financial Analyst:

- Financial analysts assess economic trends, analyze financial data, and provide insights to help organizations make informed investment decisions. Given the specialized skill set and expertise required for this role, financial analysts typically earn salaries ranging from $60,000 to $80,000 annually.

- Civil Engineer:

- Civil engineers design, plan, and oversee construction projects, such as bridges, roads, and buildings, to ensure structural integrity and compliance with regulations. With their expertise in engineering principles and project management, civil engineers command salaries in the five-figure range, typically ranging from $60,000 to $90,000 annually.

These examples showcase a range of professions across different industries that offer competitive salaries within the five-figure range. Each of these roles requires specialized skills, education, and experience, making them desirable career paths for individuals seeking financial stability and professional growth.

Next, let’s talk about how you can increase your income to 5 figures if you aren’t making 5 figures.

How to Increase Your Income to 5 Figures

If you’re aiming to elevate your income to five figures, there are various effective strategies you can explore:

- Skill Development: Invest in enhancing your existing skills or acquiring new ones that are highly sought after in your industry. Continuous learning and skill improvement can significantly boost your earning potential.

- Negotiation: Don’t underestimate the power of negotiation when it comes to your salary. Whether you’re starting a new job or undergoing performance evaluations, confidently advocate for fair compensation that aligns with your value and contributions.

- Further Education: Consider pursuing advanced degrees, certifications, or specialized training programs that can enhance your qualifications and increase your marketability in the job market. Higher levels of education often correlate with higher earning potential.

- Job Switch: Sometimes, transitioning to a different job or company can result in a substantial salary increase. Explore opportunities in your field or related industries that offer competitive compensation packages and room for career growth.

- Freelancing or Part-Time Work: Supplement your primary income by taking on freelance projects or part-time work opportunities. Online platforms like Fiverr, Upwork, and TaskRabbit offer a plethora of gigs across various industries that allow you to leverage your skills and expertise for additional income.

- Start a Side Hustle: Launching a side hustle can be a lucrative way to generate extra income outside of your regular job. Explore a range of gig economy opportunities, such as dog walking/sitting, food delivery, photography, mystery shopping, and more.

By implementing these strategies and actively seeking opportunities to increase your income, you can work towards achieving your goal of earning a five-figure salary and securing financial stability for the future.

Can You Get Rich Making 5 Figures?

Earning a five-figure income can serve as a solid foundation for wealth building and financial success.

However, whether it leads to true wealth, or what some may consider being ‘rich,’ hinges on several crucial factors.

Let’s dive into these considerations:

- Financial Goals:

- Defining what “rich” means to you is essential. For some, it’s about achieving financial security and having enough to cover living expenses and retirement comfortably. For others, it may involve accumulating significant wealth. Your unique financial goals will shape your perception of wealth.

- Lifestyle Choices:

- Your spending habits and lifestyle choices profoundly impact your ability to accumulate wealth. Regardless of your income level, excessive spending or accumulating debt can impede your journey toward financial prosperity. Adopting budgeting techniques, practicing mindful spending, and living within your means are pivotal.

- Savings and Investments:

- Building wealth necessitates saving a substantial portion of your income and making astute investments. A higher income affords you the opportunity to save and invest more, accelerating your wealth accumulation. Consider contributing to retirement accounts, delving into stocks or real estate, and diversifying your investment portfolio.

- Debt Management:

- Managing and reducing debt, whether it’s student loans, credit card debt, or mortgages, is critical for building wealth. High-interest debt can impede your financial progress, so prioritizing debt repayment is crucial.

- Cost of Living:

- The cost of living in your area significantly influences your ability to save and invest. In regions with a high cost of living, it may be more challenging to accumulate wealth, even with a substantial income.

- Investment Strategy:

- Your investment strategy, including asset allocation, risk tolerance, and long-term planning, plays a pivotal role in wealth accumulation. Seeking guidance from a financial advisor can aid in making informed investment decisions aligned with your financial goals.

- Time Horizon:

- Building significant wealth requires time and consistent effort. The longer your investment horizon, the greater the potential for wealth accumulation through compounding returns.

In summary, a 5-figure income provides a solid foundation for building wealth, but it’s not the salary alone that determines your financial success.

Becoming ‘rich’ is a subjective goal, so it’s essential to define what it means for you and create a financial plan to pursue it.

Final Thoughts

In conclusion, understanding the concept of “five figures” is not merely about numbers but signifies a significant milestone in one’s financial journey.

From the starting point of $10,000 to just shy of $100,000, a five-figure income represents substantial earning potential and financial stability for individuals across various professions and industries.

Whether it’s through specialized skills, advanced education, or years of experience, attaining a five-figure salary is a testament to dedication and hard work.

However, it’s essential to recognize that earning five figures is not the ultimate measure of success, and financial well-being encompasses more than just income. Effective budgeting, prudent financial management, and pursuing passions and interests beyond monetary gains are equally important aspects of a fulfilling life.

By understanding the significance of five figures and embracing a holistic approach to finances, individuals can strive for both prosperity and fulfillment in their personal and professional endeavors.