Left turns have long been a safety challenge for drivers in New York City. Navigating congested streets and busy intersections increases the risk of accidents, particularly when making left turns. According to a study conducted by the NYC Department of Transportation, left turns caused more than double the bicyclist and pedestrian fatalities compared to right turns. The constant hustle and bustle of the city, along with the growing number of cyclists and pedestrians, make safety improvements in this area a pressing concern.

Traffic engineers and safety advocates have worked tirelessly to implement measures aimed at reducing left-turn crashes and improving overall safety. One such initiative is the Vision Zero program, introduced in the late 1990s in response to the high numbers of injuries and deaths related to left turns. This program emphasizes infrastructure improvements, as well as informational campaigns to educate drivers on how to avoid left-turn crashes.

If you are involved in a left-turn accident in New York City, legal assistance can be crucial to understanding and protecting your rights. New York car accident lawyers specialize in helping you navigate such situations, offering support and guidance in obtaining the results you deserve. Stay alert and stay safe while driving in the city and always be mindful of the increased risks associated with left turns.

Understanding Left Turn Crashes in New York

Prevalence of Left Turn Crashes

Left turn crashes are a significant safety challenge for New York drivers, as they cause more than double the number of bicyclist and pedestrian fatalities compared to right turns. According to a 2016 study by the NYC Department of Transportation (DOT), left turn crashes are more prevalent and dangerous in congested intersections.

Factors Contributing to Increased Risks

Several factors contribute to the increased risks associated with left turn crashes in New York City:

- Visibility: Drivers making left turns often have obstructed sightlines, which can make it difficult to see pedestrians or bicyclists approaching the intersection.

- Speed: Drivers may be more likely to speed when making left turns, as they attempt to beat oncoming traffic or make a sharp turn.

- Oncoming Traffic: Left turns require drivers to navigate across traffic lanes, increasing the likelihood of a collision with oncoming vehicles.

- Complex Intersections: New York City’s densely packed streets can result in complex traffic patterns, making it more challenging for drivers to execute safe left turns.

Impact on Pedestrians and Cyclists

Left turn crashes have a significant impact on vulnerable road users, such as pedestrians and bicyclists. According to the aforementioned DOT study, these crashes result in a higher rate of fatal and serious injuries for pedestrians and cyclists when compared to other types of accidents. This highlights the importance of addressing the issue of left turn crashes in order to improve overall traffic safety in New York City.

Strategies to Mitigate Left Turn Accidents

Policy and Infrastructure Solutions

The issue of left turn accidents can be addressed through changes in infrastructure and policies. Implementing safety measures such as Vision Zero by the Department of Transportation (DOT) is an excellent starting point. Vision Zero aims to reduce traffic fatalities by developing a comprehensive approach to roadway safety that includes improving road design, enhancing enforcement, and investing in education.

One of the most effective methods to improve left turn safety is to modify road designs for intersection approaches. Signalized Intersections can be enhanced with protected/permitted left turns (green arrow) or exclusive left turns (only left turns are allowed) to reduce conflict points. Moreover, the Federal Highway Administration (FHWA) recommends evaluating the need for Left Turn Acceleration lanes based on factors like traffic volume, lane configurations, and competing left-turn storage volumes.

Reducing the Speed Limit in vulnerable areas makes left turns safer by giving drivers more time to react. Other Traffic Calming Measures used by cities include installing speed humps, narrowing roadways, and creating traffic circles. Furthermore, enforcing State Laws on yielding to pedestrians and bicyclists can help reinforce a culture of safety.

Educational and Behavioral Interventions

Education and awareness play a key role in preventing left turn accidents. The Insurance Institute for Highway Safety (IIHS) emphasizes the importance of Shared Responsibility among drivers, pedestrians, and cyclists for overall traffic safety. Educational campaigns focused on promoting safe driving behaviors, such as obeying Traffic Signals and yielding to oncoming traffic during left turns, can help reduce the risk of accidents.

It’s crucial for a Driver Turning Left to be vigilant and scan the intersection carefully before making a turn. Authorities can develop multimedia resources, including videos and brochures, to illustrate proper turning techniques and how to navigate signalized intersections. Defensive driving courses can also benefit drivers by teaching them to anticipate potential hazards and improve decision-making.

A combination of policy and infrastructure solutions, along with educational and behavioral interventions, can effectively address the challenge of left turn accidents in New York and contribute to overall road safety.

In Conclusion

Left turn crashes pose a significant safety challenge for New York drivers. According to the New York City Department of Transportation, drivers turning left account for 19 percent of serious pedestrian and bicyclist injuries. This is three times the share caused by right turns.

Due to the congested streets of New York, left turns are the cause of more than double the bicyclist and pedestrian fatalities as right turns, reports the NYC Department of Transportation’s study in 2016. Initiatives such as Vision Zero have been implemented to decrease the number of left-turn-related fatalities.

To address this issue, the city’s Department of Transportation has been redesigning intersections to make left turns safer for all road users, including pedestrians and cyclists. The NYPD launched a safety initiative to further decrease the fatalities caused by drivers making left turns.

It is important for drivers, pedestrians, and cyclists to be aware of the dangers associated with left turns and to exercise caution at intersections. By remaining vigilant and adhering to traffic rules, road users can contribute to reducing the risks posed by left-turn-related accidents.

As the use of medical marijuana gains traction across the United States, a growing interest has emerged in exploring its potential benefits for pets. In California, recent legislation has opened the door for veterinarians to discuss and recommend cannabis for animal patients. Assembly Bill 1885, passed in 2022, has provided legal protection for veterinarians who recommend cannabis for pets, with certain limitations. This development has sparked a new conversation on the legal considerations surrounding medical marijuana for pets in California.

The bill stipulates that veterinarians may not discuss or recommend cannabis use if they have a financial interest in a cannabis-related business or product, ensuring that their advice is unbiased and in the best interest of the patient. Additionally, the California Veterinary Medical Board is prohibited from disciplining veterinarians who recommend cannabis to animal patients, except under limited circumstances.

It is important for pet owners and veterinarians to be aware of legal charges in California regarding cannabis use for pets in order to make informed decisions about their animal’s health. While the state has made strides in legitimizing medical marijuana for pets, there are still legal considerations to be taken into account. As the industry develops and further research is conducted, the legal framework surrounding this issue may continue to evolve.

Legal Framework of Medical Marijuana for Animals in California

State Legislation and Bills

In California, the legal landscape regarding medical marijuana for animals has been shaped by recent assembly bills. Assembly Bill 2215, passed in 2018, provided protection for veterinarians when discussing cannabis with clients. This bill allowed veterinarians to advise clients about the use of cannabis for their pets without facing disciplinary action from the veterinary board.

Following this, Assembly Bill 1885 passed in 2022, further protecting veterinarians by prohibiting the veterinary board from disciplining a veterinarian for recommending cannabis use in a patient. This legislation made it easier for veterinarians to discuss the potential therapeutic benefits of cannabis for animals with their clients.

Federal Regulations and Controlled Substances Act

On the federal level, the use of cannabis in veterinary medicine is governed by the Controlled Substances Act and the Drug Enforcement Administration (DEA). Cannabis is still classified as a Schedule I controlled substance under the Controlled Substances Act, making it illegal for veterinarians to prescribe, administer, or dispense marijuana for animals in any form.

Despite this, the 2018 Farm Bill removed hemp-derived products with less than 0.3% THC from the Controlled Substances Act, which opened the doors for hemp-derived CBD products to be recommended by veterinarians.

However, it is essential to note that as long as cannabis remains a Schedule I controlled substance, veterinarians who recommend or discuss marijuana for animal use do so at the risk of federal prosecution. Thus, there is still a complicated relationship between state and federal laws when it comes to the legal considerations of medical marijuana for pets in California.

Veterinary Considerations and Professional Practice

Clinical Use and Potential Therapeutic Benefits

Veterinary professionals are increasingly considering the potential use of cannabis-derived and hemp-derived products to treat various conditions in animals. Medical cannabis has shown promise in human medicine for conditions such as chronic pain, anxiety, and seizures. The same benefits may apply to pets, though more research is needed to confirm their efficacy and safety.

