Have you ever wondered how much you’d make in a year if you earned $98 an hour? It’s a common question, and the answer can provide valuable insights into your financial well-being.

In this article, we’ll break down the math and explore what $98 an hour means annually, after taxes, in a month, and on a biweekly basis. Plus, we’ll discuss whether $98 an hour is considered a good wage in today’s economic landscape.

$98 an Hour is How Much a Year?

Let’s start with the big picture: how much would you earn in a year if you were paid $98 per hour?

To calculate your annual income, you’ll need to consider a few factors. First, you need to determine how many hours you work each week and how many weeks you work in a year.

Assuming you work full-time, which is typically 40 hours per week, you’d multiply your hourly wage by the number of weeks in a year. There are 52 weeks in a year.

So, the basic calculation looks like this:

$98 (hourly wage) x 40 (hours per week) x 52 (weeks per year) = $203,840

At $98 an hour, you would earn $203,840 per year before taxes.

If you work less than 52 weeks a year, or work more or less than 40 hours a week, then you will want to adjust the formula to get an understanding of how much money you are making per year.

How Making $98 an Hour Compares to Other Individuals In The United States

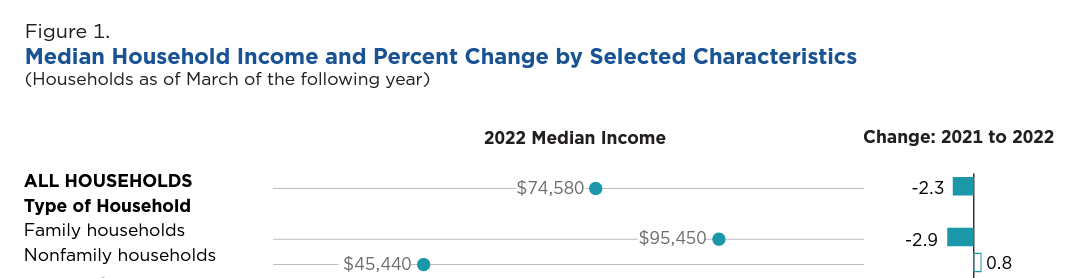

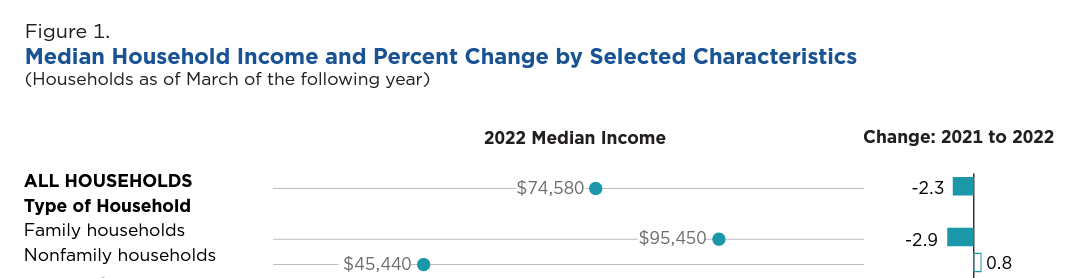

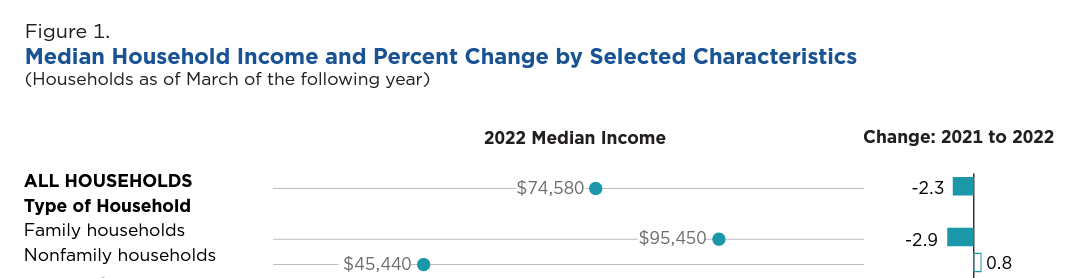

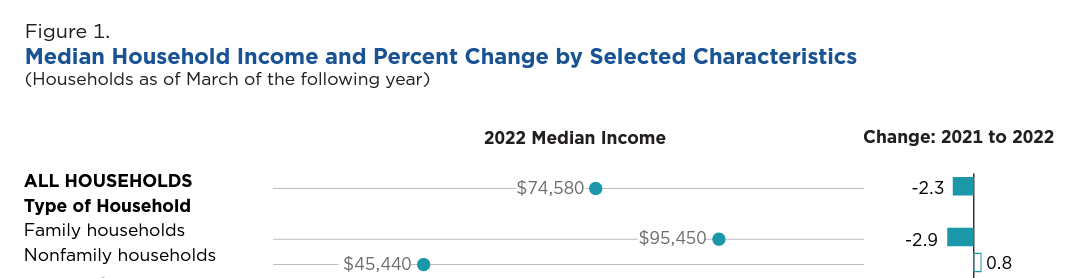

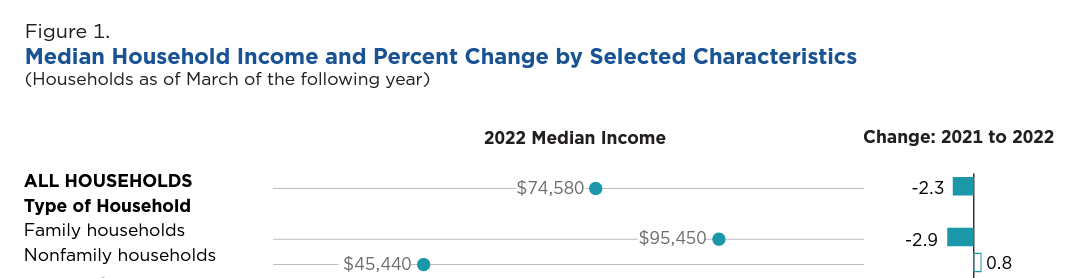

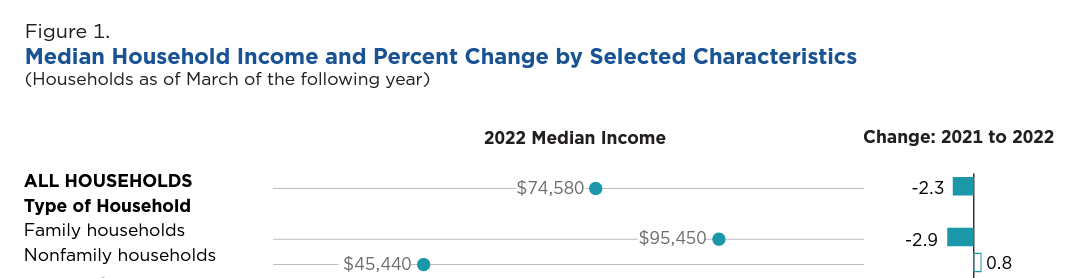

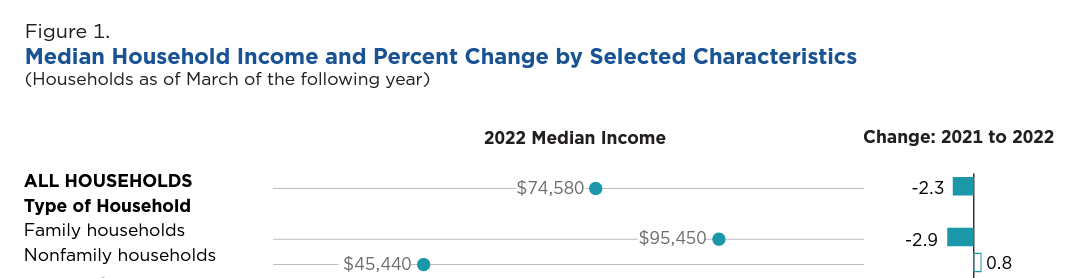

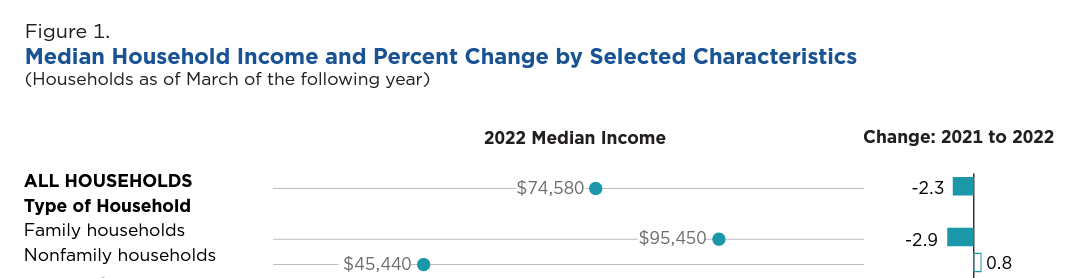

According to data from the US Census Bureau for 2022, the median income for Nonfamily households in the United States was approximately $45,440 – which means that half of all individuals earned more than this amount, and half earned less.

