Applying for a same day payday loan can seem intimidating, but it doesn’t have to be! Whether you’re facing unexpected expenses or just need a quick financial boost, knowing the right approach can make all the difference.

With a few smart strategies, you can streamline the application process and increase your chances of approval. Here are some tips for applying to same day payday lenders quickly and effectively.

No one wants to ever deal with a same day lender, but when you are in a tough spot it may be your only option.

Gather All Necessary Documents

Before you apply for quick payday loans, it’s important to have all your documents in order. Start by collecting your identification, proof of income, and bank statements. These documents show lenders that you are a responsible borrower.

Having everything ready can speed up the process and make it easier to get approval. Once you have your documents in hand, you’ll be prepared to fill out your application confidently.

Check Eligibility Criteria

Before applying for a same day payday loan, it’s essential to understand the eligibility criteria. Lenders typically look for a steady source of income, which can include your job salary or benefits. You must also be at least 18 years old and a resident of the state where you are applying.

Some lenders may check your credit score, but many offer instant cash loans even if you have less-than-perfect credit. Make sure you meet these requirements to increase your chances of getting approved quickly.

Fill out the Application Accurately

When you fill out the application for a same day payday loan, accuracy is key. Be sure to provide all the required information, including your personal details, income, and employment information. Double-check that your entries are correct to avoid any delays.

Using clear and concise information can help lenders quickly understand your situation, leading to fast loan approval. If you are unsure about any part of the application, don’t hesitate to ask for help. Taking your time to fill it out accurately can make a big difference in getting the funds you need.

Understand the Terms

Before you accept a same day payday loan, it’s important to understand the terms. Look at the interest rate, repayment schedule, and any fees. The interest rate will tell you how much extra you will pay back on top of the loan amount. The repayment schedule shows when your payments are due.

Be clear on how long you have to repay the loan and if you can make partial payments. Understanding these terms will help you avoid surprises and manage your finances better. Don’t be afraid to ask questions if something is unclear. Knowing what you are signing up for is key to making a smart decision.

![]()

Plan for Repayment

Having a clear repayment plan is vital after getting your loan. Knowing when payments are due helps you avoid late fees. When you take out an emergency loan bad credit, you should outline how you will repay it.

Consider your monthly budget and find a balance between your income and expenses. Make sure to set aside money each month dedicated to loan repayment. This way, you can pay off your loan on time and maintain your financial health.

Learn All About Same Day Payday Lenders

In conclusion, applying for same day payday lenders can be a straightforward process if you prepare well. Gather your documents, check the eligibility requirements, and fill out your application carefully.

Understanding the terms of the loan and having a repayment plan will help you manage your finances better. With these tips, you can feel more confident in getting the funds you need quickly.

Check out Tips from Dave Ramsey to prevent yourself from having to deal repeatedly with PayDay style lenders.

When you’re navigating the job market or budgeting for your future, knowing what your annual salary translates to in terms of an hourly wage can be incredibly helpful.

In this article, we’ll break down the math and explore what $105,000 a year means on an hourly basis.

We’ll also dive into related topics such as post-tax income, biweekly earnings, monthly income, and whether $105,000 a year can be considered a good salary. Plus, we’ll share tips on how you can potentially increase your hourly wage.

$105,000 a Year is How Much an Hour?

Determining how much an annual salary of $105,000 translates to on an hourly basis can provide a clearer perspective on your earnings. This calculation can be particularly useful when evaluating job offers, budgeting, or understanding the value of your time. To figure out your hourly wage from an annual salary, follow this straightforward formula:

$105,000 (annual income) / 52 (number of weeks in a year) / 40 (standard hours in a workweek) = $50.48 per hour

So, if you earn $105,000 a year, your hourly wage is approximately $50.48 before taxes. This calculation assumes you work a standard 40-hour workweek for all 52 weeks in a year.

Understanding your hourly rate is not just about the numbers; it can help you make informed financial decisions and plan your budget effectively. Whether you’re considering a job change, negotiating a raise, or simply curious about the value of your time, knowing your hourly wage is a valuable piece of financial information.

What is $105,000 a Year After Taxes?

Understanding your take-home pay is crucial when planning your finances. The amount you receive after taxes depends on various factors, including your tax filing status, deductions, and the state you reside in.

On average, individuals can expect to pay around 20-30% or more of their income in federal and state income taxes. Let’s take some data from the IRS website on what your tax rate will be according to your income. This does not account for any of the factors listed above.

- 37% for incomes over $578,125 ($693,750 for married couples filing jointly)

- 35% for incomes over $231,250 ($462,500 for married couples filing jointly)

- 32% for incomes over $182,100 ($364,200 for married couples filing jointly)

- 24% for incomes over $95,375 ($190,750 for married couples filing jointly)

- 22% for incomes over $44,725 ($89,450 for married couples filing jointly)

- 12% for incomes over $11,000 ($22,000 for married couples filing jointly)

So at a $105,000 annual income, we will assume a tax rate of 24%.

$105,000 (annual income) x 24% (tax rate) = $25,200

So, after taxes, you would have approximately $79,800 left as your annual income.

$105,000 a Year is How Much Biweekly?

Many employers pay their employees on a biweekly schedule, which means you receive a paycheck every two weeks. To calculate your biweekly income, you’ll need to divide your annual income by the number of pay periods in a year. Most often, there are 26 pay periods in a year for biweekly paychecks.

So, the calculation would look like this:

$105,000 (annual income) / 26 (biweekly pay periods) ≈ $4,038

At $105,000 a year, you would earn approximately $4,038 before taxes with each biweekly paycheck.

$105,000 a Year is How Much a Month?

If you’re curious about your monthly income at an annual rate of $105,000, you can calculate it by dividing your yearly income by 12 (since there are 12 months in a year):

$105,000 (annual income) / 12 (months) = $8,750

So, at a yearly salary of $105,000, your monthly income before taxes would be approximately $8,750.

Is $105,000 a Year a Good Salary?

Whether $105,000 a year is considered a good salary depends on various factors, including your location, cost of living, and personal financial goals. In some areas with a lower cost of living, $105,000 can provide a comfortable life. However, in more expensive cities, it may not stretch as far.

To determine if it’s sufficient for your needs, consider your monthly expenses, such as housing, utilities, transportation, groceries, and savings goals.

Additionally, factors like job benefits, opportunities for advancement, and job satisfaction play a significant role in evaluating the overall value of your wage.

Let’s take a look at how a $105,000 a year salary compares to others in the United States.

