When Kyla Scanlon coined the term Vibecession, it was in the midst of the pandemic spike in inflation in 2022 and in the years since it has captured the general mood of most of the world. The major shock of that year was the one-two punch of a spike in housing prices in most cities followed by the jump in interest rates. This shock came on top of a gradual uptick in the cost of insurance, groceries and childcare that have made the American Dream seem unattainable.

The internet feeds the world a consistent diet of statistics that show how the averages for house prices, wages and debt for Americans are moving in the wrong direction. If all you see is these numbers it can seem like the battle for a quality life has already been lost. In leading cities like New York, San Francisco or LA, the gap between normal wages and the housing market is beyond reach, but there are many people who are finding places to build a life in less glamorous locations.

Image of Glen Park in San Francisco. Such a cool neighborhood, but also out of reach for most.

The Challenge Starts in the Big Cities

Especially for anyone under 40, the biggest challenge that I’m seeing is that the majority of the career opportunities are in the major cities like Seattle and San Francisco. I can picture the hopelessness of working in your 20s in one of these cities and potentially even earning a decent salary, but never seeing how you can afford a home over $1 million dollars. If you are underemployed and not even working in the field you studied in college, then it would look like an impossible mountain to climb.

Increasingly, the major hub cities in the US are becoming places where people go to get experience and hopefully grow their careers, but simply aren’t where most can settle down. Its been well documented that most of these cities don’t build enough housing and so the math is simply going to be moving in the wrong direction for the vast majority of people.

When a poll found that Gen Z thought they needed over $500K to feel successful, I can’t help but think that this is linked to where Gen Z is currently living. If you are in New York City or San Francisco, this number probably feels right. For anyone living in Buffalo, Omaha or Indianapolis, this number would feel massive.

Big Cities are For a Season, not forever

The one thing that is clear for virtually everyone is that the traditional American Dream of owning a home with a nice little yard and having a couple kids is out of reach in the major coastal cities of America. This is understandably massively discouraging since these cities are really cool places and it would be great if there was a clearer path to making it in the “big city.”

So what is someone in their 20s or 30s supposed to do when the cities with the best jobs are simply impossible to get established in?

For most people living in a major city, its just about making sure you get the value from the city as you look for an offramp to a smaller, less expensive place. Get the amazing experience at a startup or at one of the leading companies in the world, but don’t kid yourself to think that this will be a place you settle.

Even for those who stay in areas like Austin, they end up way out in the suburbs and not in the core. Families just don’t stay in the cities and so the time for relocating is coming for virtually everyone.

The Migration is on to Find a Quality Life Outside the Big City

For people in the phase of life with young kids or getting ready to start a family, the transition out of a major city is increasingly part of the deal. It has really been trending this way for decades, but the recent housing spike and interest rate hikes has made it even more pronounced. This is what makes the recent data from 2025 that put Hartford, CT and Buffalo, NY at the top of the hottest housing markets. This can be coupled with the consistent flow of people to the Carolinas and Texas. Some areas have gotten expensive, but there is still a lot of value even in the suburbs of Austin or Dallas. In these southern markets, the constant construction has actually led to pretty extensive price drops even though people continue to move there in pretty high numbers.

For my family, the move was to my hometown of Spokane, which sits at right about half the housing cost of Seattle. Spokane will never be as cool as Seattle, and we always look forward to trips across the Cascades to experience all that it has to offer. Spokane, like other middle of the road cities across the US, does have all that we need for a quality life. It has just enough and also has enough challenges that it will likely never become a place that wealthy people pour into in droves.

It’s this layer of cities that is the remedy to the Vibecession in my opinion. Its the places that we don’t want to move to in our 20s, but when you have a kid or two and your closing in on 40 then they actually have all that a family could need.

Its not as splashy an American Dream as I’m sure most people want, but its a quality life and its one that many people are quietly finding across the country. They don’t post on social media that they just bought a house in Buffalo, Spokane or the suburbs of Houston, but they are finding footing and quietly building a future.

Renting often gets a bad rep, with the general narrative favoring owning your own home. And while investing in property has a lot of benefits, it doesn’t mean it’s the most suitable choice for everyone, all the time. For a lot of people, renting is the only available option.

So to help combat some of the negativity around renting, here are some of the positive sides to it, helping you feel more confident in your choices and ready to make the most of it.

Image Credit: Unsplash under Creative Commons

It can be the cheaper option

One of the main pluses for renting versus buying a home is the cost. Rent is generally more affordable than a mortgage, and avoids the long-term financial commitment that can make some homeowners regret their choice. Renting from someone else means they’re responsible for their property, so you won’t have to worry about maintenance costs and the other expenses that can come with owning your own property.

If money is tight or you have a lack of savings for a deposit, renting is a great option that can still allow you to live where you want, without the high monthly costs.

