Having a complicated life is not optimal. Living the simple life and looking to simplify things over time can do wonders for your experience in life. In this post, you’ll learn about some easy ways to simplify life.

There is beauty in simplicity. Living a simple life, a life where you can do what you want without distraction, can be attained with the right steps.

If you are like me, you have maybe felt the overwhelming burden of stress in one form or another during your life.

Bu,t did you know about all the adverse effects stress can have on your long-term health and quality of life?

Stress in its chronic (long term) form has a long list of symptoms including, but not limited to: mental health problems, cardiovascular problems, gastrointestinal problems, sexual dysfunction, and eating disorders. That’s quite the list!

Sadly, you often cannot control the sources of stress in your life.

But what if I told you that there is, quite literally, a simple way to manage stress?

Making efforts to simplify your life is a great way to limit your exposure to stress.

In this post, I’m going to share with you 5 foolproof ways you can simplify your life and live more simply.

5 Ways to Simplify Life and Live a Simple Life

Living a simple life is doable with the right framework and plan. While it might sound easy, living a simple life can be tough with all of the distractions that surround us in the 21st century.

The 5 foolproof ways to simplify your life are:

- Block out the noise

- Re-Evaluate your Time Commitments

- Take it one day at a time

- Automate your Finances

- Destroy your Debt

Let’s get into each of these in more detail below.

1. Block Out The Noise

The first step to simplifying your life is to block out noise.

Noise is everywhere in life, both figuratively and literally. This method of simplifying your life focuses on the figurative noise all around you. What is this noise exactly?

I deal with statistical noise all the time at my 9 to 5 job. Take a look at the graph below: the red points are the actual data, while the blue line is a trend. The jagged ups and downs of the red lines are “noisy” compared to the smooth curve of the blue trend line, which is the line that is significant.

Noise of any kind cannot be controlled, anticipated, or prevented. All you can do is tune out the noise, leaving only the important things behind.

Tuning out statistical noise is a common task for me at my 9 to 5 job. You can apply the same concept to remove distractions and become successful in your life as well.

The Sources of Noise in Our Lives

The noise of the world is greatly amplified by technology. The best place to start filtering out noise is the device in the palm of your hands! These are all steps you can take from your phone.

Go to your email inbox and see how many promotional emails you’re receiving. How many of these actually benefit you? If you unsubscribe from email lists that don’t provide value, you can make your inbox tidy and distraction-free.

Another huge source of noise is the news. The matter of fact is that much of world news is irrelevant to your daily life.

Should you be informed? Certainly. But, to the point where the negativity of it all is hindering you? Absolutely not.

Be wary of consuming news content in any form, whether it is through TV, social media, or mobile apps.

Finally, limit your exposure to social media. Not only can it take up a lot of time, it can also promote some toxic behaviors such as comparing yourself to others.

2. Re-Evaluate your Time Commitments

The second step in simplifying your life is to re-evaluate your current time commitments.

You have 168 hours every week. How do you use them currently, and how do you want to use them?

Everyone has a different answer. We all have different commitments, and we all enjoy our free time in different ways.

I want you to take a good, hard look at your commitments. What are they?

Here are the categories you should look over:

- Work

- Look at how many hours a week you work, including your commute time. Work should be challenging and rewarding, but it should not be consuming.

- If work feels like the latter, consider making changes that will bring balance to your life. This can be as simple as learning to say no to extra work, or as drastic as changing positions or companies. Put your own wellbeing first!

- Sleep

- How much sleep do you get? Odds are you do not make sleep as high of a priority as you’d like. You will eventually pay for this with the many side effects accompanying fatigue.

- Exercise & Nutrition

- This is one many find challenging. You only have one body; are you eating what you need to ensure its well being?

- Exercising 3 times a week would take up no more than 4 hours of your week (including changing / showering). Can you fit these 4 hours, or 2.38% of your week, into your schedule?

- Relationships

- Are you seeing your friends and family as often as you’d like?

- Take a good, hard look at the quality of your relationships. Toxic ones should be removed from your life to free up both valuable time and energy.

A Tip Prioritizing your Time

Someone once told me, “Try saying ‘it’s not a priority’ instead of ‘I don’t have time’.”

Now, this person didn’t have an original idea by any means; this mindset has been explored many times on the Internet.

However, it still holds meaning!

Revisit the previous examples.

Say, “The gym is not a priority” instead of “I don’t have time for the gym”, and see how that sounds to you. If you are content with that, then no further action is needed.

Consider truly making a change if the act of saying that bothers you.

3. Take it One Day at a Time

3. Take it One Day at a Time

The third step in simplifying your life is to take things one day at a time.

It can get overwhelming real quick when thinking about the future. How are you supposed to know what you want 5 years from now when you don’t even know what you want for dinner tonight?

While it’s important to have goals for the medium to long-term, you also need to take life one day at a time.

Here is a trick to stop the future from stealing time and energy in the present. All you need to do is set aside dedicated time every day or every week. Any time something about the future comes up, write it down!

You aren’t allowed to think about those thoughts until the dedicated time you’ve set for yourself. You’ll be relieved knowing you’ll have a set time to think about these worries later. You’ll save precious time today by not dwelling on the future.

If this sounds like an intriguing idea to you, then you may want to buy yourself a daily journal. You start every morning setting your goals for the day, and finish it by reflecting on your day and whether or not the goals were accomplished. It takes no more than 5 minutes out of your day!

4. Automate Your Finances

The fourth step in simplifying your life is automating your finances.

Thinking and worrying about money can take a toll on you. 62% of Americans are stressed about finances in some way, according to the APA.

Full disclosure: this method won’t magically solve all your financial problems.

However, it will help you onto the right track, especially if you struggle to manage discretionary spending.

Most, if not all banks allow for the setup of auto-transfers between accounts. What you have to do is set up a recurring auto-transfer that is in sync with your payday.

If you get paid every second Thursday; you can set an auto-transfer for every second Friday, moving money from your checking account to your savings!

Automating your savings contributions allows you to simplify your life by removing one key element: the element of choice.

There is one less decision to be made, and one less dilemma to think about. When you automate your finances, you are saving.

You need to be careful though. You must ensure that you aren’t saving too much, or else you won’t be able to pay your bills.

Taking a quick tally and projecting your regular expenses will help you figure out how much of a contribution you can afford.

5. Destroy Your Debt

5. Destroy Your Debt

The fifth and final method is also a personal finance one: destroy your debt!

We already discussed about the strong ties between finance and mental well-being.

Sadly, those ties are even stronger when it comes to debt.

In fact, people with mental health problems are 5 times as likely to have problem debt (i.e. debt in which you cannot keep up with the payments). 86% of respondents with mental health problems (from the same survey) said that their debt was a contributing factor.

Luckily for you, there is a whole section of this site dedicated to destroying your debt. Having an effective plan to pay off debt will clear up both your finances and your mind.

The Two Methods to Pay off Debt Effectively

You will need to come up with a list of all your debts (balances and interest rates) in order to work with either of these two debt pay off methods, so I suggest you do that first.

The two methods are:

- Debt Snowball Method – paying extra towards your smallest balance first, then your second smallest, and so on. Like a snowball growing larger building momentum!

- Debt Avalanche Method – paying extra towards the debt with the highest interest rate first, and then second highest, and so on. You start high and work your way down, like an avalanche.

In case you’re wondering which method is better, the answer is “it depends.” The debt avalanche method is mathematically the best option, as it will save you the most money in interest.