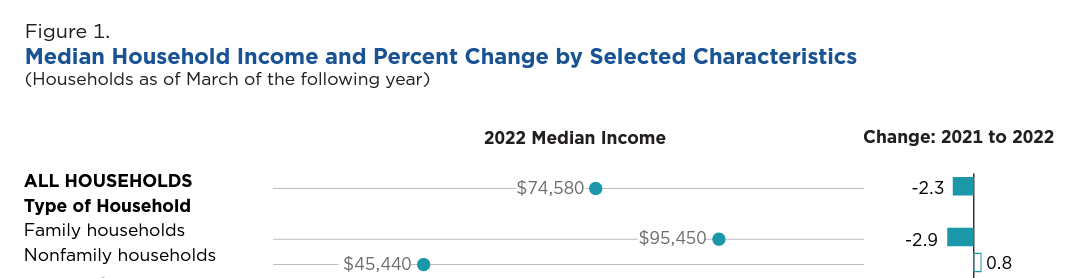

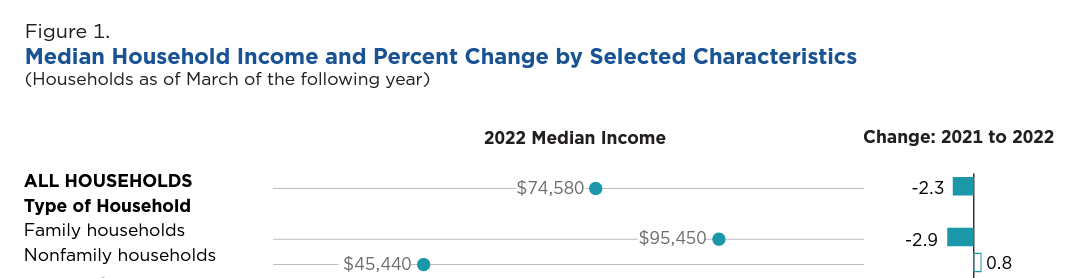

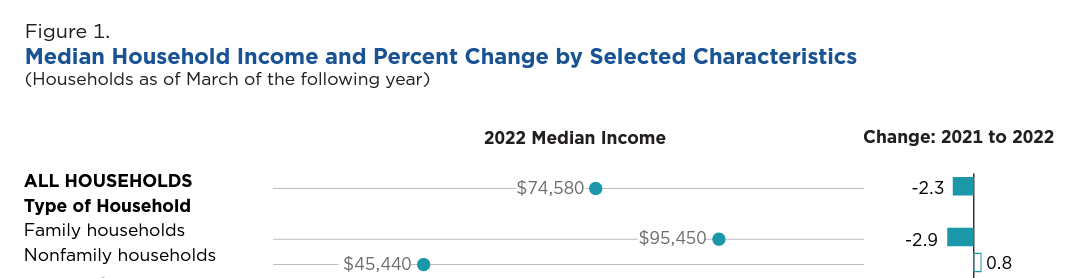

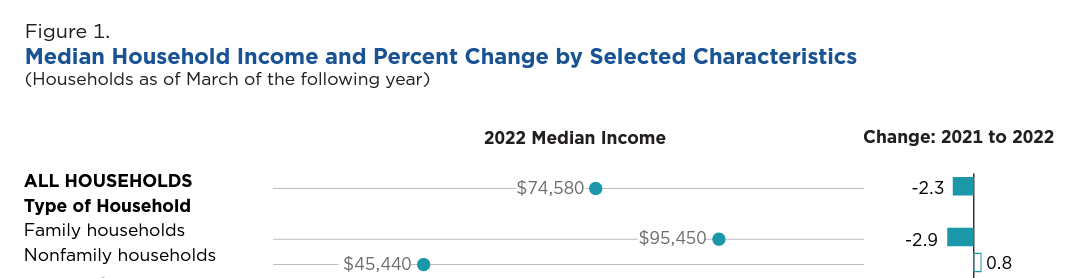

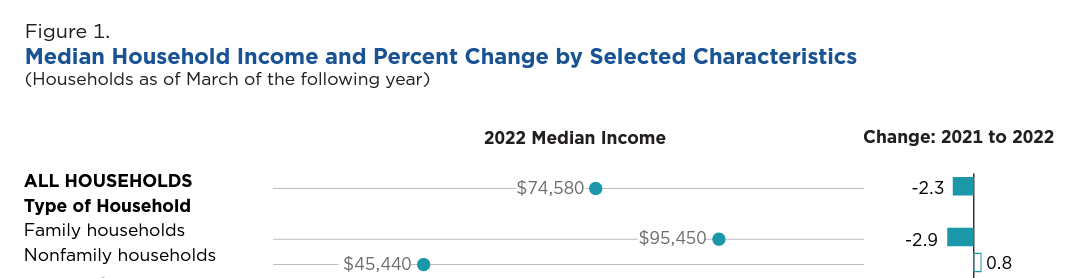

According to data from the US Census Bureau for 2022, the median income for Nonfamily households in the United States was approximately $45,440 – which means that half of all individuals earned more than this amount, and half earned less.

So, if you have a salary of $105,000, you have a salary that is in the top 50 percent of all earners in the United States.

With a salary of over $100,000, you are doing very well and in the top echelon of earners in the United States.

How to Increase Your Hourly Wage

If you’re looking to boost your hourly wage, there are several strategies you can consider:

- Skill Development: Enhance your skills or acquire new ones that are in demand in your industry.

- Negotiation: When starting a new job or during performance reviews, don’t hesitate to negotiate your wage.

- Further Education: Consider pursuing additional education or certifications that can increase your market value.

- Job Switch: Sometimes, switching to a different job or company can lead to a significant salary increase.

- Freelancing or Part-Time Work: Explore part-time job opportunities or freelance work to supplement your primary income. Apps like Fiverr or Upwork can be a great spot to post your skills and get hired for part-time work.

- Start a Side Hustle: Look to make more money by starting a side hustle. A lot of these you can do from your phone. The list includes dog walking/sitting apps, food delivery apps, picture-taking apps, secret shopping apps, and plenty more. It is a great resource to see all the different side hustle apps that are out there.

Will a Salary of $105,000 Help Me Become Rich?

A salary of $105,000 can certainly help you build wealth and achieve financial success, but whether it will make you ‘rich’ depends on various factors, including your financial goals, lifestyle choices, expenses, and savings/investment strategies.

Here are some considerations:

- Financial Goals: The definition of “rich” varies from person to person. For some, it means achieving financial security and having enough to comfortably cover living expenses and retirement. For others, it means accumulating significant wealth. Your specific financial goals will determine what “rich” means to you.

- Lifestyle Choices: Your spending habits and lifestyle choices play a significant role in your ability to accumulate wealth. Even with a high salary, if you spend excessively or accumulate debt, it can hinder your path to becoming rich. Budgeting, practicing mindful spending, and living below your means are essential.

- Savings and Investments: Building wealth often involves saving a significant portion of your income and making smart investments. A high salary provides the opportunity to save and invest more, which can accelerate your wealth-building journey. Consider contributing to retirement accounts, investing in stocks or real estate, and diversifying your investments.

- Debt Management: Reducing and managing debt, such as student loans, credit card debt, and mortgages, is crucial for building wealth. High-interest debt can erode your financial progress, so it’s important to prioritize paying it off.

- Cost of Living: The cost of living in your area can significantly impact your ability to save and invest. In high-cost-of-living areas, it may be more challenging to build wealth, even with a high salary.

- Investment Strategy: Your investment strategy, including asset allocation, risk tolerance, and long-term planning, can greatly influence your wealth accumulation. Consulting with a financial advisor can help you make informed investment decisions.

- Time Horizon: Building substantial wealth often takes time and consistent effort. The longer your time horizon, the more potential you have to accumulate wealth through the power of compounding returns.

In summary, a $105,000 salary provides a solid foundation for building wealth, but it’s not the salary alone that determines your financial success. Becoming ‘rich’ is a subjective goal, so it’s essential to define what it means for you and create a financial plan to pursue it.

Conclusion

In conclusion, understanding what your annual salary translates to on an hourly basis can provide valuable insights into your financial situation. It’s not just about the number, but how it aligns with your financial goals, lifestyle, and location.

Remember, if you’re aiming for an increase in your hourly wage, there are steps you can take to make it happen.

When you’re navigating the job market or budgeting for your future, knowing what your annual salary translates to in terms of an hourly wage can be incredibly helpful.

In this article, we’ll break down the math and explore what $205,000 a year means on an hourly basis.

We’ll also dive into related topics such as post-tax income, biweekly earnings, monthly income, and whether $205,000 a year can be considered a good salary. Plus, we’ll share tips on how you can potentially increase your hourly wage.

$205,000 a Year is How Much an Hour?

Determining how much an annual salary of $205,000 translates to on an hourly basis can provide a clearer perspective on your earnings. This calculation can be particularly useful when evaluating job offers, budgeting, or understanding the value of your time. To figure out your hourly wage from an annual salary, follow this straightforward formula:

$205,000 (annual income) / 52 (number of weeks in a year) / 40 (standard hours in a workweek) = $98.56 per hour

So, if you earn $205,000 a year, your hourly wage is approximately $98.56 before taxes. This calculation assumes you work a standard 40-hour workweek for all 52 weeks in a year.

Understanding your hourly rate is not just about the numbers; it can help you make informed financial decisions and plan your budget effectively. Whether you’re considering a job change, negotiating a raise, or simply curious about the value of your time, knowing your hourly wage is a valuable piece of financial information.

What is $205,000 a Year After Taxes?

Understanding your take-home pay is crucial when planning your finances. The amount you receive after taxes depends on various factors, including your tax filing status, deductions, and the state you reside in.

On average, individuals can expect to pay around 20-30% or more of their income in federal and state income taxes. Let’s take some data from the IRS website on what your tax rate will be according to your income. This does not account for any of the factors listed above.

- 37% for incomes over $578,125 ($693,750 for married couples filing jointly)

- 35% for incomes over $231,250 ($462,500 for married couples filing jointly)

- 32% for incomes over $182,100 ($364,200 for married couples filing jointly)

- 24% for incomes over $95,375 ($190,750 for married couples filing jointly)

- 22% for incomes over $44,725 ($89,450 for married couples filing jointly)

- 12% for incomes over $11,000 ($22,000 for married couples filing jointly)

So at a $205,000 annual income, we will assume a tax rate of 35%.