It gives you flexibility

Renting is particularly popular with younger workers who are just finding their feet after college or high school. Renting gives you the flexibility to move around or pack up and go traveling, making the most of the time in your life where responsibilities are few and opportunity is everywhere. With short-term lease options available, you don’t have to stay somewhere for too long if you want to try another neighborhood, city or even country.

You can invest your money elsewhere

While owning a home is a great way to invest in your future, it isn’t the only form of investing. The money you could save by renting can be invested in plenty of real estate alternatives, helping you build wealth without a property portfolio. These investments could also be a way of growing your deposit, should you decide to invest in property further down the line.

There’s a lot of choice

Renting gives you options. Whether you want to live by yourself, try living with a partner or enjoy renting with friends, you can find a wide choice of properties to suit your needs. It’s also easier than ever to rent with a reputable landlord, thanks to rental review websites and easier access to information. Renting can help you narrow down what you really want and where you want to live, helping you try different things without a long-term commitment.

Owning your home has its benefits, but that doesn’t mean you should disregard renting completely. Renting can be a great choice in many situations, especially if you’re at a stage in your life where you want to avoid feeling tied down or want the flexibility of moving. With a lot of choice and cheaper monthly payments, renting could be the ideal solution for you for now, helping you live your life your way.

Real estate can offer an excellent return on your investment if you make the right choice. However, before you invest, you must consider the following things.

Image located at Pexels – Licence CC0

Where will you source the finances needed?

The first thing you will need to consider is where you will get the finances to invest in property. This type of investment is rarely cheap, and that means you may need to save for a considerable amount of time, as well as get a loan from the bank. Of course, your eligibility for a loan will depend on a range of different factors, including how you plan to make money back from your investment.

What type of property will you choose?

Another important decision will be the type of property you will choose. Most people think the only option for investments is residential properties, but this is not the case. Indeed, commercial properties can provide an excellent return on investment, and in some cases are a great deal easier to manage than residential ones, where you can be expected to do all the property repairs and management yourself.

What locations will you consider?

Many people think that location should be your very first consideration when thinking about investing in real estate, and while the type of property you will choose, as mentioned above, must also be key to success.

However, once you have a good idea of the type of property that you would like to invest in, you will be able to seek out more suitable locations much more easily. Remember, different types of locations will be better for different goals. For example, buying a residential house in a n up and coming neighborhood can be a good bet for buying and leasing. Whereas a worn-down property in a popular neighbourhood can be a better choice for a flip project.

Any legal issues relating to the property?

It also makes a lot of sense to carefully consider any legal issues concerning the property in question. After all, you won’t want to be left in possession of a property that is not what it seemed. The good news is that by working with an expert like the Taylor Law Group, you can protect your property investment from any potential issues that could arise and endanger not only its viability but your profit margin as well.

When will you cash out of your investment?

Last of all, before you invest in a property, you need to have a clear idea of when you will cash in your investment. This will help you prevent getting stuck with a property with little returns. For some people, time is the most important element in cashing out their investment as they want to turn a profit as quickly as possible. Usually, these types of investments end up being house flips, where a house is renovated and sold quickly to release as much profit as possible.

For others, it can be a specific figure or range. In those cases, cash outs tend to come from a longer-term investment such as buy-to-let, as these provide enough time to build up profit to the necessary level.

In a recent article published right before the end of 2025, The Economist described the affordability crisis as “mostly a mirage.” The article includes data about wages and grocery prices which have largely stayed in step with each other over that period coming out of Covid. There is a recognition of the impact of increased interest rates hitting the ability of Americans to buy a house, but overall there isn’t alignment with the sentiment of the popular mood. So what is really going on? Is The Economist seeing through the noise or is there something missing in this assessment?

The Core Issue isn’t Wages vs. Grocery Prices

In its assessment on affordability, The Economist focuses on wages and food prices which makes sense, but misses the core of what is really driving the pain in affordability in America. It is good to note that real wages have been headed in a very encouraging direction over that past ten years. In the overall averages across the country, its appears that wages have kept up with the overall increase in costs. This seems to show that all this noise about affordability is felt, but doesn’t reflect reality.

However, the issue sits outside of these two items. The greater challenge that I hear about from friends and is discussed on social media is the stack of expenses that are now weighing on the middle class. It is the combination of student loans, childcare, health care and now the jump in housing prices that is bringing the angst. This is what is delaying the American dream or simply making it seem impossible for people.

Student loans are particularly challenging because they tend to be higher for people who have pursued an advanced degree. This ends up taking a bite out of higher earners like counselors or physical therapists, and its taking the bite during the years correspond to young kids in the home.

Its this stack of expenses that is beating up the middle class in their 20s and 30s.

