Top 7 Benefits of Outsourced Paraplanning Services for Financial Planners

As a financial planner, your day is filled with client meetings, investment strategies, portfolio reviews, and keeping up with an ever-changing regulatory landscape. But there’s a part of your practice that often gets pushed aside: the technical, time-consuming work of paraplanning. That’s where outsourced paraplanning services come into play, a growing solution that’s helping financial planners improve efficiency, reduce costs, and maintain high service standards.

If you’ve ever wondered whether outsourcing your paraplanning is right for you, read on. Here are the top 7 benefits of outsourced paraplanning services and why more financial planners are making the switch.

What Is Outsourced Paraplanning?

Simply put, outsourced paraplanning services involve hiring external experts to handle the technical and administrative tasks of preparing financial plans, reports, and compliance documentation. Instead of having a paraplanner on your in-house team, you partner with a specialized service provider who delivers high-quality, accurate paraplanning work on demand.

These services include research, preparing recommendations, financial modeling, fact-finding document analysis, and ensuring compliance with the latest regulations. The key benefit? You get expert paraplanner support without the cost and complexity of managing another full-time employee.

If you’ve ever wondered whether outsourcing your paraplanning is right for you, read on. Here are the top 7 benefits of outsourced paraplanning services and why more financial planners are making the switch.

1. Cost Efficiency: Pay for What You Use

Hiring a full-time, in-house paraplanner comes with more than just a salary. There are recruitment costs, employee benefits, training, and office space to consider. With outsourced paraplanning services, you pay only for what you need, whether it’s a few reports a month or a full-time equivalent workload.

The outsourced paraplanning costs are generally much lower compared to the total expenses of an in-house paraplanner. This helps smaller firms or solo financial planners manage their budgets better without compromising on the quality of service.

2. Access to Specialised Expertise

It’s unrealistic to expect every financial planner to have deep technical paraplanning expertise. Fortunately, outsourced providers employ paraplanners who specialise in areas such as investment analysis, tax structuring, insurance review, risk profiling, and compliance research.

This means your clients get high-quality, in-depth reports and recommendations without you needing to spend hours doing detailed calculations or regulatory research yourself. The paraplanner support you get is often from professionals who have worked across multiple industries, bringing valuable insights and technical rigor that would be hard to replicate in-house.

3. Free Up Time to Focus on Strategic Advice

Let’s face it, most financial planners got into the business to help clients achieve their financial goals, not to spend hours drafting technical reports or researching the latest compliance regulations. Outsourcing paraplanning frees up your time so you can focus on strategic advice and building meaningful client relationships.

Rather than juggling spreadsheets, fact-finding questionnaires, and investment research, your time is spent where it matters most, growing your business and deepening client trust.

4. Better Compliance and Consistency

In today’s highly regulated environment, staying on top of compliance is non-negotiable. With paraplanning compliance constantly evolving, relying solely on internal resources can expose your business to compliance risks. Many firms find that paraplanning outsourcing is the best way to keep up with these constant changes.

By using outsourced paraplanning services, you gain access to experts who are always up-to-date with industry regulations, such as ASIC compliance in Australia or other local regulatory frameworks. This ensures your reports, recommendations, and documentation meet the highest quality and compliance standards, reducing the risk of costly mistakes or audits.

5. Scalability and Business Flexibility

Financial planning practices aren’t static. Some months are busier than others, especially during tax season or market volatility. Paraplanning services offer the flexibility to scale up or down based on your workload without the hassle of hiring or laying off staff.

Whether you need financial planning support for a few complex cases or consistent paraplanning help every week, outsourcing allows you to match your service level with your business cycle. This kind of flexibility is hard to achieve with an in-house team.

6. Leverage Advanced Technology

Top outsourced paraplanning providers use sophisticated financial modeling, risk analysis, and reporting tools that most small advisory firms wouldn’t invest in directly. These technologies automate repetitive tasks, speed up calculations, and help generate professional, consistent reports quickly.

This means your paraplanning output is not only faster but also more accurate and reliable. You get the benefit of advanced tools without having to invest in expensive software yourself, keeping your practice competitive in a tech-driven world.

