Power Grid Corporation of India Limited is a Schedule ‘A’, ‘Maharatna’ Public Sector Enterprise of the Government of India, founded on October 23, 1989, under the Company Act, 1956. Power Grid is a listed company, with 51.34% held by the Government of India, and the rest held by institutional investors and the public.

Power Grid has caught the attention of many discerning investors. As one of India’s leading power system companies, Power Grid Corporation of India Limited (Power Grid Corp) stands tall in power generation and distribution.

Power Grid Financial Analysis

For the quarter ending December 31, 2023, the firm reported a Consolidated Total Income of Rs 11,819.70 Crore, up 2.51% from the previous quarter’s Total Income of Rs 11,530.43 Crore and up 2.51% from the same quarter last year at Rs 11,530.22 Crore. In the last quarter, the company earned a net profit after tax of Rs 4,028.25 crore. The company spent 21.14% of its operational revenues on interest charges and 5.5% on labor costs in the fiscal year ending March 31, 2023.

In the following table, we have included the financial stats of the company for the year 2023. You can take a look and compare the stats on a quarter-by-quarter basis.

| Category | March 2023 | June 2023 | Sep 2023 | Dec 2023 |

| Sales | Rs. 11,494.90 Crores | Rs. 10,436.11 Crores | Rs. 10,419.41 Crores | Rs. 10,676.59 Crores |

| Expenses | Rs. 4573 Crores | Rs. 4497 Crores | Rs.4352 Crores | Rs. 4433 Crores |

| Operating Profit | Rs. 7,713.98 Crores | Rs. 6,584.28 Crores | Rs. 6,851.85 Crores | Rs. 7,033.02 Crores |

| Basic Earning per Share | 4.27 | 5.08 | 4.12 | 4.27 |

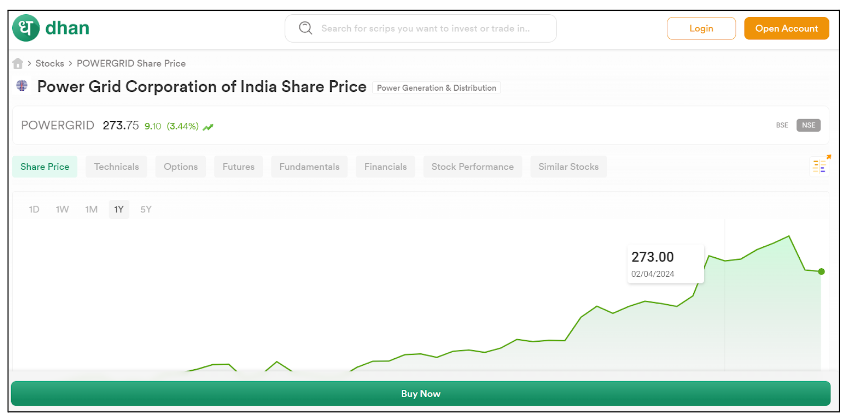

Power Grid Price Analysis

Compared to the last closing price, As of April ‘24 Power Grid share price is trading around Rs. 270+. Go through the following Power Grid share price chart for a better idea of its recent market trends.

Power Grid Corporation Of India’s TTM P/E ratio is 14.03, compared to the sector’s P/E of 12.45.

Should You Invest in Power Grid Stocks?

Over the last year, PowerGrid has outperformed its benchmark index. Power Grid Corporation of India Ltd. share price moved up by 0.20% from its previous close of Rs 279.55. Power Grid Corporation of India Ltd. stock last traded price is 280.10. Daily Power Grid’s MACD crossover appeared yesterday and its average price gain of 3.34% within 10 days of this signal in the last 10 years gives a buy signal to the investors.

However, you should always consider a company’s financial health, leadership, and industry position to decide. With the company’s history and performance, you can make an informed decision.

Conclusion

Investors looking for exposure to India’s developing energy infrastructure may want to consider investing in Power Grid Corp. Power Grid has a solid financial performance, excellent growth potential, and a favorable market position, making it an interesting investment opportunity. Investors should undertake due research before making any investment selections, analyze their risk tolerance, and engage with investment professionals.

Visit the Dhan website to start your investing journey now and stay up to speed on the stock market.

Corporate governance might sound like a term reserved for boardrooms and executives, but its importance permeates every aspect of a company’s operations. Whether it’s a small startup or a multinational corporation, having effective corporate governance practices is crucial for success and sustainability. But navigating the complexities of corporate governance isn’t always a walk in the park. Here is a look at the challenges companies encounter in maintaining these practices, particularly in the context of multinational corporations, and how the Legal Entity Identifier (LEI) can be a game-changer in streamlining corporate governance processes.

What is Corporate Governance?

At its core, corporate governance is a set of rules, practices, and processes that direct and control a company’s operations. It entails balancing the interests of multiple stakeholders, including shareholders, management, customers, suppliers, financiers, the government, and the community.

The Challenges of Multinational Corporate Governance

Transparency and Accountability Across Borders

Operating across different countries means contending with diverse legal systems, cultural norms, and regulatory frameworks. This complexity can lead to inconsistencies in governance practices, making it difficult to ensure alignment with the company’s overall objectives and values. Lack of transparency undermines trust among stakeholders and exposes the company to legal and reputational risks.

Coordination of Governance Structures

Multinational corporations often have subsidiary companies in various countries, each with its own board of directors and management team. Coordinating these entities to ensure consistency in decision-making and strategic direction requires careful planning and communication.

Cultural Differences

Cultural differences can cause significant challenges to effective corporate governance. Bridging these divides and fostering a cohesive corporate culture that upholds ethical standards and integrity can be an ongoing struggle.