$205,000 (annual income) x 35% (tax rate) = $71,750

So, after taxes, you would have approximately $133,250 left as your annual income.

$205,000 a Year is How Much Biweekly?

Many employers pay their employees on a biweekly schedule, which means you receive a paycheck every two weeks. To calculate your biweekly income, you’ll need to divide your annual income by the number of pay periods in a year. Most often, there are 26 pay periods in a year for biweekly paychecks.

So, the calculation would look like this:

$205,000 (annual income) / 26 (biweekly pay periods) ≈ $7,885

At $205,000 a year, you would earn approximately $7,885 before taxes with each biweekly paycheck.

$205,000 a Year is How Much a Month?

If you’re curious about your monthly income at an annual rate of $205,000, you can calculate it by dividing your yearly income by 12 (since there are 12 months in a year):

$205,000 (annual income) / 12 (months) = $17,083

So, at a yearly salary of $205,000, your monthly income before taxes would be approximately $17,083.

Is $205,000 a Year a Good Salary?

Whether $205,000 a year is considered a good salary depends on various factors, including your location, cost of living, and personal financial goals. In some areas with a lower cost of living, $205,000 can provide a comfortable life. However, in more expensive cities, it may not stretch as far.

To determine if it’s sufficient for your needs, consider your monthly expenses, such as housing, utilities, transportation, groceries, and savings goals.

Additionally, factors like job benefits, opportunities for advancement, and job satisfaction play a significant role in evaluating the overall value of your wage.

Let’s take a look at how a $205,000 a year salary compares to others in the United States.

According to data from the US Census Bureau for 2022, the median income for Nonfamily households in the United States was approximately $45,440 – which means that half of all individuals earned more than this amount, and half earned less.

So, if you have a salary of $205,000, you have a salary that is in the top 50 percent of all earners in the United States.

With a salary of over $60,000, you are doing very well and in the top echelon of earners in the United States.

How to Increase Your Hourly Wage

If you’re looking to boost your hourly wage, there are several strategies you can consider:

- Skill Development: Enhance your skills or acquire new ones that are in demand in your industry.

- Negotiation: When starting a new job or during performance reviews, don’t hesitate to negotiate your wage.

- Further Education: Consider pursuing additional education or certifications that can increase your market value.

- Job Switch: Sometimes, switching to a different job or company can lead to a significant salary increase.

- Freelancing or Part-Time Work: Explore part-time job opportunities or freelance work to supplement your primary income. Apps like Fiverr or Upwork can be a great spot to post your skills and get hired for part-time work.

- Start a Side Hustle: Look to make more money by starting a side hustle. A lot of these you can do from your phone. The list includes dog walking/sitting apps, food delivery apps, picture-taking apps, secret shopping apps, and plenty more. It is a great resource to see all the different side hustle apps that are out there.

Will a Salary of $205,000 Help Me Become Rich?

A salary of $205,000 can certainly help you build wealth and achieve financial success, but whether it will make you ‘rich’ depends on various factors, including your financial goals, lifestyle choices, expenses, and savings/investment strategies.

Here are some considerations:

- Financial Goals: The definition of “rich” varies from person to person. For some, it means achieving financial security and having enough to comfortably cover living expenses and retirement. For others, it means accumulating significant wealth. Your specific financial goals will determine what “rich” means to you.

- Lifestyle Choices: Your spending habits and lifestyle choices play a significant role in your ability to accumulate wealth. Even with a high salary, if you spend excessively or accumulate debt, it can hinder your path to becoming rich. Budgeting, practicing mindful spending, and living below your means are essential.

- Savings and Investments: Building wealth often involves saving a significant portion of your income and making smart investments. A high salary provides the opportunity to save and invest more, which can accelerate your wealth-building journey. Consider contributing to retirement accounts, investing in stocks or real estate, and diversifying your investments.

- Debt Management: Reducing and managing debt, such as student loans, credit card debt, and mortgages, is crucial for building wealth. High-interest debt can erode your financial progress, so it’s important to prioritize paying it off.

- Cost of Living: The cost of living in your area can significantly impact your ability to save and invest. In high-cost-of-living areas, it may be more challenging to build wealth, even with a high salary.

- Investment Strategy: Your investment strategy, including asset allocation, risk tolerance, and long-term planning, can greatly influence your wealth accumulation. Consulting with a financial advisor can help you make informed investment decisions.

- Time Horizon: Building substantial wealth often takes time and consistent effort. The longer your time horizon, the more potential you have to accumulate wealth through the power of compounding returns.

In summary, a $205,000 salary provides a solid foundation for building wealth, but it’s not the salary alone that determines your financial success. Becoming ‘rich’ is a subjective goal, so it’s essential to define what it means for you and create a financial plan to pursue it.

Conclusion

In conclusion, understanding what your annual salary translates to on an hourly basis can provide valuable insights into your financial situation. It’s not just about the number, but how it aligns with your financial goals, lifestyle, and location.

Remember, if you’re aiming for an increase in your hourly wage, there are steps you can take to make it happen.

When you’re navigating the job market or budgeting for your future, knowing what your annual salary translates to in terms of an hourly wage can be incredibly helpful.

In this article, we’ll break down the math and explore what $220,000 a year means on an hourly basis.

We’ll also dive into related topics such as post-tax income, biweekly earnings, monthly income, and whether $220,000 a year can be considered a good salary. Plus, we’ll share tips on how you can potentially increase your hourly wage.

$220,000 a Year is How Much an Hour?

Determining how much an annual salary of $220,000 translates to on an hourly basis can provide a clearer perspective on your earnings. This calculation can be particularly useful when evaluating job offers, budgeting, or understanding the value of your time. To figure out your hourly wage from an annual salary, follow this straightforward formula:

$220,000 (annual income) / 52 (number of weeks in a year) / 40 (standard hours in a workweek) = $105.77 per hour

So, if you earn $220,000 a year, your hourly wage is approximately $105.77 before taxes. This calculation assumes you work a standard 40-hour workweek for all 52 weeks in a year.

Understanding your hourly rate is not just about the numbers; it can help you make informed financial decisions and plan your budget effectively. Whether you’re considering a job change, negotiating a raise, or simply curious about the value of your time, knowing your hourly wage is a valuable piece of financial information.

What is $220,000 a Year After Taxes?

Understanding your take-home pay is crucial when planning your finances. The amount you receive after taxes depends on various factors, including your tax filing status, deductions, and the state you reside in.

On average, individuals can expect to pay around 20-30% or more of their income in federal and state income taxes. Let’s take some data from the IRS website on what your tax rate will be according to your income. This does not account for any of the factors listed above.

- 37% for incomes over $578,125 ($693,750 for married couples filing jointly)

- 35% for incomes over $231,250 ($462,500 for married couples filing jointly)

- 32% for incomes over $182,100 ($364,200 for married couples filing jointly)

- 24% for incomes over $95,375 ($190,750 for married couples filing jointly)

- 22% for incomes over $44,725 ($89,450 for married couples filing jointly)

- 12% for incomes over $11,000 ($22,000 for married couples filing jointly)

So at a $220,000 annual income, we will assume a tax rate of 35%.

$220,000 (annual income) x 35% (tax rate) = $77,000

So, after taxes, you would have approximately $143,000 left as your annual income.

$220,000 a Year is How Much Biweekly?

Many employers pay their employees on a biweekly schedule, which means you receive a paycheck every two weeks. To calculate your biweekly income, you’ll need to divide your annual income by the number of pay periods in a year. Most often, there are 26 pay periods in a year for biweekly paychecks.

So, the calculation would look like this:

$220,000 (annual income) / 26 (biweekly pay periods) ≈ $8,462

At $220,000 a year, you would earn approximately $8,462 before taxes with each biweekly paycheck.

$220,000 a Year is How Much a Month?

If you’re curious about your monthly income at an annual rate of $220,000, you can calculate it by dividing your yearly income by 12 (since there are 12 months in a year):

$220,000 (annual income) / 12 (months) = $18,333

So, at a yearly salary of $220,000, your monthly income before taxes would be approximately $18,333.

Is $220,000 a Year a Good Salary?

Whether $220,000 a year is considered a good salary depends on various factors, including your location, cost of living, and personal financial goals. In some areas with a lower cost of living, $220,000 can provide a comfortable life. However, in more expensive cities, it may not stretch as far.

To determine if it’s sufficient for your needs, consider your monthly expenses, such as housing, utilities, transportation, groceries, and savings goals.