However, personal finance is personal. You need to take psychology into account, which is where the debt snowball method has the advantage.

Paying off smaller debts first triggers the reward mechanisms in your brain and leaves you motivated, wanting to chase the next “reward.”

By paying off debt, you’ll be able to continue to focus on what matters to you and live a simpler life.

Start Living a Simpler Life Today

You now have multiple new tools at your disposal that can be used to simplify your life.

Filtering out noise and re-evaluating your commitments will lead to less stress and pressure on you.

Focusing on one day at a time allows for small but consistent progress to compound and help reach your long-term goals.

Automating your finances and destroying debt will help mitigate one of the leading stress producers – financial trouble!

Implementing some or all of these techniques in an intentional and proactive manner will lead to a simpler, more rewarding life.

A simple life may not happen overnight. However, over time, you can definitely find success and reach your goals.

The best time to start, as always, is today. Get out there and take the first step towards a simpler life today.

Managing finances effectively is critical to running a successful small business, requiring owners to navigate financial challenges with limited resources and tight budgets through precision, foresight, and careful decision-making.

According to the Chamber of Commerce, around 18% of small businesses fail to survive within the first year, often due to financial mismanagement, among other reasons, emphasizing the importance of understanding financial intricacies for success.

Small business owners can establish stability, growth, and resilience in the competitive landscape by implementing effective strategies, optimizing cash flow, and monitoring key indicators. Additionally, investing in professional development, utilizing financial tools, and staying informed about industry trends further enhance their financial management capabilities.

Now let’s discuss some powerful tips to help small businesses manage their finances better and increase their chances of success.

Invest in Your Professional Development

Investing in professional development is crucial for small business owners seeking to strengthen their financial management skills. Pursuing relevant courses or certifications is invaluable for staying current with the latest financial tools, software, and technologies that effectively streamline financial processes and improve efficiency.

Keeping abreast of industry advancements empowers small business owners to leverage innovative solutions and stay ahead of the curve in financial management. Furthermore, these programs offer practical insights and real-world case studies that can directly translate into effective financial management practices.

Small business owners can enroll in an MBA in accounting online, which provides comprehensive knowledge and skills tailored to managing finances in a business setting. This program covers financial principles, strategic planning, budgeting, and managerial accounting, providing a strong foundation for financial management. The knowledge gained empowers business owners to tackle complex financial challenges, develop robust strategies, manage cashflows, and effectively communicate financial information to stakeholders.

Moreover, the online format of this program allows small business owners to balance their work commitments while studying at their own pace.

Create a Comprehensive Budget

A budget acts as a financial guide, allowing you to monitor income and expenses, strategically allocate funds, and make informed decisions for your business’s growth and sustainability.

To create a comprehensive budget, evaluate your historical financial information and identify income sources such as sales revenue or client payments. Next, carefully analyze your expenses, categorizing them as fixed (e.g., rent, utilities) or variable (e.g., marketing, inventory). Also, consider recurring and one-time expenses, such as equipment purchases or marketing campaigns. Equipment can be expensive, but you can make savings by visiting sites like this one here. Once your equipment has been bought, you shouldn’t need to replace it for a long time.

Once you understand income and expenses, allocate funds to various business areas, including marketing, research and development, employee salaries, and contingency funds.

Lastly, regularly review and adjust your budget to align with business goals and changing market conditions, thus helping maintain financial stability.

Monitor Cash Flow

Cash flow serves as the essential lifeline for your business, representing the inflow and outflow of money that keeps your operations running smoothly.

Begin by closely monitoring your revenue streams, tracking sales, client payments, and other income sources specific to your business. Real-time revenue visibility is crucial for meeting financial obligations and planning future growth. By registering with a bank that offers small business banking solutions they can help monitor transactions and provide services for you that would be beneficial to your business. For example, if your company is healthcare focused many banks will offer services like improved payment practices and financing for new equipment.

Carefully track outgoing cash and analyze expenses to identify cost-saving opportunities. This may involve negotiating better deals with suppliers, implementing cost-cutting measures, or streamlining operational processes to eliminate unnecessary expenditures.

To enhance cash flow, consider implementing incentives for early customer payments, which can encourage prompt payments and improve available cash.

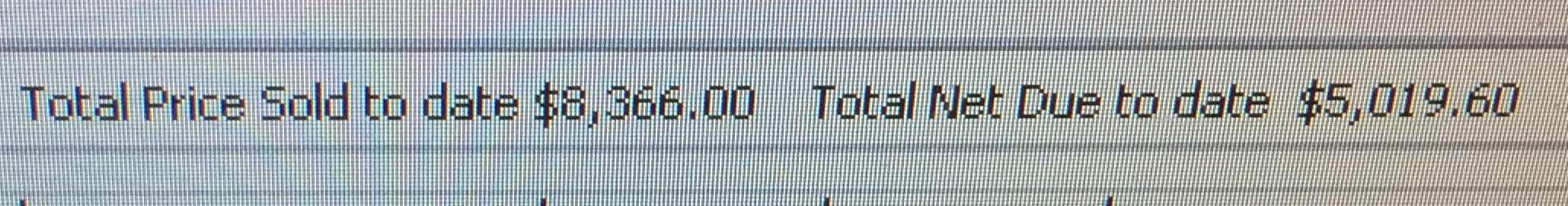

Implement Effective Invoicing and Payment Processes

Implementing efficient invoicing and payment procedures is crucial for small businesses to uphold a robust cash flow, make accurate payments, and reduce payment delays.

Begin by utilizing professional invoice templates that outline products or services and their related costs, or even software like this booking and invoicing software, if it suits your business. To ensure clarity and prompt payment, clearly state the payment terms on the invoice, including the due date and any applicable penalties for late payments. This encourages timely settlement and reduces the likelihood of payment delays. Additionally, offer incentives like rewards or discounts for early payments that motivate customers to settle their invoices promptly.

Leverage Technology

Embracing technology tools and software can streamline financial processes, enhance efficiency, and provide valuable insights for informed decision-making.

An essential tool for small businesses is accounting software, which allows tracking of income and expenses, invoice management, financial reporting, and simplified tax preparation. With automated features and built-in functionalities, this software saves time and reduces manual errors.

Cloud computing is another trend, offering secure data storage, remote access to financial information, and seamless collaboration. Traditional cloud networks are those which are either public or private, although there are also hybrid cloud networks which can use a combination of the two. Another type of cloud infrastructure that businesses could use is multi-cloud. A multi-cloud strategy enables businesses to choose services across clouds that best fit their requirements to improve business resiliency and achieve digital transformation goals.

Furthermore, various technology tools are available to streamline financial processes, including expense management software, payroll systems, electronic payment platforms, and financial analytics tools.

Plan for Taxes

Planning taxes and staying proactive in meeting your tax obligations is crucial when managing your small business finances.

Start by understanding the tax laws and regulations applicable to your business and staying informed about changes and updates. Maintain accurate and organized records of income, expenses, and deductions.

Know key tax deadlines for filing returns, making estimated payments, and submitting required forms. Failure to meet deadlines leads to penalties, so meeting obligations on time is crucial.

Build Emergency Funds

Establishing a contingency fund is a crucial part of small business financial management. Firstly, it ensures financial stability and resilience during challenging periods without disrupting operations or accumulating high-interest debt.