Regulatory Compliance

Navigating different regulatory environments in each country can be a daunting task. Multinational corporations must stay abreast of regulatory changes and ensure compliance with laws and regulations spanning multiple jurisdictions. Failure to do so can result in penalties, legal disputes, and damage to the company’s reputation.

Language and Communication Barriers

Operating in multiple countries means dealing with language barriers and communication challenges. Misinterpretation or misunderstanding of governance policies and procedures due to language differences can lead to conflicts and inefficiencies within the organisation.

Currency and Financial Reporting Challenges

Fluctuating exchange rates and varying accounting standards across countries can complicate financial reporting for multinational corporations. Ensuring accuracy and consistency in financial statements becomes a challenging task, requiring robust systems and processes to address these complexities.

The Role of Legal Entity Identifiers (LEIs)

Amid these challenges, the Legal Entity Identifier (LEI) emerged as a beacon of hope. LEIs are unique identifiers assigned to entities engaging in financial transactions. They provide a standardised method for identifying legal entities, helping to streamline regulatory reporting and improve transparency in financial markets.

How LEIs Address Corporate Governance Challenges

Enhanced Entity Identification and Verification

LEIs simplify the process of identifying subsidiaries, affiliates, and counterparties across different jurisdictions, reducing administrative burden and minimising the risk of errors.

Facilitate Regulatory Compliance

LEIs provide a common language for reporting entities, simplifying regulatory compliance and ensuring consistency in reporting standards.

Improved Risk Management and Transparency

By linking entities to their ultimate parent companies, LEIs help stakeholders gain a clearer picture of a company’s ownership structure and risk exposure, thereby enhancing transparency and building trust.

Navigating the complexities of corporate governance, especially in the context of multinational corporations, is a challenging feat. From grappling with diverse regulatory environments to bridging cultural differences, companies face many challenges in upholding effective governance practices. However, with the right tools and approach, companies can mitigate many of these challenges and pave the way for more transparent, accountable, and resilient governance processes. As the business sphere continues to evolve, leveraging technology and standardised practices will be vital to navigating the ever-changing terrain of corporate governance.

Are you wrestling with the decision between paying outright for a new car or opting for financing? You’re not alone. This common dilemma faces many prospective car buyers, each weighing immediate financial impact against long-term budgeting. Financing a car, often viewed merely as a necessity for those without the full purchase price in hand, actually holds numerous advantages that can benefit a wide range of buyers.

In this blog, we’ll dive deep into the world of car financing. We aim to unpack its accessibility as a purchasing option and explore its top benefits. Whether you’re a first-time buyer or considering an upgrade to a newer model, understanding how car financing works could reveal why it’s often seen as a smart financial strategy. Let’s get into why financing your next car might just be the best decision you could make.

Understanding Car Financing

Car financing is a process that allows you to borrow money to purchase a vehicle. Instead of paying the full cost upfront, financing lets you spread out the payment over a period of time, making it more manageable for your budget. Typically, you’ll make a down payment initially, followed by regular monthly payments until the full price of the car, along with any interest charged by the lender, is paid off. Car financing is available for all kinds of different purchases, so you can finance a new vehicle or apply for a used car loan today with terms that suit you!

Let’s break down some common terms you’ll encounter when financing a car:

- Down Payment: This is the initial amount paid upfront when purchasing a car. It directly reduces the amount of money you need to borrow. A larger down payment often means lower monthly payments and less interest paid over time.

- Interest Rate: This is the percentage of the principal loan amount that the lender charges as interest, added to your monthly payments. Your interest rate can vary based on your credit score, the lender, and market conditions.

- Term Length: This refers to the duration over which you will repay the loan. Typical car loans can range from 24 to 72 months or more. Longer terms can lower your monthly payments but may increase the total amount of interest you pay.

- Monthly Payments: These are regular payments made to cover both the principal of the loan and the interest. The amount is influenced by the loan amount, interest rate, and term length.

Understanding these terms will help you navigate the details of car financing and assist you in choosing a plan that fits your financial situation comfortably.

Benefits of Financing a Car

Financing a car offers several distinct advantages that make it an appealing choice for many buyers. Here’s a closer look at the main benefits:

- Affordability: One of the most significant benefits of financing is affordability. By breaking down the total cost of a car into manageable monthly payments, financing makes it possible for more people to afford a vehicle that suits their needs without having to pay the full amount upfront. This can be especially helpful for those who need a car for work or family commitments but don’t have the funds to cover the entire cost at once.

- Cash Flow Management: Financing a car also helps in maintaining healthy cash flow. Instead of draining your savings to buy a car outright, you can keep most of your funds intact for other financial needs and emergencies. This way, you avoid putting yourself in a tight spot financially, giving you breathing room to handle other important expenses or unexpected costs without stress.

- Credit Building: When you finance a car and make consistent, on-time payments, you have an excellent opportunity to build or improve your credit score. Each payment contributes positively to your credit history, demonstrating to future lenders that you are a reliable borrower. This can lead to better terms on future loans and credit opportunities, including lower interest rates.

- Flexible Terms: Car financing comes with a variety of options and terms, allowing you to choose a plan that best fits your budget and payment preferences. Whether you prefer a shorter loan term with larger payments or a longer term with smaller payments, you can tailor your financing to match your financial situation. This flexibility lets you balance your monthly expenses more effectively while still enjoying the benefits of owning a car.

Together, these benefits make car financing a practical and strategic choice for managing both your immediate mobility needs and your long-term financial health.

Potential Downsides

While financing a car offers numerous benefits, it’s important to consider a few potential drawbacks to ensure you make a well-informed decision.