The One-Two Punch of the Covid Housing Bump and Interest Rates

The Economist does a good job recognizing the impact of the sharp rise in interest rates on the housing market, but it doesn’t seem to understand the impact of the equally sharp rise in housing prices during Covid. In some metro areas the prices have come back to earth, but in most a good portion of the price gains have remained. This has created a major shift in affordability in the course of a four year period. In a city like Spokane, where I live, this means that young people are looking at drastically different homes for a first purchase then they would have in 2019.

I see this as the major reason that average age of a first home purchase has shifted all the way up to nearly 40 years old. This is the impact of the shifts in the housing market coming out of Covid and its important to understand how significant it really is. The angst comes much more from having to shift life timelines drastically from previous expectations.

- People who hoped to buy homes are priced out

- People who want to rent in a safe area aren’t able to

- Homeowners who would want to buy a larger house are stuck

This one-two punch has shifted down the plans of almost any person who wasn’t already in a long term home on a 3% mortgage. This downgrade is what is disheartening.

The Weird Frozen Job Market is Making People Feel Stuck

While there has been an overall increase in wages over the past 10 years, anyone involved in the job market will tell you that these increases are highly variable. It is common to get a 10-20% raise when moving jobs, but only get a 3-5% bump in the same role. My experience aligns with that of The Economist that the lower end of the pay scale has seen more consistent pay bumps in order to stay maintain their hourly workforce. The challenge comes as you move up into more competitive roles.

The fact that the more substantial increases in pay tend to come with changing jobs has made the challenges in searching for new roles incredibly frustrating. While the rise of Linkedin and Indeed has made the process of identifying new roles easier, there has also been an increase in frustration at how often resumes float out never to be heard from again. It takes a lot of applying to land a new role and this is increasingly a taxing proposition for anyone who needs to make more money to stay on track financially.

In 2025, the job market took a turn due to the political chaos, tariffs and tech layoffs. Now there are less opportunities coupled with the challenges of the new job hunting environment. This isn’t an impossible situation, but its been very frustrating for most people. This is the reality of the affordability crisis. The overall numbers for average wages are going up, but the journey to get those wages is more difficult than many realize.

The Never Ending Attack of Digital Money Syphons

If you watch any program with commercials in the US, you will see a steady flow of adds for food delivery and gambling apps. Add onto this the ever expanding availability of media subscriptions and you have an incredibly challenging situation for the average American. This layer is also challenging because people know that they are choosing to funnel their money into these syphons.

Its not forced, but these convenient options grab away potential savings from people in their 20s and 30s. We are at a peak in the dangerous freedom of unlimited options. Baby boomers had to go to a casino or racetrack to lose their money gambling. Now, most people can do it in a few clicks. The normalizing of the convenience economy means additional money going out of the monthly budget.

This challenge is the easiest to overcome, but needs to be considered because of the havoc it is having on people in their 20s and 30s. All of these apps have become part of the culture and as we’ve seen with credit cards, these new spending norms are hard to undo.

Conclusion

The increase in the grocery bill simply isn’t the core reason for the angst of the affordability crisis. People are frustrated that they can’t get the bill lower, but the main reason is that the stack of housing costs, childcare, student loans and healthcare costs are making it extremely challenging to get on plane financially.

Add onto this the amount of effort it takes to find a better job and actually get hired and you can see why people are discouraged. Its as if people set out on a six mile hike and then found out halfway in that it was actually going to be 12 miles. It is a jarring shift in reality and that is why there is so much discouragement throughout the culture.

A settlement can feel like it’s going to fix everything, and yeah, it can absolutely help. But it can also create this weird pressure, because suddenly there’s money on the table and people expect it to solve problems fast. Friends might have opinions, family might have opinions, and even your own brain can get a little loud, because it’s tempting to spend in a way that finally feels like relief. While no, it doesn’t feel like you’re winning the lottery, you just feel like you’re getting justice, be it from an injury, harassment, wronged in some way, well, you get the idea here.

But all those thoughts that might be rushed into your head after all the legal fees are paid are totally normal. But similar to the lottery, there’s the idea of spending. Like, that settlement money is meant to support stability, not just create a quick feeling of “okay, life is good now.” It’s not fun to think about, but planning matters. It matters because without a plan, money doesn’t disappear slowly; it disappears in chunks, which, yes, is a problem.

Just Start by Defining What the Money Needs to Do

Well, before anything gets paid off or purchased, it helps to slow down and decide what this money is actually for. So, stability is usually the goal, right? Well, that can mean covering therapy or ongoing care, maybe even due to a juvenile facility sexual abuse report you dealt with for years, meaning years of therapy, making housing feel secure, handling debt that’s been hanging around, or setting up a cushion so there’s breathing room for the next few years. This part is important because the biggest threat to settlement money isn’t always one big spending decision.