7. Reliable Business Continuity and Peace of Mind

What happens if your in-house paraplanner suddenly leaves or falls sick? Business continuity can be a real challenge for small financial planning firms.

With outsourced paraplanning services, there’s no disruption to your workflow. Most service providers operate under strong Service Level Agreements (SLAs) and guarantee timely delivery of work, ensuring your business remains fully operational at all times.

Conclusion: Is Outsourced Paraplanning Right for Your Practice?

The paraplanning benefits are clear cost savings, access to expertise, improved compliance, time efficiency, scalability, advanced technology, and reliable business continuity. By outsourcing paraplanning, you gain a flexible and professional solution that helps you deliver higher-value advice to your clients without the burden of managing every technical detail in-house.

If you’re aiming to focus more on client strategy, grow your practice without adding overheads, and stay compliant in a changing regulatory landscape, it’s time to consider partnering with a reliable outsourced paraplanning provider.

Institutions don’t just set the stage for daily life — they shape the conditions where safety can either thrive or collapse. When misconduct occurs, attention often stops at an individual name. Yet schools, hospitals, corporations and agencies make choices about staffing, oversight and response that directly affect vulnerability, accountability and long-term trust across communities.

Examining these organizational layers uncovers how preventable harm takes root. Patterns of weak hiring practices, ignored complaints, or neglected safety logs often point to systemic choices rather than isolated missteps. Holding institutions responsible broadens the scope of justice: it recognizes how policies and failures of oversight create risks that outlast any single offender’s actions.

When Institutions Shape Risk Environments

Safety lapses often grow from overlooked details rather than dramatic failures. A skipped reference check, a rushed orientation or too few supervisors on duty each increase the chance that misconduct slips by unnoticed. Looking closely at hiring standards and training design often reveals how everyday decisions created risks long before harm was reported.

Personnel records, complaint logs and training rosters often highlight the same recurring shortcuts: temporary hires brought on without vetting, shallow one-off trainings presented as compliance, and complaints filed but never pursued. These patterns show that risk emerges from deliberate choices, not accidents. Legal professionals like Dallas sex crimes attorneys often point to such oversight gaps as clear evidence of institutional responsibility.

Documenting Negligence That Goes Beyond Policy Failures

A maintenance checklist with blank boxes, a flickering corridor light and an unsigned safety log outweigh posted rules. Written protocols promise monthly checks and immediate reporting, while records show skipped dates, delayed repairs and incidents closed without inspection. Comparing procedures to timestamps, work orders and invoices exposes where practice diverged from policy.

Emails marked read without replies, audit memos that praise managers while incidents repeat, and safety walk reports filed long after problems were reported signal indifference. Cross-referencing timestamps, payroll for overtime, and vendor receipts can reveal systemic neglect. A dated folder with complaints, photos and follow-up logs often proves patterns for investigators.

Legal Pathways for Institutional Accountability

A stack of unprinted emails, a locked shared drive and a calendar full of ignored meetings often tell more than a policy binder. Building a legal claim means mapping decisions to harm: timelines, metadata, vendor invoices and complaint threads establish causation. Discovery — subpoenas, preservation notices and ESI requests — opens those sealed folders for review.

Emails, memos and board minutes often show ignored warnings, missed escalations and repeated excuses. Depositions and forensic pulls can link a supervisor’s silence to a pattern of nonresponse, reinforcing liability and opening damages avenues. A preservation letter paired with targeted custodial email requests often uncovers the internal threads needed for firm accountability.

Why Institutional Cases Broaden Recovery Options

A successful institutional claim can unlock remedies unavailable in individual suits. Beyond direct compensation for therapy and lost wages, courts can award damages for future care, relocation costs, and reputational harm. Punitive damages may further punish deliberate indifference or systemic cover-ups, signaling to boards and regulators that lapses carry financial consequences and civil penalties in some jurisdictions.

Settlements often include non-monetary change, including mandated training funds, independent monitors, and revised reporting procedures that reduce future risk. Combining compensatory, punitive, and injunctive relief widens options for survivors seeking repair and prevention. Keeping pay stubs and therapy invoices organized strengthens claims for lost income and care.

