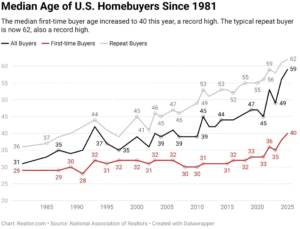

There has been quite a bit of commotion about the fact that the average age of a first time home buyer in the US has risen to 40 based on the latest data available. This average age has been moving up for years as homes become more expensive, but also due to families forming later in life. When this number gets discussed it is mostly from the negative perspective, but it is worth stepping back and looking at this from a fresh perspective. The world is undergoing a major shift as people migrate towards the economic engine cities which come with sky high housing costs. There is also a significant shift towards getting married and starting families later in life.

In this new climate, it is worth simply evaluating if 40 is actually the right age to purchase a first property? Is this the right balance between benefiting from the lower cost to rent in many cities, but ending up in a home that you can eventually pay off.

Life Takes Longer To Launch in the Modern World

Aside from those who work in tech or finance, the process of working up to a solid salary takes some time. Its a balance of getting experience and finding where you can add the most value in whatever profession you choose. Most people have false starts in one way or another. For most of my friends, their 20s was largely a feeling out period of trying out the different aspects of their chosen field or realizing that they needed to shift to something new. This sorting period isn’t expected and is frankly incredibly disappointing to many, but its common.

This aspect of career development seems to be causing Gen Z tons of grief because it doesn’t present a linear path to making the kind of money that fits with owning a home. College is far from an automatic step and it adds on student loans to the equation. When you are fresh out of college and only making $50K a year, it looks impossible, but it just needs space to breathe. For most, 30 is just too young to think about saving enough for a down payment, and that is okay.

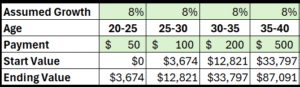

Here are a couple scenarios that show how a person can gradually increase their savings as they grow their income. The first assumes a steady increase between 20-40. It doesn’t look great at 30, but between 35 and 40 the combo of increased savings and compounding really kick in. This is actually pretty conservative returns at 8% a year and it still gets to $87K to put towards a home (or just keep rolling in an index fund).

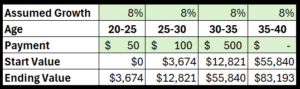

This next scenario represents a couple who knows they want to have kids and so puts more down in their early 30s, but doesn’t save at all for 5 years when the kids are little. This still puts them in a spot to buy a house as the first kid starts school.

No money goes in from 35-40, but it still gets up to $83K. That is more than enough for a solid down payment in many parts of the country. It also shows that you can get to some decent savings without huge monthly savings rates. These numbers would be very approachable for two incomes renting a reasonable place.

Why Buy a House at all?

If you are in your late 30s and you’ve actually started getting a nice nest egg invested in the stock market it would make sense to just keep riding with that plan. If you want to stay in a big city where homes are extremely expensive then this could be a good idea. The reason to buy a home starts with entering a season of life where you want to be stable for a while.

Real estate has historically been a good investment when held for a long time. If you think you will be moving around and jumping to new jobs, then it doesn’t actually make much sense. If you have school age kids or will in the coming years, then having a stable location becomes much more appealing.

This first aspect of buying a home connects with the needs of the moment, but the most important reason to buy a home relates more to the eventual goal of retirement. If you buy a home at 40, then with some additional principal payments each year you can actually set your sites on paying it off. This is a huge deal for thinking about the shift into living off your investments. If you are still renting at 60 or 65, it puts all of your well being at the hands of your investment portfolio. If you have a paid off house, you have a much lower burden and also a separate source of potential money for the future. Paying off a house is the ultimate hedge on the markets and this shouldn’t be missed even though stocks provide more annual returns.

If you are investing in a 401K and putting some extra on paying off a home, this is in my opinion the best way to get ready for retirement. A paid off house takes much of the risk out of future potential black swan events for the stock market or even the housing market.