Additionally, factors like job benefits, opportunities for advancement, and job satisfaction play a significant role in evaluating the overall value of your wage.

Let’s take a look at how a $220,000 a year salary compares to others in the United States.

According to data from the US Census Bureau for 2022, the median income for Nonfamily households in the United States was approximately $45,440 – which means that half of all individuals earned more than this amount, and half earned less.

So, if you have a salary of $220,000, you have a salary that is in the top 50 percent of all earners in the United States.

With a salary of over $200,000, you are doing very well and in the top echelon of earners in the United States.

How to Increase Your Hourly Wage

If you’re looking to boost your hourly wage, there are several strategies you can consider:

- Skill Development: Enhance your skills or acquire new ones that are in demand in your industry.

- Negotiation: When starting a new job or during performance reviews, don’t hesitate to negotiate your wage.

- Further Education: Consider pursuing additional education or certifications that can increase your market value.

- Job Switch: Sometimes, switching to a different job or company can lead to a significant salary increase.

- Freelancing or Part-Time Work: Explore part-time job opportunities or freelance work to supplement your primary income. Apps like Fiverr or Upwork can be a great spot to post your skills and get hired for part-time work.

- Start a Side Hustle: Look to make more money by starting a side hustle. The folks over at the blog, Financial Panther, have put together a comprehensive list of over 70+ gig economy apps, with strategies and thoughts on each one. A lot of these you can do from your phone. The list includes dog walking/sitting apps, food delivery apps, picture-taking apps, secret shopping apps, and plenty more. It is a great resource to see all the different side hustle apps that are out there.

Will a Salary of $220,000 Help Me Become Rich?

A salary of $220,000 can certainly help you build wealth and achieve financial success, but whether it will make you ‘rich’ depends on various factors, including your financial goals, lifestyle choices, expenses, and savings/investment strategies.

Here are some considerations:

- Financial Goals: The definition of “rich” varies from person to person. For some, it means achieving financial security and having enough to comfortably cover living expenses and retirement. For others, it means accumulating significant wealth. Your specific financial goals will determine what “rich” means to you.

- Lifestyle Choices: Your spending habits and lifestyle choices play a significant role in your ability to accumulate wealth. Even with a high salary, if you spend excessively or accumulate debt, it can hinder your path to becoming rich. Budgeting, practicing mindful spending, and living below your means are essential.

- Savings and Investments: Building wealth often involves saving a significant portion of your income and making smart investments. A high salary provides the opportunity to save and invest more, which can accelerate your wealth-building journey. Consider contributing to retirement accounts, investing in stocks or real estate, and diversifying your investments.

- Debt Management: Reducing and managing debt, such as student loans, credit card debt, and mortgages, is crucial for building wealth. High-interest debt can erode your financial progress, so it’s important to prioritize paying it off.

- Cost of Living: The cost of living in your area can significantly impact your ability to save and invest. In high-cost-of-living areas, it may be more challenging to build wealth, even with a high salary.

- Investment Strategy: Your investment strategy, including asset allocation, risk tolerance, and long-term planning, can greatly influence your wealth accumulation. Consulting with a financial advisor can help you make informed investment decisions.

- Time Horizon: Building substantial wealth often takes time and consistent effort. The longer your time horizon, the more potential you have to accumulate wealth through the power of compounding returns.

In summary, a $220,000 salary provides a solid foundation for building wealth, but it’s not the salary alone that determines your financial success. Becoming ‘rich’ is a subjective goal, so it’s essential to define what it means for you and create a financial plan to pursue it.

Conclusion

In conclusion, understanding what your annual salary translates to on an hourly basis can provide valuable insights into your financial situation. It’s not just about the number, but how it aligns with your financial goals, lifestyle, and location.

Remember, if you’re aiming for an increase in your hourly wage, there are steps you can take to make it happen.

By: Chris Bemis

Have you ever wondered how much you’d make in a year if you earned $15 an hour? It’s a common question, and the answer can provide valuable insights into your financial well-being.

In this article, we’ll break down the math and explore what $15 an hour means annually, after taxes, in a month, and on a biweekly basis. Plus, we’ll discuss whether $15 an hour is considered a good wage in today’s economic landscape.

$15 an Hour is How Much a Year?

Let’s start with the big picture: how much would you earn in a year if you were paid $15 per hour?

To calculate your annual income, you’ll need to consider a few factors. First, you need to determine how many hours you work each week and how many weeks you work in a year.

Assuming you work full-time, which is typically 40 hours per week, you’d multiply your hourly wage by the number of weeks in a year. There are 52 weeks in a year.

So, the basic calculation looks like this:

$15 (hourly wage) x 40 (hours per week) x 52 (weeks per year) = $31,200

At $15 an hour, you would earn $31,200 per year before taxes.

If you work less than 52 weeks a year, or work more or less than 40 hours a week, then you will want to adjust the formula to get an understanding of how much money you are making per year.

How Making $15 an Hour Compares to Other Individuals In The United States

According to data from the US Census Bureau for 2022, the median income for Nonfamily households in the United States was approximately $45,440 – which means that half of all individuals earned more than this amount, and half earned less.

So, if you have a salary of $31,200, you have a salary that is in the lower 50 percent of all earners in the United States.

With a salary of under $45,440, you are doing ok and near the middle of average earners in the United States.

For more info on this check out Just the Facts on the US Economy from Steve Ballmer.

$15 an Hour is How Much a Year After Taxes?

Now, let’s talk about the real-world scenario after taxes. Your take-home pay will depend on several factors, including your tax filing status, deductions, and the state in which you live.

On average, you can expect to lose anywhere from 15% to 30% or more of your income to federal and state income taxes. If we take a conservative estimate of a 20% tax rate, your annual take-home pay would be:

$6,240 (annual income) x 0.20 (tax rate) = $31,200

Subtracting $6,240 from your annual income leaves you with $24,960 after taxes.

$15 an Hour is How Much a Month?

If you’re curious about your monthly income at $15 an hour, it’s relatively straightforward to calculate. Simply multiply your hourly wage by the number of hours you work in a week and then multiply that by 4 (assuming four weeks in a month). Here’s the formula:

$15 (hourly wage) x 40 (hours per week) x 4 (weeks per month) = $2,400

So, if you earn $15 an hour, your monthly income before taxes would be $2,400.

$15 an Hour is How Much Biweekly?

Many employers pay their employees on a biweekly schedule, which means you receive a paycheck every two weeks. To calculate your biweekly income, you’ll multiply your hourly wage by the number of hours you work in a two-week period. Here’s the formula:

$15 (hourly wage) x 40 (hours per week) x 2 (weeks) = $2,400

At $15 an hour, your biweekly income before taxes would be $2,400.

To figure out your post tax biweekly income, you can multiply $15 by your tax rate as we did above.

Is $15 an Hour a Good Wage?

The answer to whether $15 an hour is a good wage depends on various factors, including your location, cost of living, and individual financial goals. In some areas with a lower cost of living, $15 an hour can provide a comfortable living. However, in more expensive cities, it may not stretch as far.

It’s crucial to consider your monthly expenses, such as housing, utilities, transportation, groceries, and savings goals when determining if $15 an hour meets your needs. Additionally, factors like job benefits, opportunities for advancement, and job satisfaction play a significant role in evaluating the overall value of your wage.

How to Increase Your Hourly Wage

If you’re looking to boost your hourly wage, there are several strategies you can consider:

- Skill Development: Enhance your skills or acquire new ones that are in demand in your industry.

- Negotiation: When starting a new job or during performance reviews, don’t hesitate to negotiate your wage.

- Further Education: Consider pursuing additional education or certifications that can increase your market value.

- Job Switch: Sometimes, switching to a different job or company can lead to a significant salary increase.

- Freelancing or Part-Time Work: Explore part-time job opportunities or freelance work to supplement your primary income. Apps like Fiverr or Upwork can be a great spot to post your skills and get hired for part-time work.

- Start a Side Hustle: Look to make more money by starting a side hustle. The folks over at the blog, Financial Panther, have put together a comprehensive list of over 70+ gig economy apps, with strategies and thoughts on each one. A lot of these you can do from your phone. The list includes dog walking/sitting apps, food delivery apps, picture-taking apps, secret shopping apps, and plenty more. It is a great resource to see all the different side hustle apps that are out there.

Will an Hourly Wage of $15 Help Me Become Rich?