Some common ailments for which cannabis products may be considered include arthritis, cancer, and seizure disorders. Additionally, CBD, a non-psychoactive component of cannabis, has been studied for its potential to reduce anxiety, improve appetite, and provide pain relief for pets. THC, the psychoactive component, is generally avoided in veterinary treatments due to its potential for side effects.

It’s essential for veterinarians to stay up-to-date on the latest research and findings regarding the use of these products. This includes understanding the endocannabinoid system in animals, how cannabis-derived compounds interact with it, and what the appropriate dosages and forms of administration may be.

Ethical Considerations and Communicating with Pet Owners

Veterinarians in California are legally protected to discuss cannabis use for their animal patients under AB 2215. However, the California Veterinary Medical Board still has regulations limiting their ability to prescribe medical marijuana products. Consequently, veterinarians must tread carefully when considering cannabis-derived products while still upholding their responsibility to provide the best possible care for their patients.

To maintain ethical standards and meet the expectations of pet owners, veterinarians should engage in open and honest communication with their clients about the potential benefits, risks, and legal implications of using cannabis products for their pets. This includes the discussion of current research, available treatment options, potential side effects, and the proper administration of cannabis products.

Veterinarians must also be aware of the potential consequences of cannabis use in pets, such as THC toxicity, and be prepared to provide information to pet owners on treatment and prevention options.

As more research is conducted, the knowledge base surrounding the clinical use and therapeutic benefits of cannabis in veterinary medicine will continue to expand. Veterinarians in California need to be aware of the legal protections and limitations in place as they navigate the complex landscape of cannabis use for pets. Clear communication with pet owners and an ongoing commitment to staying informed about research developments will help veterinarians maintain ethical standards and provide the best possible care for their animal patients.

In Conclusion

The legalization of medical marijuana for pets in California has been a significant milestone for both pet owners and veterinarians. With the passing of Assembly Bill 1885 in 2022, veterinarians are now permitted to recommend cannabis for their animal patients without facing disciplinary action from the California Veterinary Medical Board, except under limited circumstances.

It is essential for pet owners and veterinarians to be aware of the legal landscape surrounding cannabis use for pets. This includes understanding the responsibilities and limitations that come with recommending and administering cannabis to animals. For example, a veterinarian must establish a veterinary-client-patient relationship prior to discussing cannabis use with a client, as defined by the California Code of Regulations.

As each state has its own unique laws concerning cannabis use for pets, it is crucial for pet owners and professionals to stay informed about the legal landscape in their respective states. Additionally, safety should be a top priority when considering cannabis use for pets, as it can be toxic in high doses.

In conclusion, the legalization of medical marijuana for pets in California has opened up new possibilities for effective treatments, but it also comes with a responsibility to understand the legal framework and safety considerations. By staying informed, pet owners and veterinarians can ensure they are providing the best care possible for their animal patients.

Loans are essential for financial stability and can provide a safety net for both personal and business needs. To fully benefit from loans, making the right choice is essential. Begin by understanding the array of options available and the perks of each. In your evaluations, focus on the term and interest rates, friendliness, and the repayment structures’ convenience. This blog post breaks down five key loan options to pave the way for your financial empowerment.

Fix and Flip Loans

These specific types of loans are perfectly designed to help you as a real estate investor planning to buy a property, do renovations, and put it on sale quickly for a profit. You stand a good chance of securing a fix-and-flip loan when you present yourself as an experienced real estate investor and attach a solid plan for your project.

Lenders may evaluate the property’s potential to appreciate and how promising your execution is. When considering a fix and flip loan programs, look for lenders who prioritize equity over credit, meaning even with a less-than-ideal credit score, you can still secure funding for your investment.

Mortgages

Buying a home is a major milestone but comes with a lot of financial considerations. A mortgage can be the best solution to financing the purchase, especially when you choose the right mortgage. If you are considering this financial option, you can choose either adjustable-rate or fixed-rate mortgages.

The adjustable type comes with the advantage of lower payments but tends to change over time, going with the prevailing market conditions. Fixed-rate mortgages can be a great idea if you want to enjoy more stability in your monthly payments.

Personal Loans

Unexpected expenses can sometimes emerge and leave you looking for cash to deal with them. Taking a personal loan and channeling suitable funds seems like the best answer. The good thing is that you don’t need collateral and this is an attribute that makes it widely accessible to many.

You can even apply online, depending on the lender you choose. Before applying, consider evaluating your financial need and borrowing capacity. Having a solid repayment plan that doesn’t strain your budget is also crucial. Despite the convenience and ease of access, borrowing responsibility is essential to avoiding unnecessary debts.

Student Loans

Pursuing higher education takes you closer to realizing your dreams, but you need to keep in mind the financial strategy as an aspiring student. Student loans provide you with a lifeline to cover various expenses, from tuition fees and living expenses to the purchase of sturdy materials.

Begin by targeting federal student loans due to the benefits of relatively lower interest rates and more flexible repayment programs. However, as you apply for financial support, it’s crucial to project into the future and evaluate the potential earnings. The best thing is to apply for only what you need as you explore grants, work-study programs, and scholarships.

Business Loans

It would be best if you had sound financial planning, whether starting or expanding a business; this is where business loans help. Some can also be tailored to meet your specific entrepreneurial goals. Before making the application, have a good business plan showcasing all your goals, financial projections, and market analysis.

A lender will thoroughly assess your creditworthiness and the business’s validity before approving it. Providing tax returns, business licenses, and financial statements may also be necessary.

Endnote

Having a good understanding of the different types of loans is important before making any decision on which to apply. You want one that matches your goals and comes with a favorable repayment plan. Make thorough comparisons to increase the chances of arriving at the best lender.

When you’re navigating the job market or budgeting for your future, knowing what your annual salary translates to in terms of an hourly wage can be incredibly helpful.

In this article, we’ll break down the math and explore what $57,000 a year means on an hourly basis.

We’ll also dive into related topics such as post-tax income, biweekly earnings, monthly income, and whether $57,000 a year can be considered a good salary. Plus, we’ll share tips on how you can potentially increase your hourly wage.

$57,000 a Year is How Much an Hour?

Determining how much an annual salary of $57,000 translates to on an hourly basis can provide a clearer perspective on your earnings. This calculation can be particularly useful when evaluating job offers, budgeting, or understanding the value of your time. To figure out your hourly wage from an annual salary, follow this straightforward formula:

$57,000 (annual income) / 52 (number of weeks in a year) / 40 (standard hours in a workweek) = $27.40 per hour

So, if you earn $57,000 a year, your hourly wage is approximately $27.40 before taxes. This calculation assumes you work a standard 40-hour workweek for all 52 weeks in a year.

Understanding your hourly rate is not just about the numbers; it can help you make informed financial decisions and plan your budget effectively. Whether you’re considering a job change, negotiating a raise, or simply curious about the value of your time, knowing your hourly wage is a valuable piece of financial information.

What is $57,000 a Year After Taxes?

Understanding your take-home pay is crucial when planning your finances. The amount you receive after taxes depends on various factors, including your tax filing status, deductions, and the state you reside in.

On average, individuals can expect to pay around 20-30% or more of their income in federal and state income taxes. Let’s take some data from the IRS website on what your tax rate will be according to your income. This does not account for any of the factors listed above.

- 37% for incomes over $578,125 ($693,750 for married couples filing jointly)

- 35% for incomes over $231,250 ($462,500 for married couples filing jointly)

- 32% for incomes over $182,100 ($364,200 for married couples filing jointly)

- 24% for incomes over $95,375 ($190,750 for married couples filing jointly)

- 22% for incomes over $44,725 ($89,450 for married couples filing jointly)

- 12% for incomes over $11,000 ($22,000 for married couples filing jointly)

So at a $57,000 annual income, we will assume a tax rate of 22%.

$57,000 (annual income) x 22% (tax rate) = $12,540

So, after taxes, you would have approximately $44,460 left as your annual income.

$57,000 a Year is How Much Biweekly?

Many employers pay their employees on a biweekly schedule, which means you receive a paycheck every two weeks. To calculate your biweekly income, you’ll need to divide your annual income by the number of pay periods in a year. Most often, there are 26 pay periods in a year for biweekly paychecks.