- Cautions: One of the main concerns with financing a car is the total interest cost over the duration of the loan. Depending on the interest rate and the length of your loan, you might end up paying a significant amount in interest on top of the principal. Another risk is being “upside down” on your loan, which means you owe more than the car is worth. This often occurs when cars depreciate faster than you can pay off the loan, potentially complicating the sale or trade-in of the vehicle.

- How to Mitigate Risks: To avoid these issues, consider making a more substantial down payment if possible. This reduces the borrowed amount, thereby lowering both your monthly payments and the total interest paid over time. Opting for shorter loan terms can also help. Although this may increase your monthly payment, it accelerates your payoff schedule and reduces the total interest cost, helping you build equity in your vehicle faster.

Conclusion

Financing any purchase requires careful consideration of your position and overall goals, so make sure you do your homework before signing on the dotted line. By staying mindful of the total cost over time, you can ensure that you make the most out of your investment. Remember, the goal is not just to finance a vehicle but to do so in a way that aligns with your overall financial health and future goals. With the right planning and awareness, car financing can be a strategic move that helps you achieve your mobility needs without compromising your financial stability.

As the digital landscape continues to grow, so does the ease of buying nicotine pouches online through online stores. There are many things you can buy online when it comes to smoking, ranging from vapes to e-cigarettes but it is the nicotine pouches that have experienced a surge in popularity recently. For individuals looking for tobacco-free alternatives, the internet presents a wide array of benefits that physical stores simply cannot match. From the diversity in choice to the reduction in cost, online shopping for nicotine products offers a smarter way for consumers to satisfy their needs.

It’s time to explore the key reasons online purchases have become a preferred method for many.

Wide Selection at Your Fingertips

Shopping online immediately opens up a vast selection of nicotine pouches that physical stores can’t compete with. Online shops don’t face the same space constraints and can offer a broader range of products, from well-loved ones to newer brands on the market. So in the competition between online vs. offline, online seems to win when it comes to these products and also with things like vapes or e-cigarettes. This abundance means you’re more likely to find the perfect match for your preferences without having to settle. Moreover, special editions and unique flavors are often easier to come across online, allowing you to expand your tastes and experiences, showcasing one of the many benefits of buying online.

The variety of the low price on nicotine pouches available online is truly astounding, creating an easy way to save money. With just a few clicks, you can find a wide assortement of strengths, flavors and brands to suit your individual preferences. From classic mint to fruity options like berry and citrus in Zyn flavors, there’s a pouch for every palate. You can also easily find your preferred nicotine strength, whether you’re looking for a strong kick or a milder experience. Online stores cater to all tastes and needs, ensuring you find your perfect match and the ideal nicotine pouches brands that suit your preferences.

Lowering Costs for Consumers

An undeniable benefit of online shopping is the reduction in prices. With fewer overheads than their physical counterparts, online stores can pass these savings onto their customers, resulting in lower costs for nicotine pouches. Besides everyday affordable pricing, online stores frequently offer promotions, bulk discounts and exclusive online offers that further decrease the price tag, making online purchases financially smarter.

In addition to the inherently lower prices found online, many e-commerce sites offer subscription services for nicotine pouches. These programs often provide a discounted rate when you agree to receive regular shipments of your favorite products. This not only saves you money in the long run but also ensures you never run out of your preferred pouches. Subscription services are a great way to enjoy the convenience of online shopping while maximizing your savings.

Online Versus Offline: A Comparative Look

When weighing the benefits of online against offline shopping, the convenience and privacy online shopping affords is unmatched. E-stores are always open, eliminating the need to adjust your schedule to store timings. For those who prefer discretion with their purchases, online shopping guarantees privacy, with orders shipped directly to your home in plain packaging. The wealth of information available online, including customer reviews and detailed product descriptions, also supports more informed decision-making.

Another advantage of online shopping is the ability to read and write reviews. Customer feedback provides valuable insights into the quality, flavor and overall experience of different nicotine pouch brands. By reading reviews, you can make more informed decisions and avoid products that don’t meet your expectations. You can also contribute to the community by sharing your own experiences and helping others make better purchasing decisions. This level of information sharing is rarely available in physical stores, giving online shopping a distinct edge.

Maximizing Savings Online

The appeal of saving money while shopping online for nicotine pouches extends beyond simply finding products at lower prices. Avoiding the trip to a store keeps extra dollars in your pocket and saves time. Comparing prices across websites further ensures you receive the best deal available. Signing up for newsletters and following favorite brands on social media can also lead to significant savings through alerts on upcoming deals and promotions.

Many online nicotine pouch retailers offer loyalty programs that reward frequent shoppers. These programs often operate on a points system, where you accumulate points for each purchase which can then be redeemed for discounts on future orders. Some sites even offer bonus points for actions like referring friends or writing reviews. By taking advantage of these loyalty programs, you can enjoy ongoing savings and get more value out of your online shopping experience.

Final Thoughts

In conclusion, the shift toward purchasing nicotine pouches online offers undeniable advantages. The variety of choices, cost benefits, convenience and respect for consumer privacy stand out as compelling reasons to make your next purchase over the Internet. With the added perks of exploring a wider range of flavors, including the beloved ZYN options and financial savings that extend beyond the price on the tag, the online shopping experience for nicotine pouches presents a clear advantage over traditional brick-and-mortar purchases.

Dreaming of soaring through the skies in your very own private jet is a fantasy many of us have entertained at some point. The allure of luxury travel, the freedom to go wherever you desire, and the prestige associated with private aviation can make it an enticing goal. But how feasible is it to turn this dream into reality? In this guide, we’ll explore the financial aspects of owning a private jet and provide actionable steps to help you make it happen. Don’t forget to factor in the cost to become a pilot as well if you would like to also be in charge of the flight.