A $15 an hour wage can certainly help you build wealth and achieve financial success, but whether it will make you ‘rich’ depends on various factors, including your financial goals, lifestyle choices, expenses, and savings/investment strategies.

Here are some considerations:

- Financial Goals: The definition of “rich” varies from person to person. For some, it means achieving financial security and having enough to comfortably cover living expenses and retirement. For others, it means accumulating significant wealth. Your specific financial goals will determine what “rich” means to you.

- Lifestyle Choices: Your spending habits and lifestyle choices play a significant role in your ability to accumulate wealth. Even with a high salary, if you spend excessively or accumulate debt, it can hinder your path to becoming rich. Budgeting, practicing mindful spending, and living below your means are essential.

- Savings and Investments: Building wealth often involves saving a significant portion of your income and making smart investments. A high salary provides the opportunity to save and invest more, which can accelerate your wealth-building journey. Consider contributing to retirement accounts, investing in stocks or real estate, and diversifying your investments.

- Debt Management: Reducing and managing debt, such as student loans, credit card debt, and mortgages, is crucial for building wealth. High-interest debt can erode your financial progress, so it’s important to prioritize paying it off.

- Cost of Living: The cost of living in your area can significantly impact your ability to save and invest. In high-cost-of-living areas, it may be more challenging to build wealth, even with a high salary.

- Investment Strategy: Your investment strategy, including asset allocation, risk tolerance, and long-term planning, can greatly influence your wealth accumulation. Consulting with a financial advisor can help you make informed investment decisions.

- Time Horizon: Building substantial wealth often takes time and consistent effort. The longer your time horizon, the more potential you have to accumulate wealth through the power of compounding returns.

In summary, an hourly wage of $15 provides a solid foundation for building wealth, but it’s not the salary alone that determines your financial success. Becoming ‘rich’ is a subjective goal, so it’s essential to define what it means for you and create a financial plan to pursue it.

Conclusion

$15 an hour can be a decent income for many, it’s essential to assess your specific circumstances to determine if it aligns with your financial objectives and lifestyle. Understanding how your hourly wage translates into yearly, monthly, and biweekly income, as well as factoring in taxes, is a valuable step in managing your finances effectively.

Hopefully this article has been useful for you to learn how much $15 an hour is a year.

Have you ever wondered how much you’d make in a year if you earned $37 an hour? It’s a common question, and the answer can provide valuable insights into your financial well-being.

In this article, we’ll break down the math and explore what $37 an hour means annually, after taxes, in a month, and on a biweekly basis. Plus, we’ll discuss whether $37 an hour is considered a good wage in today’s economic landscape.

$37 an Hour is How Much a Year?

Let’s start with the big picture: how much would you earn in a year if you were paid $37 per hour?

To calculate your annual income, you’ll need to consider a few factors. First, you need to determine how many hours you work each week and how many weeks you work in a year.

Assuming you work full-time, which is typically 40 hours per week, you’d multiply your hourly wage by the number of weeks in a year. There are 52 weeks in a year.

So, the basic calculation looks like this:

$37 (hourly wage) x 40 (hours per week) x 52 (weeks per year) = $76,960

At $37 an hour, you would earn $76,960 per year before taxes.

If you work less than 52 weeks a year, or work more or less than 40 hours a week, then you will want to adjust the formula to get an understanding of how much money you are making per year.

$37 an Hour is How Much a Year After Taxes?

Now, let’s talk about the real-world scenario after taxes. Your take-home pay will depend on several factors, including your tax filing status, deductions, and the state in which you live.

On average, you can expect to lose anywhere from 15% to 30% or more of your income to federal and state income taxes. If we take a conservative estimate of a 20% tax rate, your annual take-home pay would be:

$15,392 (annual income) x 0.20 (tax rate) = $76,960

Subtracting $15,392 from your annual income leaves you with $61,568 after taxes.

$37 an Hour is How Much a Month?

If you’re curious about your monthly income at $37 an hour, it’s relatively straightforward to calculate. Simply multiply your hourly wage by the number of hours you work in a week and then multiply that by 4 (assuming four weeks in a month). Here’s the formula:

$37 (hourly wage) x 40 (hours per week) x 4 (weeks per month) = $5,920

So, if you earn $37 an hour, your monthly income before taxes would be $5,920.

$37 an Hour is How Much Biweekly?

Many employers pay their employees on a biweekly schedule, which means you receive a paycheck every two weeks. To calculate your biweekly income, you’ll multiply your hourly wage by the number of hours you work in a two-week period. Here’s the formula:

$37 (hourly wage) x 40 (hours per week) x 2 (weeks) = $5,920

At $37 an hour, your biweekly income before taxes would be $5,920.

To figure out your post tax biweekly income, you can multiply $37 by your tax rate as we did above.

Is $37 an Hour a Good Wage?

The answer to whether $37 an hour is a good wage depends on various factors, including your location, cost of living, and individual financial goals. In some areas with a lower cost of living, $37 an hour can provide a comfortable living. However, in more expensive cities, it may not stretch as far.

It’s crucial to consider your monthly expenses, such as housing, utilities, transportation, groceries, and savings goals when determining if $37 an hour meets your needs. Additionally, factors like job benefits, opportunities for advancement, and job satisfaction play a significant role in evaluating the overall value of your wage.

How to Increase Your Hourly Wage

If you’re looking to boost your hourly wage, there are several strategies you can consider:

- Skill Development: Enhance your skills or acquire new ones that are in demand in your industry.

- Negotiation: When starting a new job or during performance reviews, don’t hesitate to negotiate your wage.

- Further Education: Consider pursuing additional education or certifications that can increase your market value.

- Job Switch: Sometimes, switching to a different job or company can lead to a significant salary increase.

- Freelancing or Part-Time Work: Explore part-time job opportunities or freelance work to supplement your primary income. Apps like Fiverr or Upwork can be a great spot to post your skills and get hired for part-time work.

- Start a Side Hustle: Look to make more money by starting a side hustle. The folks over at the blog, Financial Panther, have put together a comprehensive list of over 70+ gig economy apps, with strategies and thoughts on each one. A lot of these you can do from your phone. The list includes dog walking/sitting apps, food delivery apps, picture-taking apps, secret shopping apps, and plenty more. It is a great resource to see all the different side hustle apps that are out there.

Will a Hourly Wage of of $37 Help Me Become Rich?

A $37 an hour wage can certainly help you build wealth and achieve financial success, but whether it will make you ‘rich’ depends on various factors, including your financial goals, lifestyle choices, expenses, and savings/investment strategies.

Here are some considerations:

- Financial Goals: The definition of “rich” varies from person to person. For some, it means achieving financial security and having enough to comfortably cover living expenses and retirement. For others, it means accumulating significant wealth. Your specific financial goals will determine what “rich” means to you.

- Lifestyle Choices: Your spending habits and lifestyle choices play a significant role in your ability to accumulate wealth. Even with a high salary, if you spend excessively or accumulate debt, it can hinder your path to becoming rich. Budgeting, practicing mindful spending, and living below your means are essential.

- Savings and Investments: Building wealth often involves saving a significant portion of your income and making smart investments. A high salary provides the opportunity to save and invest more, which can accelerate your wealth-building journey. Consider contributing to retirement accounts, investing in stocks or real estate, and diversifying your investments.

- Debt Management: Reducing and managing debt, such as student loans, credit card debt, and mortgages, is crucial for building wealth. High-interest debt can erode your financial progress, so it’s important to prioritize paying it off.

- Cost of Living: The cost of living in your area can significantly impact your ability to save and invest. In high-cost-of-living areas, it may be more challenging to build wealth, even with a high salary.

- Investment Strategy: Your investment strategy, including asset allocation, risk tolerance, and long-term planning, can greatly influence your wealth accumulation. Consulting with a financial advisor can help you make informed investment decisions.

- Time Horizon: Building substantial wealth often takes time and consistent effort. The longer your time horizon, the more potential you have to accumulate wealth through the power of compounding returns.

In summary, an hourly wage of $37 provides a solid foundation for building wealth, but it’s not the salary alone that determines your financial success. Becoming ‘rich’ is a subjective goal, so it’s essential to define what it means for you and create a financial plan to pursue it.

Conclusion

$37 an hour can be a decent income for many, it’s essential to assess your specific circumstances to determine if it aligns with your financial objectives and lifestyle. Understanding how your hourly wage translates into yearly, monthly, and biweekly income, as well as factoring in taxes, is a valuable step in managing your finances effectively.

Hopefully this article has been useful for you to learn how much $37 an hour is a year.