Putting Down Roots is Bigger than Just Money

In the previous section I’ve laid out the financial side of why buying one home and paying it off would be valuable from a financial perspective, but there is a more important side to this. The idea of really putting roots down in a community has far more potential benefit than just the financial. If you mentally plant yourself and start paying a home down, then its easier to invest in neighbors and in your local city. This is part of a remedy to the disconnected existence that is so common in modern life. When everyone is passing through its easy to stay aloof, but when you have planted, it can’t help but shift your mentality.

In the culture of the United States, there is a major difference to a neighborhood where most people own their homes and are looking to stay long term. It is incredibly pronounced when you move from a major city where people are highly transient to any smaller metro where people tend to settle down to raise kids.

This is the last major reason that it makes the most sense to target 40 to buy a first home: you need to be ready to settle down. People aren’t settling down to have kids at 28 anymore. Those days are long gone and that is okay. The idea of locking into an area and truly investing in that community is something I hope everyone finds at some point. That is still incredibly connected to buying a home and even though it takes longer these days, it still something worth pursuing.

If you have found a property that you love, but you have not sold your home yet, then there are some steps you need to take to make sure that everything goes smoothly. Finding a way to speed up your own home sale is one of the best things you can do as well, as it allows you to not only focus on getting the most profit, but it also puts you in a good position on the market.

Source: Pexels

Declutter

The first thing you need to try and do is take the time to declutter everything. At the same time, you have to make sure that you don’t depersonalise. Get rid of any items that you might have accumulated but at the same time, consider removing any bulky furniture you may have lying around. People have to be able to imagine what life would look for them if they lived there. At the same time, you don’t want your property to look like a generic hotel. Leave some personality if you can, as it gives buyers the chance to imagine their future.

New Paint

Another thing you need to do is give your home a new lick of paint. If you give your home a new lick of paint, then this will make it feel lighter and bigger. It will also allow people to see the rooms and how they would adapt to their needs. A new lick of paint can also help your home to appear brighter than it is, as it will help the light to bounce around the room way more. If you have not given thought to what colour you should be going for, then opting for something like cream, beige, or even white can be a good idea. If you go for colours like this, then you can’t really go wrong, and you may find that your home is more appealing as a result. If you don’t feel as though the home you have right now is that appealing and that it needs more work done to it than you can accommodate right now, then going to market isn’t your only option. Services, like the one provided by Maryland Cash Home Buyers can help you to not only get the sale you needed, but to also get a cash offer for your home so you can move on without extensive renovations.

Curb Appeal

Another thing you need to do is look into your home’s curb appeal. Curb appeal will create a lasting impression, and it will also help your buyers to make up their mind about your property. If you focus on curb appeal then this will help you to stand out in the market and it will also help you to make your property appear more valuable. Things like this can make a major difference to your home, and it can also help you to not only go into your property with more positivity, but also to feel as though you have taken the time to maintain your home.

A recent survey showed that almost 80% of Americans are anxious about their finances. Money worries are among the most common causes of stress. Thinking about the future isn’t always easy, especially if you’re struggling to stay afloat now, but there are solutions. In this guide, we’ll explore some simple ways to combat future financial stress.

Image credit:

https://www.pexels.com/photo/hand-of-a-man-holding-a-bill-with-past-due-stamp-7926666/

Take stock of your current situation

The first thing to do when embarking upon a mission to take control of your finances is to take stock of your current situation. We live in a strange time when it’s both easier and more difficult than ever to keep track of spending. We receive alerts every time money goes out and check accounts in real-time at the touch of a button, but we also tap to order and pay bills via direct debits. It’s all too common to overspend without realizing and forget about regular payments, such as subscriptions. Checking your account balances frequently is essential for effective budgeting and planning. It can also help you reduce the risk of getting into debt and facing penalties for missing payments or going over your agreed overdraft limit. It’s wise to note down all your balances, including outstanding loan and credit card bills and repayments.

Seek expert advice

Financial experts are there to help if you have questions or queries about anything from getting a mortgage to saving for your retirement. If you’re looking for the best ways to boost your pension, talk to advisers with expertise and experience in retirement planning. This will give you insights into what you can do now to save more and how you can bolster funds in the coming years. If you’re thinking about buying your first property, schedule a consultation with mortgage advisers and find out more about schemes that could help you access lower rates and get help with your deposit. For investing, contact reputable investment or personal finance firms and explore your options. It’s important to make decisions based on your individual needs and objectives.