Secondly, an emergency fund enables you to seize unforeseen opportunities. These could include unexpected expansion prospects, investments, or strategic partnerships.

Lastly, an emergency fund showcases financial discipline and responsible management, reflecting your ability to plan, manage risks, and navigate uncertainties. This enhances your credibility with lenders, investors, and stakeholders.

Explore Small Business Loan Options

Exploring small business loan options is important when managing your finances as they provide the necessary capital for growth, expansion, or addressing financial challenges. The most common loan options are:

- Traditional Bank Loans – These loans are common for small businesses and typically require a strong credit history, collateral, and a detailed business plan. They offer competitive interest rates and longer repayment terms, making them suitable for larger investments.

- Crowdfunding – Utilize crowdfunding platforms to raise funds from individuals who support your business idea or project, which is especially beneficial for startups or businesses with unique offerings.

- Microloans – Nonprofit organizations or community development financial institutions (CDFIs) provide small loans to assist businesses with limited access to traditional financing sources.

Conclusion

Effective financial management is crucial in establishing financial stability and fostering growth for small businesses. By prioritizing financial health and implementing the tips outlined above, small business owners can effectively navigate challenges, seize opportunities, and achieve their financial goals.

With effective strategies and a proactive mindset, you can achieve financial success and pave the way for a prosperous future.

Getting in shape and getting that beach body you’ve always wanted isn’t as easy as just working out consistently. Having a great diet is very important for getting in shape.

Sometimes, it makes sense to supplement your diet as well, and in this post, you’ll learn about 7 great workout supplements.

Hitting the gym, eating a balanced diet, and getting in shape are great habits to practice to lead a healthy life.

Maybe you want a little more from your life, and want to be very healthy and attain your dream body.

Part of becoming the master of your life is being physically and mentally healthy. By putting beneficial foods and supplements into your body, this can lead to feeling better over time.

While it is possible to attain an amazing physique with natural food, sometimes our bodies need a little boost from other healthy sources.

For me, for example, I don’t always eat enough protein during a day, and when I’m working out, I feel the need to replenish my muscles with a protein shake or protein bar.

Over the past few years, I’ve been experimenting with different workout supplements and believe I’ve found 7 workout supplements which are best for me.

Maybe they won’t be best for you, but by learning, experimenting, and seeing what works for you, you can work towards your dream body.

In this post, I’m going to share with you the 7 workout supplements I use to supplement my diet, and talk about the uses and benefits of each.

Let’s get into the article!

7 Workout Supplements to Take for Your Dream Body

Below is a list of the 7 workout supplements I personally use and think are great to become more healthy and reach your physical fitness goals.

I’m not a doctor – some of these may not be for you. Please check with your doctor to make sure these different products are suitable for your use.

The 7 workout supplements I use and believe are great for helping you get healthy are:

Let’s dive into each of these workout supplements in greater detail below.

1. Whey Protein

Protein is the building block of muscle, and is essential to have if you are looking to get stronger over time.

Whey protein is one of the most common workout supplements as it contains all 9 essential amino acids (the building blocks of protein). Essential amino acids must be obtained from food, whereas non-essential amino acids can be created internally.

For working out, building muscle, and having a healthy diet, having a lot of protein can possibly help you reach your goals faster.

I try to get at least 100 grams of protein a day, and on most days, I’ll get upwards of 150 grams (also, for reference, I weigh about 165 pounds – as of writing this).

Depending on your goals and bodyweight, you’ll want to research and figure out how much protein you need.

To supplement my workouts and overall health, I use whey protein powder once a day. Some people will have multiple protein shakes a day, but for me, I try to only have 1 “non-real” protein based “meal” a day for my stomach’s sake.

2. Creatine HCL

Creatine is one of the most cost effective and powerful workout supplements. Our bodies naturally have creatine running through them, but with a creatine supplement, you can get extra energy and muscle stimulation.

The one downside about creatine is there are no FDA approved supplements on the market.

That being said, I’ve used creatine on and off for the past few years and never had any issues (but I have had cramping a few times – you need to drink a lot of water with it – and have been careful if I ever had an upset stomach).

Make sure to do your own research and due diligence on these different supplements before using them.

While there is a lot of controversy on using creatine, again, it is a naturally occurring compound and one of the most commonly used supplements.

When buying creatine, I’ve been able to get 45 days worth of supplement for only $14.

With creatine, you get massive bang for your buck, and can see some good results, both in body composition and performance.

3. Pine Pollen

Pine pollen is one of my favorite supplements. This naturally occurring super food has many benefits and nutrients.

I was turned on to pine pollen by a friend because he mentioned pine pollen provides a natural testosterone boost.

In addition to this, there are many nutrients, anti-oxidants, minerals and amino acids which can provide you a nice boost for your workout and general well-being.

Pine pollen is available both in powder and tincture. I’ve tried both the powder and tincture, and recommend the tincture (the powder tastes like tree…)

For me, I cycle through a 4 oz bottle of Pine Pollen every few months. Over time, your body builds up a resistance to pine pollen. For this reason, I don’t take pine pollen all the time.

However, when I do take pine pollen, I love it and definitely would recommend giving it a try (but be aware it is a natural supplement, and not necessarily “regulated” as some other vitamins and supplements).

4. Bee Pollen

4. Bee Pollen

Bee pollen is another super food I take as a health supplement. Similar to pine pollen, bee pollen is a naturally occurring substance which has many enzymes, nutrients, minerals and amino acids.

In addition to being a super food packed with nutrients, there are some other benefits of having bee pollen.

One unexpected benefit I’ve found is how bee pollen contains some protein, and also can help with allergies.

Most Spring seasons, I’m hit with bad allergies. However this year (this is anecdotal), I didn’t get hit at all by allergies, and I’m wondering if it had to do with the bee pollen.

I typically take my bee pollen straight, or mix it in with a yogurt or fruit smoothie.

Again, this is a naturally occurring substance, and falls more into the “hippy” and “organic” supplement camp (though that doesn’t negate or lessen effects of bee pollen).

5. Fish Oil

Fish oil contains Omega-3 fatty acids, which are essential nutrients that are important in preventing and managing heart disease.

Much of our food is Omega-6 fatty acid based (from corn), and Omega-3 balances this out.

Since our diets do not include fish that much, that’s where fish oil comes in.

Taking fish oil over time has shown to be beneficial for a person’s heart. As you probably know, a healthy heart can allow you to perform exercise at a higher level!

I take fish oil for prevention of any heart issues, and for some of the other proven benefits of these fatty acids.

6. BCAAs

BCAAs are another workout supplement I take to supplement my exercises. BCAAs stands for Branched-chain amino acids.

Branched-chain amino acids are a group of three essential amino acids: leucine, isoleucine and valine.

While you can get these amino acids from your whey protein and other protein sources, it sometimes can be helpful to get them directly.

BCAA supplements can help you with muscle performance, prevent muscle fatigue, and help stimulate growth.

I usually take my BCAA supplement before I work out, and I have definitely felt a slight difference in how I’m able to move throughout my workout.

7. Beta-Alanine

Beta-alanine is a non-essential amino acid. Our bodies use beta-alanine to create the amino acid carnosine, an amino acid which regulates the build up of acid in our muscles.

Beta-alanine helps your muscles perform and promotes muscle endurance and power.

Beware though! If you have too much of a dose of beta-alanine, you’ll get the tingles! (something which has happened to me a few too many times!)

Get Your Dream Body with These Amazing Supplements!