So, if you have a salary of $203,840, you have a salary that is in the top 50 percent of all earners in the United States.

With a salary well over $45,400, you are doing very well and in the top echelon of earners in the United States.

$98 an Hour is How Much a Year After Taxes?

Now, let’s talk about the real-world scenario after taxes. Your take-home pay will depend on several factors, including your tax filing status, deductions, and the state in which you live.

On average, you can expect to lose anywhere from 15% to 30% or more of your income to federal and state income taxes. If we take a conservative estimate of a 20% tax rate, your annual take-home pay would be:

$40,768 (annual income) x 0.20 (tax rate) = $203,840

Subtracting $40,768 from your annual income leaves you with $163,072 after taxes.

$98 an Hour is How Much a Month?

If you’re curious about your monthly income at $98 an hour, it’s relatively straightforward to calculate. Simply multiply your hourly wage by the number of hours you work in a week and then multiply that by 4 (assuming four weeks in a month). Here’s the formula:

$98 (hourly wage) x 40 (hours per week) x 4 (weeks per month) = $15,680

So, if you earn $98 an hour, your monthly income before taxes would be $15,680.

$98 an Hour is How Much Biweekly?

Many employers pay their employees on a biweekly schedule, which means you receive a paycheck every two weeks. To calculate your biweekly income, you’ll multiply your hourly wage by the number of hours you work in a two-week period. Here’s the formula:

$98 (hourly wage) x 40 (hours per week) x 2 (weeks) = $15,680

At $98 an hour, your biweekly income before taxes would be $15,680.

To figure out your post tax biweekly income, you can multiply $98 by your tax rate as we did above.

Is $98 an Hour a Good Wage?

The answer to whether $98 an hour is a good wage depends on various factors, including your location, cost of living, and individual financial goals. In some areas with a lower cost of living, $98 an hour can provide a comfortable living. However, in more expensive cities, it may not stretch as far.

It’s crucial to consider your monthly expenses, such as housing, utilities, transportation, groceries, and savings goals when determining if $98 an hour meets your needs. Additionally, factors like job benefits, opportunities for advancement, and job satisfaction play a significant role in evaluating the overall value of your wage.

How to Increase Your Hourly Wage

If you’re looking to boost your hourly wage, there are several strategies you can consider:

- Skill Development: Enhance your skills or acquire new ones that are in demand in your industry.

- Negotiation: When starting a new job or during performance reviews, don’t hesitate to negotiate your wage.

- Further Education: Consider pursuing additional education or certifications that can increase your market value.

- Job Switch: Sometimes, switching to a different job or company can lead to a significant salary increase.

- Freelancing or Part-Time Work: Explore part-time job opportunities or freelance work to supplement your primary income. Apps like Fiverr or Upwork can be a great spot to post your skills and get hired for part-time work.

- Start a Side Hustle: Look to make more money by starting a side hustle. The folks over at the blog, Financial Panther, have put together a comprehensive list of over 70+ gig economy apps, with strategies and thoughts on each one. A lot of these you can do from your phone. The list includes dog walking/sitting apps, food delivery apps, picture-taking apps, secret shopping apps, and plenty more. It is a great resource to see all the different side hustle apps that are out there.

Will a Hourly Wage of of $98 Help Me Become Rich?

A $98 an hour wage can certainly help you build wealth and achieve financial success, but whether it will make you ‘rich’ depends on various factors, including your financial goals, lifestyle choices, expenses, and savings/investment strategies.

Here are some considerations:

- Financial Goals: The definition of “rich” varies from person to person. For some, it means achieving financial security and having enough to comfortably cover living expenses and retirement. For others, it means accumulating significant wealth. Your specific financial goals will determine what “rich” means to you.

- Lifestyle Choices: Your spending habits and lifestyle choices play a significant role in your ability to accumulate wealth. Even with a high salary, if you spend excessively or accumulate debt, it can hinder your path to becoming rich. Budgeting, practicing mindful spending, and living below your means are essential.

- Savings and Investments: Building wealth often involves saving a significant portion of your income and making smart investments. A high salary provides the opportunity to save and invest more, which can accelerate your wealth-building journey. Consider contributing to retirement accounts, investing in stocks or real estate, and diversifying your investments.

- Debt Management: Reducing and managing debt, such as student loans, credit card debt, and mortgages, is crucial for building wealth. High-interest debt can erode your financial progress, so it’s important to prioritize paying it off.

- Cost of Living: The cost of living in your area can significantly impact your ability to save and invest. In high-cost-of-living areas, it may be more challenging to build wealth, even with a high salary.

- Investment Strategy: Your investment strategy, including asset allocation, risk tolerance, and long-term planning, can greatly influence your wealth accumulation. Consulting with a financial advisor can help you make informed investment decisions.

- Time Horizon: Building substantial wealth often takes time and consistent effort. The longer your time horizon, the more potential you have to accumulate wealth through the power of compounding returns.

In summary, an hourly wage of $98 provides a solid foundation for building wealth, but it’s not the salary alone that determines your financial success. Becoming ‘rich’ is a subjective goal, so it’s essential to define what it means for you and create a financial plan to pursue it.

Conclusion

$98 an hour can be a decent income for many, it’s essential to assess your specific circumstances to determine if it aligns with your financial objectives and lifestyle. Understanding how your hourly wage translates into yearly, monthly, and biweekly income, as well as factoring in taxes, is a valuable step in managing your finances effectively.

Hopefully this article has been useful for you to learn how much $98 an hour is a year.

By: Chris Bemis

Have you ever wondered how much you’d make in a year if you earned $31 an hour? It’s a common question, and the answer can provide valuable insights into your financial well-being.

In this article, we’ll break down the math and explore what $31 an hour means annually, after taxes, in a month, and on a biweekly basis. Plus, we’ll discuss whether $31 an hour is considered a good wage in today’s economic landscape.

$31 an Hour is How Much a Year?

Let’s start with the big picture: how much would you earn in a year if you were paid $31 per hour?

To calculate your annual income, you’ll need to consider a few factors. First, you need to determine how many hours you work each week and how many weeks you work in a year.

Assuming you work full-time, which is typically 40 hours per week, you’d multiply your hourly wage by the number of weeks in a year. There are 52 weeks in a year.

So, the basic calculation looks like this:

$31 (hourly wage) x 40 (hours per week) x 52 (weeks per year) = $64,480

At $31 an hour, you would earn $64,480 per year before taxes.

If you work less than 52 weeks a year, or work more or less than 40 hours a week, then you will want to adjust the formula to get an understanding of how much money you are making per year.

How Making $31 an Hour Compares to Other Individuals In The United States

According to data from the US Census Bureau for 2022, the median income for Nonfamily households in the United States was approximately $45,440 – which means that half of all individuals earned more than this amount, and half earned less.

So, if you have a salary of $64,480, you have a salary that is in the top 50 percent of all earners in the United States.

With a salary over $45,440, you are doing well and are part of a high group of earners in the United States.

For more info on this check out Just the Facts on the US Economy from Steve Ballmer.

$31 an Hour is How Much a Year After Taxes?

Now, let’s talk about the real-world scenario after taxes. Your take-home pay will depend on several factors, including your tax filing status, deductions, and the state in which you live.

On average, you can expect to lose anywhere from 15% to 30% or more of your income to federal and state income taxes. If we take a conservative estimate of a 20% tax rate, your annual take-home pay would be:

$12,896 (annual income) x 0.20 (tax rate) = $64,480

Subtracting $12,896 from your annual income leaves you with $51,584 after taxes.

$31 an Hour is How Much a Month?

If you’re curious about your monthly income at $31 an hour, it’s relatively straightforward to calculate. Simply multiply your hourly wage by the number of hours you work in a week and then multiply that by 4 (assuming four weeks in a month). Here’s the formula:

$31 (hourly wage) x 40 (hours per week) x 4 (weeks per month) = $4,960

So, if you earn $31 an hour, your monthly income before taxes would be $4,960.

$31 an Hour is How Much Biweekly?

Many employers pay their employees on a biweekly schedule, which means you receive a paycheck every two weeks. To calculate your biweekly income, you’ll multiply your hourly wage by the number of hours you work in a two-week period. Here’s the formula:

$31 (hourly wage) x 40 (hours per week) x 2 (weeks) = $4,960

At $31 an hour, your biweekly income before taxes would be $4,960.

To figure out your post tax biweekly income, you can multiply $31 by your tax rate as we did above.

Is $31 an Hour a Good Wage?

The answer to whether $31 an hour is a good wage depends on various factors, including your location, cost of living, and individual financial goals. In some areas with a lower cost of living, $31 an hour can provide a comfortable living. However, in more expensive cities, it may not stretch as far.