By: Chris Bemis

Have you ever wondered how much you’d make in a year if you earned $57 an hour? It’s a common question, and the answer can provide valuable insights into your financial well-being.

In this article, we’ll break down the math and explore what $57 an hour means annually, after taxes, in a month, and on a biweekly basis. Plus, we’ll discuss whether $57 an hour is considered a good wage in today’s economic landscape.

$57 an Hour is How Much a Year?

Let’s start with the big picture: how much would you earn in a year if you were paid $57 per hour?

To calculate your annual income, you’ll need to consider a few factors. First, you need to determine how many hours you work each week and how many weeks you work in a year.

Assuming you work full-time, which is typically 40 hours per week, you’d multiply your hourly wage by the number of weeks in a year. There are 52 weeks in a year.

So, the basic calculation looks like this:

$57 (hourly wage) x 40 (hours per week) x 52 (weeks per year) = $118,560

At $57 an hour, you would earn $118,560 per year before taxes.

If you work less than 52 weeks a year, or work more or less than 40 hours a week, then you will want to adjust the formula to get an understanding of how much money you are making per year.

How Making $57 an Hour Compares to Other Individuals In The United States

According to data from the US Census Bureau for 2022, the median income for Nonfamily households in the United States was approximately $45,440 – which means that half of all individuals earned more than this amount, and half earned less.

So, if you have a salary of $118,560, you have a salary that is in the top 50 percent of all earners in the United States.

With a salary well over $45,400, you are doing very well and in the top echelon of earners in the United States.

For more info on this check out Just the Facts on the US Economy from Steve Ballmer.

$57 an Hour is How Much a Year After Taxes?

Now, let’s talk about the real-world scenario after taxes. Your take-home pay will depend on several factors, including your tax filing status, deductions, and the state in which you live.

On average, you can expect to lose anywhere from 15% to 30% or more of your income to federal and state income taxes. If we take a conservative estimate of a 20% tax rate, your annual take-home pay would be:

$23,712 (annual income) x 0.20 (tax rate) = $118,560

Subtracting $23,712 from your annual income leaves you with $94,848 after taxes.

$57 an Hour is How Much a Month?

If you’re curious about your monthly income at $57 an hour, it’s relatively straightforward to calculate. Simply multiply your hourly wage by the number of hours you work in a week and then multiply that by 4 (assuming four weeks in a month). Here’s the formula:

$57 (hourly wage) x 40 (hours per week) x 4 (weeks per month) = $9,120

So, if you earn $57 an hour, your monthly income before taxes would be $9,120.

$57 an Hour is How Much Biweekly?

Many employers pay their employees on a biweekly schedule, which means you receive a paycheck every two weeks. To calculate your biweekly income, you’ll multiply your hourly wage by the number of hours you work in a two-week period. Here’s the formula:

$57 (hourly wage) x 40 (hours per week) x 2 (weeks) = $9,120

At $57 an hour, your biweekly income before taxes would be $9,120.

To figure out your post tax biweekly income, you can multiply $57 by your tax rate as we did above.

Is $57 an Hour a Good Wage?

The answer to whether $57 an hour is a good wage depends on various factors, including your location, cost of living, and individual financial goals. In some areas with a lower cost of living, $57 an hour can provide a comfortable living. However, in more expensive cities, it may not stretch as far.

It’s crucial to consider your monthly expenses, such as housing, utilities, transportation, groceries, and savings goals when determining if $57 an hour meets your needs. Additionally, factors like job benefits, opportunities for advancement, and job satisfaction play a significant role in evaluating the overall value of your wage.

How to Increase Your Hourly Wage

If you’re looking to boost your hourly wage, there are several strategies you can consider:

- Skill Development: Enhance your skills or acquire new ones that are in demand in your industry.

- Negotiation: When starting a new job or during performance reviews, don’t hesitate to negotiate your wage.

- Further Education: Consider pursuing additional education or certifications that can increase your market value.

- Job Switch: Sometimes, switching to a different job or company can lead to a significant salary increase.

- Freelancing or Part-Time Work: Explore part-time job opportunities or freelance work to supplement your primary income. Apps like Fiverr or Upwork can be a great spot to post your skills and get hired for part-time work.

- Start a Side Hustle: Look to make more money by starting a side hustle. The folks over at the blog, Financial Panther, have put together a comprehensive list of over 70+ gig economy apps, with strategies and thoughts on each one. A lot of these you can do from your phone. The list includes dog walking/sitting apps, food delivery apps, picture-taking apps, secret shopping apps, and plenty more. It is a great resource to see all the different side hustle apps that are out there.

Will a Hourly Wage of of $57 Help Me Become Rich?

A $57 an hour wage can certainly help you build wealth and achieve financial success, but whether it will make you ‘rich’ depends on various factors, including your financial goals, lifestyle choices, expenses, and savings/investment strategies.

Here are some considerations:

- Financial Goals: The definition of “rich” varies from person to person. For some, it means achieving financial security and having enough to comfortably cover living expenses and retirement. For others, it means accumulating significant wealth. Your specific financial goals will determine what “rich” means to you.

- Lifestyle Choices: Your spending habits and lifestyle choices play a significant role in your ability to accumulate wealth. Even with a high salary, if you spend excessively or accumulate debt, it can hinder your path to becoming rich. Budgeting, practicing mindful spending, and living below your means are essential.

- Savings and Investments: Building wealth often involves saving a significant portion of your income and making smart investments. A high salary provides the opportunity to save and invest more, which can accelerate your wealth-building journey. Consider contributing to retirement accounts, investing in stocks or real estate, and diversifying your investments.

- Debt Management: Reducing and managing debt, such as student loans, credit card debt, and mortgages, is crucial for building wealth. High-interest debt can erode your financial progress, so it’s important to prioritize paying it off.

- Cost of Living: The cost of living in your area can significantly impact your ability to save and invest. In high-cost-of-living areas, it may be more challenging to build wealth, even with a high salary.

- Investment Strategy: Your investment strategy, including asset allocation, risk tolerance, and long-term planning, can greatly influence your wealth accumulation. Consulting with a financial advisor can help you make informed investment decisions.

- Time Horizon: Building substantial wealth often takes time and consistent effort. The longer your time horizon, the more potential you have to accumulate wealth through the power of compounding returns.

In summary, an hourly wage of $57 provides a solid foundation for building wealth, but it’s not the salary alone that determines your financial success. Becoming ‘rich’ is a subjective goal, so it’s essential to define what it means for you and create a financial plan to pursue it.

Conclusion

$57 an hour can be a decent income for many, it’s essential to assess your specific circumstances to determine if it aligns with your financial objectives and lifestyle. Understanding how your hourly wage translates into yearly, monthly, and biweekly income, as well as factoring in taxes, is a valuable step in managing your finances effectively.

Hopefully this article has been useful for you to learn how much $57 an hour is a year.

By: Chris Bemis

Have you ever wondered how much you’d make in a year if you earned $73 an hour? It’s a common question, and the answer can provide valuable insights into your financial well-being.

In this article, we’ll break down the math and explore what $73 an hour means annually, after taxes, in a month, and on a biweekly basis. Plus, we’ll discuss whether $73 an hour is considered a good wage in today’s economic landscape.

$73 an Hour is How Much a Year?

Let’s start with the big picture: how much would you earn in a year if you were paid $73 per hour?

To calculate your annual income, you’ll need to consider a few factors. First, you need to determine how many hours you work each week and how many weeks you work in a year.

Assuming you work full-time, which is typically 40 hours per week, you’d multiply your hourly wage by the number of weeks in a year. There are 52 weeks in a year.

So, the basic calculation looks like this:

$73 (hourly wage) x 40 (hours per week) x 52 (weeks per year) = $151,840

At $73 an hour, you would earn $151,840 per year before taxes.

If you work less than 52 weeks a year, or work more or less than 40 hours a week, then you will want to adjust the formula to get an understanding of how much money you are making per year.

How Making $73 an Hour Compares to Other Individuals In The United States

According to data from the US Census Bureau for 2022, the median income for Nonfamily households in the United States was approximately $45,440 – which means that half of all individuals earned more than this amount, and half earned less.

So, if you have a salary of $151,840, you have a salary that is in the top 50 percent of all earners in the United States.

With a salary well over $45,400, you are doing very well and in the top echelon of earners in the United States.

For more info on this check out Just the Facts on the US Economy from Steve Ballmer.