No matter if your dream body is a 6 pack, being able to walk 5 miles straight, swim a mile, or just feel more confident, you can become healthier with the right diet and supplementation.

Hopefully this article has provided you with some new information and resources for your health.

Depending on your health goals, maybe it makes sense to try one of the supplements above and see how you feel with it.

We only have one life and one body – with the proper diet, you are capable of doing anything.

While workout and diet supplements won’t get you your dream body alone, with consistent good eating habits and exercise, you can see the results you want and deserve.

Thank you for reading!

Readers: what supplements do you use to get your dream body and be healthy? Are there any supplements you’d recommend I check out?

Becoming rich is more than just having money in the bank. You can also be rich if you have the right mindset, and know what you want in life.

At a young age, you most likely understood the difference between “poor” and “rich”.

Rich people have money. Poor people do not.

The financial difference between a poor person and a rich person can be pretty significant.

However, there’s another difference between the poor and the rich which has nothing to do with how much money is in the bank. The difference between being rich and poor is mindset.

Some of the wealthiest people I know aren’t rich financially, but they understand how to use their money for happiness.

Through saving and investing, you can use your money to live the life you want and deserve. You can become rich over time, and do what matters to you.

Your mindset towards money influences all of your habits pertaining to money:

- how you earn money

- how you spend money

- where you save your money

- how you use your money over time

While there are always going to be factors outside of your control (where you were born, your parent’s financial wellness and education, etc.), we all have the ability to change our mindset from one that makes us poor to one that brings us riches.

What do I mean by the mindset of the rich?

A rich mindset is the belief money is a tool, and you can use money to create a life you love. A rich mindset is also having the understanding that money should work for us, rather than us working for our money.

The rich know a dollar saved and invested today is better than a dollar spent today.

Put another way, it’s the understanding that putting our money to work is a better use of our money than buying stuff we think will make us happy.

Let’s dive more into detail about how you can cultivate a rich mindset.

The Mindset for Building Wealth to Fund Your Dream Life

Whatever your dream life is, you can fund it through understanding the mindset of the rich.

People without the mindset of the rich are often caught in the trap of trading their time for money – they’re on a financial treadmill leading them to nowhere fast.

Conversely, people with a rich mindset are busy building assets. These assets leverage the power of time to generate passive income – passive income which isn’t dependent on them directly swapping their time for money.

We all have limited time on this Earth, and if you are spending a lot of your time trying to make money to make ends meet, you probably aren’t living your best life.

Spending money on things that don’t bring you happiness, and doing things which don’t align with your purpose and passions will lead a less than a truly fulfilling life.

People with a rich mindset have a long term mindset and are able to delay gratification. If they have a job and get a pay raise, they don’t look to spend money upgrading their home to an executive condo.

The rich are more likely to invest their money in buying a run-down property and fixing it up.

Rich minded individuals believe money, when invested in stocks, bonds, or other assets, can lead to a secure financial future.

People with a rich mindset understand compounding and the time value of money. People with a poor mindset believe that money can be used to buy stuff to make you happy right now.

Understanding the time value of money is very important.

Having a wealthy mindset, or a poor mindset, is not how many zeros you have in their bank account.

Instead, it’s how you approach making an income and where they invest (or spend) their resources.

How People Make Money

How People Make Money

One of the best books about building wealth is Rich Dad Poor Dad. In Rich Dad Poor Dad, the author presents four categories in how people make money.

Most people will fall into the first two categories that are related to a direct trade of swapping time for money.

Jobs are a perfectly okay way to make money.

However, if you want to become financially rich, you need to consider the last two categories while currently being employed or self-employed, This way, you can step off the financial treadmill known as the rat race and start walking the path to financial freedom.

The four ways a person can make money are through the following roles:

- Employee

- Small Business Owner

- Big Business Owner

- Investor

Let’s discuss each of these roles in detail.

Working as an Employee to Make Money

Being an employee is a very common way to make money. Being an employee is probably the most common, but yet, the most ineffective way to go about making money.

While it can be stable and provide security, as an employee you are trading time for money – and someone else is pulling the strings.

Working for a corporation at the higher level can certainly have its perks.

You can drive fancy cars, travel business class, and earn a great income.

However, being an employee is a similar to renting rather than owning a house. You’re not building something that will become an asset.

You are simply trading time for money, and when you stop trading time, you stop making money.

Being a Small Business Owner to Earn Income

The second way people make money is through owning their own small business.

Many people take the entrepreneurial leap to run their own small business.

Small business owners often find themselves trading the comfort, stability, and regular income with a stress, instability and a volatile income. While many small business owners are able to do what they love and make their own hours, it is very tough to make it.

As a small business owner, at least in the first year, you will most likely have doubled the amount of time you spend working, and make a lot less money than before starting the business.

The financial rewards of having a small business can be substantial, but for most people they are simply trading a job they don’t own for a job they own.

Becoming a Big Business Owner to Build Wealth

Becoming a Big Business Owner to Build Wealth

The third way people make money is through big business ownership.

Small business owners, in this context, relate to people who ‘own their job’. For example, small business owners might be massage therapists or personal trainers – they are still trading their time for money.

These small business owners are limited by time. They could be a great massage therapist, charging $100 an hour, yet there are only so many hours in each day to realistically work.

Big business leverages systems and other people to create their income.

For example, let’s take an ice cream van. The small business owner mentality runs an ice cream van generating $200 profit from selling ice cream.

The big business owner, however, goes out and buys five ice cream trucks and employs five people to serve ice cream. The big business owner now has leverage. A system has been created, and there exists a network which is able to scale.

Construction of this system is how the wealthy become wealthy.

Using Investing to Become Rich

Finally, the last way a person can make money is through investing.

An investor has true leverage. Rather than work for his or her money, in the conventional sense of swapping time for money, they put their money to work for them.

Think of it this way, if you have $500,000 in a savings account earning 2% in interest each year, then, by doing nothing, you have a savings account is generating $10,000 a year.

The challenge is getting that initial $500,000 in the first place. However, the concept remains, investors create assets that generate income automatically in perpetuity.

Now that we have gone over the four ways you can make money, and discussed how through creating systems and investing, you can create passive income, now let’s talk about the principles for living a life of wealth and abundance.

Five Principles for Living a Life of Wealth and Abundance

I look to live my life with an abundance mindset – there’s so much money in the world and we just need to get a little bit of it.

From the last section, we have a grasp of the four ways of making money.

Now, let’s look at five general principles to help you create a life of financial wealth and abundance.

These five principles are:

- Dream Big

- Envision a Prosperous Future

- Learn More

- Start a Business or Start Investing

- Do What Matters and Live a Life You Love

Below, let’s get into each of these five rich mindset principles in more detail.

1. Live a Life of Abundance by Dreaming Big

Dreaming big is step one to living a life of abundance.

Why is dreaming big important?

You are capable of everything and anything you put your mind to. You can have and build towards your dream life – you just have to set a goal and start working towards it.

While this may not happen overnight, over time you can get there.

What do you want your life to look like? What’s keeping you from living it today? What steps do you need to take to get there?

Dreaming is the first step to living the life you want and deserve.

2. Envision a Prosperous Future

2. Envision a Prosperous Future

Many highly successful people talk about the importance of having a vision board. A vision board is used to help you connect what your hearts desires with what your future life looks like to you.

Similar to how athletes use positive visualization techniques to picture themselves winning that big race, you can do the same for your dream life.