It’s crucial to consider your monthly expenses, such as housing, utilities, transportation, groceries, and savings goals when determining if $31 an hour meets your needs. Additionally, factors like job benefits, opportunities for advancement, and job satisfaction play a significant role in evaluating the overall value of your wage.

How to Increase Your Hourly Wage

If you’re looking to boost your hourly wage, there are several strategies you can consider:

- Skill Development: Enhance your skills or acquire new ones that are in demand in your industry.

- Negotiation: When starting a new job or during performance reviews, don’t hesitate to negotiate your wage.

- Further Education: Consider pursuing additional education or certifications that can increase your market value.

- Job Switch: Sometimes, switching to a different job or company can lead to a significant salary increase.

- Freelancing or Part-Time Work: Explore part-time job opportunities or freelance work to supplement your primary income. Apps like Fiverr or Upwork can be a great spot to post your skills and get hired for part-time work.

- Start a Side Hustle: Look to make more money by starting a side hustle. The folks over at the blog, Financial Panther, have put together a comprehensive list of over 70+ gig economy apps, with strategies and thoughts on each one. A lot of these you can do from your phone. The list includes dog walking/sitting apps, food delivery apps, picture-taking apps, secret shopping apps, and plenty more. It is a great resource to see all the different side hustle apps that are out there.

Will a Hourly Wage of of $31 Help Me Become Rich?

A $31 an hour wage can certainly help you build wealth and achieve financial success, but whether it will make you ‘rich’ depends on various factors, including your financial goals, lifestyle choices, expenses, and savings/investment strategies.

Here are some considerations:

- Financial Goals: The definition of “rich” varies from person to person. For some, it means achieving financial security and having enough to comfortably cover living expenses and retirement. For others, it means accumulating significant wealth. Your specific financial goals will determine what “rich” means to you.

- Lifestyle Choices: Your spending habits and lifestyle choices play a significant role in your ability to accumulate wealth. Even with a high salary, if you spend excessively or accumulate debt, it can hinder your path to becoming rich. Budgeting, practicing mindful spending, and living below your means are essential.

- Savings and Investments: Building wealth often involves saving a significant portion of your income and making smart investments. A high salary provides the opportunity to save and invest more, which can accelerate your wealth-building journey. Consider contributing to retirement accounts, investing in stocks or real estate, and diversifying your investments.

- Debt Management: Reducing and managing debt, such as student loans, credit card debt, and mortgages, is crucial for building wealth. High-interest debt can erode your financial progress, so it’s important to prioritize paying it off.

- Cost of Living: The cost of living in your area can significantly impact your ability to save and invest. In high-cost-of-living areas, it may be more challenging to build wealth, even with a high salary.

- Investment Strategy: Your investment strategy, including asset allocation, risk tolerance, and long-term planning, can greatly influence your wealth accumulation. Consulting with a financial advisor can help you make informed investment decisions.

- Time Horizon: Building substantial wealth often takes time and consistent effort. The longer your time horizon, the more potential you have to accumulate wealth through the power of compounding returns.

In summary, an hourly wage of $31 provides a solid foundation for building wealth, but it’s not the salary alone that determines your financial success. Becoming ‘rich’ is a subjective goal, so it’s essential to define what it means for you and create a financial plan to pursue it.

Conclusion

$31 an hour can be a decent income for many, it’s essential to assess your specific circumstances to determine if it aligns with your financial objectives and lifestyle. Understanding how your hourly wage translates into yearly, monthly, and biweekly income, as well as factoring in taxes, is a valuable step in managing your finances effectively.

Hopefully this article has been useful for you to learn how much $31 an hour is a year.

By: Chris Bemis

Have you ever wondered how much you’d make in a year if you earned $51 an hour? It’s a common question, and the answer can provide valuable insights into your financial well-being.

In this article, we’ll break down the math and explore what $51 an hour means annually, after taxes, in a month, and on a biweekly basis. Plus, we’ll discuss whether $51 an hour is considered a good wage in today’s economic landscape.

$51 an Hour is How Much a Year?

Let’s start with the big picture: how much would you earn in a year if you were paid $51 per hour?

To calculate your annual income, you’ll need to consider a few factors. First, you need to determine how many hours you work each week and how many weeks you work in a year.

Assuming you work full-time, which is typically 40 hours per week, you’d multiply your hourly wage by the number of weeks in a year. There are 52 weeks in a year.

So, the basic calculation looks like this:

$51 (hourly wage) x 40 (hours per week) x 52 (weeks per year) = $106,080

At $51 an hour, you would earn $106,080 per year before taxes.

If you work less than 52 weeks a year, or work more or less than 40 hours a week, then you will want to adjust the formula to get an understanding of how much money you are making per year.

How Making $51 an Hour Compares to Other Individuals In The United States

According to data from the US Census Bureau for 2022, the median income for Nonfamily households in the United States was approximately $45,440 – which means that half of all individuals earned more than this amount, and half earned less.

So, if you have a salary of $106,080, you have a salary that is in the top 50 percent of all earners in the United States.

With a salary well over $45,400, you are doing very well and in the top echelon of earners in the United States.

For more info on this check out Just the Facts on the US Economy from Steve Ballmer.

$51 an Hour is How Much a Year After Taxes?

Now, let’s talk about the real-world scenario after taxes. Your take-home pay will depend on several factors, including your tax filing status, deductions, and the state in which you live.

On average, you can expect to lose anywhere from 15% to 30% or more of your income to federal and state income taxes. If we take a conservative estimate of a 20% tax rate, your annual take-home pay would be:

$21,216 (annual income) x 0.20 (tax rate) = $106,080

Subtracting $21,216 from your annual income leaves you with $84,864 after taxes.

$51 an Hour is How Much a Month?

If you’re curious about your monthly income at $51 an hour, it’s relatively straightforward to calculate. Simply multiply your hourly wage by the number of hours you work in a week and then multiply that by 4 (assuming four weeks in a month). Here’s the formula:

$51 (hourly wage) x 40 (hours per week) x 4 (weeks per month) = $8,160

So, if you earn $51 an hour, your monthly income before taxes would be $8,160.

$51 an Hour is How Much Biweekly?

Many employers pay their employees on a biweekly schedule, which means you receive a paycheck every two weeks. To calculate your biweekly income, you’ll multiply your hourly wage by the number of hours you work in a two-week period. Here’s the formula:

$51 (hourly wage) x 40 (hours per week) x 2 (weeks) = $8,160

At $51 an hour, your biweekly income before taxes would be $8,160.

To figure out your post tax biweekly income, you can multiply $51 by your tax rate as we did above.

Is $51 an Hour a Good Wage?

The answer to whether $51 an hour is a good wage depends on various factors, including your location, cost of living, and individual financial goals. In some areas with a lower cost of living, $51 an hour can provide a comfortable living. However, in more expensive cities, it may not stretch as far.

It’s crucial to consider your monthly expenses, such as housing, utilities, transportation, groceries, and savings goals when determining if $51 an hour meets your needs. Additionally, factors like job benefits, opportunities for advancement, and job satisfaction play a significant role in evaluating the overall value of your wage.

How to Increase Your Hourly Wage

If you’re looking to boost your hourly wage, there are several strategies you can consider:

- Skill Development: Enhance your skills or acquire new ones that are in demand in your industry.

- Negotiation: When starting a new job or during performance reviews, don’t hesitate to negotiate your wage.

- Further Education: Consider pursuing additional education or certifications that can increase your market value.

- Job Switch: Sometimes, switching to a different job or company can lead to a significant salary increase.

- Freelancing or Part-Time Work: Explore part-time job opportunities or freelance work to supplement your primary income. Apps like Fiverr or Upwork can be a great spot to post your skills and get hired for part-time work.

- Start a Side Hustle: Look to make more money by starting a side hustle. The folks over at the blog, Financial Panther, have put together a comprehensive list of over 70+ gig economy apps, with strategies and thoughts on each one. A lot of these you can do from your phone. The list includes dog walking/sitting apps, food delivery apps, picture-taking apps, secret shopping apps, and plenty more. It is a great resource to see all the different side hustle apps that are out there.

Will a Hourly Wage of of $51 Help Me Become Rich?

A $51 an hour wage can certainly help you build wealth and achieve financial success, but whether it will make you ‘rich’ depends on various factors, including your financial goals, lifestyle choices, expenses, and savings/investment strategies.

Here are some considerations:

- Financial Goals: The definition of “rich” varies from person to person. For some, it means achieving financial security and having enough to comfortably cover living expenses and retirement. For others, it means accumulating significant wealth. Your specific financial goals will determine what “rich” means to you.

- Lifestyle Choices: Your spending habits and lifestyle choices play a significant role in your ability to accumulate wealth. Even with a high salary, if you spend excessively or accumulate debt, it can hinder your path to becoming rich. Budgeting, practicing mindful spending, and living below your means are essential.