So, the calculation would look like this:

$57,000 (annual income) / 26 (biweekly pay periods) ≈ $2,192

At $57,000 a year, you would earn approximately $2,192 before taxes with each biweekly paycheck.

$57,000 a Year is How Much a Month?

If you’re curious about your monthly income at an annual rate of $57,000, you can calculate it by dividing your yearly income by 12 (since there are 12 months in a year):

$57,000 (annual income) / 12 (months) = $4,750

So, at a yearly salary of $57,000, your monthly income before taxes would be approximately $4,750.

Is $57,000 a Year a Good Salary?

Whether $57,000 a year is considered a good salary depends on various factors, including your location, cost of living, and personal financial goals. In some areas with a lower cost of living, $57,000 can provide a comfortable life. However, in more expensive cities, it may not stretch as far.

To determine if it’s sufficient for your needs, consider your monthly expenses, such as housing, utilities, transportation, groceries, and savings goals.

Additionally, factors like job benefits, opportunities for advancement, and job satisfaction play a significant role in evaluating the overall value of your wage.

Let’s take a look at how a $57,000 a year salary compares to others in the United States.

According to data from the US Census Bureau for 2022, the median income for Nonfamily households in the United States was approximately $45,440 – which means that half of all individuals earned more than this amount, and half earned less.

So, if you have a salary of $57,000, you have a salary that is in the top 50 percent of all earners in the United States.

How to Increase Your Hourly Wage

If you’re looking to boost your hourly wage, there are several strategies you can consider:

- Skill Development: Enhance your skills or acquire new ones that are in demand in your industry.

- Negotiation: When starting a new job or during performance reviews, don’t hesitate to negotiate your wage.

- Further Education: Consider pursuing additional education or certifications that can increase your market value.

- Job Switch: Sometimes, switching to a different job or company can lead to a significant salary increase.

- Freelancing or Part-Time Work: Explore part-time job opportunities or freelance work to supplement your primary income. Apps like Fiverr or Upwork can be a great spot to post your skills and get hired for part-time work.

- Start a Side Hustle: Look to make more money by starting a side hustle. The folks over at the blog, Financial Panther, have put together a comprehensive list of over 70+ gig economy apps, with strategies and thoughts on each one. A lot of these you can do from your phone. The list includes dog walking/sitting apps, food delivery apps, picture-taking apps, secret shopping apps, and plenty more. It is a great resource to see all the different side hustle apps that are out there.

Will a Salary of $57,000 Help Me Become Rich?

A salary of $57,000 can certainly help you build wealth and achieve financial success, but whether it will make you ‘rich’ depends on various factors, including your financial goals, lifestyle choices, expenses, and savings/investment strategies.

Here are some considerations:

- Financial Goals: The definition of “rich” varies from person to person. For some, it means achieving financial security and having enough to comfortably cover living expenses and retirement. For others, it means accumulating significant wealth. Your specific financial goals will determine what “rich” means to you.

- Lifestyle Choices: Your spending habits and lifestyle choices play a significant role in your ability to accumulate wealth. Even with a high salary, if you spend excessively or accumulate debt, it can hinder your path to becoming rich. Budgeting, practicing mindful spending, and living below your means are essential.

- Savings and Investments: Building wealth often involves saving a significant portion of your income and making smart investments. A high salary provides the opportunity to save and invest more, which can accelerate your wealth-building journey. Consider contributing to retirement accounts, investing in stocks or real estate, and diversifying your investments.

- Debt Management: Reducing and managing debt, such as student loans, credit card debt, and mortgages, is crucial for building wealth. High-interest debt can erode your financial progress, so it’s important to prioritize paying it off.

- Cost of Living: The cost of living in your area can significantly impact your ability to save and invest. In high-cost-of-living areas, it may be more challenging to build wealth, even with a high salary.

- Investment Strategy: Your investment strategy, including asset allocation, risk tolerance, and long-term planning, can greatly influence your wealth accumulation. Consulting with a financial advisor can help you make informed investment decisions.

- Time Horizon: Building substantial wealth often takes time and consistent effort. The longer your time horizon, the more potential you have to accumulate wealth through the power of compounding returns.

In summary, a $57,000 salary provides a solid foundation for building wealth, but it’s not the salary alone that determines your financial success. Becoming ‘rich’ is a subjective goal, so it’s essential to define what it means for you and create a financial plan to pursue it.

Conclusion

In conclusion, understanding what your annual salary translates to on an hourly basis can provide valuable insights into your financial situation. It’s not just about the number, but how it aligns with your financial goals, lifestyle, and location.

Remember, if you’re aiming for an increase in your hourly wage, there are steps you can take to make it happen.

When you’re navigating the job market or budgeting for your future, knowing what your annual salary translates to in terms of an hourly wage can be incredibly helpful.

In this article, we’ll break down the math and explore what $58,000 a year means on an hourly basis.

We’ll also dive into related topics such as post-tax income, biweekly earnings, monthly income, and whether $58,000 a year can be considered a good salary. Plus, we’ll share tips on how you can potentially increase your hourly wage.

$58000 a Year is How Much an Hour?

Determining how much an annual salary of $58,000 translates to on an hourly basis can provide a clearer perspective on your earnings. This calculation can be particularly useful when evaluating job offers, budgeting, or understanding the value of your time. To figure out your hourly wage from an annual salary, follow this straightforward formula:

$58,000 (annual income) / 52 (number of weeks in a year) / 40 (standard hours in a workweek) = $27.88 per hour

So, if you earn $58,000 a year, your hourly wage is approximately $27.88 before taxes. This calculation assumes you work a standard 40-hour workweek for all 52 weeks in a year.

Understanding your hourly rate is not just about the numbers; it can help you make informed financial decisions and plan your budget effectively. Whether you’re considering a job change, negotiating a raise, or simply curious about the value of your time, knowing your hourly wage is a valuable piece of financial information.

What is $58,000 a Year After Taxes?

Understanding your take-home pay is crucial when planning your finances. The amount you receive after taxes depends on various factors, including your tax filing status, deductions, and the state you reside in.

On average, individuals can expect to pay around 20-30% or more of their income in federal and state income taxes. Let’s take some data from the IRS website on what your tax rate will be according to your income. This does not account for any of the factors listed above.

- 35% for incomes over $250,525 ($501,050 for married couples filing jointly).

- 32% for incomes over $197,300 ($394,600 for married couples filing jointly).

- 24% for incomes over $103,350 ($206,700 for married couples filing jointly).

- 22% for incomes over $48,475 ($96,950 for married couples filing jointly).

- 12% for incomes over $11,925 ($23,850 for married couples filing jointly).

- 10% for incomes $11,925 or less ($23,850 or less for married couples filing jointly).

So at a $58,000 annual income, we will assume a tax rate of 22%.

$58,000 (annual income) x 22% (tax rate) = $12,760

So, after taxes, you would have approximately $45,240 left as your annual income.

$58,000 a Year is How Much Biweekly?

Many employers pay their employees on a biweekly schedule, which means you receive a paycheck every two weeks. To calculate your biweekly income, you’ll need to divide your annual income by the number of pay periods in a year. Most often, there are 26 pay periods in a year for biweekly paychecks.

So, the calculation would look like this:

$58,000 (annual income) / 26 (biweekly pay periods) ≈ $2,231

At $58,000 a year, you would earn approximately $2,231 before taxes with each biweekly paycheck.

$58,000 a Year is How Much a Month?

If you’re curious about your monthly income at an annual rate of $58,000, you can calculate it by dividing your yearly income by 12 (since there are 12 months in a year):

$58,000 (annual income) / 12 (months) = $4,833

So, at a yearly salary of $58,000, your monthly income before taxes would be approximately $4,833.

Is $58,000 a Year a Good Salary?

Whether $58,000 a year is considered a good salary depends on various factors, including your location, cost of living, and personal financial goals. In some areas with a lower cost of living, $58,000 can provide a comfortable life. However, in more expensive cities, it may not stretch as far.

To determine if it’s sufficient for your needs, consider your monthly expenses, such as housing, utilities, transportation, groceries, and savings goals.

Additionally, factors like job benefits, opportunities for advancement, and job satisfaction play a significant role in evaluating the overall value of your wage.

Let’s take a look at how a $58,000 a year salary compares to others in the United States.