Through visualization and affirmations, you can set yourself up for success and lean into the experiences you want.

Dreams are just that, dreams. However, by visualizing and planning, you can start to make it real.

Now, it’s time to take action and make those dreams and visualizations a true reality.

3. Invest in Yourself, Learn and Become Better

Your level of success is rarely exceeded by your level of personal development, because success is something you attract by the person you become.

Your level of success is rarely exceeded by your level of personal development, because success is something you attract by the person you become.

Education and investing in yourself can have an amazing return on investment, if done correctly.

Learning, growing, and gaining experience in the field of your interest will help you grow the necessary skills for success.

Investing and building systems are complicated endeavors which require some understanding of different industries and companies to be successful.

To learn, you can go the traditional route with academic courses, or look to learn through experience.

Some academic courses are required to enter a particular profession, and these should be considered. However you can find highly educated white collar workers attending weekend seminars on topics such as real estate investing, Amazon selling, and digital marketing which are led by people who didn’t go to college.

The one thing to bear in mind, when it comes to learning, is to ensure the time and money you put into the course provides a decent return on investment.

“Your level of success rarely exceeds your level of personal development, because success is something you attract by the person you become.” – Hal Elrod

4. Start a Business or Start Investing to Earn Passive Income

Today, you can easily start a business for under $500. Depending on the business, you can start for under $100 if you’re setting up an online business, such as a blog or online shop.

Running a business is difficult, but the experience and knowledge gained through this endeavor will be very beneficial.

The last four years of my entrepreneurial adventures have been incredibly beneficial for my development.

While I haven’t had amazing financial returns, my mindset and skills have grown and I’m confident I can become successful through business in the future.

Again, it’s very hard to become super wealthy by being an employee.

By learning how business and systems work, you can increase your skills and value, and start to tap into passive income sources to make more money.

If starting a business doesn’t make sense for you, you can putting your money to work with investing.

By investing in the right assets, you can earn passive income. Passive income allows you to make money without work.

Even if you have just $100 in your bank account, start investing, you should still get into the habit of saving to build your asset pile over time.

The main difference in mindset between the rich and the poor is the poor tend to spend money in order to derive pleasure or gain comfort (e.g. a fancy car, nice meal, or expensive outfit), whereas the wealthy invest their money in order to derive long-term financial stability (e.g. houses, savings accounts, stock portfolios).

5. Live the Life You Want and Deserve

5. Live the Life You Want and Deserve

The final step for living a life of abundance is realizing you are enough and you have enough – regardless of the number which appears on your financial statements.

While having more money is great, being happy, helping others, and doing what matters to you with your time is the true meaning of life.

Money is a tool which you can use to live the life you want and deserve.

Living with a rich mindset will allow you to create your dream life and live the life you want.

Become Rich Through Learning, Investing, and Action

Hopefully this article has opened your mind into looking at the different ways people make money, and the fundamental difference between mindsets of the rich and the poor.

Making money will not make you happy, but you can use money to live a great life. Money can bring peace of mind, security, and the freedom to live life on your own terms.

That’s what being rich is about.

Being rich has nothing to do with how many zeros are printed on the end of your paycheck.

Being rich is all about living your best life, and being happy with how you spend your time.

Money is a tool, and it’s like jet fuel – it can transport you from where you are to where you want to be!

Change your mindset, and over time, you will become rich.

Success is, of course, the primary goal for any company. Regardless of their industry, companies want to implement plans and deliver a service that will see their business succeed and grow throughout the years. How do they achieve this?

To start, business leaders will undergo thorough research to help them gain greater insight and understanding into how they can expand their company. Research uncovers any issues and enables business leaders to implement measures and procedures the company can follow should an issue occur. Putting these measures in place allows the team to act and resolve a problem as soon as it arises efficiently and effectively. Lack of research and ineffective planning is one of the common reasons why companies fail. Finding and implementing measures to avoid this is crucial for businesses.

Ensuring that the team is on the same page regarding processes in place for the company is a must to help avoid falling for the common reasons businesses fail. One of these improvements could be to the current document management processes. Keep reading to find out why.

Understanding the Importance of Effective Document Management

Effective document management is vital for any company, regardless of size or industry. It encompasses the processes and strategies to efficiently create, organize, store, retrieve, and manage documents throughout their lifecycle. Effective document management is essential because it directly impacts productivity, collaboration, compliance, and overall operational efficiency.

Implementing robust document management practices ensures that companies’ information is updated, readily accessible, and accurate – enabling them to facilitate better decision-making and streamlined workflows. For example, by working with a company that specializes in large document scanning, your team will be able to quickly access digitized versions of documents that may not have been possible to upload on your existing printers. Effective document management can also help improve team members’ collaboration by providing a centralized location for file sharing and version control. Finding ways to achieve this is a top priority for any business leader. Fortunately, there are measures they can implement to help them improve document management and help improve efficiency in the company.

Investing In Tools And Software To Improve Processes

The right tools and software can be beneficial for a company. These can be tailored to suit the needs and requirements of the company, allowing the team to find ways to support them in their pursuit of completing tasks. For instance, those working in the highly important field of pathology might find it beneficial to collaborate with a laboratory information system company to install the relevant software. In this context, the software will help to upload, categorize and easily edit any patient records and files that are required, before allowing them to be digitally sent to other employees in a completely different lab or hospital. They can also provide a high level of security for these documents, and ensure that they comply with all of the present regulations. Effective document management can therefore benefit from a team using tools and software to help improve processes. These tools help increase efficiency, allowing the team to create management processes that are simple and easy to follow.

Companies handling multiple files of varying file sizes will understand the importance of storage space. Large files can consume significant storage space on a company’s system and employees’ devices. Lack of storage space can delay processes being completed on time, as employers and employees try to find additional space for storing documents. This is where a PDF compression tool is worthwhile. Compressing a PDF to reduce the file size of PDFs can prove to be a valuable tool for the company. Look at the PDF compressor tools from Smallpdf to see how they could work to the company’s advantage.

Encouraging Collaboration And Communication Across The Team

Collaboration and communication in a company between teams is a goal many businesses wish to attain. This unity helps strengthen a company, encouraging team participation, which opens the door to new ideas and different perspectives, as well as helping to boost morale amongst the team. When the team is on the same page about processes and how documents should be managed, it can positively affect the rest of the company. This domino effect ensures that the company can work effectively and efficiently to complete the work.

Any document that is needed can be easily accessed by the relevant individuals and edited and saved without causing any delays to others. Proper documentation management can help with improving the organization within a company. Collaborative tools help maintain order and manage each workflow stage by encouraging open communication among the team. Both the company and the team can benefit from an improvement in how they collaborate and communicate.

Improving Document Security and Limiting Access Control

Data protection is a top concern for any modern business. As a rising number of businesses become a target of cybercrimes, companies are looking for measures to implement to boost safety and protection, understandably so. Investing in software to protect from cybercrime is a top priority for business leaders. However, improving document safety is also a must. The documents a company handles often feature personal client information. A company must ensure that this information is protected, especially from potential cyber threats.

Improving document security is possible by taking different measures, and limiting access control should be the first change made. All the documents a company has can be shared with only some employees, especially if the documents contain information that is not relevant or needed by all teams. Business leaders should start by limiting employees’ access and control over documents. Of course, they should grant them access to the documents needed to help them complete their job. However, they can restrict the access granted to other documents that are not needed to help improve security. When handling sensitive material, choosing trusted digital service providers can also add an extra layer of protection through encryption and secure file handling. Many of these providers can also specialize in scanning large documents, ensuring that oversized files can be digitized with accuracy, confidentiality, and care.