- Savings and Investments: Building wealth often involves saving a significant portion of your income and making smart investments. A high salary provides the opportunity to save and invest more, which can accelerate your wealth-building journey. Consider contributing to retirement accounts, investing in stocks or real estate, and diversifying your investments.

- Debt Management: Reducing and managing debt, such as student loans, credit card debt, and mortgages, is crucial for building wealth. High-interest debt can erode your financial progress, so it’s important to prioritize paying it off.

- Cost of Living: The cost of living in your area can significantly impact your ability to save and invest. In high-cost-of-living areas, it may be more challenging to build wealth, even with a high salary.

- Investment Strategy: Your investment strategy, including asset allocation, risk tolerance, and long-term planning, can greatly influence your wealth accumulation. Consulting with a financial advisor can help you make informed investment decisions.

- Time Horizon: Building substantial wealth often takes time and consistent effort. The longer your time horizon, the more potential you have to accumulate wealth through the power of compounding returns.

In summary, an hourly wage of $51 provides a solid foundation for building wealth, but it’s not the salary alone that determines your financial success. Becoming ‘rich’ is a subjective goal, so it’s essential to define what it means for you and create a financial plan to pursue it.

Conclusion

$51 an hour can be a decent income for many, it’s essential to assess your specific circumstances to determine if it aligns with your financial objectives and lifestyle. Understanding how your hourly wage translates into yearly, monthly, and biweekly income, as well as factoring in taxes, is a valuable step in managing your finances effectively.

Hopefully this article has been useful for you to learn how much $51 an hour is a year.

By: Chris Bemis

Have you ever wondered how much you’d make in a year if you earned $67 an hour? It’s a common question, and the answer can provide valuable insights into your financial well-being.

In this article, we’ll break down the math and explore what $67 an hour means annually, after taxes, in a month, and on a biweekly basis. Plus, we’ll discuss whether $67 an hour is considered a good wage in today’s economic landscape.

$67 an Hour is How Much a Year?

Let’s start with the big picture: how much would you earn in a year if you were paid $67 per hour?

To calculate your annual income, you’ll need to consider a few factors. First, you need to determine how many hours you work each week and how many weeks you work in a year.

Assuming you work full-time, which is typically 40 hours per week, you’d multiply your hourly wage by the number of weeks in a year. There are 52 weeks in a year.

So, the basic calculation looks like this:

$67 (hourly wage) x 40 (hours per week) x 52 (weeks per year) = $139,360

At $67 an hour, you would earn $139,360 per year before taxes.

If you work less than 52 weeks a year, or work more or less than 40 hours a week, then you will want to adjust the formula to get an understanding of how much money you are making per year.

How Making $67 an Hour Compares to Other Individuals In The United States

According to data from the US Census Bureau for 2022, the median income for Nonfamily households in the United States was approximately $45,440 – which means that half of all individuals earned more than this amount, and half earned less.

So, if you have a salary of $139,360, you have a salary that is in the top 50 percent of all earners in the United States.

With a salary well over $45,400, you are doing very well and in the top echelon of earners in the United States.

For more info on this check out Just the Facts on the US Economy from Steve Ballmer.

$67 an Hour is How Much a Year After Taxes?

Now, let’s talk about the real-world scenario after taxes. Your take-home pay will depend on several factors, including your tax filing status, deductions, and the state in which you live.

On average, you can expect to lose anywhere from 15% to 30% or more of your income to federal and state income taxes. If we take a conservative estimate of a 20% tax rate, your annual take-home pay would be:

$27,872 (annual income) x 0.20 (tax rate) = $139,360

Subtracting $27,872 from your annual income leaves you with $111,488 after taxes.

$67 an Hour is How Much a Month?

If you’re curious about your monthly income at $67 an hour, it’s relatively straightforward to calculate. Simply multiply your hourly wage by the number of hours you work in a week and then multiply that by 4 (assuming four weeks in a month). Here’s the formula:

$67 (hourly wage) x 40 (hours per week) x 4 (weeks per month) = $10,720

So, if you earn $67 an hour, your monthly income before taxes would be $10,720.

$67 an Hour is How Much Biweekly?

Many employers pay their employees on a biweekly schedule, which means you receive a paycheck every two weeks. To calculate your biweekly income, you’ll multiply your hourly wage by the number of hours you work in a two-week period. Here’s the formula:

$67 (hourly wage) x 40 (hours per week) x 2 (weeks) = $10,720

At $67 an hour, your biweekly income before taxes would be $10,720.

To figure out your post tax biweekly income, you can multiply $67 by your tax rate as we did above.

Is $67 an Hour a Good Wage?

The answer to whether $67 an hour is a good wage depends on various factors, including your location, cost of living, and individual financial goals. In some areas with a lower cost of living, $67 an hour can provide a comfortable living. However, in more expensive cities, it may not stretch as far.

It’s crucial to consider your monthly expenses, such as housing, utilities, transportation, groceries, and savings goals when determining if $67 an hour meets your needs. Additionally, factors like job benefits, opportunities for advancement, and job satisfaction play a significant role in evaluating the overall value of your wage.

How to Increase Your Hourly Wage

If you’re looking to boost your hourly wage, there are several strategies you can consider:

- Skill Development: Enhance your skills or acquire new ones that are in demand in your industry.

- Negotiation: When starting a new job or during performance reviews, don’t hesitate to negotiate your wage.

- Further Education: Consider pursuing additional education or certifications that can increase your market value.

- Job Switch: Sometimes, switching to a different job or company can lead to a significant salary increase.

- Freelancing or Part-Time Work: Explore part-time job opportunities or freelance work to supplement your primary income. Apps like Fiverr or Upwork can be a great spot to post your skills and get hired for part-time work.

- Start a Side Hustle: Look to make more money by starting a side hustle. The folks over at the blog, Financial Panther, have put together a comprehensive list of over 70+ gig economy apps, with strategies and thoughts on each one. A lot of these you can do from your phone. The list includes dog walking/sitting apps, food delivery apps, picture-taking apps, secret shopping apps, and plenty more. It is a great resource to see all the different side hustle apps that are out there.

Will a Hourly Wage of of $67 Help Me Become Rich?

A $67 an hour wage can certainly help you build wealth and achieve financial success, but whether it will make you ‘rich’ depends on various factors, including your financial goals, lifestyle choices, expenses, and savings/investment strategies.

Here are some considerations:

- Financial Goals: The definition of “rich” varies from person to person. For some, it means achieving financial security and having enough to comfortably cover living expenses and retirement. For others, it means accumulating significant wealth. Your specific financial goals will determine what “rich” means to you.

- Lifestyle Choices: Your spending habits and lifestyle choices play a significant role in your ability to accumulate wealth. Even with a high salary, if you spend excessively or accumulate debt, it can hinder your path to becoming rich. Budgeting, practicing mindful spending, and living below your means are essential.

- Savings and Investments: Building wealth often involves saving a significant portion of your income and making smart investments. A high salary provides the opportunity to save and invest more, which can accelerate your wealth-building journey. Consider contributing to retirement accounts, investing in stocks or real estate, and diversifying your investments.

- Debt Management: Reducing and managing debt, such as student loans, credit card debt, and mortgages, is crucial for building wealth. High-interest debt can erode your financial progress, so it’s important to prioritize paying it off.

- Cost of Living: The cost of living in your area can significantly impact your ability to save and invest. In high-cost-of-living areas, it may be more challenging to build wealth, even with a high salary.

- Investment Strategy: Your investment strategy, including asset allocation, risk tolerance, and long-term planning, can greatly influence your wealth accumulation. Consulting with a financial advisor can help you make informed investment decisions.

- Time Horizon: Building substantial wealth often takes time and consistent effort. The longer your time horizon, the more potential you have to accumulate wealth through the power of compounding returns.

In summary, an hourly wage of $67 provides a solid foundation for building wealth, but it’s not the salary alone that determines your financial success. Becoming ‘rich’ is a subjective goal, so it’s essential to define what it means for you and create a financial plan to pursue it.

Conclusion

$67 an hour can be a decent income for many, it’s essential to assess your specific circumstances to determine if it aligns with your financial objectives and lifestyle. Understanding how your hourly wage translates into yearly, monthly, and biweekly income, as well as factoring in taxes, is a valuable step in managing your finances effectively.

Hopefully this article has been useful for you to learn how much $67 an hour is a year.

By: Chris Bemis

Have you ever wondered how much you’d make in a year if you earned $83 an hour? It’s a common question, and the answer can provide valuable insights into your financial well-being.

In this article, we’ll break down the math and explore what $83 an hour means annually, after taxes, in a month, and on a biweekly basis. Plus, we’ll discuss whether $83 an hour is considered a good wage in today’s economic landscape.

$83 an Hour is How Much a Year?

Let’s start with the big picture: how much would you earn in a year if you were paid $83 per hour?

To calculate your annual income, you’ll need to consider a few factors. First, you need to determine how many hours you work each week and how many weeks you work in a year.