According to data from the US Census Bureau for 2022, the median income for Nonfamily households in the United States was approximately $45,440 – which means that half of all individuals earned more than this amount, and half earned less.

So, if you have a salary of $58,000, you have a salary that is in the top 50 percent of all earners in the United States.

How to Increase Your Hourly Wage

If you’re looking to boost your hourly wage, there are several strategies you can consider:

- Skill Development: Enhance your skills or acquire new ones that are in demand in your industry.

- Negotiation: When starting a new job or during performance reviews, don’t hesitate to negotiate your wage.

- Further Education: Consider pursuing additional education or certifications that can increase your market value.

- Job Switch: Sometimes, switching to a different job or company can lead to a significant salary increase.

- Freelancing or Part-Time Work: Explore part-time job opportunities or freelance work to supplement your primary income. Apps like Fiverr or Upwork can be a great spot to post your skills and get hired for part-time work.

- Start a Side Hustle: Look to make more money by starting a side hustle. The folks over at the blog, Financial Panther, have put together a comprehensive list of over 70+ gig economy apps, with strategies and thoughts on each one. A lot of these you can do from your phone. The list includes dog walking/sitting apps, food delivery apps, picture-taking apps, secret shopping apps, and plenty more. It is a great resource to see all the different side hustle apps that are out there.

Will a Salary of $58,000 Help Me Become Rich?

A salary of $58,000 can certainly help you build wealth and achieve financial success, but whether it will make you ‘rich’ depends on various factors, including your financial goals, lifestyle choices, expenses, and savings/investment strategies.

Here are some considerations:

- Financial Goals: The definition of “rich” varies from person to person. For some, it means achieving financial security and having enough to comfortably cover living expenses and retirement. For others, it means accumulating significant wealth. Your specific financial goals will determine what “rich” means to you.

- Lifestyle Choices: Your spending habits and lifestyle choices play a significant role in your ability to accumulate wealth. Even with a high salary, if you spend excessively or accumulate debt, it can hinder your path to becoming rich. Budgeting, practicing mindful spending, and living below your means are essential.

- Savings and Investments: Building wealth often involves saving a significant portion of your income and making smart investments. A high salary provides the opportunity to save and invest more, which can accelerate your wealth-building journey. Consider contributing to retirement accounts, investing in stocks or real estate, and diversifying your investments.

- Debt Management: Reducing and managing debt, such as student loans, credit card debt, and mortgages, is crucial for building wealth. High-interest debt can erode your financial progress, so it’s important to prioritize paying it off.

- Cost of Living: The cost of living in your area can significantly impact your ability to save and invest. In high-cost-of-living areas, it may be more challenging to build wealth, even with a high salary.

- Investment Strategy: Your investment strategy, including asset allocation, risk tolerance, and long-term planning, can greatly influence your wealth accumulation. Consulting with a financial advisor can help you make informed investment decisions.

- Time Horizon: Building substantial wealth often takes time and consistent effort. The longer your time horizon, the more potential you have to accumulate wealth through the power of compounding returns.

In summary, a $58,000 salary provides a solid foundation for building wealth, but it’s not the salary alone that determines your financial success. Becoming ‘rich’ is a subjective goal, so it’s essential to define what it means for you and create a financial plan to pursue it.

Conclusion

In conclusion, understanding what your annual salary translates to on an hourly basis can provide valuable insights into your financial situation. It’s not just about the number, but how it aligns with your financial goals, lifestyle, and location.

Remember, if you’re aiming for an increase in your hourly wage, there are steps you can take to make it happen.

When you’re navigating the job market or budgeting for your future, knowing what your annual salary translates to in terms of an hourly wage can be incredibly helpful.

In this article, we’ll break down the math and explore what $59,000 a year means on an hourly basis.

We’ll also dive into related topics such as post-tax income, biweekly earnings, monthly income, and whether $59,000 a year can be considered a good salary. Plus, we’ll share tips on how you can potentially increase your hourly wage.

$59,000 a Year is How Much an Hour?

Determining how much an annual salary of $59,000 translates to on an hourly basis can provide a clearer perspective on your earnings. This calculation can be particularly useful when evaluating job offers, budgeting, or understanding the value of your time. To figure out your hourly wage from an annual salary, follow this straightforward formula:

$59,000 (annual income) / 52 (number of weeks in a year) / 40 (standard hours in a workweek) = $28.37 per hour

So, if you earn $59,000 a year, your hourly wage is approximately $28.37 before taxes. This calculation assumes you work a standard 40-hour workweek for all 52 weeks in a year.

Understanding your hourly rate is not just about the numbers; it can help you make informed financial decisions and plan your budget effectively. Whether you’re considering a job change, negotiating a raise, or simply curious about the value of your time, knowing your hourly wage is a valuable piece of financial information.

What is $59,000 a Year After Taxes?

Understanding your take-home pay is crucial when planning your finances. The amount you receive after taxes depends on various factors, including your tax filing status, deductions, and the state you reside in.

On average, individuals can expect to pay around 20-30% or more of their income in federal and state income taxes. Let’s take some data from the IRS website on what your tax rate will be according to your income. This does not account for any of the factors listed above.

- 37% for incomes over $578,125 ($693,750 for married couples filing jointly)

- 35% for incomes over $231,250 ($462,500 for married couples filing jointly)

- 32% for incomes over $182,100 ($364,200 for married couples filing jointly)

- 24% for incomes over $95,375 ($190,750 for married couples filing jointly)

- 22% for incomes over $44,725 ($89,450 for married couples filing jointly)

- 12% for incomes over $11,000 ($22,000 for married couples filing jointly)

So at a $59,000 annual income, we will assume a tax rate of 22%.

$59,000 (annual income) x 22% (tax rate) = $12,980

So, after taxes, you would have approximately $46,020 left as your annual income.

$59,000 a Year is How Much Biweekly?

Many employers pay their employees on a biweekly schedule, which means you receive a paycheck every two weeks. To calculate your biweekly income, you’ll need to divide your annual income by the number of pay periods in a year. Most often, there are 26 pay periods in a year for biweekly paychecks.

So, the calculation would look like this:

$59,000 (annual income) / 26 (biweekly pay periods) ≈ $2,269

At $59,000 a year, you would earn approximately $2,269 before taxes with each biweekly paycheck.

$59,000 a Year is How Much a Month?

If you’re curious about your monthly income at an annual rate of $59,000, you can calculate it by dividing your yearly income by 12 (since there are 12 months in a year):

$59,000 (annual income) / 12 (months) = $4,917

So, at a yearly salary of $59,000, your monthly income before taxes would be approximately $4,917.

Is $59,000 a Year a Good Salary?

Whether $59,000 a year is considered a good salary depends on various factors, including your location, cost of living, and personal financial goals. In some areas with a lower cost of living, $59,000 can provide a comfortable life. However, in more expensive cities, it may not stretch as far.

To determine if it’s sufficient for your needs, consider your monthly expenses, such as housing, utilities, transportation, groceries, and savings goals.

Additionally, factors like job benefits, opportunities for advancement, and job satisfaction play a significant role in evaluating the overall value of your wage.

Let’s take a look at how a $59,000 a year salary compares to others in the United States.

According to data from the US Census Bureau for 2022, the median income for Nonfamily households in the United States was approximately $45,440 – which means that half of all individuals earned more than this amount, and half earned less.

So, if you have a salary of $59,000, you have a salary that is in the top 50 percent of all earners in the United States.

How to Increase Your Hourly Wage

If you’re looking to boost your hourly wage, there are several strategies you can consider:

- Skill Development: Enhance your skills or acquire new ones that are in demand in your industry.

- Negotiation: When starting a new job or during performance reviews, don’t hesitate to negotiate your wage.

- Further Education: Consider pursuing additional education or certifications that can increase your market value.

- Job Switch: Sometimes, switching to a different job or company can lead to a significant salary increase.

- Freelancing or Part-Time Work: Explore part-time job opportunities or freelance work to supplement your primary income. Apps like Fiverr or Upwork can be a great spot to post your skills and get hired for part-time work.