$73 an Hour is How Much a Year After Taxes?

Now, let’s talk about the real-world scenario after taxes. Your take-home pay will depend on several factors, including your tax filing status, deductions, and the state in which you live.

On average, you can expect to lose anywhere from 15% to 30% or more of your income to federal and state income taxes. If we take a conservative estimate of a 20% tax rate, your annual take-home pay would be:

$30,368 (annual income) x 0.20 (tax rate) = $151,840

Subtracting $30,368 from your annual income leaves you with $121,472 after taxes.

$73 an Hour is How Much a Month?

If you’re curious about your monthly income at $73 an hour, it’s relatively straightforward to calculate. Simply multiply your hourly wage by the number of hours you work in a week and then multiply that by 4 (assuming four weeks in a month). Here’s the formula:

$73 (hourly wage) x 40 (hours per week) x 4 (weeks per month) = $11,680

So, if you earn $73 an hour, your monthly income before taxes would be $11,680.

$73 an Hour is How Much Biweekly?

Many employers pay their employees on a biweekly schedule, which means you receive a paycheck every two weeks. To calculate your biweekly income, you’ll multiply your hourly wage by the number of hours you work in a two-week period. Here’s the formula:

$73 (hourly wage) x 40 (hours per week) x 2 (weeks) = $11,680

At $73 an hour, your biweekly income before taxes would be $11,680.

To figure out your post tax biweekly income, you can multiply $73 by your tax rate as we did above.

Is $73 an Hour a Good Wage?

The answer to whether $73 an hour is a good wage depends on various factors, including your location, cost of living, and individual financial goals. In some areas with a lower cost of living, $73 an hour can provide a comfortable living. However, in more expensive cities, it may not stretch as far.

It’s crucial to consider your monthly expenses, such as housing, utilities, transportation, groceries, and savings goals when determining if $73 an hour meets your needs. Additionally, factors like job benefits, opportunities for advancement, and job satisfaction play a significant role in evaluating the overall value of your wage.

How to Increase Your Hourly Wage

If you’re looking to boost your hourly wage, there are several strategies you can consider:

- Skill Development: Enhance your skills or acquire new ones that are in demand in your industry.

- Negotiation: When starting a new job or during performance reviews, don’t hesitate to negotiate your wage.

- Further Education: Consider pursuing additional education or certifications that can increase your market value.

- Job Switch: Sometimes, switching to a different job or company can lead to a significant salary increase.

- Freelancing or Part-Time Work: Explore part-time job opportunities or freelance work to supplement your primary income. Apps like Fiverr or Upwork can be a great spot to post your skills and get hired for part-time work.

- Start a Side Hustle: Look to make more money by starting a side hustle. The folks over at the blog, Financial Panther, have put together a comprehensive list of over 70+ gig economy apps, with strategies and thoughts on each one. A lot of these you can do from your phone. The list includes dog walking/sitting apps, food delivery apps, picture-taking apps, secret shopping apps, and plenty more. It is a great resource to see all the different side hustle apps that are out there.

Will an Hourly Wage of $73 Help Me Become Rich?

A $73 an hour wage can certainly help you build wealth and achieve financial success, but whether it will make you ‘rich’ depends on various factors, including your financial goals, lifestyle choices, expenses, and savings/investment strategies.

Here are some considerations:

- Financial Goals: The definition of “rich” varies from person to person. For some, it means achieving financial security and having enough to comfortably cover living expenses and retirement. For others, it means accumulating significant wealth. Your specific financial goals will determine what “rich” means to you.

- Lifestyle Choices: Your spending habits and lifestyle choices play a significant role in your ability to accumulate wealth. Even with a high salary, if you spend excessively or accumulate debt, it can hinder your path to becoming rich. Budgeting, practicing mindful spending, and living below your means are essential.

- Savings and Investments: Building wealth often involves saving a significant portion of your income and making smart investments. A high salary provides the opportunity to save and invest more, which can accelerate your wealth-building journey. Consider contributing to retirement accounts, investing in stocks or real estate, and diversifying your investments.

- Debt Management: Reducing and managing debt, such as student loans, credit card debt, and mortgages, is crucial for building wealth. High-interest debt can erode your financial progress, so it’s important to prioritize paying it off.

- Cost of Living: The cost of living in your area can significantly impact your ability to save and invest. In high-cost-of-living areas, it may be more challenging to build wealth, even with a high salary.

- Investment Strategy: Your investment strategy, including asset allocation, risk tolerance, and long-term planning, can greatly influence your wealth accumulation. Consulting with a financial advisor can help you make informed investment decisions.

- Time Horizon: Building substantial wealth often takes time and consistent effort. The longer your time horizon, the more potential you have to accumulate wealth through the power of compounding returns.

In summary, an hourly wage of $73 provides a solid foundation for building wealth, but it’s not the salary alone that determines your financial success. Becoming ‘rich’ is a subjective goal, so it’s essential to define what it means for you and create a financial plan to pursue it.

Conclusion

$73 an hour can be a decent income for many, it’s essential to assess your specific circumstances to determine if it aligns with your financial objectives and lifestyle. Understanding how your hourly wage translates into yearly, monthly, and biweekly income, as well as factoring in taxes, is a valuable step in managing your finances effectively.

Hopefully this article has been useful for you to learn how much $73 an hour is a year.

Have you ever wondered how much you’d make in a year if you earned $89 an hour? It’s a common question, and the answer can provide valuable insights into your financial well-being.

In this article, we’ll break down the math and explore what $89 an hour means annually, after taxes, in a month, and on a biweekly basis. Plus, we’ll discuss whether $89 an hour is considered a good wage in today’s economic landscape.

$89 an Hour is How Much a Year?

Let’s start with the big picture: how much would you earn in a year if you were paid $89 per hour?

To calculate your annual income, you’ll need to consider a few factors. First, you need to determine how many hours you work each week and how many weeks you work in a year.

Assuming you work full-time, which is typically 40 hours per week, you’d multiply your hourly wage by the number of weeks in a year. There are 52 weeks in a year.

So, the basic calculation looks like this:

$89 (hourly wage) x 40 (hours per week) x 52 (weeks per year) = $185,120

At $89 an hour, you would earn $185,120 per year before taxes.

If you work less than 52 weeks a year, or work more or less than 40 hours a week, then you will want to adjust the formula to get an understanding of how much money you are making per year.

How Making $89 an Hour Compares to Other Individuals In The United States

According to data from the US Census Bureau for 2022, the median income for Nonfamily households in the United States was approximately $45,440 – which means that half of all individuals earned more than this amount, and half earned less.

So, if you have a salary of $185,120, you have a salary that is in the top 50 percent of all earners in the United States.

With a salary well over $45,400, you are doing very well and in the top echelon of earners in the United States.

$89 an Hour is How Much a Year After Taxes?

Now, let’s talk about the real-world scenario after taxes. Your take-home pay will depend on several factors, including your tax filing status, deductions, and the state in which you live.

On average, you can expect to lose anywhere from 15% to 30% or more of your income to federal and state income taxes. If we take a conservative estimate of a 20% tax rate, your annual take-home pay would be:

$37,024 (annual income) x 0.20 (tax rate) = $185,120

Subtracting $37,024 from your annual income leaves you with $148,096 after taxes.

$89 an Hour is How Much a Month?

If you’re curious about your monthly income at $89 an hour, it’s relatively straightforward to calculate. Simply multiply your hourly wage by the number of hours you work in a week and then multiply that by 4 (assuming four weeks in a month). Here’s the formula:

$89 (hourly wage) x 40 (hours per week) x 4 (weeks per month) = $14,240

So, if you earn $89 an hour, your monthly income before taxes would be $14,240.

$89 an Hour is How Much Biweekly?

Many employers pay their employees on a biweekly schedule, which means you receive a paycheck every two weeks. To calculate your biweekly income, you’ll multiply your hourly wage by the number of hours you work in a two-week period. Here’s the formula:

$89 (hourly wage) x 40 (hours per week) x 2 (weeks) = $14,240

At $89 an hour, your biweekly income before taxes would be $14,240.

To figure out your post tax biweekly income, you can multiply $89 by your tax rate as we did above.

Is $89 an Hour a Good Wage?

The answer to whether $89 an hour is a good wage depends on various factors, including your location, cost of living, and individual financial goals. In some areas with a lower cost of living, $89 an hour can provide a comfortable living. However, in more expensive cities, it may not stretch as far.