Assuming you work full-time, which is typically 40 hours per week, you’d multiply your hourly wage by the number of weeks in a year. There are 52 weeks in a year.

So, the basic calculation looks like this:

$83 (hourly wage) x 40 (hours per week) x 52 (weeks per year) = $172,640

At $83 an hour, you would earn $172,640 per year before taxes.

If you work less than 52 weeks a year, or work more or less than 40 hours a week, then you will want to adjust the formula to get an understanding of how much money you are making per year.

How Making $83 an Hour Compares to Other Individuals In The United States

According to data from the US Census Bureau for 2022, the median income for Nonfamily households in the United States was approximately $45,440 – which means that half of all individuals earned more than this amount, and half earned less.

So, if you have a salary of $172,640, you have a salary that is in the top 50 percent of all earners in the United States.

With a salary well over $45,400, you are doing very well and in the top echelon of earners in the United States.

For more info on this check out Just the Facts on the US Economy from Steve Ballmer.

$83 an Hour is How Much a Year After Taxes?

Now, let’s talk about the real-world scenario after taxes. Your take-home pay will depend on several factors, including your tax filing status, deductions, and the state in which you live.

On average, you can expect to lose anywhere from 15% to 30% or more of your income to federal and state income taxes. If we take a conservative estimate of a 20% tax rate, your annual take-home pay would be:

$34,528 (annual income) x 0.20 (tax rate) = $172,640

Subtracting $34,528 from your annual income leaves you with $138,112 after taxes.

$83 an Hour is How Much a Month?

If you’re curious about your monthly income at $83 an hour, it’s relatively straightforward to calculate. Simply multiply your hourly wage by the number of hours you work in a week and then multiply that by 4 (assuming four weeks in a month). Here’s the formula:

$83 (hourly wage) x 40 (hours per week) x 4 (weeks per month) = $13,280

So, if you earn $83 an hour, your monthly income before taxes would be $13,280.

$83 an Hour is How Much Biweekly?

Many employers pay their employees on a biweekly schedule, which means you receive a paycheck every two weeks. To calculate your biweekly income, you’ll multiply your hourly wage by the number of hours you work in a two-week period. Here’s the formula:

$83 (hourly wage) x 40 (hours per week) x 2 (weeks) = $13,280

At $83 an hour, your biweekly income before taxes would be $13,280.

To figure out your post tax biweekly income, you can multiply $83 by your tax rate as we did above.

Is $83 an Hour a Good Wage?

The answer to whether $83 an hour is a good wage depends on various factors, including your location, cost of living, and individual financial goals. In some areas with a lower cost of living, $83 an hour can provide a comfortable living. However, in more expensive cities, it may not stretch as far.

It’s crucial to consider your monthly expenses, such as housing, utilities, transportation, groceries, and savings goals when determining if $83 an hour meets your needs. Additionally, factors like job benefits, opportunities for advancement, and job satisfaction play a significant role in evaluating the overall value of your wage.

How to Increase Your Hourly Wage

If you’re looking to boost your hourly wage, there are several strategies you can consider:

- Skill Development: Enhance your skills or acquire new ones that are in demand in your industry.

- Negotiation: When starting a new job or during performance reviews, don’t hesitate to negotiate your wage.

- Further Education: Consider pursuing additional education or certifications that can increase your market value.

- Job Switch: Sometimes, switching to a different job or company can lead to a significant salary increase.

- Freelancing or Part-Time Work: Explore part-time job opportunities or freelance work to supplement your primary income. Apps like Fiverr or Upwork can be a great spot to post your skills and get hired for part-time work.

- Start a Side Hustle: Look to make more money by starting a side hustle. The folks over at the blog, Financial Panther, have put together a comprehensive list of over 70+ gig economy apps, with strategies and thoughts on each one. A lot of these you can do from your phone. The list includes dog walking/sitting apps, food delivery apps, picture-taking apps, secret shopping apps, and plenty more. It is a great resource to see all the different side hustle apps that are out there.

Will an Hourly Wage of $83 Help Me Become Rich?

A $83 an hour wage can certainly help you build wealth and achieve financial success, but whether it will make you ‘rich’ depends on various factors, including your financial goals, lifestyle choices, expenses, and savings/investment strategies.

Here are some considerations:

- Financial Goals: The definition of “rich” varies from person to person. For some, it means achieving financial security and having enough to comfortably cover living expenses and retirement. For others, it means accumulating significant wealth. Your specific financial goals will determine what “rich” means to you.

- Lifestyle Choices: Your spending habits and lifestyle choices play a significant role in your ability to accumulate wealth. Even with a high salary, if you spend excessively or accumulate debt, it can hinder your path to becoming rich. Budgeting, practicing mindful spending, and living below your means are essential.

- Savings and Investments: Building wealth often involves saving a significant portion of your income and making smart investments. A high salary provides the opportunity to save and invest more, which can accelerate your wealth-building journey. Consider contributing to retirement accounts, investing in stocks or real estate, and diversifying your investments.

- Debt Management: Reducing and managing debt, such as student loans, credit card debt, and mortgages, is crucial for building wealth. High-interest debt can erode your financial progress, so it’s important to prioritize paying it off.

- Cost of Living: The cost of living in your area can significantly impact your ability to save and invest. In high-cost-of-living areas, it may be more challenging to build wealth, even with a high salary.

- Investment Strategy: Your investment strategy, including asset allocation, risk tolerance, and long-term planning, can greatly influence your wealth accumulation. Consulting with a financial advisor can help you make informed investment decisions.

- Time Horizon: Building substantial wealth often takes time and consistent effort. The longer your time horizon, the more potential you have to accumulate wealth through the power of compounding returns.

In summary, an hourly wage of $83 provides a solid foundation for building wealth, but it’s not the salary alone that determines your financial success. Becoming ‘rich’ is a subjective goal, so it’s essential to define what it means for you and create a financial plan to pursue it.

Conclusion

$83 an hour can be a decent income for many, it’s essential to assess your specific circumstances to determine if it aligns with your financial objectives and lifestyle. Understanding how your hourly wage translates into yearly, monthly, and biweekly income, as well as factoring in taxes, is a valuable step in managing your finances effectively.

Hopefully this article has been useful for you to learn how much $83 an hour is a year.

By: Chris Bemis

Have you ever wondered how much you’d make in a year if you earned $99 an hour? It’s a common question, and the answer can provide valuable insights into your financial well-being.

In this article, we’ll break down the math and explore what $99 an hour means annually, after taxes, in a month, and on a biweekly basis. Plus, we’ll discuss whether $99 an hour is considered a good wage in today’s economic landscape.

$99 an Hour is How Much a Year?

Let’s start with the big picture: how much would you earn in a year if you were paid $99 per hour?

To calculate your annual income, you’ll need to consider a few factors. First, you need to determine how many hours you work each week and how many weeks you work in a year.

Assuming you work full-time, which is typically 40 hours per week, you’d multiply your hourly wage by the number of weeks in a year. There are 52 weeks in a year.

So, the basic calculation looks like this:

$99 (hourly wage) x 40 (hours per week) x 52 (weeks per year) = $205,920

At $99 an hour, you would earn $205,920 per year before taxes.

If you work less than 52 weeks a year, or work more or less than 40 hours a week, then you will want to adjust the formula to get an understanding of how much money you are making per year.

How Making $99 an Hour Compares to Other Individuals In The United States

According to data from the US Census Bureau for 2022, the median income for Nonfamily households in the United States was approximately $45,440 – which means that half of all individuals earned more than this amount, and half earned less.

So, if you have a salary of $205,920, you have a salary that is in the top 50 percent of all earners in the United States.

With a salary well over $45,400, you are doing very well and in the top echelon of earners in the United States.

For more info on this check out Just the Facts on the US Economy from Steve Ballmer.

$99 an Hour is How Much a Year After Taxes?

Now, let’s talk about the real-world scenario after taxes. Your take-home pay will depend on several factors, including your tax filing status, deductions, and the state in which you live.

On average, you can expect to lose anywhere from 15% to 30% or more of your income to federal and state income taxes. If we take a conservative estimate of a 20% tax rate, your annual take-home pay would be:

$41,184 (annual income) x 0.20 (tax rate) = $205,920

Subtracting $41,184 from your annual income leaves you with $164,736 after taxes.

$99 an Hour is How Much a Month?

If you’re curious about your monthly income at $99 an hour, it’s relatively straightforward to calculate. Simply multiply your hourly wage by the number of hours you work in a week and then multiply that by 4 (assuming four weeks in a month). Here’s the formula:

$99 (hourly wage) x 40 (hours per week) x 4 (weeks per month) = $15,840

So, if you earn $99 an hour, your monthly income before taxes would be $15,840.

$99 an Hour is How Much Biweekly?