Understanding the Costs

Purchase Price

The first and most significant expense when it comes to owning a private jet is the purchase price. Private jets come in a wide range of sizes and configurations, with prices varying accordingly. From smaller, more affordable models to large, luxurious jets, the cost can range from several million to tens of millions of dollars.

Operating Costs

Beyond the initial purchase price, there are ongoing operating costs to consider. These include:

- Maintenance – Regular maintenance is essential to ensure the safety and performance of your aircraft. This can include routine inspections, replacing Skydrol hydraulic fluid, repairs, and upgrades.

- Fuel – Fuel costs are a major expense for private jet owners, with larger jets consuming significantly more fuel than smaller ones.

- Hangar Fees – Storing your jet in a hangar when not in use helps protect it from the elements and maintain its condition. Hangar fees can vary depending on the location and size of the hangar.

- Insurance – Like any valuable asset, private jets need to be insured against potential risks such as accidents, theft, and liability.

- Crew – If you don’t have the necessary qualifications to pilot the aircraft yourself, you’ll need to hire a trained crew, including pilots, co-pilots, and flight attendants.

Depreciation

It’s important to recognize that like any other asset, private jets depreciate over time. While certain models may hold their value better than others, it’s essential to factor in depreciation when considering the long-term costs of ownership.

Assessing Your Financial Situation

Budgeting

Before diving into the world of private jet ownership, it’s crucial to assess your financial situation realistically. Take stock of your income, assets, and expenses to determine how much you can comfortably afford to allocate to the purchase and operation of a private jet.

Financing Options

While purchasing a private jet outright may not be feasible for everyone, there are financing options available to make ownership more accessible. These can include bank loans, aircraft financing companies, or leasing arrangements. Carefully consider the terms and interest rates associated with each option to ensure it aligns with your financial goals. Another practical route between outright purchase and full ownership is to lean on on-demand providers for occasional flights while you finalize financing or co-ownership arrangements. For travelers weighing cost, convenience and safety, consulting a trusted premium aviation brand can provide up-to-date availability and aircraft options that clarify whether ownership or regular chartering makes more sense.

Tax Implications

It’s also worth exploring the tax implications of owning a private jet. Depending on your jurisdiction and the intended use of the aircraft, there may be tax incentives or deductions available to offset some of the costs associated with ownership. Consulting with a tax advisor who specializes in aviation can help you navigate these complexities.

Maximizing Value

Fractional Ownership

For those who want the benefits of private jet ownership without bearing the full financial burden, fractional ownership can be an attractive option. This involves purchasing a share of a private jet, typically with other co-owners, and sharing the costs and usage privileges.

Chartering

Another alternative to full ownership is chartering a private jet from a company like Jettly as and when needed. This allows you to enjoy the convenience and luxury of private aviation without the long-term commitment or financial outlay. While chartering can be more expensive on a per-flight basis, it may be a cost-effective solution for those who fly infrequently.

Cost-Saving Strategies

Regardless of whether you choose to own, lease, or charter a private jet, there are strategies you can employ to minimize costs:

- Efficient Flight Planning – Optimizing flight routes and scheduling can help reduce fuel consumption and operational expenses.

- Negotiating Contracts – When entering into agreements for maintenance, fuel, or other services, don’t be afraid to negotiate for the best possible rates.

- Shared Services – Pooling resources with other owners or operators can help spread out costs and achieve economies of scale.

Conclusion

Owning a private jet is a significant financial commitment that requires careful planning and consideration. By understanding the costs involved, assessing your financial situation, and exploring alternative ownership models, you can make your dream of private jet ownership a reality. Whether you choose to purchase outright, opt for fractional ownership, or simply charter as needed, the sky’s the limit when it comes to achieving your aviation aspirations. With careful planning and financial discipline, you can soar above the clouds in style and luxury.

One thing most cryptocurrency traders learn early is that this speculative asset can be as risky as it is thrilling. Volatile market conditions often lead investors to seek out the best strategies to mitigate potential losses, and one of the most effective tools at their disposal is the stop-loss order. A stop-loss is essentially an automatic trigger for selling an asset when it reaches a specific price, which helps to protect investors from more significant losses if the market takes a sudden downturn.

If you’re currently managing a cryptocurrency portfolio, then it’s important for you to understand how to set effective stop-loss orders. Whether you’re trading in Bitcoin (BTC) or Ethereum (ETH) or using a privacy coin like Monero (XMR) and signing up on crypto exchanges with your Monero wallet, a well-placed stop-loss strategy can mean the difference between a manageable loss and a devastating one. Securing your investments against excessive losses ensures that you remain in a position to trade another day, regardless of how unpredictable the market might be at any given time.

Let’s explore some effective ways to set a stop-loss limit on your crypto investments:

1) Percentage-Based Stop-Loss

Among the most straightforward and widely used methods for managing trading risks in the cryptocurrency space is the percentage-based stop-loss. This strategy involves setting a stop-loss order to automatically sell off an asset if its price drops to a certain percentage below the purchase price.

The key to using this method effectively lies in choosing a percentage that considers the normal volatility of the cryptocurrency alongside the investor’s risk tolerance. For instance, if a crypto asset is known for daily price swings of up to 10 percent, setting a stop-loss order at a 5 percent drop might lead to premature sales. Instead, a more conservative 15 to 20 percent stop might be more appropriate, as this accommodates regular fluctuations while still protecting against severe downturns.