- Start a Side Hustle: Look to make more money by starting a side hustle. The folks over at the blog, Financial Panther, have put together a comprehensive list of over 70+ gig economy apps, with strategies and thoughts on each one. A lot of these you can do from your phone. The list includes dog walking/sitting apps, food delivery apps, picture-taking apps, secret shopping apps, and plenty more. It is a great resource to see all the different side hustle apps that are out there.

Will a Salary of $59,000 Help Me Become Rich?

A salary of $59,000 can certainly help you build wealth and achieve financial success, but whether it will make you ‘rich’ depends on various factors, including your financial goals, lifestyle choices, expenses, and savings/investment strategies.

Here are some considerations:

- Financial Goals: The definition of “rich” varies from person to person. For some, it means achieving financial security and having enough to comfortably cover living expenses and retirement. For others, it means accumulating significant wealth. Your specific financial goals will determine what “rich” means to you.

- Lifestyle Choices: Your spending habits and lifestyle choices play a significant role in your ability to accumulate wealth. Even with a high salary, if you spend excessively or accumulate debt, it can hinder your path to becoming rich. Budgeting, practicing mindful spending, and living below your means are essential.

- Savings and Investments: Building wealth often involves saving a significant portion of your income and making smart investments. A high salary provides the opportunity to save and invest more, which can accelerate your wealth-building journey. Consider contributing to retirement accounts, investing in stocks or real estate, and diversifying your investments.

- Debt Management: Reducing and managing debt, such as student loans, credit card debt, and mortgages, is crucial for building wealth. High-interest debt can erode your financial progress, so it’s important to prioritize paying it off.

- Cost of Living: The cost of living in your area can significantly impact your ability to save and invest. In high-cost-of-living areas, it may be more challenging to build wealth, even with a high salary.

- Investment Strategy: Your investment strategy, including asset allocation, risk tolerance, and long-term planning, can greatly influence your wealth accumulation. Consulting with a financial advisor can help you make informed investment decisions.

- Time Horizon: Building substantial wealth often takes time and consistent effort. The longer your time horizon, the more potential you have to accumulate wealth through the power of compounding returns.

In summary, a $59,000 salary provides a solid foundation for building wealth, but it’s not the salary alone that determines your financial success. Becoming ‘rich’ is a subjective goal, so it’s essential to define what it means for you and create a financial plan to pursue it.

Conclusion

In conclusion, understanding what your annual salary translates to on an hourly basis can provide valuable insights into your financial situation. It’s not just about the number, but how it aligns with your financial goals, lifestyle, and location.

Remember, if you’re aiming for an increase in your hourly wage, there are steps you can take to make it happen.

By: Chris Bemis

When you’re navigating the job market or budgeting for your future, knowing what your annual salary translates to in terms of an hourly wage can be incredibly helpful.

In this article, we’ll break down the math and explore what $60,000 a year means on an hourly basis.

We’ll also dive into related topics such as post-tax income, biweekly earnings, monthly income, and whether $60,000 a year can be considered a good salary. Plus, we’ll share tips on how you can potentially increase your hourly wage.

$60,000 a Year is How Much an Hour?

Determining how much an annual salary of $60,000 translates to on an hourly basis can provide a clearer perspective on your earnings. This calculation can be particularly useful when evaluating job offers, budgeting, or understanding the value of your time. To figure out your hourly wage from an annual salary, follow this straightforward formula:

$60,000 (annual income) / 52 (number of weeks in a year) / 40 (standard hours in a workweek) = $28.85 per hour

So, if you earn $60,000 a year, your hourly wage is approximately $28.85 before taxes. This calculation assumes you work a standard 40-hour workweek for all 52 weeks in a year.

Understanding your hourly rate is not just about the numbers; it can help you make informed financial decisions and plan your budget effectively. Whether you’re considering a job change, negotiating a raise, or simply curious about the value of your time, knowing your hourly wage is a valuable piece of financial information.

What is $60,000 a Year After Taxes?

Understanding your take-home pay is crucial when planning your finances. The amount you receive after taxes depends on various factors, including your tax filing status, deductions, and the state you reside in.

On average, individuals can expect to pay around 20-30% or more of their income in federal and state income taxes. Let’s take some data from the IRS website on what your tax rate will be according to your income. This does not account for any of the factors listed above.

- 37% for incomes over $578,125 ($693,750 for married couples filing jointly)

- 35% for incomes over $231,250 ($462,500 for married couples filing jointly)

- 32% for incomes over $182,100 ($364,200 for married couples filing jointly)

- 24% for incomes over $95,375 ($190,750 for married couples filing jointly)

- 22% for incomes over $44,725 ($89,450 for married couples filing jointly)

- 12% for incomes over $11,000 ($22,000 for married couples filing jointly)

So at a $60,000 annual income, we will assume a tax rate of 22%.

$60,000 (annual income) x 22% (tax rate) = $13,200

So, after taxes, you would have approximately $46,800 left as your annual income.

$60,000 a Year is How Much Biweekly?

Many employers pay their employees on a biweekly schedule, which means you receive a paycheck every two weeks. To calculate your biweekly income, you’ll need to divide your annual income by the number of pay periods in a year. Most often, there are 26 pay periods in a year for biweekly paychecks.

So, the calculation would look like this:

$60,000 (annual income) / 26 (biweekly pay periods) ≈ $2,308

At $60,000 a year, you would earn approximately $2,308 before taxes with each biweekly paycheck.

$60,000 a Year is How Much a Month?

If you’re curious about your monthly income at an annual rate of $60,000, you can calculate it by dividing your yearly income by 12 (since there are 12 months in a year):

$60,000 (annual income) / 12 (months) = $5,000

So, at a yearly salary of $60,000, your monthly income before taxes would be approximately $5,000.

Is $60,000 a Year a Good Salary?

Whether $60,000 a year is considered a good salary depends on various factors, including your location, cost of living, and personal financial goals. In some areas with a lower cost of living, $60,000 can provide a comfortable life. However, in more expensive cities, it may not stretch as far.

To determine if it’s sufficient for your needs, consider your monthly expenses, such as housing, utilities, transportation, groceries, and savings goals.

Additionally, factors like job benefits, opportunities for advancement, and job satisfaction play a significant role in evaluating the overall value of your wage.

Let’s take a look at how a $60,000 a year salary compares to others in the United States.

According to data from the US Census Bureau for 2022, the median income for Nonfamily households in the United States was approximately $45,440 – which means that half of all individuals earned more than this amount, and half earned less.

So, if you have a salary of $60,000, you have a salary that is in the top 50 percent of all earners in the United States.

How to Increase Your Hourly Wage

If you’re looking to boost your hourly wage, there are several strategies you can consider:

- Skill Development: Enhance your skills or acquire new ones that are in demand in your industry.

- Negotiation: When starting a new job or during performance reviews, don’t hesitate to negotiate your wage.

- Further Education: Consider pursuing additional education or certifications that can increase your market value.

- Job Switch: Sometimes, switching to a different job or company can lead to a significant salary increase.

- Freelancing or Part-Time Work: Explore part-time job opportunities or freelance work to supplement your primary income. Apps like Fiverr or Upwork can be a great spot to post your skills and get hired for part-time work.

- Start a Side Hustle: Look to make more money by starting a side hustle. The list includes dog walking/sitting apps, food delivery apps, picture-taking apps, secret shopping apps, and plenty more. It is a great resource to see all the different side hustle apps that are out there.

Will a Salary of $60,000 Help Me Become Rich?

A salary of $60,000 can certainly help you build wealth and achieve financial success, but whether it will make you ‘rich’ depends on various factors, including your financial goals, lifestyle choices, expenses, and savings/investment strategies.

Here are some considerations:

- Financial Goals: The definition of “rich” varies from person to person. For some, it means achieving financial security and having enough to comfortably cover living expenses and retirement. For others, it means accumulating significant wealth. Your specific financial goals will determine what “rich” means to you.

- Lifestyle Choices: Your spending habits and lifestyle choices play a significant role in your ability to accumulate wealth. Even with a high salary, if you spend excessively or accumulate debt, it can hinder your path to becoming rich. Budgeting, practicing mindful spending, and living below your means are essential.

- Savings and Investments: Building wealth often involves saving a significant portion of your income and making smart investments. A high salary provides the opportunity to save and invest more, which can accelerate your wealth-building journey. Consider contributing to retirement accounts, investing in stocks or real estate, and diversifying your investments.