Many employers pay their employees on a biweekly schedule, which means you receive a paycheck every two weeks. To calculate your biweekly income, you’ll multiply your hourly wage by the number of hours you work in a two-week period. Here’s the formula:

$99 (hourly wage) x 40 (hours per week) x 2 (weeks) = $15,840

At $99 an hour, your biweekly income before taxes would be $15,840.

To figure out your post tax biweekly income, you can multiply $99 by your tax rate as we did above.

Is $99 an Hour a Good Wage?

The answer to whether $99 an hour is a good wage depends on various factors, including your location, cost of living, and individual financial goals. In some areas with a lower cost of living, $99 an hour can provide a comfortable living. However, in more expensive cities, it may not stretch as far.

It’s crucial to consider your monthly expenses, such as housing, utilities, transportation, groceries, and savings goals when determining if $99 an hour meets your needs. Additionally, factors like job benefits, opportunities for advancement, and job satisfaction play a significant role in evaluating the overall value of your wage.

How to Increase Your Hourly Wage

If you’re looking to boost your hourly wage, there are several strategies you can consider:

- Skill Development: Enhance your skills or acquire new ones that are in demand in your industry.

- Negotiation: When starting a new job or during performance reviews, don’t hesitate to negotiate your wage.

- Further Education: Consider pursuing additional education or certifications that can increase your market value.

- Job Switch: Sometimes, switching to a different job or company can lead to a significant salary increase.

- Freelancing or Part-Time Work: Explore part-time job opportunities or freelance work to supplement your primary income. Apps like Fiverr or Upwork can be a great spot to post your skills and get hired for part-time work.

- Start a Side Hustle: Look to make more money by starting a side hustle. The folks over at the blog, Financial Panther, have put together a comprehensive list of over 70+ gig economy apps, with strategies and thoughts on each one. A lot of these you can do from your phone. The list includes dog walking/sitting apps, food delivery apps, picture-taking apps, secret shopping apps, and plenty more. It is a great resource to see all the different side hustle apps that are out there.

Will a Hourly Wage of of $99 Help Me Become Rich?

A $99 an hour wage can certainly help you build wealth and achieve financial success, but whether it will make you ‘rich’ depends on various factors, including your financial goals, lifestyle choices, expenses, and savings/investment strategies.

Here are some considerations:

- Financial Goals: The definition of “rich” varies from person to person. For some, it means achieving financial security and having enough to comfortably cover living expenses and retirement. For others, it means accumulating significant wealth. Your specific financial goals will determine what “rich” means to you.

- Lifestyle Choices: Your spending habits and lifestyle choices play a significant role in your ability to accumulate wealth. Even with a high salary, if you spend excessively or accumulate debt, it can hinder your path to becoming rich. Budgeting, practicing mindful spending, and living below your means are essential.

- Savings and Investments: Building wealth often involves saving a significant portion of your income and making smart investments. A high salary provides the opportunity to save and invest more, which can accelerate your wealth-building journey. Consider contributing to retirement accounts, investing in stocks or real estate, and diversifying your investments.

- Debt Management: Reducing and managing debt, such as student loans, credit card debt, and mortgages, is crucial for building wealth. High-interest debt can erode your financial progress, so it’s important to prioritize paying it off.

- Cost of Living: The cost of living in your area can significantly impact your ability to save and invest. In high-cost-of-living areas, it may be more challenging to build wealth, even with a high salary.

- Investment Strategy: Your investment strategy, including asset allocation, risk tolerance, and long-term planning, can greatly influence your wealth accumulation. Consulting with a financial advisor can help you make informed investment decisions.

- Time Horizon: Building substantial wealth often takes time and consistent effort. The longer your time horizon, the more potential you have to accumulate wealth through the power of compounding returns.

In summary, an hourly wage of $99 provides a solid foundation for building wealth, but it’s not the salary alone that determines your financial success. Becoming ‘rich’ is a subjective goal, so it’s essential to define what it means for you and create a financial plan to pursue it.

Conclusion

$99 an hour can be a decent income for many, it’s essential to assess your specific circumstances to determine if it aligns with your financial objectives and lifestyle. Understanding how your hourly wage translates into yearly, monthly, and biweekly income, as well as factoring in taxes, is a valuable step in managing your finances effectively.

Hopefully this article has been useful for you to learn how much $99 an hour is a year.

Have you ever wondered how much you’d make in a year if you earned $10 an hour? It’s a common question, and the answer can provide valuable insights into your financial well-being.

In this article, we’ll break down the math and explore what $10 an hour means annually, after taxes, in a month, and on a biweekly basis. Plus, we’ll discuss whether $10 an hour is considered a good wage in today’s economic landscape.

$10 an Hour is How Much a Year?

Let’s start with the big picture: how much would you earn in a year if you were paid $10 per hour?

To calculate your annual income, you’ll need to consider a few factors. First, you need to determine how many hours you work each week and how many weeks you work in a year.

Assuming you work full-time, which is typically 40 hours per week, you’d multiply your hourly wage by the number of weeks in a year. There are 52 weeks in a year.

So, the basic calculation looks like this:

$10 (hourly wage) x 40 (hours per week) x 52 (weeks per year) = $20,800

At $10 an hour, you would earn $20,800 per year before taxes.

If you work less than 52 weeks a year, or work more or less than 40 hours a week, then you will want to adjust the formula to get an understanding of how much money you are making per year.

How Making $10 an Hour Compares to Other Individuals In The United States

According to data from the US Census Bureau for 2022, the median income for Nonfamily households in the United States was approximately $45,440 – which means that half of all individuals earned more than this amount, and half earned less.

So, if you have a salary of $20,800, you have a salary that is in the lower 50 percent of all earners in the United States.

With a salary of under $45,440, you are doing ok and near the middle of average earners in the United States.

$10 an Hour is How Much a Year After Taxes?

Now, let’s talk about the real-world scenario after taxes. Your take-home pay will depend on several factors, including your tax filing status, deductions, and the state in which you live.

On average, you can expect to lose anywhere from 15% to 30% or more of your income to federal and state income taxes. If we take a conservative estimate of a 20% tax rate, your annual take-home pay would be:

$4,160 (annual income) x 0.20 (tax rate) = $20,800

Subtracting $4,160 from your annual income leaves you with $16,640 after taxes.

$10 an Hour is How Much a Month?

If you’re curious about your monthly income at $10 an hour, it’s relatively straightforward to calculate. Simply multiply your hourly wage by the number of hours you work in a week and then multiply that by 4 (assuming four weeks in a month). Here’s the formula:

$10 (hourly wage) x 40 (hours per week) x 4 (weeks per month) = $1,600

So, if you earn $10 an hour, your monthly income before taxes would be $1,600.

$10 an Hour is How Much Biweekly?

Many employers pay their employees on a biweekly schedule, which means you receive a paycheck every two weeks. To calculate your biweekly income, you’ll multiply your hourly wage by the number of hours you work in a two-week period. Here’s the formula:

$10 (hourly wage) x 40 (hours per week) x 2 (weeks) = $1,600

At $10 an hour, your biweekly income before taxes would be $1,600.

To figure out your post tax biweekly income, you can multiply $10 by your tax rate as we did above.

Is $10 an Hour a Good Wage?

The answer to whether $10 an hour is a good wage depends on various factors, including your location, cost of living, and individual financial goals. In some areas with a lower cost of living, $10 an hour can provide a comfortable living. However, in more expensive cities, it may not stretch as far.

It’s crucial to consider your monthly expenses, such as housing, utilities, transportation, groceries, and savings goals when determining if $10 an hour meets your needs. Additionally, factors like job benefits, opportunities for advancement, and job satisfaction play a significant role in evaluating the overall value of your wage.

How to Increase Your Hourly Wage

If you’re looking to boost your hourly wage, there are several strategies you can consider:

- Skill Development: Enhance your skills or acquire new ones that are in demand in your industry.

- Negotiation: When starting a new job or during performance reviews, don’t hesitate to negotiate your wage.

- Further Education: Consider pursuing additional education or certifications that can increase your market value.

- Job Switch: Sometimes, switching to a different job or company can lead to a significant salary increase.

- Freelancing or Part-Time Work: Explore part-time job opportunities or freelance work to supplement your primary income. Apps like Fiverr or Upwork can be a great spot to post your skills and get hired for part-time work.

- Start a Side Hustle: Look to make more money by starting a side hustle. The folks over at the blog, Financial Panther, have put together a comprehensive list of over 70+ gig economy apps, with strategies and thoughts on each one. A lot of these you can do from your phone. The list includes dog walking/sitting apps, food delivery apps, picture-taking apps, secret shopping apps, and plenty more. It is a great resource to see all the different side hustle apps that are out there.

Will a Hourly Wage of of $10 Help Me Become Rich?

A $10 an hour wage can certainly help you build wealth and achieve financial success, but whether it will make you ‘rich’ depends on various factors, including your financial goals, lifestyle choices, expenses, and savings/investment strategies.