It’s crucial to consider your monthly expenses, such as housing, utilities, transportation, groceries, and savings goals when determining if $89 an hour meets your needs. Additionally, factors like job benefits, opportunities for advancement, and job satisfaction play a significant role in evaluating the overall value of your wage.

How to Increase Your Hourly Wage

If you’re looking to boost your hourly wage, there are several strategies you can consider:

- Skill Development: Enhance your skills or acquire new ones that are in demand in your industry.

- Negotiation: When starting a new job or during performance reviews, don’t hesitate to negotiate your wage.

- Further Education: Consider pursuing additional education or certifications that can increase your market value.

- Job Switch: Sometimes, switching to a different job or company can lead to a significant salary increase.

- Freelancing or Part-Time Work: Explore part-time job opportunities or freelance work to supplement your primary income. Apps like Fiverr or Upwork can be a great spot to post your skills and get hired for part-time work.

- Start a Side Hustle: Look to make more money by starting a side hustle. The folks over at the blog, Financial Panther, have put together a comprehensive list of over 70+ gig economy apps, with strategies and thoughts on each one. A lot of these you can do from your phone. The list includes dog walking/sitting apps, food delivery apps, picture-taking apps, secret shopping apps, and plenty more. It is a great resource to see all the different side hustle apps that are out there.

Will a Hourly Wage of of $89 Help Me Become Rich?

A $89 an hour wage can certainly help you build wealth and achieve financial success, but whether it will make you ‘rich’ depends on various factors, including your financial goals, lifestyle choices, expenses, and savings/investment strategies.

Here are some considerations:

- Financial Goals: The definition of “rich” varies from person to person. For some, it means achieving financial security and having enough to comfortably cover living expenses and retirement. For others, it means accumulating significant wealth. Your specific financial goals will determine what “rich” means to you.

- Lifestyle Choices: Your spending habits and lifestyle choices play a significant role in your ability to accumulate wealth. Even with a high salary, if you spend excessively or accumulate debt, it can hinder your path to becoming rich. Budgeting, practicing mindful spending, and living below your means are essential.

- Savings and Investments: Building wealth often involves saving a significant portion of your income and making smart investments. A high salary provides the opportunity to save and invest more, which can accelerate your wealth-building journey. Consider contributing to retirement accounts, investing in stocks or real estate, and diversifying your investments.

- Debt Management: Reducing and managing debt, such as student loans, credit card debt, and mortgages, is crucial for building wealth. High-interest debt can erode your financial progress, so it’s important to prioritize paying it off.

- Cost of Living: The cost of living in your area can significantly impact your ability to save and invest. In high-cost-of-living areas, it may be more challenging to build wealth, even with a high salary.

- Investment Strategy: Your investment strategy, including asset allocation, risk tolerance, and long-term planning, can greatly influence your wealth accumulation. Consulting with a financial advisor can help you make informed investment decisions.

- Time Horizon: Building substantial wealth often takes time and consistent effort. The longer your time horizon, the more potential you have to accumulate wealth through the power of compounding returns.

In summary, an hourly wage of $89 provides a solid foundation for building wealth, but it’s not the salary alone that determines your financial success. Becoming ‘rich’ is a subjective goal, so it’s essential to define what it means for you and create a financial plan to pursue it.

Conclusion

$89 an hour can be a decent income for many, it’s essential to assess your specific circumstances to determine if it aligns with your financial objectives and lifestyle. Understanding how your hourly wage translates into yearly, monthly, and biweekly income, as well as factoring in taxes, is a valuable step in managing your finances effectively.

Hopefully this article has been useful for you to learn how much $89 an hour is a year.

Have you ever wondered how much you’d make in a year if you earned $16 an hour? It’s a common question, and the answer can provide valuable insights into your financial well-being.

In this article, we’ll break down the math and explore what $16 an hour means annually, after taxes, in a month, and on a biweekly basis. Plus, we’ll discuss whether $16 an hour is considered a good wage in today’s economic landscape.

$16 an Hour is How Much a Year?

Let’s start with the big picture: how much would you earn in a year if you were paid $16 per hour?

To calculate your annual income, you’ll need to consider a few factors. First, you need to determine how many hours you work each week and how many weeks you work in a year.

Assuming you work full-time, which is typically 40 hours per week, you’d multiply your hourly wage by the number of weeks in a year. There are 52 weeks in a year.

So, the basic calculation looks like this:

$16 (hourly wage) x 40 (hours per week) x 52 (weeks per year) = $33,280

At $16 an hour, you would earn $33,280 per year before taxes.

If you work less than 52 weeks a year, or work more or less than 40 hours a week, then you will want to adjust the formula to get an understanding of how much money you are making per year.

How Making $16 an Hour Compares to Other Individuals In The United States

According to data from the US Census Bureau for 2022, the median income for Nonfamily households in the United States was approximately $45,440 – which means that half of all individuals earned more than this amount, and half earned less.

So, if you have a salary of $33,280, you have a salary that is in the lower 50 percent of all earners in the United States.

With a salary of under $45,440, you are doing ok and near the middle of average earners in the United States.

$16 an Hour is How Much a Year After Taxes?

Now, let’s talk about the real-world scenario after taxes. Your take-home pay will depend on several factors, including your tax filing status, deductions, and the state in which you live.

On average, you can expect to lose anywhere from 15% to 30% or more of your income to federal and state income taxes. If we take a conservative estimate of a 20% tax rate, your annual take-home pay would be:

$6,656 (annual income) x 0.20 (tax rate) = $33,280

Subtracting $6,656 from your annual income leaves you with $26,624 after taxes.

$16 an Hour is How Much a Month?

If you’re curious about your monthly income at $16 an hour, it’s relatively straightforward to calculate. Simply multiply your hourly wage by the number of hours you work in a week and then multiply that by 4 (assuming four weeks in a month). Here’s the formula:

$16 (hourly wage) x 40 (hours per week) x 4 (weeks per month) = $2,560

So, if you earn $16 an hour, your monthly income before taxes would be $2,560.

$16 an Hour is How Much Biweekly?

Many employers pay their employees on a biweekly schedule, which means you receive a paycheck every two weeks. To calculate your biweekly income, you’ll multiply your hourly wage by the number of hours you work in a two-week period. Here’s the formula:

$16 (hourly wage) x 40 (hours per week) x 2 (weeks) = $2,560

At $16 an hour, your biweekly income before taxes would be $2,560.

To figure out your post tax biweekly income, you can multiply $16 by your tax rate as we did above.

Is $16 an Hour a Good Wage?

The answer to whether $16 an hour is a good wage depends on various factors, including your location, cost of living, and individual financial goals. In some areas with a lower cost of living, $16 an hour can provide a comfortable living. However, in more expensive cities, it may not stretch as far.

It’s crucial to consider your monthly expenses, such as housing, utilities, transportation, groceries, and savings goals when determining if $16 an hour meets your needs. Additionally, factors like job benefits, opportunities for advancement, and job satisfaction play a significant role in evaluating the overall value of your wage.

How to Increase Your Hourly Wage

If you’re looking to boost your hourly wage, there are several strategies you can consider:

- Skill Development: Enhance your skills or acquire new ones that are in demand in your industry.

- Negotiation: When starting a new job or during performance reviews, don’t hesitate to negotiate your wage.

- Further Education: Consider pursuing additional education or certifications that can increase your market value.

- Job Switch: Sometimes, switching to a different job or company can lead to a significant salary increase.

- Freelancing or Part-Time Work: Explore part-time job opportunities or freelance work to supplement your primary income. Apps like Fiverr or Upwork can be a great spot to post your skills and get hired for part-time work.

- Start a Side Hustle: Look to make more money by starting a side hustle. The folks over at the blog, Financial Panther, have put together a comprehensive list of over 70+ gig economy apps, with strategies and thoughts on each one. A lot of these you can do from your phone. The list includes dog walking/sitting apps, food delivery apps, picture-taking apps, secret shopping apps, and plenty more. It is a great resource to see all the different side hustle apps that are out there.

Will a Hourly Wage of of $16 Help Me Become Rich?

A $16 an hour wage can certainly help you build wealth and achieve financial success, but whether it will make you ‘rich’ depends on various factors, including your financial goals, lifestyle choices, expenses, and savings/investment strategies.

Here are some considerations:

- Financial Goals: The definition of “rich” varies from person to person. For some, it means achieving financial security and having enough to comfortably cover living expenses and retirement. For others, it means accumulating significant wealth. Your specific financial goals will determine what “rich” means to you.