Set realistic targets

Expectation can lead to pressure and stress, whether it comes from you, people around you, or wider societal influences. Many of us grow up with a routemap in mind, which involves getting a job, settling down, buying a property, saving money, and enjoying a long and fulfilling retirement thanks to a substantial pension pot. In reality, times have changed, and it’s harder to meet milestones. There’s also nothing wrong with veering off-piste if you don’t want to follow the path most people take. Setting targets can be hugely beneficial for your finances, but it’s crucial to be realistic. Try to avoid putting too much pressure on yourself or trying to achieve goals if they don’t align with your personal desires or preferences.

Financial stress is rife. If you’re looking to improve your financial situation while reducing the risk of money worries in the future, it’s wise to take stock of your current circumstances, seek expert advice to get tailored guidance and help, and set realistic targets that are relevant to your preferences and objectives. Being proactive in managing your money, getting advice, and thinking about what you actually want to achieve can help you avoid stress.

As much as you may enjoy your job, it’s important to remember that life is for living, and at some point, you may wish to retire. If you are somebody who likes the idea of retiring early, then this needs to be something that you’re very intentional about. It’s also important for you to build the financial future required to make this happen. In this blog post, we’re going to walk through how you can do that.

1. Focus on What That Looks Like

To begin with, you need to make sure that you are clear on what your retirement plan entails. Retiring early will look different to everybody, so it’s important for you to focus on exactly when you’d like to retire and start planning out scenarios of how you’re going to make that happen.

2. Assess and Prepare Your Financial Situation

When you have a clearer idea of what your retirement situation will look like and how you want it to go, you can then start to look at your financial situation and get things in line. In order for you to retire when you want to, you need to make sure that you have savings in place and that you have a retirement plan and fund ready to go. But the good news is you can put the legwork in now so that you’re secure in the future and you can retire when you want to.

3. Lay the Groundwork for Passive Income

As you are likely to need to put quite a bit of money away in order to have the secure financial future you want and retire on time, it’s important to consider other options here. Having multiple sources of income is always a good idea. You may also want to build some passive income streams so that you can have additional money coming in when you retire. Property is always great for this. If you’re concerned about managing it, you will find that you can procure rental property management to do that for you. So your only job is to make sure that you are choosing the right properties, investing wisely, and generating a passive income from your portfolio.

4. Make Decisions in Line With Retirement

When it comes to any further decisions that you may be looking to make with regard to either your finances or your future plans, make sure that you’re doing them by focusing on your retirement. It’s easy to make decisions based on how you feel today or your current circumstances, but this may impact when you want to retire and your ability to do so. So it’s important that you focus on that as your overall goal and make decisions accordingly.

5. React and Adjust Along the Way

Finally, it is also important for you to make sure that you are aware of what’s going on in your life and what changes may be coming. Just making a plan today doesn’t mean that it will all fall into place. This is just because we never know what’s around the corner, and decisions that you make today may not work for you in ten years’ time. So it’s important that you are reacting to whatever’s going on in your life and in the economy and making adjustments to your plan along the way. That way, you’ll be able to build the financial future that you’re looking for and retire on time.

A work injury can turn your life upside down in a moment. Beyond the physical pain of one, there are practical warriors, too. Medical bills, lost income and uncertainty about your job are just the top of the pile of worries you’re going to have to deal with.

Knowing the steps that you need to take early can make a big difference to your recovery and your financial stability. In our short guide here, we’ll explain in simple terms how to get help after a work injury and protect yourself both legally and financially.

Get medical help first.

Your health will always come first and if the injury is serious, seeking emergency care immediately is a must. For less urgent injuries, see a GP, urgent care centre or occupational health provider as soon as you can. Early treatment doesn’t just help your recovery but also creates a medical record linking the injury to your work, which can be important later on. Follow medical advice closely and keep copies of all reports, prescriptions and appointment notes. These documents will help to show the impact of the injury over time.