Instead, it’s a bunch of smaller ones that feel justified in the moment, especially when life has been stressful for a long time. And no, it’s not fun like winning the lottery, because settlements aren’t some fun “get rich quick” thing; these long lawsuits happen for a reason.

Give Yourself a Pause Before Big Decisions

There’s usually a window right after a settlement where it’s tempting to do everything at once. Like, fun upgrades or something like that, but no, it’s best to wait weeks for something like that. You have to think clearly, and “life-changing money’ hitting you at once can mean you’re not thinking the same.

It’s Fine to Keep it Private

One dramatic example was already mentioned, but for whatever reason, you’ve got this settlement money, just keep it to yourself, or at least only keep it to close family/ loved ones. The reason alone is already private and serious, and the settlement money too should also be kept private. People might give unsolicited advice on how to spend the money, ask for money, or worse than that, hence why you should keep it to yourself.

Build a Realistic Monthly Budget With Long-Term Costs in Mind

Can’t work a regular job? Have to see a therapist on a regular basis? On medication? Well, all of these costs you. A common mistake is treating settlement money like it’s endless, because the number can look big.

But the reality is that long-term stability usually comes from breaking it down. What does life cost per month, and what needs to be covered over the next year, two years, five years? All those medical and mental health care and issues add up really fast.

Oklahoma judges handle high-exposure personal injury cases with added structure and closer oversight. Higher potential awards and busy court calendars place more emphasis on clear claims, defined liability theories, and focused requests for relief. Courts expect pleadings that outline issues plainly, propose realistic schedules, and tailor discovery to the scope of the case. Briefing limits and targeted motions are common tools judges use to manage time efficiently.

Meeting these expectations helps cases move more predictably and reduces unnecessary disputes. Judges respond favorably to organized medical records, compliant expert disclosures, and focused witness lists. Helpful submissions include exhibit indexes, damage summaries, witness time estimates, and practical scheduling proposals. These materials support consistent rulings and help parties plan litigation steps with fewer delays across complex litigation timelines.

Case Framing: Establishing Credibility Early

Clear case framing allows judges to evaluate credibility without sorting through unnecessary detail. An Oklahoma personal injury attorney builds this clarity through alignment of each damage category with a recognized cause of action under applicable state law and consistent terminology across pleadings, discovery, and motions. Liability theories should connect specific duties to alleged conduct, supported by relevant statutes or controlling judicial authority when available. This structure helps the court understand the legal basis of the claim quickly and reduces confusion during early rulings.

Consistency across filings improves clarity and limits decisions driven by procedural uncertainty. Motions should state precise relief and link each request to the identified causes of action. Avoid broad or undefined remedies that require clarification. Updating case framing as facts develop keeps filings accurate and makes it easier for the court to rule on the specific legal questions presented.

Effective Case Management Signals

Strong case management signals preparation and respect for the court’s workload. Discovery disputes should be narrowed by identifying specific documents, custodians, and witness testimony at issue. Phased or limited production schedules help manage volume while preserving necessary discovery. Tailored privilege logs and focused motions reduce unnecessary hearings and keep factual development on track.

Practical scheduling proposals include concrete deposition dates, realistic witness time estimates, and planned windows to resolve disputes without emergency filings. Consistent filing practices, timely meet-and-confer reports, and prompt responses to procedural orders show organization and reliability. These habits build judicial confidence and support steady case progression toward trial or negotiated resolution.

Expectations for Evidence Organization and Readiness

Well-organized evidence reduces review time in high-exposure personal injury cases. Medical records should be arranged chronologically, with clear links between diagnoses, treatment, and billing entries. Exhibit indexes should reflect intended trial use, separating foundation documents, demonstratives, and substantive exhibits. The structure allows judges to rule more efficiently on evidentiary issues.

Expert disclosures must include timely reports, qualifications, and clear bases for opinions, supported by underlying work product related to causation and damages. Witness lists should be limited to individuals offering direct, admissible testimony and include realistic time estimates. Damage summaries should remain current and clearly labeled so scheduling and rulings can proceed without delay.

Professional Conduct and Its Influence on Judicial Perception

Professional conduct influences how judges evaluate counsel in high-exposure cases. Written submissions should rely on legal standards, record citations, and admissible evidence rather than personal attacks. Clear, restrained briefing respects the court’s time and reduces the risk of adverse reactions. Maintaining consistent positions across motions and proposed orders avoids confusion and supports credibility.

During hearings, concise explanations supported by targeted record references help resolve disagreements efficiently. Adherence to local rules, punctual appearances, and courteous exchanges carry more weight than aggressive rhetoric. Such practices support productive hearings and help the court move issues toward resolution without unnecessary friction.

Indicators of Trial Readiness

Trial-ready filings show the court how proceedings will unfold. Proposed timelines should outline testimony order, exhibit use, and realistic time allocations. Linking each exhibit to the witness who will lay its foundation allows judges to assess pacing and address evidentiary issues in advance.