- Debt Management: Reducing and managing debt, such as student loans, credit card debt, and mortgages, is crucial for building wealth. High-interest debt can erode your financial progress, so it’s important to prioritize paying it off.

- Cost of Living: The cost of living in your area can significantly impact your ability to save and invest. In high-cost-of-living areas, it may be more challenging to build wealth, even with a high salary.

- Investment Strategy: Your investment strategy, including asset allocation, risk tolerance, and long-term planning, can greatly influence your wealth accumulation. Consulting with a financial advisor can help you make informed investment decisions.

- Time Horizon: Building substantial wealth often takes time and consistent effort. The longer your time horizon, the more potential you have to accumulate wealth through the power of compounding returns.

In summary, a $60,000 salary provides a solid foundation for building wealth, but it’s not the salary alone that determines your financial success. Becoming ‘rich’ is a subjective goal, so it’s essential to define what it means for you and create a financial plan to pursue it.

Conclusion

In conclusion, understanding what your annual salary translates to on an hourly basis can provide valuable insights into your financial situation. It’s not just about the number, but how it aligns with your financial goals, lifestyle, and location.

Remember, if you’re aiming for an increase in your hourly wage, there are steps you can take to make it happen.

Adopting an I Don’t Know Mindset for Personal Growth

I can pick new topics and skills up quickly, I received A’s in school, and am able to connect with others on many different levels. I have 2 math degrees, am a reader of hundreds of books, and someone who is always looking to grow and improve my situation through what I’m learning on a daily basis.

I spend hours each week learning new things and apply them in my daily life.

Yet all of what I just mentioned doesn’t matter.

I’m self-aware. In particular, I’m self-aware that I know very little.

That’s right.

In the grand scheme of things, I don’t know much about anything.

That’s why I push to have what I call an “I don’t know mindset” (also called a growth mindset) in life and to live without ego towards my ideas and thoughts.

Dr. Carol Dweck, a pioneer in growth mindset research, defines it as “the understanding that abilities and intelligence can be developed.” Basically, the knowledge that even if you don’t know everything (none of us do, of course), you can always learn more and continue to develop and cultivate skills and knowledge!

“The only thing I know is that I know nothing, and I am no quite sure that I know that.” – Socrates

The Dunning-Kruger Effect and Perceived Knowledge

There are so many things I do not know. As humans, we tend to overestimate what we think we know.

There are two concepts I want to share with you now to illustrate my point.

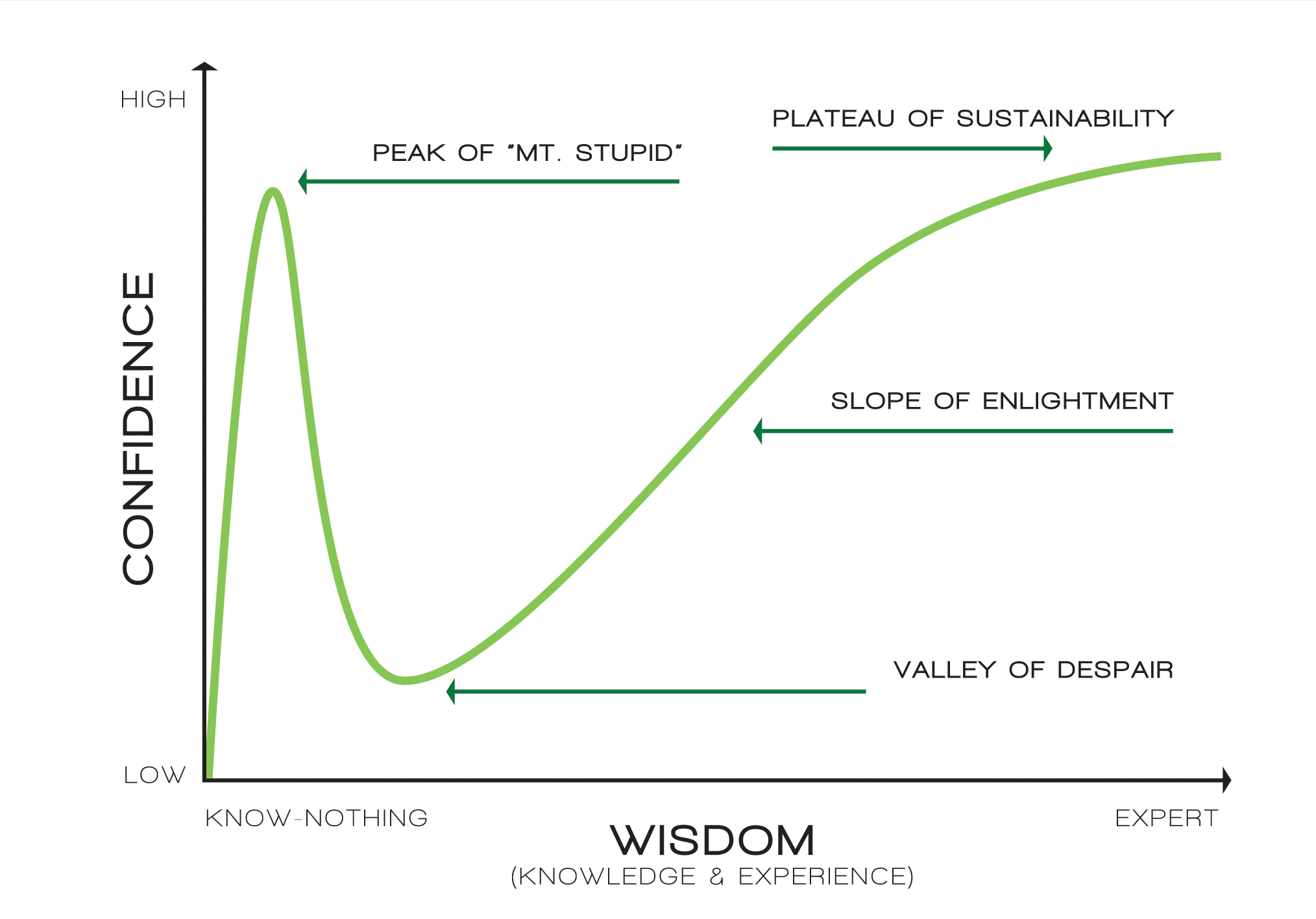

The Dunning-Kruger Effect is shown in the chart below:

When starting out in a new field, we start to learn a little bit and become very confident in our ability to perform. Think about when you first started learning math. What was the first thing that was taught? Counting! 1, 2, 3, 4…

We were confident because we could count, but then came addition. Then came subtraction, and then came word problems and all the other mumbo jumbo math stuff I don’t want to talk about here.

As we learned more, it became more difficult, and we became more weary of our ability to perform.

As our level of experience grew, we tend to be less confident in our abilities.

Many of us stay at the initial level because we feel confident where we are in our knowledge.

There are so many people in America who think they are experts on what’s going on in Washington DC, or in the C-Suite at their company, and yet don’t have political science degrees, MBAs, etc. This is the Dunning-Kruger effect at work.

As You Start to Know More, You Realize You Know Less

What’s interesting to me is that as you learn more in a subject, you realize you actually don’t know anything in the subject. In addition, you realize how much more there is to know and find out.

We go from “I know nothing” to “I’m an expert” to “I know nothing” as our actual level of knowledge increases! See this illustrated in the chart below:

Like I mentioned above, there’s quite a bit I know and am looking to improve my knowledge on. What I’m realizing more and more though is that I really don’t know anything.

Adopt a Growth Mindset and Become More Successful

Would there be a point to learning if you knew everything? No.

There would be no point to being curious or asking questions about the world or other people. Frankly, life would probably be pretty boring.

I’m suggesting working on adopting a growth mindset, or an “I don’t know mindset” for success.

How can you do this?

There are a few strategies that I’ve employed over the years to adopt a growth mindset myself.

- Live without an Ego

- There are 7 billion people and counting on this Earth. Do I really matter in the grand scheme of things? Does anyone actually care what I think? Am I better than anyone? The answer to all of these questions is NO.

- Believing that everyone is unique and no one is below you will allow you to live without an ego and put yourself in the proper mindset.