Report the injury at work.

Tell your boss about the injury as soon as you can. Most workplaces have an accident book or a formal reporting process, so you should be clear about when, where and how the injury happened. Even if the injury seems minor at first, reporting it protects you if symptoms worse and later on. If possible, keep your own written record of what happened, including names of witnesses, because this can be useful if there are disagreements later.

Understand your rights.

Employers have a legal duty to provide a safe working environment. If an injury happened because of unsafe conditions, faulty equipment or lack of training, you may be entitled to compensation. At this stage, having a legal team backing you can help to clarify your options, especially if you’re unsure whether the injury qualifies for a claim. Legal advice can explain time limits, what evidence is needed and the compensation that you might cover.

Manage the financial impact.

Work injuries often affect your income, so you might be entitled to statutory sick pay, contractual sick pay or other benefits, depending on your employment terms. Checking your contract and speaking to HR, if available, is a must if the injury affects your ability to work long term, financial advice can help you to plan for reduced incomes, ongoing costs or debt management. Compensation, if it’s awarded, could cover lost earnings, medical expenses and rehabilitation, but it can take some time. So, budget early. It’s important.

Don’t rush any decisions.

It’s common to feel pressure to get back to normal quickly, but Russian can harm your recovery or weaken your position. Take some time to understand your diagnosis and prognosis before you make decisions about anything. If your employer is disputing your injury or you feel unsupported, independent advice becomes more important at this stage.

Living abroad while running a growing business sounds glamorous until the small problems start stacking up. Time zones don’t care about your calendar. Bank transfers take longer than they should. Simple decisions need an extra email or two. You tell yourself to just deal with it, because the lifestyle is worth it. And most days, it is. But scaling from another country brings challenges people rarely talk about until they’re knee-deep in them.

The tricky part isn’t your ambition. It’s keeping momentum when everything around you moves slightly out of sync.

Source: Unsplash (CC0)

Distance makes simple things feel heavier

When you’re not physically close to your team, partners, or customers, small tasks gain weight. A five-minute chat becomes a scheduled call. A quick fix waits overnight. You learn patience fast, sometimes whether you like it or not.

The key is accepting that speed looks different now. That doesn’t mean slower growth. It means clearer communication and better systems. When things are written down properly and decisions don’t live only in your head, distance stops being such a drain on your energy.

Your lifestyle can outpace your planning

If you’re earning well while living abroad, things can move quickly. New opportunities. New markets. New responsibilities. This hits especially hard if you’re someone with high income at a young age, because success arrives before you’ve had time to build guardrails to protect you.

It’s easy to focus on scaling revenue and forget the boring bits underneath. Legal structures. Compliance. Long-term planning. Ignoring those doesn’t break things straight away, but it adds pressure that shows up later when the business is bigger and mistakes cost more.

Money gets complicated across borders

Handling finances internationally is where many people feel the most stress. Different banks. Different rules. Different expectations. What feels normal in one country can raise flags in another.

For US citizens especially, things like FBAR filing requirements if you’re a US citizen with accounts outside of the country aren’t optional or niche. They’re part of the deal. Missing them isn’t a huge problem at first, but it can turn into a mess that eats time, focus, and sleep. Getting advice early saves a lot of panic later.

Time zones test leadership in subtle ways

Running a team across time zones forces you to lead differently. You can’t rely on being “around” all the time. You have to trust people to make decisions without you watching every move.

That shift can feel uncomfortable at first. You might worry things will slip. In reality, it often shows who’s ready to step up and where communication needs tightening. Strong teams don’t need constant supervision. They need clarity and room to operate.

Scaling works best when your life and your business stop fighting

The biggest lesson people learn is that lifestyle and business growth can’t be at odds forever. If they pull in opposite directions, something gives. Usually your energy.

This is usually when people start thinking differently. Not about doing less, but about doing things in a way that fits where they live. Better structure. Better support. Fewer assumptions. Once the business adapts to your reality, instead of the other way around, growth starts feeling sustainable again rather than exhausting.

