There has been quite a bit of commotion about the fact that the average age of a first time home buyer in the US has risen to 40 based on the latest data available. This average age has been moving up for years as homes become more expensive, but also due to families forming later in life. When this number gets discussed it is mostly from the negative perspective, but it is worth stepping back and looking at this from a fresh perspective. The world is undergoing a major shift as people migrate towards the economic engine cities which come with sky high housing costs. There is also a significant shift towards getting married and starting families later in life.

In this new climate, it is worth simply evaluating if 40 is actually the right age to purchase a first property? Is this the right balance between benefiting from the lower cost to rent in many cities, but ending up in a home that you can eventually pay off.

Life Takes Longer To Launch in the Modern World

Aside from those who work in tech or finance, the process of working up to a solid salary takes some time. Its a balance of getting experience and finding where you can add the most value in whatever profession you choose. Most people have false starts in one way or another. For most of my friends, their 20s was largely a feeling out period of trying out the different aspects of their chosen field or realizing that they needed to shift to something new. This sorting period isn’t expected and is frankly incredibly disappointing to many, but its common.

This aspect of career development seems to be causing Gen Z tons of grief because it doesn’t present a linear path to making the kind of money that fits with owning a home. College is far from an automatic step and it adds on student loans to the equation. When you are fresh out of college and only making $50K a year, it looks impossible, but it just needs space to breathe. For most, 30 is just too young to think about saving enough for a down payment, and that is okay.

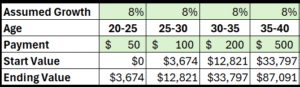

Here are a couple scenarios that show how a person can gradually increase their savings as they grow their income. The first assumes a steady increase between 20-40. It doesn’t look great at 30, but between 35 and 40 the combo of increased savings and compounding really kick in. This is actually pretty conservative returns at 8% a year and it still gets to $87K to put towards a home (or just keep rolling in an index fund).

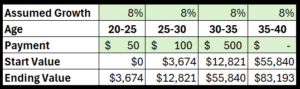

This next scenario represents a couple who knows they want to have kids and so puts more down in their early 30s, but doesn’t save at all for 5 years when the kids are little. This still puts them in a spot to buy a house as the first kid starts school.

No money goes in from 35-40, but it still gets up to $83K. That is more than enough for a solid down payment in many parts of the country. It also shows that you can get to some decent savings without huge monthly savings rates. These numbers would be very approachable for two incomes renting a reasonable place.

Why Buy a House at all?

If you are in your late 30s and you’ve actually started getting a nice nest egg invested in the stock market it would make sense to just keep riding with that plan. If you want to stay in a big city where homes are extremely expensive then this could be a good idea. The reason to buy a home starts with entering a season of life where you want to be stable for a while.

Real estate has historically been a good investment when held for a long time. If you think you will be moving around and jumping to new jobs, then it doesn’t actually make much sense. If you have school age kids or will in the coming years, then having a stable location becomes much more appealing.

This first aspect of buying a home connects with the needs of the moment, but the most important reason to buy a home relates more to the eventual goal of retirement. If you buy a home at 40, then with some additional principal payments each year you can actually set your sites on paying it off. This is a huge deal for thinking about the shift into living off your investments. If you are still renting at 60 or 65, it puts all of your well being at the hands of your investment portfolio. If you have a paid off house, you have a much lower burden and also a separate source of potential money for the future. Paying off a house is the ultimate hedge on the markets and this shouldn’t be missed even though stocks provide more annual returns.

If you are investing in a 401K and putting some extra on paying off a home, this is in my opinion the best way to get ready for retirement. A paid off house takes much of the risk out of future potential black swan events for the stock market or even the housing market.

Putting Down Roots is Bigger than Just Money

In the previous section I’ve laid out the financial side of why buying one home and paying it off would be valuable from a financial perspective, but there is a more important side to this. The idea of really putting roots down in a community has far more potential benefit than just the financial. If you mentally plant yourself and start paying a home down, then its easier to invest in neighbors and in your local city. This is part of a remedy to the disconnected existence that is so common in modern life. When everyone is passing through its easy to stay aloof, but when you have planted, it can’t help but shift your mentality.

In the culture of the United States, there is a major difference to a neighborhood where most people own their homes and are looking to stay long term. It is incredibly pronounced when you move from a major city where people are highly transient to any smaller metro where people tend to settle down to raise kids.

This is the last major reason that it makes the most sense to target 40 to buy a first home: you need to be ready to settle down. People aren’t settling down to have kids at 28 anymore. Those days are long gone and that is okay. The idea of locking into an area and truly investing in that community is something I hope everyone finds at some point. That is still incredibly connected to buying a home and even though it takes longer these days, it still something worth pursuing.