Proposed jury instructions should track Oklahoma personal injury law, cite applicable statutes and controlling state cases, and include only elements supported by the evidence. Damage calculations should be updated, clearly annotated, and supported with referenced records. Submitting final exhibit lists and witness estimates before pretrial conferences helps the court set realistic trial dates and issue informed rulings.

High-exposure personal injury cases move more smoothly when filings are clear, organized, and tailored to the court’s expectations. Oklahoma judges look for defined claims, focused discovery plans, and evidence presented in a practical format that supports efficient review. Attention to scheduling, expert disclosures, and witness preparation reduces avoidable disputes and helps keep cases on track. Professional, consistent advocacy further supports productive rulings. When these elements come together, courts can manage complex cases more effectively, and parties benefit from clearer timelines, more predictable decisions, and better opportunities for resolution or trial preparation

Things are rough for many right now across the developed world and it can seem like there isn’t much hope for improvement. Everyone has been hit by a strong wave of inflation which has made daily life more costly and the housing market is reaching a breaking point. The jump in home prices during Covid, followed by the drastic increase in mortgage rates has made home affordability out of reach for most.

Recently, an article about how $140K could be the new poverty line captured the mood, but also put a crushing exclamation point on it. It starts to feel like anyone who hasn’t found a home yet is screwed and that the American Dream is simply running away. The goal of this article is to put forward a few thoughts that help show how the math could start to turn back in our favor for the biggest pain point, the housing market.

Home and Rent Prices are down dramatically across a number of cities

The city that exemplifies this the most is Austin, TX. Its a city I lived in for 6 years and watched explode during the 2010s. I never would have figured that this housing market would cool off, but I also didn’t expect the ridiculous quantity of homes and apartments that would go up. Each trip my family takes back to the city there are new complexes built it doesn’t seem to be slowing too much even with the price drops.

What this drop has shown is that there are limits to the housing madness, but also it gives a roadmap for other cities. Even the construction of luxury apartments has shown to be part of what is bringing the prices down overall. Wealthier people are moving up to the new units, but it creates openings lower down. This creates opportunities for folks down the ladder to find a place.

The cause for hope is that many have thought the need was to build housing for middle class renters, but the reality is even housing that is focused up the income ladder still opens up spots. This cascade can really help people who are in the outlying areas where rents may drop off the most due to cooling demand. Austin has given proof of concept which then puts pressure on other cities to get building if they really care about their citizens.

Image of Moontower Saloon in the affordable 78748 zip code in South Austin

Restaurants and coffee shops continue to spread into the outer neighborhoods of Austin which makes these areas more fun to call home. This trend, coupled with the dramatic drop in prices for both rent and homes in the greater Austin area creates better chances for younger people to get traction.

Smaller, Affordable Cities are Quietly Getting Cooler

The funky bars and cool coffee shops are spreading around Austin, but they are also finding their way into the smaller metro areas around the country. One of the major factors in my families decision to relocate back to my hometown of Spokane, Washington was that it had more and more pockets that reminded us of Austin.

Image of Indaba Coffee Shop in Spokane in the affordable 99205 zip code

Spokane is among the many mid-size cities across the country that don’t inspire much nostalgia from people who aren’t connected to them. These are the sleepy places where people grow up and move to a big city like Seattle or Portland. However, as the years go by, more and more places are popping up that are bringing big city culture into the smaller metros. A reason for this is that the people opening these hip businesses also need to afford a place to live.

I’m sure if I ventured into any of the mid-size metros across the US, I could track down enough trendy spots to keep most people happy. These cities aren’t turning into Seattle or San Francisco, but they have enough. The key is to find a place with enough to make you happy, but not enough to turn into the next Bend or Bozeman. Being a little trashy is perfect to keep the super rich away.

I’m sure there are a ton of people who would puff out their chests to say that a place like Spokane could never compete with Seattle or Austin, but that is a big part of why there is hope here. Places like Spokane will never get the hype of the big cities which will always keep them more reasonable and therefore keep them a place where you can hope to afford a home.

Slow Housing Market Opens the Door for Fixer Upper Deals

I can still remember the chaos of the housing market in the great blitz from 2010 – 2020 where offers were flying and bidding wars were the norm. In that rush, it didn’t matter if a place had bad carpet or needed all the flooring replaced. Prices were just going up and if you wanted to be slow you would just be sitting on the sidelines.

Now the vibe is completely different in most places. Homes aren’t selling as quickly and if they have some issues they can fall further than they should. Its not like things are going to drop into the bargain basement, but things can definitely fall further than they should. Most first time home buyers simply don’t want to deal with the work to bring new life to a home in less than optimal shape.