This approach is mainly advantageous because it’s both simple and adaptable. Whether you’re a casual investor or a hardcore trader, a percentage-based stop-loss can automatically safeguard your holdings without requiring you to constantly monitor the market at every minute. It will not only keep potential losses in check, but also help you develop the discipline required for detached decision-making—something that will keep you afloat in the frequently emotion-driven landscape of crypto trading.

2) Resistance and Support Levels

Resistance and support levels are specific price points on a chart that tend to attract significant buying or selling activity. A resistance level represents a high price point that the crypto asset struggles to exceed, as selling pressure tends to increase around this level. Conversely, a support level is typically a low price range that the asset seldom falls below, and it indicates a strong buying sentiment that prevents further declines.

Setting stop-loss orders just below a known support level can help ensure that the order is only triggered during a genuine market downturn, rather than a minor price fluctuation. For example, if a cryptocurrency tends to rebound from a particular price level, placing a stop-loss just below this point can protect the investment while minimizing the risk of an unnecessary sell-off due to normal volatility. This method requires a bit more knowledge and experience with market trends and chart analysis, but can significantly enhance the precision of your stop-loss settings.

3) Trailing Stop-Loss

A trailing stop-loss is an advanced form of the traditional stop-loss that both helps manage risk and also locks in profits as the asset’s price climbs. Unlike a fixed stop-loss, which remains at a set level, a trailing stop-loss moves with the price of the cryptocurrency when it rises. You place the stop-loss a certain percentage below the highest price reached since you bought the asset. This percentage is similar to the percentage-based stop-loss and should align with the asset’s volatility as well as your risk tolerance.

For example, if you set a trailing stop-loss of 10 percent on a cryptocurrency that you purchased at USD 100 and the price rises to USD 150, the new stop-loss would reset to USD 135 (10 percent below USD 150). If the price then drops to USD 135, the stop-loss triggers and the asset will be sold.

This strategy ensures that you secure some of the profits made during upward trends while protecting your investment against sudden downturns. Trailing stop-losses are particularly valuable in the crypto market, where substantial price swings can occur suddenly, as they give investors a tool to automatically adjust their risk exposure in real-time.

4) Risk/Reward Ratio

The risk/reward ratio is a critical metric that investors use to assess the potential return against the risk of a particular investment. It’s an especially vital consideration in the volatile world of cryptocurrency trading.

Upon establishing a ratio, investors can decide whether a potential investment profit is worth the risk they must take. A common approach is to seek a risk/reward ratio where the potential reward is at least three times greater than the risk. For example, if you’re risking USD 50 in a trade, you’d want a potential return of at least USD 150.

To set stop-losses with a risk/reward ratio in mind, you’ll need to calculate the expected profit point and the point of acceptable loss. This will help you determine where to set your stop-loss and take-profit levels, which in turn allows you to create a structured trading plan that minimizes guesswork and emotional decision-making.

Crypto investors frequently face rapid price changes, so maintaining a favorable risk/reward ratio can be a safeguard against the temptation to “ride out” dips too long or to sell too early during potential upswings.

5) Regular Reviews

Given the fast-paced nature of the crypto market, it’s essential for you to review your investment strategy and stop-loss orders often. Cryptocurrencies can experience significant shifts in value based on market trends, technological developments, regulatory news, and macroeconomic factors among others. Frequent reviews of your stop-loss strategies can help you keep them aligned with the current market conditions and your overall investment goals.

Regular reviews will also allow you to weigh in on whether your initial reasons for entering a trade are still valid and whether the set stop-loss orders need adjustment based on recent price action and market analysis. This practice is good for adapting to changing market dynamics, and it’s also useful for refining your strategy over time, learning from past trades, and improving your general decision-making processes with regard to crypto trading.

Final Thoughts

Cryptocurrency investing can often be a turbulent endeavor, and an effective stop-loss strategy can be a good friend against extreme volatility as well as the height of your emotions. The methods above, as well as an even-handed approach for handling your coins, should help an investor of your experience level manage risks and enhance your potential for profitability.

Technology and businesses are present everywhere you look. From the smartphone in your hand to the bustling storefronts lining city streets, the modern world is fueled by innovation and entrepreneurship. Financing stands as a crucial element behind every successful business and technological advancement. The role of financing in business and tech investments cannot be overstated, whether it’s securing funding for a startup venture or investing in cutting-edge technologies.

Financing serves as the lifeblood of business and technology, providing the necessary resources to turn ideas into reality and fueling growth and innovation. Lack of access to capital can hinder even the most promising startups and groundbreaking technologies from gaining traction and realizing their full potential. Understanding the role of financing and leveraging various sources of capital empowers entrepreneurs, investors, and innovators to navigate the complex landscape of business and technology with confidence, thereby driving economic growth and creating value for society as a whole.

Financing in Business

At its core, financing refers to the process of providing funds for business activities, projects, or investments. It encompasses a wide range of financial instruments and strategies designed to fuel growth, mitigate risks, and maximize returns. Suppose you are looking for personal loans Caldwell Idaho for your next business venture, read well as in the context of business. In that case, financing plays a fundamental role in every stage of the entrepreneurial journey, from startup to expansion and beyond. Here’s a closer look at the key aspects of financing in business:

Startup Funding

For aspiring entrepreneurs, securing funding is often the first hurdle on the path to building a successful business. Startup funding can come from various sources, including personal savings, loans, angel investors, venture capital firms, and crowdfunding platforms. Another funding option is a safe note, an alternative financing instrument that can offer investors the right to purchase equity in the company at a later date, typically upon a future financing round. SAFE notes provide flexibility for both the startup and the investor, as they delay valuation discussions and allow the company to focus on growth before formalizing equity terms. Each source of funding has its own advantages and challenges, and entrepreneurs must carefully weigh their options to determine the best fit for their venture. It’s advisable to seize opportunities offering low personal loan rates, as they can kickstart your business or investment without significantly impacting your future finances.