- Ask Questions to Clarify the Situation

- Where are you from? Why did you pick that major to study in college? What excites you about life? Why are you doing this job and not that job? How many kids do you have? Where is your favorite place to visit? Ask 100 people these questions and you will get 100 different answers.

- Many of my mistakes at work came from a misunderstanding of the problem. Would you please clarify this piece? I think I know what you are saying, is it this? Is this problem similar to this other problem? Asking questions like these will help you get clarity into the situation and shows that you are open to growth and understanding.

- Become More Self Aware

- As I’ve learned more, I’ve realized that I’m right with my intuition and thoughts quite often. That being said, I’m also cognizant that even if I’m right, there can be something I can add to my knowledge base. I don’t want to fall prey to the Dunning-Kruger effect! Instead, I want to have a growth mindset that says “I don’t know everything, but I am always learning new things.”

- Realizing when you are right and when you are wrong will allow you to navigate various situations with ease.

- For more information on becoming self aware and increasing your emotional intelligence, see these books for emotional intelligence.

- Always Look to Learn Something in Every Interaction

- One thing I’ve tried to do is whenever I go to a new website, pick up a book, or start talking to someone new is try to play investigator and try to learn something from that person. Everyone and everything has a story. There are many reasons she is like that or he is doing this. Asking questions and getting to the root of the situation is a great strategy to add to your repertoire.

Confidence is Still Key

One clarification point I’d like to make here is if you know something, I’m saying if you really know it, then be confident.

Self-doubt and a lack of confidence will hinder your ability to succeed.

If you know something, it’s important to share what you know and help others. Whenever a knowledge gap exists, there is an opportunity to teach and learn.

If you are at work and your boss asks you a question, don’t say “I don’t know” if you know the answer. But if you don’t know the answer, instead of lying, make sure to say, “I’ll get back to you with a clear answer.” This is an example of using a growth mindset because while you’re admitting that you don’t have the answer, you’re also communicating that you will look into it and figure it out.

Conclusion

Adopting an “I don’t know mindset” will help you grow. Being curious, asking questions, and uncovering the details for yourself will allow you to become more knowledgeable and valuable over time.

Even experts never stop learning – there is always something to learn and add to your portfolio of knowledge or skill set.

I ask that after reading this post, that you go out and recognize how you act when you are in conversation with someone who incorrectly says a phrase or fact. I’d ask that you also recognize if you start to talk about a subject you don’t know too much about and talk about it like you are an expert.

While I do believe there exists a learning and teaching opportunity whenever a knowledge gap exists, being able to say, “I don’t know if I’m knowledgeable in this area to speak on the matter”, and then to go and figure out the problem or idea at hand will set you up for success more often than not.

The only thing I know is that I know nothing at all.

Be curious, be courageous and be tenacious. Cultivate a growth mindset.

Readers: when you approach a new problem, do you assess it from various angles? Are you set in your ways? When is it okay to say “I know”, and move on?

When you’re navigating the job market or budgeting for your future, knowing what your annual salary translates to in terms of an hourly wage can be incredibly helpful.

In this article, we’ll break down the math and explore what $53,000 a year means on an hourly basis.

We’ll also dive into related topics such as post-tax income, biweekly earnings, monthly income, and whether $53,000 a year can be considered a good salary. Plus, we’ll share tips on how you can potentially increase your hourly wage.

$53,000 a Year is How Much an Hour?

Determining how much an annual salary of $53,000 translates to on an hourly basis can provide a clearer perspective on your earnings. This calculation can be particularly useful when evaluating job offers, budgeting, or understanding the value of your time. To figure out your hourly wage from an annual salary, follow this straightforward formula:

$53,000 (annual income) / 52 (number of weeks in a year) / 40 (standard hours in a workweek) = $25.48 per hour

So, if you earn $53,000 a year, your hourly wage is approximately $25.48 before taxes. This calculation assumes you work a standard 40-hour workweek for all 52 weeks in a year.

Understanding your hourly rate is not just about the numbers; it can help you make informed financial decisions and plan your budget effectively. Whether you’re considering a job change, negotiating a raise, or simply curious about the value of your time, knowing your hourly wage is a valuable piece of financial information.

What is $53,000 a Year After Taxes?

Understanding your take-home pay is crucial when planning your finances. The amount you receive after taxes depends on various factors, including your tax filing status, deductions, and the state you reside in.

On average, individuals can expect to pay around 20-30% or more of their income in federal and state income taxes. Let’s take some data from the IRS website on what your tax rate will be according to your income. This does not account for any of the factors listed above.

- 37% for incomes over $578,125 ($693,750 for married couples filing jointly)

- 35% for incomes over $231,250 ($462,500 for married couples filing jointly)

- 32% for incomes over $182,100 ($364,200 for married couples filing jointly)

- 24% for incomes over $95,375 ($190,750 for married couples filing jointly)

- 22% for incomes over $44,725 ($89,450 for married couples filing jointly)

- 12% for incomes over $11,000 ($22,000 for married couples filing jointly)

So at a $53,000 annual income, we will assume a tax rate of 22%.

$53,000 (annual income) x 22% (tax rate) = $11,660

So, after taxes, you would have approximately $41,340 left as your annual income.

$53,000 a Year is How Much Biweekly?

Many employers pay their employees on a biweekly schedule, which means you receive a paycheck every two weeks. To calculate your biweekly income, you’ll need to divide your annual income by the number of pay periods in a year. Most often, there are 26 pay periods in a year for biweekly paychecks.

So, the calculation would look like this:

$53,000 (annual income) / 26 (biweekly pay periods) ≈ $2,038

At $53,000 a year, you would earn approximately $2,038 before taxes with each biweekly paycheck.

$53,000 a Year is How Much a Month?

If you’re curious about your monthly income at an annual rate of $53,000, you can calculate it by dividing your yearly income by 12 (since there are 12 months in a year):

$53,000 (annual income) / 12 (months) = $4,417

So, at a yearly salary of $53,000, your monthly income before taxes would be approximately $4,417.

Is $53,000 a Year a Good Salary?

Whether $53,000 a year is considered a good salary depends on various factors, including your location, cost of living, and personal financial goals. In some areas with a lower cost of living, $53,000 can provide a comfortable life. However, in more expensive cities, it may not stretch as far.

To determine if it’s sufficient for your needs, consider your monthly expenses, such as housing, utilities, transportation, groceries, and savings goals.

Additionally, factors like job benefits, opportunities for advancement, and job satisfaction play a significant role in evaluating the overall value of your wage.

Let’s take a look at how a $53,000 a year salary compares to others in the United States.

According to data from the US Census Bureau for 2022, the median income for Nonfamily households in the United States was approximately $45,440 – which means that half of all individuals earned more than this amount, and half earned less.

So, if you have a salary of $53,000, you have a salary that is in the top 50 percent of all earners in the United States.

How to Increase Your Hourly Wage

If you’re looking to boost your hourly wage, there are several strategies you can consider:

- Skill Development: Enhance your skills or acquire new ones that are in demand in your industry.

- Negotiation: When starting a new job or during performance reviews, don’t hesitate to negotiate your wage.

- Further Education: Consider pursuing additional education or certifications that can increase your market value.

- Job Switch: Sometimes, switching to a different job or company can lead to a significant salary increase.

- Freelancing or Part-Time Work: Explore part-time job opportunities or freelance work to supplement your primary income. Apps like Fiverr or Upwork can be a great spot to post your skills and get hired for part-time work.

- Start a Side Hustle: Look to make more money by starting a side hustle. The folks over at the blog, Financial Panther, have put together a comprehensive list of over 70+ gig economy apps, with strategies and thoughts on each one. A lot of these you can do from your phone. The list includes dog walking/sitting apps, food delivery apps, picture-taking apps, secret shopping apps, and plenty more. It is a great resource to see all the different side hustle apps that are out there.

Will a Salary of $53,000 Help Me Become Rich?

A salary of $53,000 can certainly help you build wealth and achieve financial success, but whether it will make you ‘rich’ depends on various factors, including your financial goals, lifestyle choices, expenses, and savings/investment strategies.