Here are some considerations:

- Financial Goals: The definition of “rich” varies from person to person. For some, it means achieving financial security and having enough to comfortably cover living expenses and retirement. For others, it means accumulating significant wealth. Your specific financial goals will determine what “rich” means to you.

- Lifestyle Choices: Your spending habits and lifestyle choices play a significant role in your ability to accumulate wealth. Even with a high salary, if you spend excessively or accumulate debt, it can hinder your path to becoming rich. Budgeting, practicing mindful spending, and living below your means are essential.

- Savings and Investments: Building wealth often involves saving a significant portion of your income and making smart investments. A high salary provides the opportunity to save and invest more, which can accelerate your wealth-building journey. Consider contributing to retirement accounts, investing in stocks or real estate, and diversifying your investments.

- Debt Management: Reducing and managing debt, such as student loans, credit card debt, and mortgages, is crucial for building wealth. High-interest debt can erode your financial progress, so it’s important to prioritize paying it off.

- Cost of Living: The cost of living in your area can significantly impact your ability to save and invest. In high-cost-of-living areas, it may be more challenging to build wealth, even with a high salary.

- Investment Strategy: Your investment strategy, including asset allocation, risk tolerance, and long-term planning, can greatly influence your wealth accumulation. Consulting with a financial advisor can help you make informed investment decisions.

- Time Horizon: Building substantial wealth often takes time and consistent effort. The longer your time horizon, the more potential you have to accumulate wealth through the power of compounding returns.

In summary, an hourly wage of $10 provides a solid foundation for building wealth, but it’s not the salary alone that determines your financial success. Becoming ‘rich’ is a subjective goal, so it’s essential to define what it means for you and create a financial plan to pursue it.

Conclusion

$10 an hour can be a decent income for many, it’s essential to assess your specific circumstances to determine if it aligns with your financial objectives and lifestyle. Understanding how your hourly wage translates into yearly, monthly, and biweekly income, as well as factoring in taxes, is a valuable step in managing your finances effectively.

Hopefully this article has been useful for you to learn how much $10 an hour is a year.

By: Chris Bemis

Have you ever wondered how much you’d make in a year if you earned $32 an hour? It’s a common question, and the answer can provide valuable insights into your financial well-being.

In this article, we’ll break down the math and explore what $32 an hour means annually, after taxes, in a month, and on a biweekly basis. Plus, we’ll discuss whether $32 an hour is considered a good wage in today’s economic landscape.

$32 an Hour is How Much a Year?

Let’s start with the big picture: how much would you earn in a year if you were paid $32 per hour?

To calculate your annual income, you’ll need to consider a few factors. First, you need to determine how many hours you work each week and how many weeks you work in a year.

Assuming you work full-time, which is typically 40 hours per week, you’d multiply your hourly wage by the number of weeks in a year. There are 52 weeks in a year.

So, the basic calculation looks like this:

$32 (hourly wage) x 40 (hours per week) x 52 (weeks per year) = $66,560

At $32 an hour, you would earn $66,560 per year before taxes.

If you work less than 52 weeks a year, or work more or less than 40 hours a week, then you will want to adjust the formula to get an understanding of how much money you are making per year.

How Making $32 an Hour Compares to Other Individuals In The United States

According to data from the US Census Bureau for 2022, the median income for Nonfamily households in the United States was approximately $45,440 – which means that half of all individuals earned more than this amount, and half earned less.

So, if you have a salary of $66,560, you have a salary that is in the top 50 percent of all earners in the United States.

With a salary over $45,440, you are doing well and are part of a high group of earners in the United States.

For more info on this check out Just the Facts on the US Economy from Steve Ballmer.

$32 an Hour is How Much a Year After Taxes?

Now, let’s talk about the real-world scenario after taxes. Your take-home pay will depend on several factors, including your tax filing status, deductions, and the state in which you live.

On average, you can expect to lose anywhere from 15% to 30% or more of your income to federal and state income taxes. If we take a conservative estimate of a 20% tax rate, your annual take-home pay would be:

$13,312 (annual income) x 0.20 (tax rate) = $66,560

Subtracting $13,312 from your annual income leaves you with $53,248 after taxes.

$32 an Hour is How Much a Month?

If you’re curious about your monthly income at $32 an hour, it’s relatively straightforward to calculate. Simply multiply your hourly wage by the number of hours you work in a week and then multiply that by 4 (assuming four weeks in a month). Here’s the formula:

$32 (hourly wage) x 40 (hours per week) x 4 (weeks per month) = $5,120

So, if you earn $32 an hour, your monthly income before taxes would be $5,120.

$32 an Hour is How Much Biweekly?

Many employers pay their employees on a biweekly schedule, which means you receive a paycheck every two weeks. To calculate your biweekly income, you’ll multiply your hourly wage by the number of hours you work in a two-week period. Here’s the formula:

$32 (hourly wage) x 40 (hours per week) x 2 (weeks) = $5,120

At $32 an hour, your biweekly income before taxes would be $5,120.

To figure out your post tax biweekly income, you can multiply $32 by your tax rate as we did above.

Is $32 an Hour a Good Wage?

The answer to whether $32 an hour is a good wage depends on various factors, including your location, cost of living, and individual financial goals. In some areas with a lower cost of living, $32 an hour can provide a comfortable living. However, in more expensive cities, it may not stretch as far.

It’s crucial to consider your monthly expenses, such as housing, utilities, transportation, groceries, and savings goals when determining if $32 an hour meets your needs. Additionally, factors like job benefits, opportunities for advancement, and job satisfaction play a significant role in evaluating the overall value of your wage.

How to Increase Your Hourly Wage

If you’re looking to boost your hourly wage, there are several strategies you can consider:

- Skill Development: Enhance your skills or acquire new ones that are in demand in your industry.

- Negotiation: When starting a new job or during performance reviews, don’t hesitate to negotiate your wage.

- Further Education: Consider pursuing additional education or certifications that can increase your market value.

- Job Switch: Sometimes, switching to a different job or company can lead to a significant salary increase.

- Freelancing or Part-Time Work: Explore part-time job opportunities or freelance work to supplement your primary income. Apps like Fiverr or Upwork can be a great spot to post your skills and get hired for part-time work.

- Start a Side Hustle: Look to make more money by starting a side hustle. The folks over at the blog, Financial Panther, have put together a comprehensive list of over 70+ gig economy apps, with strategies and thoughts on each one. A lot of these you can do from your phone. The list includes dog walking/sitting apps, food delivery apps, picture-taking apps, secret shopping apps, and plenty more. It is a great resource to see all the different side hustle apps that are out there.

Will a Hourly Wage of of $32 Help Me Become Rich?

A $32 an hour wage can certainly help you build wealth and achieve financial success, but whether it will make you ‘rich’ depends on various factors, including your financial goals, lifestyle choices, expenses, and savings/investment strategies.

Here are some considerations:

- Financial Goals: The definition of “rich” varies from person to person. For some, it means achieving financial security and having enough to comfortably cover living expenses and retirement. For others, it means accumulating significant wealth. Your specific financial goals will determine what “rich” means to you.

- Lifestyle Choices: Your spending habits and lifestyle choices play a significant role in your ability to accumulate wealth. Even with a high salary, if you spend excessively or accumulate debt, it can hinder your path to becoming rich. Budgeting, practicing mindful spending, and living below your means are essential.

- Savings and Investments: Building wealth often involves saving a significant portion of your income and making smart investments. A high salary provides the opportunity to save and invest more, which can accelerate your wealth-building journey. Consider contributing to retirement accounts, investing in stocks or real estate, and diversifying your investments.

- Debt Management: Reducing and managing debt, such as student loans, credit card debt, and mortgages, is crucial for building wealth. High-interest debt can erode your financial progress, so it’s important to prioritize paying it off.

- Cost of Living: The cost of living in your area can significantly impact your ability to save and invest. In high-cost-of-living areas, it may be more challenging to build wealth, even with a high salary.

- Investment Strategy: Your investment strategy, including asset allocation, risk tolerance, and long-term planning, can greatly influence your wealth accumulation. Consulting with a financial advisor can help you make informed investment decisions.

- Time Horizon: Building substantial wealth often takes time and consistent effort. The longer your time horizon, the more potential you have to accumulate wealth through the power of compounding returns.

In summary, an hourly wage of $32 provides a solid foundation for building wealth, but it’s not the salary alone that determines your financial success. Becoming ‘rich’ is a subjective goal, so it’s essential to define what it means for you and create a financial plan to pursue it.

Conclusion

$32 an hour can be a decent income for many, it’s essential to assess your specific circumstances to determine if it aligns with your financial objectives and lifestyle. Understanding how your hourly wage translates into yearly, monthly, and biweekly income, as well as factoring in taxes, is a valuable step in managing your finances effectively.

Hopefully this article has been useful for you to learn how much $32 an hour is a year.