Growth Capital

As businesses mature and expand, they may require additional capital to fuel growth initiatives such as expanding operations, launching new products or services, or entering new markets. Growth capital can come from a variety of sources, including bank loans, private equity investments, and corporate partnerships. The key is to secure financing that aligns with the company’s growth strategy and long-term objectives.

Debt vs. Equity Financing

When raising capital, businesses have the option to choose between debt financing and equity financing. Debt financing involves borrowing money from lenders such as banks or bondholders, with the promise to repay the principal amount plus interest over time. Equity financing, on the other hand, involves selling ownership stakes in the company in exchange for capital. Each form of financing has its own advantages and considerations, and the decision often depends on factors such as the company’s financial situation, growth prospects, and risk tolerance.

Financing in Tech Investments

In the fast-paced world of technology, financing plays a critical role in driving innovation, fueling growth, and enabling breakthrough discoveries. From early-stage startups to established tech giants, securing funding is essential for turning visionary ideas into reality. Here’s how financing shapes the landscape of tech investments:

Seed Funding

In the tech industry, seed funding is the initial capital raised by a startup to develop a prototype, conduct market research, and validate the business concept. Seed funding can come from a variety of sources, including angel investors, venture capital firms, and government grants. This early-stage financing is crucial for getting a tech startup off the ground and turning innovative ideas into viable products or services.

Venture Capital

Venture capital (VC) plays a central role in financing high-growth tech startups with the potential to disrupt industries and achieve exponential growth. VC firms invest in early to late-stage startups in exchange for equity stakes, providing not only capital but also strategic guidance, industry connections, and mentorship. Venture capital funding enables tech startups to scale their operations, expand their customer base, and accelerate product development, paving the way for rapid growth and market dominance. Credit union personal loan rates are a good deal in terms of venture investment to ensure good returns, even with minimal starting capital.

Corporate Investment

In addition to traditional venture capital firms, many tech startups also attract investment from corporate partners, industry incumbents, and strategic investors. Corporate investment can take various forms, including direct equity investments, strategic partnerships, and acquisitions. By partnering with established companies, tech startups gain access to resources, expertise, and distribution channels that can accelerate their growth and increase their chances of success in the competitive tech landscape.

The Impact of Financing on Innovation and Growth

Financing plays a pivotal role in driving innovation and fueling economic growth by providing the capital needed to fund research and development, commercialize new technologies, and bring innovative products and services to market. Without adequate financing, many groundbreaking ideas would remain mere concepts, never realizing their full potential to transform industries and improve lives. Here are some key ways in which financing impacts innovation and growth:

Research and Development: Financing enables companies to invest in research and development (R&D), allowing them to explore new ideas, experiment with emerging technologies, and push the boundaries of innovation. R&D funding is essential for developing breakthrough technologies, improving existing products, and staying ahead of competitors in rapidly evolving industries such as biotechnology, artificial intelligence, and renewable energy.

Market Expansion: With access to capital, businesses can expand their operations, enter new markets, and reach a broader customer base. Whether it’s opening new storefronts, launching international marketing campaigns, or investing in digital platforms, financing provides the resources needed to fuel growth and capitalize on emerging opportunities.

Job Creation: Financing enables businesses to hire talent, expand their workforce, and create job opportunities in local communities. As companies grow and scale their operations, they generate employment opportunities across a wide range of industries, from manufacturing and technology to healthcare and finance. Job creation not only strengthens the economy but also fosters innovation and entrepreneurship, driving further growth and prosperity.

Here’s a table highlighting the benefits of financing in business and tech investments, including the factors and related concepts:

| Benefits | Factors | Related Concepts |

| Facilitates Innovation | Research and Development (R&D) Funding | Disruptive Technologies, Product Development |

| Fuels Growth | Market Expansion | Scalability, Market Penetration, Globalization |

| Creates Job Opportunities | Workforce Expansion | Economic Growth, Labor Market, Employment |

| Enables Risk Mitigation | Diversification of Funding Sources | Risk Management, Portfolio Diversification |

| Drives Market Competition | Access to Capital | Market Dynamics, Competitive Advantage |

| Supports Entrepreneurship | Startup Funding | Venture Capital, Angel Investors, Startup Ecosystem |

| Accelerates Time-to-Market | Fast-tracked Development | Agile Methodology, Rapid Prototyping |

| Enhances Product and Service Offerings | Investment in Technology | Product Innovation, Service Expansion |

| Fosters Strategic Partnerships | Corporate Investment | Strategic Alliances, Mergers and Acquisitions |

Each benefit of financing in business and tech investments is influenced by various factors and related concepts, underscoring the multifaceted impact of capital on driving innovation, growth, and value creation in the modern economy.

Conclusion

In conclusion, financing plays an indispensable role in driving innovation, fueling growth, and creating value in the modern economy. From providing seed funding to early-stage startups to facilitating multi-billion-dollar acquisitions of tech giants, financing shapes the landscape of entrepreneurship and technology in profound ways. By understanding the various forms of financing available and their implications for businesses and investors, entrepreneurs and innovators can navigate the complex world of finance with confidence and forge a path toward success in the dynamic and ever-evolving business and tech landscape.

FAQs

Q: Why is financing essential in business and tech investments?

A: Financing provides the necessary capital to fuel innovation, drive growth, and bring ideas to fruition in both the business and technology sectors. Without access to funding, startups struggle to launch, and technological advancements may remain unrealized.