Here are some considerations:

- Financial Goals: The definition of “rich” varies from person to person. For some, it means achieving financial security and having enough to comfortably cover living expenses and retirement. For others, it means accumulating significant wealth. Your specific financial goals will determine what “rich” means to you.

- Lifestyle Choices: Your spending habits and lifestyle choices play a significant role in your ability to accumulate wealth. Even with a high salary, if you spend excessively or accumulate debt, it can hinder your path to becoming rich. Budgeting, practicing mindful spending, and living below your means are essential.

- Savings and Investments: Building wealth often involves saving a significant portion of your income and making smart investments. A high salary provides the opportunity to save and invest more, which can accelerate your wealth-building journey. Consider contributing to retirement accounts, investing in stocks or real estate, and diversifying your investments.

- Debt Management: Reducing and managing debt, such as student loans, credit card debt, and mortgages, is crucial for building wealth. High-interest debt can erode your financial progress, so it’s important to prioritize paying it off.

- Cost of Living: The cost of living in your area can significantly impact your ability to save and invest. In high-cost-of-living areas, it may be more challenging to build wealth, even with a high salary.

- Investment Strategy: Your investment strategy, including asset allocation, risk tolerance, and long-term planning, can greatly influence your wealth accumulation. Consulting with a financial advisor can help you make informed investment decisions.

- Time Horizon: Building substantial wealth often takes time and consistent effort. The longer your time horizon, the more potential you have to accumulate wealth through the power of compounding returns.

In summary, a $53,000 salary provides a solid foundation for building wealth, but it’s not the salary alone that determines your financial success. Becoming ‘rich’ is a subjective goal, so it’s essential to define what it means for you and create a financial plan to pursue it.

Conclusion

In conclusion, understanding what your annual salary translates to on an hourly basis can provide valuable insights into your financial situation. It’s not just about the number, but how it aligns with your financial goals, lifestyle, and location.

Remember, if you’re aiming for an increase in your hourly wage, there are steps you can take to make it happen.

When you’re navigating the job market or budgeting for your future, knowing what your annual salary translates to in terms of an hourly wage can be incredibly helpful.

In this article, we’ll break down the math and explore what $54,000 a year means on an hourly basis.

We’ll also dive into related topics such as post-tax income, biweekly earnings, monthly income, and whether $54,000 a year can be considered a good salary. Plus, we’ll share tips on how you can potentially increase your hourly wage.

$54,000 a Year is How Much an Hour?

Determining how much an annual salary of $54,000 translates to on an hourly basis can provide a clearer perspective on your earnings. This calculation can be particularly useful when evaluating job offers, budgeting, or understanding the value of your time. To figure out your hourly wage from an annual salary, follow this straightforward formula:

$54,000 (annual income) / 52 (number of weeks in a year) / 40 (standard hours in a workweek) = $25.96 per hour

So, if you earn $54,000 a year, your hourly wage is approximately $25.96 before taxes. This calculation assumes you work a standard 40-hour workweek for all 52 weeks in a year.

Understanding your hourly rate is not just about the numbers; it can help you make informed financial decisions and plan your budget effectively. Whether you’re considering a job change, negotiating a raise, or simply curious about the value of your time, knowing your hourly wage is a valuable piece of financial information.

What is $54,000 a Year After Taxes?

Understanding your take-home pay is crucial when planning your finances. The amount you receive after taxes depends on various factors, including your tax filing status, deductions, and the state you reside in.

On average, individuals can expect to pay around 20-30% or more of their income in federal and state income taxes. Let’s take some data from the IRS website on what your tax rate will be according to your income. This does not account for any of the factors listed above.

- 37% for incomes over $578,125 ($693,750 for married couples filing jointly)

- 35% for incomes over $231,250 ($462,500 for married couples filing jointly)

- 32% for incomes over $182,100 ($364,200 for married couples filing jointly)

- 24% for incomes over $95,375 ($190,750 for married couples filing jointly)

- 22% for incomes over $44,725 ($89,450 for married couples filing jointly)

- 12% for incomes over $11,000 ($22,000 for married couples filing jointly)

So at a $54,000 annual income, we will assume a tax rate of 22%.

$54,000 (annual income) x 22% (tax rate) = $11,880

So, after taxes, you would have approximately $42,120 left as your annual income.

$54,000 a Year is How Much Biweekly?

Many employers pay their employees on a biweekly schedule, which means you receive a paycheck every two weeks. To calculate your biweekly income, you’ll need to divide your annual income by the number of pay periods in a year. Most often, there are 26 pay periods in a year for biweekly paychecks.

So, the calculation would look like this:

$54,000 (annual income) / 26 (biweekly pay periods) ≈ $2,077

At $54,000 a year, you would earn approximately $2,077 before taxes with each biweekly paycheck.

$54,000 a Year is How Much a Month?

If you’re curious about your monthly income at an annual rate of $54,000, you can calculate it by dividing your yearly income by 12 (since there are 12 months in a year):

$54,000 (annual income) / 12 (months) = $4,500

So, at a yearly salary of $54,000, your monthly income before taxes would be approximately $4,500.

Is $54,000 a Year a Good Salary?

Whether $54,000 a year is considered a good salary depends on various factors, including your location, cost of living, and personal financial goals. In some areas with a lower cost of living, $54,000 can provide a comfortable life. However, in more expensive cities, it may not stretch as far.

To determine if it’s sufficient for your needs, consider your monthly expenses, such as housing, utilities, transportation, groceries, and savings goals.

Additionally, factors like job benefits, opportunities for advancement, and job satisfaction play a significant role in evaluating the overall value of your wage.

Let’s take a look at how a $54,000 a year salary compares to others in the United States.

According to data from the US Census Bureau for 2022, the median income for Nonfamily households in the United States was approximately $45,440 – which means that half of all individuals earned more than this amount, and half earned less.

So, if you have a salary of $54,000, you have a salary that is in the top 50 percent of all earners in the United States.

How to Increase Your Hourly Wage

If you’re looking to boost your hourly wage, there are several strategies you can consider:

- Skill Development: Enhance your skills or acquire new ones that are in demand in your industry.

- Negotiation: When starting a new job or during performance reviews, don’t hesitate to negotiate your wage.

- Further Education: Consider pursuing additional education or certifications that can increase your market value.

- Job Switch: Sometimes, switching to a different job or company can lead to a significant salary increase.

- Freelancing or Part-Time Work: Explore part-time job opportunities or freelance work to supplement your primary income. Apps like Fiverr or Upwork can be a great spot to post your skills and get hired for part-time work.

- Start a Side Hustle: Look to make more money by starting a side hustle. The folks over at the blog, Financial Panther, have put together a comprehensive list of over 70+ gig economy apps, with strategies and thoughts on each one. A lot of these you can do from your phone. The list includes dog walking/sitting apps, food delivery apps, picture-taking apps, secret shopping apps, and plenty more. It is a great resource to see all the different side hustle apps that are out there.

Will a Salary of $54,000 Help Me Become Rich?

A salary of $54,000 can certainly help you build wealth and achieve financial success, but whether it will make you ‘rich’ depends on various factors, including your financial goals, lifestyle choices, expenses, and savings/investment strategies.

Here are some considerations:

- Financial Goals: The definition of “rich” varies from person to person. For some, it means achieving financial security and having enough to comfortably cover living expenses and retirement. For others, it means accumulating significant wealth. Your specific financial goals will determine what “rich” means to you.

- Lifestyle Choices: Your spending habits and lifestyle choices play a significant role in your ability to accumulate wealth. Even with a high salary, if you spend excessively or accumulate debt, it can hinder your path to becoming rich. Budgeting, practicing mindful spending, and living below your means are essential.

- Savings and Investments: Building wealth often involves saving a significant portion of your income and making smart investments. A high salary provides the opportunity to save and invest more, which can accelerate your wealth-building journey. Consider contributing to retirement accounts, investing in stocks or real estate, and diversifying your investments.

- Debt Management: Reducing and managing debt, such as student loans, credit card debt, and mortgages, is crucial for building wealth. High-interest debt can erode your financial progress, so it’s important to prioritize paying it off.

- Cost of Living: The cost of living in your area can significantly impact your ability to save and invest. In high-cost-of-living areas, it may be more challenging to build wealth, even with a high salary.