Continuously Evaluate And Improve Systems

After implementing any new measures and processes to help improve documentation management, the task continues. As time progresses, new technologies are released, and the realms of what is possible expand slightly. The positive side is that it allows employees to be more creative and accomplish more with their work. On the downside, it can lead to creative ways that cybercriminals target companies. As such, business leaders need to remain alert.

Regularly reviewing and evaluating the current systems will help them easily identify weak spots. The company can target these areas, enabling them to implement new measures that will help improve the current systems. Employees will benefit from these improvements as it will help them manage documents better than before, and the company is in an advantageous position, as it can reduce their risk of a cyberattack.

Any of these measures could help to make a noticeable difference in a company’s documentation management style. Finding and implementing the right tactics will help them achieve their goal of improving their current systems and methods. In the end, it will all be worthwhile!

Living frugally is a great thing to try and do to save money for your financial future.

When people think of the word “frugal”, and frugal living, they may think of extreme examples like reusing paper towels, or making your own dish detergent.

However, being frugal doesn’t mean you have to be a penny-pincher. Frugal living means having plans for your money and being more intentional with your spending.

Living frugally tends to get a bad rap, but it’s an easy and quick way to make changes in your life that add up to big savings.

In this post, you’ll learn nine money saving tips which will can help you live more frugally.

By applying these frugal habits in your life, you will be able to keep more of your hard-earned cash!

Money Saving Tips to Live More Frugally

Living frugally and saving more money is possible with the right guide and tips.

The 9 frugal living tips in this post include:

- Imposing Self Spending Limits

- Buying Last Year’s Model

- Avoiding Bank and Interest Fees

- Buying in Bulk

- Use What is Needed

- Find and Use Reward Programs

- Use Apps to Maximize Your Savings When Shopping

- Take Advantage of Offers

- Plan Ahead

Let’s now dive deeper into each of these money saving tips for frugal living.

1. Impose Self Spending Limits

One of the easiest ways to be more frugal is to put limits on your spending. After setting spending limits, you then need to hold yourself accountable to those limits.

For example, I generally avoid eating out for lunch at work because it’s expensive and bad for me.

Another limit I put on myself is how much I feel comfortable spending on one meal. Many times, I don’t like spending more than $15 for an entree.

Putting limits on your spending isn’t about depriving yourself. Putting limits on your spending is about making better decisions and then ingraining those decisions in your mind so they become second nature.

Over time, these self-imposed limits can become habits which will be difficult to break.

2. Buy Last Year’s Model

The second frugal living tip is to buy last year’s model.

Whether you’re buying a fridge, a computer, or a car, there’s something special about buying it new.

A great way to be a little more frugal when you’re buying something new is to purchase last year’s model instead.

Depending on what you’re buying, you can save anywhere between 10% to 50%, simply by buying the older model.

For example, a new 2019 Honda CR-V has an MSRP of $29,695, while a new 2018 Honda CR-V has an MSRP of $26,599.

That’s a savings of over $3,000 – just over 10 percent.

That’s a pretty big savings just for buying a slightly older model!

Buying new might be the only option for you, but if you can look to buy a slightly older model to save money.

3. Avoid Fees

The third frugal living tip is to avoid fees.

Fees, whether they’re from credit cards, banks, media rentals or subscription services, are a sneaky way to separate you from your money.

Fees are small enough to go unnoticed, but when put together, they can really put a dent in your budget.

Checking your statements frequently is a great way to make sure you aren’t getting charged any excessive fees. If you are, don’t be afraid to call the company up to see if they can remove it for you. If you’re nice and polite, they should be willing to work with you.

4. Buy in Bulk

4. Buy in Bulk

The fourth frugal living tip is buying in bulk.

Buying in bulk is another great way to be frugal.

Not only does buying in bulk keep more product on hand in the event you need it, it also saves you money by spreading the cost over more product. Buying in bulk lowers the cost per unit.

While buying in bulk can save you an average of 20%, for some items, buying in bulk can save you almost 100% on your purchase price.

No, that’s not a typo. You can save over 100% by buying some items in bulk!

For example, you can get a box of 500 Kirkland dryer sheets from Costco for $7.99 a box, or 1.6 cents a sheet.

Compare that to a 120 count box of Meijer brand dryer sheets, which cost $4.29, or 3.5 cents a sheet.

That’s more than a 100% difference! To get the same amount of dryer sheets at Meijer, you’d have to spend over $17!

I always recommend bulk buying items which don’t have expiration dates, like garbage bags, paper towels, toilet paper, dryer sheets etc. for the maximum amount of savings.

This way you get them for the cheapest possible price and you always have them on hand.

In addition to buying supplies in bulk, you can buy food in bulk.

Learning to meal prep and meal plan is not that difficult, and you can squeeze out additional savings by buying your food in bulk!

5. Use What’s Needed, Not Recommended

The fifth money saving tip is to use what’s needed, not recommended.

A super easy way to be more frugal is to simply use less product than recommended.

When it comes to stuff like shampoo, dish detergent, laundry detergent and the like, they can be easy to overuse – even if you’re following the manufacturer’s directions.

Over time, this wastes product and money!

For an easy fix, try using half the amount of product you normally use and see if you can tell the difference.

For example, you could try using 1/4 cup of laundry detergent, rather than the 1/2 cup the box recommends. If your clothes still come out clean and fresh, you’ve just found a way of getting twice the laundry done at the same cost.

Buying in bulk and only using what’s needed for the job will have a great effect on your finances.

6. Use Reward Programs

The sixth frugal habit is to use reward programs.

If you frequently shop somewhere with a reward program and you’re not a member, you may be missing out on substantial savings.

Being a rewards member typically comes with many benefits, like:

- Sales

- Targeted coupons

- Free items

In fact, many stores only allow you to take advantage of sales and promotions if you are a reward’s member.

Also, many of these programs reward you with personalized coupons and offers – sometimes put directly on your reward card or mailed to you.

A few years ago, I got the Target Red Card and have saved hundreds since.

If you’re not using the rewards program at your store, you’re leaving money on the table.

Sign up!

It only takes a moment, and over a lifetime of shopping will save you thousands of dollars.

Speaking of rewards programs…

7. Use Apps to Maximize Savings When Shopping

The seventh frugal living tip is to use apps to maximize savings when shopping.

Using cash back apps, like Ibotta, can help you maximize your savings from grocery shopping.

Here’s how it works:

- Check Ibotta for offers

- Go shopping

- Snap photo of receipt

- Collect cash back

It’s really that simple.

It doesn’t require you to change your shopping habits or your grocery store. Just shop like you normally would.

Using apps in conjunction with rewards programs and coupons can save you even more money.

For example, let’s say you open Ibotta before you go shopping and see that there’s a $.50 cash back for shredded cheese (which was on your list!).

You also received a coupon for $1 off a bag of cheese from your grocery store. Furthermore, your store is having a buy one get one free sale on cheese.

If you buy a bag of cheese for $2, you’ll also get one free. Then you can use the coupon for $1 off, and finally then redeem the offer in Ibotta for $0.50 off.

With all of this savings, you’ve effectively paid $0.50 for two bags of cheese!

Using money saving apps like Ibotta are a great way to squeeze some extra money out of your grocery bill.