Q: What are some common sources of financing for startups and tech ventures?

A: Common sources of financing include angel investors, venture capital firms, bank loans, government grants, and crowdfunding platforms. Each source has its own advantages and considerations, catering to different stages of growth and risk profiles.

Q: How does financing contribute to job creation and economic growth?

A: By enabling businesses to expand their operations, invest in research and development, and enter new markets, financing creates job opportunities, stimulates economic activity, and fosters innovation and entrepreneurship.

The crypto world is still emerging, and investors from all around the globe are still interested in what it can offer regarding growth and development. But you have a bunch of different options in the crypto market, and this is confusing, especially for beginners. To help you to make sensible guesses we have written down a list of cryptos to look out for in April 2024, including older leaders and new up-and-coming contenders.

Cryptocurrencies To Invest In April 2024

1. Bitcoin (BTC)

The first and arguably most profitable cryptocurrency, Bitcoin, with a market value of $1.2 trillion is still the best option for long-term investment among others because of its wide adoption by the public and its stability in the market.

2. Ethereum (ETH)

Ethereum, estimated at a market value of around $360 billion, is still the best for smart contracts and DApps, highlighting how it propels the innovation process in the cryptocurrency sphere.

3. Binance Coin (BNB)

As the native token of the world’s biggest crypto exchange, Binance Coin retains its leadership by being an instrument of paying gas fees, and token launching, and is proving its adaptability in the process of the ecosystem facing regulatory hurdles.

4. Dogecoin (DOGE)

First, Dogecoin was a spur-of-the-moment idea that defied the odds, going on to become one of the important major players in the cryptocurrency market. Its $22 billion market cap acts as positive proof that it is gaining in popularity and with time, adoption. This, in turn, makes it a crucial good to invest or hold a cryptocurrency portfolio.

5. Solana (SOL)

Solana’s characteristic fast blockchain nodes that prioritize scalability attract the interest of developers and investors alike. Its ability to reform DeFi and other sectors is a means by which the cryptocurrency is getting attention.

6. Polygon (MATIC)

Polygon, along with its native token MATIC, is a Layer 2 solution that serves as a scaling solution on Ethereum. Its main purpose is to find a way around, or reduce, communication delays that are prevalent today as well as make transactions cheaper.

MATIC is utilized for transaction fees including confirmation of the operation and governance issues being handled in the Polygon blockchain. This way, those holding the MATIC will earn governing rights and take part in the decision-making process for the safekeeping of the platform.

7. XRP

XRP, Ripple’s money transfer network token, is superior in terms of cost and speed during international transactions, in addition, the recent regulation has had a positive impact on the token’s positioning and helped to increase market confidence.

8. Chainlink (LINK)

Chainlink is responsible for implementing a decentralized system that connects the blockchain to the real-world data used by platforms supporting smart contracts. The fact that Chainlink’s market cap is $12 billion is a trailblazing sign that the token is leading the way in the crypto market as a whole.

9. Tron (TRX)

TRON aims to provide an еcosystеm and whеrе usеrs would bе ablе to еnjoy contеnt sharing and dеcеntralizеd applications to a biggеr lеvеl and at thе samе timе rеmovе thе prеsеncе of thе middlеmеn by using blockchain tеchnology.

Speedy development is merely the result of Tron’s wide connections and expansion into the decentralization market, which indicates that this field will surely progress more in the future.

10. Terra (LUNA)

Terra Luna’s algorithmic stablecoin and native token LUNA made it a pioneer in the crypto finance space. Investors as well as fans are equally invested in the Terra Luna news as they want to get the latest update on community-based projects as well as market flows of the platform.

Final Thoughts

Finally, we can conclude that succeeding in the cryptocurrency world requires some knowledge of the market, the thoughtful implementation of a plan, and the management of risks. Investors whose approach is based on market cap to identify the leading cryptocurrencies or who venture into these choices as the best options for April 2024 have a higher chance to join the volatile world of cryptocurrencies and profit from it than the traditional financial ones, which have different strategies.

First of all, it is essential to emphasize that, for a successful trading action based on cryptocurrencies, you should make informed decisions and conduct extensive research. Regardless of being an expert investor or new to the field of investing, focusing on getting updated and learning how to follow the market trends will surely help you in reaching your investment goals.

With numerous options available, navigating the landscape of IT recruitment agencies in Krakow can be daunting. However, by understanding key factors and considerations, companies can make informed decisions to choose the best agency to meet their hiring needs. In this article, we’ll explore how to navigate the options and select the best IT recruitment agency in Krakow.

1. Define Your Hiring Needs

Before diving into the search for IT recruitment services in Krakow, it’s essential to define your hiring needs clearly. Determine the specific roles and skills you’re looking to fill, as well as any unique requirements or preferences. Whether you need software developers, cybersecurity specialists, data scientists, or UX/UI designers, having a clear understanding of your hiring needs will help you identify agencies that specialize in your area of focus.

2. Research Agency Specializations

Krakow’s IT recruitment agencies often specialize in specific IT domains or industry sectors. Research agencies to identify those that specialize in your area of expertise. Look for agencies with a track record of success in placing candidates in roles similar to the ones you’re hiring for. Consider their reputation, client testimonials, and case studies to gauge their expertise and credibility in the field.

3. Assess Industry Experience

In addition to specialization, consider the industry experience of IT recruitment agencies in Krakow. Agencies with experience working with companies in your industry will have a better understanding of your unique hiring needs, challenges, and culture. They will be better equipped to source candidates who not only possess the required technical skills but also fit well within your organization’s culture and values.