Additionally, since the numbers for investors are so much less appealing in the higher interest rate environment, there isn’t the competition when homes drop like there was in the past decade.

This is where the terrible vibes for the housing market really give a great opportunity. Most will simply not go looking and so they won’t see where the numbers may actually look really good for an older house that a family is looking to unload. Even in the heated market during Covid, homes that need work still slipped through because people can’t always see the potential. Now that the mood has soured, there is more potential for homes to drop to a spot where it could be right to buy.

Real estate prices are very chaotic and hard to pin down due to the variablity of homes. This can make it very challenging, but it also creates opportunity.

Some parts of work are meant to stay in the background. They hum along quietly. You trust they are working, so you give your attention to everything else that feels more important or more interesting.

Until one day, they stop being quiet.

Not loudly. Not dramatically. Just enough to pull your focus back. You find yourself checking something twice. Following up sooner than usual. Wondering if you missed a step. And suddenly, a system you barely thought about is taking up more mental space than it should.

That shift is subtle, but it matters.

Clarity Is a Form of Relief

Most operational friction is not caused by complexity. It is caused by lack of clarity. When information is incomplete, inconsistent, or delayed, the brain fills in the gaps with uncertainty.

That uncertainty lingers. It shows up as mild tension. As small interruptions in focus. As the feeling that something is unfinished even when you are trying to move on.

Clear systems reduce that noise. They let you trust that things are moving as they should, even when you are not actively watching them.

The Cost of Mental Interruptions

Every time you stop to check on a process, you lose more than a few seconds. You lose continuity. The flow you were in does not always return immediately.

Over time, these interruptions add up. Not in a way that looks dramatic on a calendar, but in how work feels. More fragmented. Slightly heavier. Less smooth.

This is why well-designed systems matter. Not because they are impressive, but because they protect attention.

Why Consistency Matters More Than Speed

There is a temptation to prioritize speed in operational tasks. Get it done quickly. Move on. But speed without consistency often creates more work later.

A process that works the same way every time builds trust. You stop second-guessing it. You stop checking behind it. That trust frees up mental space.

The process of invoicing, like many back-office processes, benefits from this consistency. When it is predictable, it becomes invisible again. And invisibility, in this case, is a good thing.

Emotional Energy Is Part of the Equation

Work is not just mechanical. There is emotional energy involved, even in routine tasks. Some processes carry a subtle emotional weight. Follow-ups. Timing. Expectations.

When systems handle these moments cleanly and clearly, that emotional load decreases. You are not bracing yourself. You are not rehearsing messages in your head.

The work feels lighter, even though the tasks themselves have not changed.

When Structure Supports Momentum

Good structure does not slow work down. It supports momentum. It creates a steady rhythm that lets you focus on higher-level thinking without constantly dropping back into maintenance mode.

You notice this most when the structure is missing. Work feels choppier. Progress feels less satisfying. Small things pull attention away from bigger goals.

When structure is in place, work flows more easily. Not faster, necessarily. Just more smoothly.

Letting the Quiet Systems Stay Quiet

The best operational systems are the ones you rarely think about. They do their job without demanding attention. They do not create questions. They do not create follow-ups.

They let you stay focused on the parts of work that actually need your judgment, creativity, and presence.

And when those systems work well, you do not celebrate them. You forget about them.

Which, honestly, is exactly the point.

The office is no longer the heart of work. Team members are now spread across the country or continents. They log in from their homes, coworking spaces, airports, coffee shops, and sometimes even from the backseat of a car between meetings. Work has officially gone mobile, and so have the tools people rely on to stay connected and productive.

Relying solely on traditional desktop HR and payroll systems is just slowing everyone down. Mobile-first apps are now a necessity for speed and efficiency. They put the entire HR management system right in your pocket. This flexibility helps you develop a skilled and empowered workforce.

Ready to shift to mobile-first HR and payroll apps? Here is a look at some of the leading mobile-first apps shaping how U.S. teams manage work, pay, and compliance in 2026.

1. Paylocity

Headquartered in Schaumburg, Illinois, Paylocity is best suited for SMBs and the mid-market, serving 50 to 500+ employees. It offers everything from integrated HR and payroll to complex scheduling in one platform.

The mobile app is designed to be employee-centric and native, meaning it feels fast and reliable. Managers can easily create, view, and edit schedules and shifts right from their mobile devices.

For on-the-go teams, Paylocity simplifies time management. Employees use intuitive tools to view balances and request time off from one platform. Supervisors can quickly track attendance and approve requests. The system provides over 100 reports for instant operational insights.

Paylocity offers comprehensive tax preparation services. It’s a Registered Reporting Agent with the IRS in all 50 states. Its services cover federal, state, and local withholding and unemployment tax returns. It also files all W-2s and resolves tax notices on the client’s behalf.