8. Take Advantage of Offers

8. Take Advantage of Offers

The eighth frugal living tip is to take advantage of offers.

There are multiple ways to get discounts and save money, simply by being clever.

For example, many stores offer discounts to college students.

If you are a student or have one in the family, you may be able to use this to your advantage.

Apple, for example, offers educational pricing for students on many of their products, which can easily translate to a savings of 10 to 20 percent.

When you’re talking about fancy computers, this can be a savings of $100 or more!

Maybe your college-bound kid will let you use their name to order a computer at a discount?

Just pay it forward by feeding them or doing a load of laundry 🙂

9. Plan Ahead

Finally, the ninth tip for frugal living is to plan ahead.

Planning ahead is a great way to be frugal.

Depending on the situation, planning ahead can save you tens or even hundreds of dollars.

For example, let’s say you’re a family of four going to a theme park for the day.

You grab sunscreen, towels, a change of clothes, and you’re on your way!

Unfortunately, you forget to pack drinks or food, and have to resort to eating and drinking at the amusement park.

I hope you brought extra cash, because for a family of four to eat, one meal will cost over $60! That’s almost twice the price of a ticket!

If you had packed your own food, you could feed a family of four with homemade sandwiches, chips and pop for less than $5 a person.

Planning ahead can help you can avoid a lot of unnecessary expenses.

Save More Money by Living Frugally Today

Being frugal usually makes you think of images of people going to extreme lengths to save money, but that couldn’t be further from the truth.

Being frugal means living intentionally and being mindful of how we spend our money.

Sometimes we can be frugal without even changing how we spend money – we just do it with more thought!

Hopefully these nine tips can help you live a more frugal life, freeing up money to pursue more of your own goals.

Readers: what frugal living tips do you practice to save money?

This post is a guest post from Matt, who writes at Spills Spot. Matt works for a local minor league baseball team on the side to make some extra income. He does what he loves, and has found a side hustle which brings in a few thousand dollars a summer. In this side hustle guest post series, I’m looking to inspire others with unique stories of how people are making some extra money. Working for a sports team on the side might be for you. Read on below to learn how to work for a sports team part-time to make more money.

I fell in love with baseball as an elementary school kid playing Little League. There’s just something about the game, it’s hard to put into words.

Since then, baseball became a passion of mine and has been a huge part of my life ever since. When I realized I wasn’t going to become a professional baseball player, I knew I needed to pivot to the next best career choice.

For me, this meant going to college and majoring in sports marketing.

Breaking into the sports industry is a long and difficult road. The hours are long, the pay is low, and the competition is fierce.

I’m sure you’ve heard the saying, “Do what you love, and you’ll never work a day in your life.”

That was my thought process as I graduated from school and landed a minimum-wage position as an usher for the local minor league baseball team.

My goal was to get my foot in the door, make connections, and work my way up in the organization.

In this post, I’ll share with you my story of how I started working for a minor league baseball team, and how I make money on the side of my day job working part-time for a sports team.

How I Started Working for a Sports Team

Working as an usher for the local minor league baseball team was a lot of fun and I had made a great decision to take a role there.

Within a few months, I had displayed my strong work ethic and passion for baseball.

My managers noticed, and I got a new role working in the press box. Each baseball stadium has a press box, where various media members work for each game. This includes announcers, scoreboard operators, video producers, scorekeepers, and a few other roles.

I finished out the season keeping stats and helping operate the video scoreboard.

The next season I was offered an internship in marketing and media relations. It was the next step in my journey and another opportunity to build more skills. The season was long, but went well.

The only problem was at the end of the season, it was evident that the internship was not going to lead to a full-time position like I had been hoping for.

While I had done a great job and they wanted me to remain with the team, it was simply a matter of no full-time roles being open. Also, I was so early in my career that I hadn’t built enough marketable skills.

I had a decision to make: should I stay in a low paying role, or take a chance somewhere else?

Balancing a Low Paying Hustle with the Want to Make and Save More Money

This led me to a crossroads, with a decision to make. I could be stubborn, continue working part-time for the team, making minimum wage, and hope that a full-time role eventually opened up.

The other option was that I could pivot, find a marketing role in a different industry, and build additional marketable skills to better prepare myself for a role in the sports industry down the road.

While I wrestled with this decision, ultimately, it was clear that the latter was the right decision to make, both from a personal growth and financial standpoint. It was time to learn new skills and make some money.

Change can be difficult, but it’s often necessary to reach our full potential in life.

At this point, I decided I would continue to work with the team part-time, and find a full-time role in a different industry.

Connecting My Passion of Baseball with a Side Hustle

After making my tough decision a few years ago, I’ve been loving life and finding success in my career and side hustles.

I worked for two years doing content marketing for a startup, and another two years working in customer marketing for a tech company.

I’ve grown tremendously, gained valuable experience, and built new marketable skills.

With my part-time sports side hustle, I’ve also kept my connections with the minor league baseball team.

I’m currently in my seventh season with the team, and this balance has turned out to be the perfect fit for me.

While heading straight to the ballpark after my full-time job means that some days can be long, I love what I do and am grateful for where I’m at in my career.

Working nights and weekends can be a little rough, but I’m doing what I love and that’s what matters in life.

What Do I Do for my Sports Side Hustle

As I mentioned above, I work in the press box for a minor league baseball team. My title is Game Day Stringer.

Essentially, I am on a laptop during each game, inputting each pitch and play that happens.

This data is sent to MiLB (the minor league baseball league), and appears real-time on their website and mobile app.

This website lets people following along on their phones and computers see what’s happening in the game.

Our team plays 70 home games per season, and I usually work 50-55 of those games.

The games never conflict with my full-time work, since the large majority are on nights and weekends. The hours aren’t long, usually around 5 hours per shift.

For how much I make each summer, this can vary, but typically, I end up making a few thousand dollars per season. With this extra income from my baseball side hustle, I’ve been able to pay off our student loans and invest into our IRA’s.

Skills Needed for a Sports Industry Side Hustle

The first skill which is necessary for a sports industry side hustle is a passion for the sport and game. If you aren’t passionate about a sport, then it might be tough to work for certain team.

A second skill is advanced knowledge of the sport. For me, I need requires advanced knowledge of baseball and how a game is scored. Each team only has one main person that fills this role, and maybe a couple backups.

While this particular role is difficult to obtain, the opportunities with sports team in both the major and minor leagues are plentiful.

Typically, each team post their open roles on Teamwork Online, and you can also Google jobs for the team you’re looking for.

Also, teams usually will host a yearly job fair a few months before the season starts, where you can attend and interview for open part-time roles. This is a great way to get started.

To land a part-time role shouldn’t be too difficult. They’re looking for people with customer service skills, friendly, passionate and the team and sport, reliable, and hard working. You don’t need specific schooling or experience.

Why I Love Working for a Sports Team on the Side

I love working for a sports team because baseball is a passion of mine.

Most of these jobs will be for minimum wage, so if you’re simply looking for ways to maximize your income, this likely won’t be the right side hustle for you.

However, if you’re looking for a role that’s enjoyable and flexible, working part-time in the sports industry can be a good fit for you.

Like I’ve mentioned, I love what I do. I essentially get paid to watch baseball. Also, I’ve built strong friendships with my coworkers over the years.

As long as I’m still in the Bay Area, I see no reason to not continue working this side hustle. I’m sure as soon as my wife and I have a kid I’ll scale back and work much less games, but I still want to keep these connections.