Prop firm trading, also known as proprietary trading, is a fascinating domain that attracts more and more traders. But what exactly does it entail, and why should you consider it? In this article, we’ll dive into the core of prop firm trading and what you need to know to be successful in this world.

What is prop firm trading?

Prop firm trading is a form of trading where traders use the capital of a firm to trade in financial markets. In return, the trader shares a portion of the profits with the firm. This model allows traders to take larger positions than they could with their own capital.

How does prop firm trading work?

The process usually begins with an evaluation period where you need to prove your trading skills. This can range from a few weeks to several months. If you succeed, you gain access to the firm’s capital and can start trading. Profit-sharing varies by firm, but it’s common for traders to keep a percentage of the profits while the rest goes to the firm.

Why choose prop firm trading?

There are several reasons why traders opt for prop firm trading. One of the biggest advantages is access to substantial capital, enabling you to take larger and potentially more profitable positions. Additionally, many prop trading firms offer extensive educational programs and support, which can be especially beneficial for novice traders.

Access to capital

The biggest advantage of prop firm trading is access to capital. This allows you to take larger positions and apply your trading strategies on a larger scale. This can lead to higher profits, but it also comes with increased risk.

Support and education

Many prop trading firms offer comprehensive training programs. These programs can range from basic knowledge about financial markets to advanced trading strategies and risk management. This is a great way to improve your skills and increase your chances of success.

Evaluating prop trading firms

Choosing the right prop trading firm is crucial for your success. There are several factors to consider, including terms, costs, and profit-sharing. Websites like propfirmsyncer.com can help you find the best programs that meet your needs.

Terms and costs

Each prop trading firm has its own set of terms and costs. It’s important to evaluate these carefully before making a decision. Pay attention to things like initial evaluation fees, monthly fees, and any hidden costs that could affect your profits.

Profit-sharing

Profit-sharing is another important factor to consider. Some firms offer a fixed profit-sharing structure, while others have a variable structure depending on your performance. Make sure you understand how profit-sharing works and how it will affect your final earnings.

Trends in prop firm trading

Prop firm trading is constantly evolving, and it’s important to stay updated on the latest trends. Here are some trends currently influencing the market:

Technological advancements

Innovations like algorithmic trading and artificial intelligence are playing an increasingly significant role in prop trading. These technologies can help you make faster and more accurate trading decisions.

Regulatory changes

New regulations can impact the terms and costs of prop trading programs. It’s important to stay informed about these changes to ensure you remain compliant and avoid unexpected costs.

Educational programs

There is a growing trend of prop trading firms offering extensive training programs. These programs can help you improve your trading skills and increase your chances of success.

Prop firm trading offers a unique opportunity for traders to access substantial capital and improve their trading skills. By carefully evaluating the terms, costs, and profit-sharing of different firms, you can make the best choice that aligns with your needs. Stay updated on the latest trends and technologies to optimize your trading strategies and increase your chances of success.

The timing of tackling business debt can be just as important as the action itself. Plenty of businesses delay addressing debt anyway because they hope that the improved cash flow or future growth that they are planning for will resolve the issue naturally. Of course, this is an approach that can work in limited situations, but those situations are limited for a reason. Waiting too long often allows interest in financial pressure to compound. You need to act at the right moment before that debt becomes overwhelming to protect yourself and your long term potential.

Early intervention gives your business more options. When the debt is addressed proactively, companies are better positioned to negotiate with creditors and restructure repayments. Cash flow is typically more flexible at this stage, making it easier to balance operations and debt reduction. Leaving the unchecked camera structure access to funding and strain your relationships with your suppliers while forcing reactive decisions that limit your growth rather than encourage it.

Markets, interest rates, and business performance are all going to be affected by timing. These things are constantly changing, and periods of steady revenue or strategic transition can often present ideal opportunities to deal with outstanding obligations. Tackling debt during these windows will create stronger financial foundations and reduce future risk. The infographic below should explain settling your business debt a little bit more.