For 2026 readiness, Paylocity has streamlined expense reporting. Employees can simply snap a picture of a receipt with their mobile phone. Generative AI then takes over, automatically extracting all the relevant details, which speeds up the whole reimbursement process.

2. Gusto

Gusto is the perfect choice for U.S.-based small businesses (SMBs) who want to make payroll and benefits simple.

The platform is famous for its user-friendly interface, which is why many administrative assistants and small business owners trust it. Payroll setup can take less than 30 minutes, which is super fast. AutoPilot™ runs payroll automatically on schedule.

Gusto handles tax filings for all 50 states. This simplicity gives small business owners great peace of mind. Admins can review and approve timesheets and time-off requests right on the mobile app. They can manage payroll on the go from anywhere.

The Gusto Wallet app is a major perk designed just for employees. Workers can easily save money and split their deposits. They can even get early access to earned funds, which helps cover bills. This seamless feature boosts financial wellness across the team.

Gusto’s AI assistant, Gus, simplifies complex issues related to payroll, HR, benefits, and compliance. Gusto research shows that small businesses using generative AI report significant gains. Many report productivity gains of at least 20%.

3. Rippling

High-growth companies that need a unified platform covering HR, IT, and Finance must go for Rippling.

It scales effectively from small teams to large workforces of 5,000+ employees. This unified approach reduces tool sprawl and provides a modern, intuitive experience. Rippling is particularly ideal for companies with distributed or international teams.

Rippling includes comprehensive mobile device management (MDM) for Windows, Mac, iOS, and iPadOS. This transforms device security from a technical task into an automated business process. It supports zero-touch deployment, shipping new devices pre-configured directly to remote workers.

Security and offboarding are highly automated. When an employee is offboarded via HR, Rippling automatically schedules the locking and wiping of their device. This process mitigates security risks for remote employees. Rippling also handles the physical logistics of device retrieval and secure warehousing globally.

The platform guarantees 100% accuracy on all automated tax filings. It calculates, files, and remits federal, state, and local payroll taxes automatically. Employees can access pay stubs and download W-2s/1099s via the mobile app. The system proactively alerts clients whenever tax or labor laws change.

4. Deel

Deel is built specifically for US companies managing a workforce across international borders. If you hire people across the globe, Deel provides one unified platform for global HR, payroll, and compliance. This way, it simplifies the management and payment of global contractors.

The Deel mobile app delivers an exceptional team experience for remote workers. Team members can access important work information wherever they are. They can securely transfer funds to preferred accounts. Users can view payslips, manage time off requests, and submit expenses directly through the app.

Deel is highly regarded for payment flexibility and transparency. It supports more than 15 payment methods globally, including cryptocurrency. This caters effectively to a decentralized, digital-native global workforce. The platform helps manage worker classification and minimizes the risk of misclassification.

The 2026 roadmap includes AI-powered tools for misclassification detection. Deel also offers AI-powered products to manage goals, performance, and learning development.

5. BambooHR

PCMag recognizes BambooHR as an Editors’ Choice for general HR management software. The platform’s core value is its focus on employee development and engagement. It provides a comprehensive, all-in-one system for HR, payroll, recruiting, and performance management.

The system stands out for its exceptionally friendly user experience. Its mobile app features a clean and intuitive interface. Employees and HR staff find it easy to navigate, requiring minimal training. The system centralizes employee records, allowing self-service on the go.

The mobile solution features a highly efficient time-off management system. Employees can easily request and track available paid time off (PTO) balances with a few taps. Managers receive instant alerts and can approve requests instantly via the mobile app.

The platform automatically connects time-off data to managers and payroll, preventing errors. This streamlined process saves HR teams and employees significant time each week.

The most noteworthy feature of BambooHR is the Ask BambooHR® AI Chat. This AI-powered chat gives employees immediate, reliable answers to routine policy questions right inside the mobile app. The answers are pulled directly from the company’s HRIS records, policies, and manuals.

6. Papaya Global

Papaya Global specializes in Enterprise-scale EOR and global payroll. The unified platform is built to onboard and pay thousands of employees compliantly. It supports global payments and compliance in over 160 countries.

Papaya uses optimized payment rails for transfers. These rails are much faster and cheaper than traditional SWIFT payments. A high 95% of payments settle on the same day. The platform’s core superpower is financial compliance and guaranteed speed for global pay.

For employees, Papaya offers the ‘Papaya Personal’ mobile experience. Workers get compliant contracts and real-time tracking through the app or a web browser. They can access all documents, including payslips and benefits information, in one place.

The app also simplifies contractor management and time and attendance tracking. Employees can even securely update their banking details directly on the portal.

In 2024, Papaya focused on AI adoption. AI integration has significantly improved performance metrics. The system has achieved up to 99.7% more accurate payment delivery. It has also reduced payroll processing times by up to 40%.