I love the camaraderie with my coworkers, the extra cash flow, and getting to be at the ballpark so often.

Eventually, I may transition back into the world of sports full-time, but for now I’m simply enjoying the journey.

Please reach out if you have any questions about this side hustle, or the sports industry as a whole. I’d be happy to help in any way I can.

There are so many amazing side hustles out there in the world. I’ve found a side hustle I love, and hope you can too!

Thanks for reading, and big thanks to Erik for having me!

Readers: what do you think about this side hustle idea? Would you be interested in working for a sports team to earn some extra income?

This post is a guest post from Moriah Joy, who writes at Our Table for Two. Currently, Moriah Joy charges $30 an hour to help out students with their homework and studies. She is looking to increase her hourly rate to $75 an hour soon, and thinks this could be a fantastic boost to her financial situation! In this side hustle guest post series, I’m looking to inspire others with unique stories of how people are making some extra money. Starting a side hustle tutoring might be for you. Read on below to learn how to tutor to make more money.

If you follow my blog, you know I have debt. Not a lot of it, but enough that my partner and I are not able to live on two W2 incomes and thrive while paying off my student loans. We’d probably be able to scrape by, but not well.

Thankfully, I’ve been a tutor since high school, and have used 10 years of experience to my advantage.

After I get off work (which is around 4 PM), I head over to a local Starbucks, or a client’s house, and spend the next three to five hours (including travel time) explaining math, English, and science concepts to 5th-12th graders. During any given week, I’m tutoring 8-12 hours (not counting commuting time).

While tutoring definitely does not pay enough for me to quit my current job, or reach the illusive financial freedom, but it helps power my family’s Adventure Fund.

I love tutoring, and this side hustle is helping me improve my financial situation.

In this post, I will be sharing with you what I do as a tutor, and talk about my recommendations for you to start tutoring to make more money.

What I Do as a Tutor for My Tutoring Clients

Tutoring is helping students learn and study their school material more effectively.

For my tutoring work, I offer three different services to my clients:

- Homework help

- Study prep and research skills

- Testing prep

Let’s dive into each of these different tutoring services.

Homework Help Tutoring

Homework help is pretty self-explanatory.

My clients bring their homework, and we go through each problem together.

Going over the homework is also chance for learning how to learn to happen, as we talk about kinesthetic learning, auditory learning, and visual learning.

In college, I was a TA for a remedial math class, and I draw a lot on the experience I gained from my mentor who helped me through that position and pass that information along to my kiddos.

When going through homework, the goal isn’t for them to keep needing me. It’s for them to learn how they learn and to teach them how to teach themselves.

It sucks working myself out of a job, but it’s also super exciting to watch them “get it” and not need me anymore!

I love homework help, and always enjoy helping my clients understand the material better.

TUTOR TIP: Ask your kids a bunch of questions about the process of their project, instead of just showing them step by step what to do. This way they’re engaging multiple sections of their brain and will retain the information better.

Study and Research Preparation Tutoring

Another service I provide for my tutoring clients is study prep and research skills.

I designed the service of study prep and research skills for kids who are confident with their homework, but still aren’t getting the scores they need or want.

We comb through homework assignment to create study guides; I show them the magic of Google and how to use it to their benefit.

Generally, I work with these students a few times a month. Enough to increase their grades, but not so much that they over-rely on me.

It’s a tricky balance. And one I’ve really worked to maintain.

To help with the breaks in-between sessions, I have them send over their topics before we meet. This way I can brush up on the material (especially in subjects like chemistry and biology, where rote memorization is important to the class) and so I can look around the internet to find the pages I’ve flagged for these subjects.

The idea is to show them good websites, and bad websites, and talk about how to make sure their research is credible.

With these kids, maximizing time with techniques is more important than material.

TUTOR TIP: Have your students bring their own laptop and perform the study prep/research skills alongside you, that way they’re mirroring good scholarship, but they’re also practicing necessary life skills at the same time.

Test Prep Tutoring

Finally, test prep is the third service I offer.

Testing prep sounds similar to study prep, but with a grand exception. It’s generally SAT/ACT tests that we’re preparing for.

Also, for these tests, I run it as a class, as opposed to an ongoing tutoring relationship.

Each student gets three hours of specialized instruction on SAT tips and where they need to work to improve their own scores. This three hours of instruction is spread out over a month before they take their test.

I assign homework that I expect done before the next session. If the homework is not done, then we postpone our meeting.

Since I use the homework to compile their personalized SAT/ACT study plan, it’s a lot more time intensive for me. To compensate for my additional time, I charge $350 for the class.

I run this SAT/ACT class in the summertime (when I have more time, and when most kids take the SAT), and these higher fees definitely compensate for the lost hours during the school year.

TUTOR TIP: Take a practice SAT yourself at the beginning of every summer to make sure you’re up to date on the latest changes and can accurately reflect them to the children you tutor.

With these three services, I have a wide variety of ways to make money and can help a diverse set of students.

Now, let’s talk about what the financial results of tutoring look like, and how you can become a tutor.

How Much Money Do You Make as a Tutor?

Being a tutor can be a fairly high paying side hustle.

Currently, I charge $30 an hour for my tutoring work. $30 an hour is more than I was paid when I worked at a tutoring company, and double what I charged when I was a college student.

Next year, I’m going to increase my rates, and then every semester subsequently to that until I’m making closer to $60-$75, which is the going rate in my area.

For specialized subjects (math above Algebra 2, and honors sciences, I charge $50 an hour, and those are going to be increased to $100).

Also, as mentioned above, I offer an SAT class every summer which costs $350 per student.

With these rates, I’m able to make a decent amount each month, and this helps with debt payoff and hitting my saving goals.

Nest, let’s talk about how you can start a private tutoring side hustle.

How to Start Tutoring for Extra Income

The hardest part of tutoring, in my opinion, is finding clients.

The hardest part of tutoring, in my opinion, is finding clients.

If your community has a job board, you can look there to find people looking for tutors, or post on a social media app like Nextdoor.

For finding clients, I used Canva to create tutoring fliers and business cards which I left at local coffee shops and grocery store bulletin boards.

People you know (from the gym or church) might also be willing to pay you to tutor your kids, so ask around.

After you have clients, and have set up a good rapport with them, I generally tell the families I have openings in my schedule, and if they know anyone that needs a tutor, to please give them my name.

Of the six families I’m tutoring right now, four of them have been referrals from other families. Referrals are amazing for growth!

TUTOR TIP: I used connections at my local university to get my first two clients, and have grown my business since then. Asking around for clients makes a HUGE difference, and referrals go a long way!

What Items Do You Need to Get for Tutoring?

Tutoring requires some tools and equipment to get started. You want to make sure you have all the necessary tools for the job.

For my tutoring side hustle, I have a canvas bag which I stow in my car with everything I need:

- a Chromebook laptop

- a Ti-83 graphing calculator

- graphing paper

- lined paper

- blank paper,

- writing utensils

- and any books the kids are reading (I need to have these on hand for their papers.)

I also carry around a scheduling book, so I never accidentally overbook myself. I prefer paper schedulers to my phone, but obviously, your phone could do the trick just as well.

Basically, make sure you have the tools for the subject you’re tutoring.

If you’re working on math, a calculator is a must.

Chemistry, a periodic table of elements.

You know the subject matter and what you need to be successful.