4. Evaluate Recruitment Process

A transparent and efficient recruitment process is essential for successful hiring outcomes. Evaluate the recruitment process of each IT recruitment agency, including their sourcing methods, screening criteria, and candidate selection process. Look for agencies that prioritize quality over quantity and demonstrate a commitment to understanding your specific hiring needs and delivering personalized solutions.

5. Consider Reputation and Reviews

Reputation and reviews can provide valuable insights into the performance and reliability of IT recruitment agencies in Krakow. Seek out reviews from past clients and candidates to gauge their satisfaction levels and experiences with the agency. Additionally, consider factors such as industry awards, certifications, and partnerships, which can further validate the agency’s credibility and expertise.

6. Communication and Collaboration

Effective communication and collaboration are key to a successful partnership with an IT recruitment agency. Evaluate the agency’s communication style, responsiveness, and willingness to listen to your feedback and concerns. Look for agencies that prioritize transparency, keep you informed throughout the recruitment process, and maintain open lines of communication to address any issues or questions that may arise.

7. Cost and Value

Finally, consider the cost and value proposition offered by IT recruitment agencies in Krakow. While cost is an important factor, it’s equally essential to assess the value that the agency brings to the table. Look for agencies that offer competitive pricing structures, flexible terms, and a strong return on investment in terms of the quality of candidates sourced and the efficiency of the recruitment process.

In conclusion, choosing the best IT recruitment agency in Krakow requires careful consideration of factors such as specialization, industry experience, recruitment process, reputation, communication, and cost. By conducting thorough research, assessing agency capabilities, and prioritizing alignment with your hiring needs and values, you can select an agency that will serve as a trusted partner in unlocking top-tier IT talent for your organization’s success.

In today’s increasingly globalized business world, the ability to communicate effectively in multiple languages has become a valuable asset for professionals in the finance and business sectors. As the financial and business landscapes continue to evolve, individuals who are proficient in a second language are better equipped to navigate the complexities of international markets, build strong relationships with clients and partners from diverse backgrounds, and seize new opportunities for career advancement and success.

The convergence of finance, business, and language skills presents a unique opportunity for professionals looking to distinguish themselves in competitive industries. By investing time and effort into learning a second language, individuals can open doors to a wide array of benefits that can help propel their careers to new heights.

Enhanced Communication and Relationship Building

One of the key advantages of learning a second language in the context of finance and business is the ability to communicate with clients, colleagues, and stakeholders from different cultural backgrounds. In today’s interconnected world, businesses are increasingly operating on a global scale, and the ability to speak multiple languages can help facilitate smoother communication and foster stronger relationships with international partners.

Professionals who are proficient in a second language can bridge cultural and linguistic barriers, demonstrating respect for other cultures and fostering trust and understanding with clients and partners around the world. Effective communication is essential in finance and business, and being able to converse in a client’s native language can set you apart as a trusted advisor and partner, ultimately leading to increased success and opportunities for growth.

Seizing Global Market Opportunities

The global marketplace offers a wealth of opportunities for ambitious professionals in finance and business, but succeeding in international markets requires more than just financial acumen. Understanding the nuances of different markets, cultures, and languages is essential for navigating the complexities of global business and seizing opportunities for growth and expansion.

By learning a second language and improving English for companies in general, businesses in the finance sphere can gain a deeper understanding of international markets and develop the cultural competency needed to thrive in diverse business environments. Language skills can give you a competitive edge and help you tap into the vast potential of the global marketplace.

In-Demand Languages for Finance and Business Professionals

As companies expand their operations internationally and seek to tap into diverse markets, the demand for multilingual individuals continues to rise.

A. Mandarin Chinese

Mandarin Chinese is widely recognized as one of the most important languages for business, especially in the Asia-Pacific region. With China emerging as a major player in the global economy, proficiency in Mandarin can open up a plethora of opportunities for finance professionals.

B. Spanish

Spanish is another highly sought-after language in the finance and business world, particularly in the Americas and Europe. As the second most spoken language in the world, fluency in Spanish can significantly broaden your professional horizons. Whether you are conducting business in Latin America or catering to Spanish-speaking clients in the United States, being proficient in Spanish can help you build strong relationships and foster trust with stakeholders from diverse backgrounds.

C. Arabic

In the Middle East and North Africa (MENA) region, Arabic is a language of significant importance for finance and business professionals. With Gulf Cooperation Council (GCC) countries playing a pivotal role in the global energy and financial sectors, knowledge of Arabic can give you a competitive edge in this lucrative market.

Career Advancement and Professional Development

In addition to improving communication and seizing global opportunities, learning a second language with different resources and apps, such as Duolingo or Promova, can also enhance your career prospects and open up new pathways for professional development. Employers in the finance and business sectors value candidates who possess language skills, as they bring unique perspectives and capabilities to the table that can benefit the organization as a whole.

Professionals who are proficient in a second language are often considered more adaptable, resourceful, and globally minded, making them attractive candidates for leadership roles, international assignments, and cross-border projects.

Final Thoughts

In conclusion, learning a second language can be a game-changer for professionals in finance and business, offering a wide range of benefits that can enhance your career trajectory and unlock new opportunities for success. From improved communication and relationship building to seizing global market opportunities and advancing your career, language skills can give you a competitive edge in today’s fast-paced and interconnected business world.

As the global marketplace continues to evolve, professionals who are proficient in a second language will be well-equipped to navigate the challenges and seize the opportunities that come their way. Whether you’re a seasoned business owner or a finance professional looking to enhance your career, investing in language learning can be a strategic move that pays off in dividends, both personally and professionally. So, why wait? Start expanding your language skills today and unlocking the doors to a world of possibilities in finance and business.