By: Chris Bemis

Have you ever wondered how much you’d make in a year if you earned $52 an hour? It’s a common question, and the answer can provide valuable insights into your financial well-being.

In this article, we’ll break down the math and explore what $52 an hour means annually, after taxes, in a month, and on a biweekly basis. Plus, we’ll discuss whether $52 an hour is considered a good wage in today’s economic landscape.

$52 an Hour is How Much a Year?

Let’s start with the big picture: how much would you earn in a year if you were paid $52 per hour?

To calculate your annual income, you’ll need to consider a few factors. First, you need to determine how many hours you work each week and how many weeks you work in a year.

Assuming you work full-time, which is typically 40 hours per week, you’d multiply your hourly wage by the number of weeks in a year. There are 52 weeks in a year.

So, the basic calculation looks like this:

$52 (hourly wage) x 40 (hours per week) x 52 (weeks per year) = $108,160

At $52 an hour, you would earn $108,160 per year before taxes.

If you work less than 52 weeks a year, or work more or less than 40 hours a week, then you will want to adjust the formula to get an understanding of how much money you are making per year.

$52 an Hour is How Much a Year After Taxes?

Now, let’s talk about the real-world scenario after taxes. Your take-home pay will depend on several factors, including your tax filing status, deductions, and the state in which you live.

On average, you can expect to lose anywhere from 15% to 30% or more of your income to federal and state income taxes. If we take a conservative estimate of a 20% tax rate, your annual take-home pay would be:

$21,632 (annual income) x 0.20 (tax rate) = $108,160

Subtracting $21,632 from your annual income leaves you with $86,528 after taxes.

$52 an Hour is How Much a Month?

If you’re curious about your monthly income at $52 an hour, it’s relatively straightforward to calculate. Simply multiply your hourly wage by the number of hours you work in a week and then multiply that by 4 (assuming four weeks in a month). Here’s the formula:

$52 (hourly wage) x 40 (hours per week) x 4 (weeks per month) = $8,320

So, if you earn $52 an hour, your monthly income before taxes would be $8,320.

$52 an Hour is How Much Biweekly?

Many employers pay their employees on a biweekly schedule, which means you receive a paycheck every two weeks. To calculate your biweekly income, you’ll multiply your hourly wage by the number of hours you work in a two-week period. Here’s the formula:

$52 (hourly wage) x 40 (hours per week) x 2 (weeks) = $8,320

At $52 an hour, your biweekly income before taxes would be $8,320.

To figure out your post tax biweekly income, you can multiply $52 by your tax rate as we did above.

Is $52 an Hour a Good Wage?

The answer to whether $52 an hour is a good wage depends on various factors, including your location, cost of living, and individual financial goals. In some areas with a lower cost of living, $52 an hour can provide a comfortable living. However, in more expensive cities, it may not stretch as far.

It’s crucial to consider your monthly expenses, such as housing, utilities, transportation, groceries, and savings goals when determining if $52 an hour meets your needs. Additionally, factors like job benefits, opportunities for advancement, and job satisfaction play a significant role in evaluating the overall value of your wage.

For more info on this check out Just the Facts on the US Economy from Steve Ballmer.

How to Increase Your Hourly Wage

If you’re looking to boost your hourly wage, there are several strategies you can consider:

- Skill Development: Enhance your skills or acquire new ones that are in demand in your industry.

- Negotiation: When starting a new job or during performance reviews, don’t hesitate to negotiate your wage.

- Further Education: Consider pursuing additional education or certifications that can increase your market value.

- Job Switch: Sometimes, switching to a different job or company can lead to a significant salary increase.

- Freelancing or Part-Time Work: Explore part-time job opportunities or freelance work to supplement your primary income. Apps like Fiverr or Upwork can be a great spot to post your skills and get hired for part-time work.

- Start a Side Hustle: Look to make more money by starting a side hustle. The folks over at the blog, Financial Panther, have put together a comprehensive list of over 70+ gig economy apps, with strategies and thoughts on each one. A lot of these you can do from your phone. The list includes dog walking/sitting apps, food delivery apps, picture-taking apps, secret shopping apps, and plenty more. It is a great resource to see all the different side hustle apps that are out there.

Will a Hourly Wage of of $52 Help Me Become Rich?

A $52 an hour wage can certainly help you build wealth and achieve financial success, but whether it will make you ‘rich’ depends on various factors, including your financial goals, lifestyle choices, expenses, and savings/investment strategies.

Here are some considerations:

- Financial Goals: The definition of “rich” varies from person to person. For some, it means achieving financial security and having enough to comfortably cover living expenses and retirement. For others, it means accumulating significant wealth. Your specific financial goals will determine what “rich” means to you.

- Lifestyle Choices: Your spending habits and lifestyle choices play a significant role in your ability to accumulate wealth. Even with a high salary, if you spend excessively or accumulate debt, it can hinder your path to becoming rich. Budgeting, practicing mindful spending, and living below your means are essential.

- Savings and Investments: Building wealth often involves saving a significant portion of your income and making smart investments. A high salary provides the opportunity to save and invest more, which can accelerate your wealth-building journey. Consider contributing to retirement accounts, investing in stocks or real estate, and diversifying your investments.

- Debt Management: Reducing and managing debt, such as student loans, credit card debt, and mortgages, is crucial for building wealth. High-interest debt can erode your financial progress, so it’s important to prioritize paying it off.

- Cost of Living: The cost of living in your area can significantly impact your ability to save and invest. In high-cost-of-living areas, it may be more challenging to build wealth, even with a high salary.

- Investment Strategy: Your investment strategy, including asset allocation, risk tolerance, and long-term planning, can greatly influence your wealth accumulation. Consulting with a financial advisor can help you make informed investment decisions.

- Time Horizon: Building substantial wealth often takes time and consistent effort. The longer your time horizon, the more potential you have to accumulate wealth through the power of compounding returns.

In summary, an hourly wage of $52 provides a solid foundation for building wealth, but it’s not the salary alone that determines your financial success. Becoming ‘rich’ is a subjective goal, so it’s essential to define what it means for you and create a financial plan to pursue it.

Conclusion

$52 an hour can be a decent income for many, it’s essential to assess your specific circumstances to determine if it aligns with your financial objectives and lifestyle. Understanding how your hourly wage translates into yearly, monthly, and biweekly income, as well as factoring in taxes, is a valuable step in managing your finances effectively.

Hopefully this article has been useful for you to learn how much $52 an hour is a year.

Have you ever wondered how much you’d make in a year if you earned $68 an hour? It’s a common question, and the answer can provide valuable insights into your financial well-being.

In this article, we’ll break down the math and explore what $68 an hour means annually, after taxes, in a month, and on a biweekly basis. Plus, we’ll discuss whether $68 an hour is considered a good wage in today’s economic landscape.

$68 an Hour is How Much a Year?

Let’s start with the big picture: how much would you earn in a year if you were paid $68 per hour?

To calculate your annual income, you’ll need to consider a few factors. First, you need to determine how many hours you work each week and how many weeks you work in a year.

Assuming you work full-time, which is typically 40 hours per week, you’d multiply your hourly wage by the number of weeks in a year. There are 52 weeks in a year.

So, the basic calculation looks like this:

$68 (hourly wage) x 40 (hours per week) x 52 (weeks per year) = $141,440

At $68 an hour, you would earn $141,440 per year before taxes.

If you work less than 52 weeks a year or work more or less than 40 hours a week, then you will want to adjust the formula to get an understanding of how much money you are making per year.

$68 an Hour is How Much a Year After Taxes?

Now, let’s talk about the real-world scenario after taxes. Your take-home pay will depend on several factors, including your tax filing status, deductions, and the state in which you live.

On average, you can expect to lose anywhere from 15% to 30% or more of your income to federal and state income taxes. If we take a conservative estimate of a 20% tax rate, your annual take-home pay would be:

$28,288 (annual income) x 0.20 (tax rate) = $141,440

Subtracting $28,288 from your annual income leaves you with $113,152 after taxes.

$68 an Hour is How Much a Month?

If you’re curious about your monthly income at $68 an hour, it’s relatively straightforward to calculate. Simply multiply your hourly wage by the number of hours you work in a week and then multiply that by 4 (assuming four weeks in a month). Here’s the formula:

$68 (hourly wage) x 40 (hours per week) x 4 (weeks per month) = $10,880

So, if you earn $68 an hour, your monthly income before taxes would be $10,880.

$68 an Hour is How Much Biweekly?

Many employers pay their employees on a biweekly schedule, which means you receive a paycheck every two weeks. To calculate your biweekly income, you’ll multiply your hourly wage by the number of hours you work in a two-week period. Here’s the formula:

$68 (hourly wage) x 40 (hours per week) x 2 (weeks) = $10,880

At $68 an hour, your biweekly income before taxes would be $10,880.

To figure out your post tax biweekly income, you can multiply $68 by your tax rate as we did above.

Is $68 an Hour a Good Wage?