7. Paycor

Paycor is a great choice for mid-market teams. They are best for HR-focused small businesses prioritizing workforce insights.

The platform features a modern, comprehensive mobile-first design. This structure ensures employees and managers can access critical information from anywhere. Employees can easily view pay details and HR documents on their devices. Managers gain deep insights and real-time analytics for decision-making.

Furthermore, Paycor offers financial wellness tools, including the Paycor Visa Card and On-Demand Pay options. Providing immediate access to earned wages via the mobile app is a key tool for employee retention in fast-paced, hourly environments.

Paycor excels at integrated talent management and acquisition. It uses cutting-edge AI-driven recruiting to source talent faster and at lower costs. This tool gives recruiters a competitive edge. The system supports talent management, development, and workforce productivity.

8. Workday

Designed for the largest, most complex global enterprises, Workday is a premier Human Capital Management (HCM) solution. It focuses on providing a secure, comprehensive system with deep functionality across all HR areas, including payroll, learning, and talent optimization.

The Workday mobile app is a secure, comprehensive self-service tool. Employees can submit expenses, check in and out for work, request time off, and access their learning courses instantly. Managers can approve requests and perform essential job changes or compensation updates wherever they are.

Workday excels in advanced talent management features. The AI-powered Skills Cloud is a key feature in this area. This technology surfaces employee potential and skills through dashboards. It supports personalized growth paths and helps drive higher retention rates.

Workday also has a conversational AI feature called Intelligent Answers. This feature allows deskless workers to ask complex questions directly within the app and receive instant, AI-powered responses.

Selecting the Right Mobile-First Platform for Your Team

Mobile HR technology is now a core business process for success in 2026. It is certainly not just an optional feature anymore. These powerful apps help you hire, pay, and manage people anywhere easily.

When taking your pick, prioritize systems that offer seamless integration. Look for platforms that effortlessly combine HR, time tracking, and payroll functions. This deep integration reduces errors and ultimately saves your entire team valuable time.

Now, go try some demos and see which app feels like the best fit for your specific team.

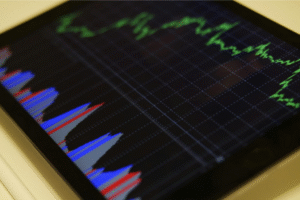

Putting all of your money in one place is rather like that old adage of putting all of your eggs in one basket; it’s a really bad idea because, if something goes wrong it will decimate all of your savings, rather than just a small portion of it. That’s why people who know their eggs (pun intended) when it comes to financial investments will always advise you to diversify your portfolio and invest in a lot of different interests. Below, we are going to take a look at some of the most interesting ways you can do that in 2026.

Mix Traditional Assets with Modern Twists

Stocks, bonds, and ETFs still form the backbone of many portfolios, and for good reason. They’re familiar, regulated, and relatively easy to manage. But modern investors are getting creative by blending traditional assets with newer options that offer different growth patterns.

The idea isn’t to abandon the basics, but to pair them with assets that don’t all move in the same direction at the same time.

Add a Touch of Precious Metals

Precious metals have been a diversification favorite for centuries, and they’re still holding strong in 2026. Gold, in particular, is often seen as a hedge against inflation and market volatility.

Some investors enjoy holding physical gold for its tangible value, such as coins or bars. Collectible options like the 2026 Gold Buffalo Coin combine intrinsic metal value with the appeal of limited releases, making them an interesting addition for those who like their investments to feel a bit more real.

Explore Real Estate Without Buying a Building

Real estate doesn’t have to mean becoming a landlord or dealing with late-night maintenance calls. In 2026, many investors are accessing property markets through REITs, crowdfunding platforms, or fractional ownership models.

These options allow you to benefit from property income and appreciation without the headaches of owning bricks and mortar outright. It’s real estate diversification with far less commitment.

Consider Alternative and Passion Investments

Alternative investments are gaining traction, especially among investors looking for variety. This could include art, collectibles, vintage items, or even niche markets tied to personal interests.

While these investments can be less liquid and harder to value, they add a layer of diversification and, in some cases, enjoyment. Just remember that passion investments should complement your portfolio, not replace its foundation.

Look Beyond Your Home Market

Geographic diversification is often overlooked. Investing internationally can expose you to different economic cycles, industries, and growth opportunities.

Global funds and international ETFs make it easier than ever to diversify across regions without needing deep knowledge of every local market. It’s a simple way to avoid being overly dependent on one economy.

Balance Growth with Stability

Diversification isn’t just about adding more assets; it’s about balance. High-growth investments can boost returns, while more stable options help smooth out volatility.

The key in 2026 is building a portfolio that reflects your goals, time horizon, and comfort with risk. A well-diversified portfolio doesn’t eliminate risk, but it helps you manage it intelligently.