Infographic designed by Delancey Street

If you are simply reading the news lately and following social media it would be easy to think that the American Dream has passed us by. The focus is constantly on the increased levels of debt, high house prices and the frozen job market. Stats are skewed to focus on the depressing and there is a growing fatalism in people under 40 that a future with a home and a family is simply not an option.

Obviously, there wouldn’t be all this bad press out there if there wasn’t truth in it. The American Dream is definitely under assault from the forces of inflation and the highest home prices in history. A college degree isn’t seen as an automatic pass to a stable future anymore either.

However, all this negative news is simply exposing trends that have actually been true for quite a while. The journey to the American Dream has been perilous for decades and has to be treated that way to find success. The great lie is believing that success in America has ever really been that easy. There have obviously been seasons where it was simpler to find a home and build a life, but every generation has faced serious headwinds.

Lost in all the focus on negativity is the fact that there are plenty of people quietly carving out a life. It’s not post worthy to figure out a tight budget to stay out of debt during the years when you are paying for childcare. A small home from the 1970s that needs fresh paint and new flooring isn’t something you celebrate outside your friends and family. All the steps that eventually lead to a financial breakthrough in your 40s look like a grind in your 20s and 30s, but if you talk to most retired people you will find that its pretty much always been this way.

The Myth of the Easy American Dream

It has always been a small fraction of people who have access to an easy path to a beautiful home and growing wealth. This is essentially what separates the upper class from the various flavors of the middle class. For the middle class, getting established has been a scrap even for the baby boomers. People in their 70s faces a terrible economy and double digit inflation in the 70s. Wages stagnated all through the 80s and 90s, so while home prices were low it wasn’t incredibly easy to get established. Gen X has been identified recently as the “Real Loser Generation” according the the Economist. This is largely due to the stock market stagnating in the early 2000s which cut them off from accumulating wealth.

There have been periodic recessions and stock market crashes through the past 50 years and so there have been plenty of periods where it looked equally bleak to the current state if not worse. Its good to talk to retired family about how their early years of marriage and kids because there are a lot of stories of pinching every penny, DIY home projects and worrying about the future.

The true story of the American Dream is that it is a battle. Its a battle to get established in a career, to find a place you want to settle down and for most its scrapping to make it work with kids. This was my parents experience, it was definitely how it went for my family and its what I’ll tell my kids to expect.

Fatalism towards the Future can be a self fulfilling prophecy

The biggest challenge I’m seeing for anyone looking to get established and build a life is that there is so much energy focusing on how impossible everything is. If people don’t believe that they will be able to make smart financial choices pay off, then it makes more sense to live for now. This has led to an epidemic of gambling, hyper risky investing and wasteful spending.

Why not get Doordash all week? Why not have fun putting some money on the football games over the weekend? Thanks to the tech economy, all these whims are easily realized on a phone.

The scary thing is that all of these convenient ways to pull money away are what can sink Gen Z’s future more than just the challenges they are facing in the housing market.

If you add $30K in credit card debt to an existing student load balance, then it can push the situation over the edge.

It’s okay to be figuring things out in your 20s and 30s

So what are people supposed to do? The first thing is to keep moving. Most people feel pretty lost in their career when they are starting out. Entry level roles are a grind and it is tough to see a vision of where things can go. The arc of the modern career is longer than it was in previous generations and that has to be accepted. Feeling pressure to buy a house at 30 simply isn’t realistic for most people. 30 is likely a time to still be getting experience and learning an industry. Its a great time to still be a a major hub city renting a small apartment.

There is so much internet conversation about early retirement or getting out of the 9 to 5, that it can be lost that most people grow their wealth through a normal career path. Its likely not going to make you super wealthy, but making the standard 401K contributions over the course of 30-40 years will most likely set you up for a comfortable retirement.

The key to the early years of a career is to be gaining skills to make you increasingly more marketable and moving around to find opportunities. Its now standard practice, that to get a legitimate raise you need to move to a new company. 3% is a pretty common annual raise and you might get close to 10% for a promotion, but companies will often give a larger bump when you are new. This is a huge reason why people shouldn’t stress to get a home by 30 because its most likely that the potential job that makes a home affordable is going to involve moving to a new city.

40 Might be the Right Time to Buy a First Home

It seems pretty bleak that the median first time home buyer was 40 years old in 2025. However, if you think about what a modern career looks like, this is probably the right age to think about. This allows for keeping expenses lower as you grow your career and focus on investing a bit in the stock market. It allows for easy movement in the critical years for making advancement.

This also is a realistic timeline for when kids may be starting school which is realistically a great time to really put roots in one place for at least 5-10 years. Its really the season of life where it make sense settle in and that takes a lot of the risk out of the volatility that I forsee in the housing market. If you are comfortable staying in a house long term, then its still a great investment.

While the biggest cities are crushingly expensive, there continue to be plenty of areas in the US that are approachable for a couple on a middle class income. As I’ve mentioned in a previous piece, when cities like Buffalo show up on the hottest housing markets, you can bet its people looking for an affordable place to settle down.

Increasingly Challenging, but Possible

I’m writing this piece as someone who was pretty down on my prospects as a 30 year old. My career was still just getting rolling and I already had two young kids. I was like many people today and felt completely behind. I didn’t see a path for the long term, but my wife and I buckled down during the little kid years and stayed out of debt even if we weren’t investing much.

Careers kept moving along and we kept our lifestyle under control and then around 40 things really turned and we’ve seen our ability to save increase dramatically. Now I look back and can see how much those early years were building towards this, but it just doesn’t show up in the bank account in a linear fashion.

I am quite encouraged when I see that Gen Z invests in stocks at a higher rate than older generations because I think there will be many who see themselves get traction in 10 years despite things looking dire in the current moment.

At least here’s hoping.

Location is always an important factor to consider when you are buying real estate. For many investors, buying a home on a busy street is a smart decision that can make life genuinely a lot easier. You’re instantly close to things that matter to you, whether it’s a park, the school, public transportation, or even the workplace. Besides, there’s also the financial aspect of it, which is that properties in high-traffic areas tend to appreciate at similar rates, which is a great thing for anyone who is considering selling in the future.

However, you need to be aware of the financial risks of such a property. There are many advantages, but a home on a busy street can also bring a set of challenges.

The Risk of Accidents

Ultimately, living on a busy street with public transportation means you don’t need to drive everywhere. But when you’re walking more, you’re also more exposed to higher traffic volumes. While it’s fair to say that accidents may not be related to financial losses per se, the gravity of the accident can affect your long-term health, income, and quality of living.

In fact, the first thing you are likely to hear from a pedestrian accident personal lawyer is that living on a busy street is essentially an accident waiting to happen. It doesn’t matter how careful you are; when there are many cars on the road, it only takes one inattentive driver to injure you.

Noise Pollution

Can you escape noise pollution in the city? The answer is no. You can, of course, invest in soundproofing solutions, but these come at a high cost in urban environments.

While some people get used to it, it can put off some buyers. In fact, this may be something most people don’t think about, but noise pollution has measurable financial consequences when you’re trying to sell your home. It can reduce its appeal to potential buyers. You may also be involved in lengthy negotiations, especially with buyers who are trying to bring the price down as a result of noise.

Risk of Property Damage

Busy streets don’t bring only more noise; they also bring more risks of accidental damage to your property. Once again, more vehicles on the road increase the risk of minor bumps that can affect your car if you park on the street.

When it comes to the property itself, you can expect more traffic-related debris, pollution, and vibrations, which can increase signs of wear and tear. This means that fencing, siding, windows, and even facade paint can be affected, and maintenance costs can ramp up.

Higher Insurance Premiums

Homes near high-traffic areas tend to have high risk ratings, which can translate into increased homeowners’ insurance premiums. You may also find that insurers tend to recommend higher coverage limits for such properties, especially if there is a history of accidents in the same area.

In day-to-day life, this is something you can feel through increased monthly expenses, and it can even affect long-term affordability.

So, is it really worth buying a property on a busy street? There is no clear yes or no answer, as every investor will need to come to their own conclusion by assessing the pros and cons.