Survivor Impact and Broader Accountability

A courtroom settlement notice tacked to a hospital corridor can shift more than dollars. Public records, mandated reporting changes and required training reshape staff behavior, while formal apologies and reputational remedies give survivors a wider audience. When institutions face financial and regulatory scrutiny, boards rethink oversight and managers revise incident response to prevent repeat harm.

Cases often fund independent monitors, community reporting hotlines and survivor-led advisory panels that alter policy in concrete ways. Transparent benchmarks — regular compliance reports, accessible complaint portals and revisable consent forms — make institutional commitments measurable; a settlement clause for biennial independent audits provides an early metric and eases follow-up.

Accountability that extends beyond a single offender addresses the systems that allowed harm to occur. When overlooked warnings, poor oversight and weak policies come to light, they reveal how preventable risks became entrenched. Legal claims against organizations can secure compensation, but equally important, they press for reforms that strengthen reporting, hiring and safety practices. Survivors gain validation and resources while also seeing change ripple outward. Pressure on institutions to act turns individual cases into collective progress, creating safer schools, hospitals, workplaces and communities where protection is not an afterthought but a standard.

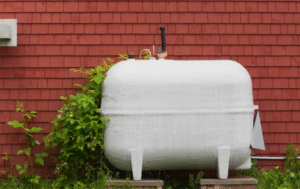

For many households, oil tanks are the backbone of daily comfort. They keep homes warm in the winter and ensure hot water is always available. But when an oil tank begins to fail, homeowners face an unavoidable decision: replacement. One of the biggest concerns is cost. Understanding the cost to replace oil tank helps families prepare financially and avoid surprises.

Oil tank replacement isn’t just about swapping out old equipment. It involves safety measures, environmental considerations, and professional installation. All of these factors influence the total price.

The Average Range of Oil Tank Replacement Costs

On average, replacing a residential oil tank can range from $3,000 to $5,000, though this number varies depending on several factors. Some homeowners pay less, while others face higher costs due to unique circumstances.

The final price often depends on:

- Tank size and capacity – Larger tanks cost more to install.

- Tank material – Steel, fiberglass, or double-walled designs affect the price.

- Location of the tank – Indoor, outdoor, underground, or above-ground installations each have different requirements.

- Removal of the old tank – Disposing of the old unit safely can add to the bill.

Understanding these variables helps homeowners budget more realistically.

Factors That Influence Cost

1. Tank Material and Design

Different materials come with different price tags. Fiberglass tanks, for instance, cost more upfront but last longer and resist corrosion better than steel. Double-walled tanks offer extra protection but also increase costs.

2. Tank Size

A small tank may be less expensive, but families with larger homes often require bigger units to keep up with demand. A 275-gallon tank is the most common size, but larger capacities can significantly add to the cost.

3. Location and Accessibility

Replacing a tank located in a basement or tight space may require more labor. Underground tanks are especially complex, often involving excavation and environmental checks. Above-ground tanks, by contrast, are usually less costly to replace.

4. Labor and Installation

Labor is one of the most significant factors in oil tank replacement costs. Proper installation requires trained professionals who follow safety regulations. While this adds to the bill, it also ensures long-term efficiency and safety.

5. Environmental Safety Measures

If your old tank leaked or shows signs of corrosion, cleanup and soil testing may be necessary. These measures protect your home and the environment but increase total expenses.

The Hidden Value Behind the Price

While the upfront costs may feel daunting, replacement often pays off in the long run. A new tank:

- Improves heating efficiency, saving on fuel bills.

- Reduces the risk of leaks or environmental hazards.

- Provides peace of mind during cold seasons.

- Adds value to your home by ensuring safe, updated equipment.

Think of replacement as an investment in your home’s comfort and safety.

Indoor vs. Outdoor Tank Costs

Indoor tanks typically last longer because they are protected from harsh weather, but installation can be tricky if access is limited. Outdoor tanks are easier to replace but may require protective coatings or housing to shield them from elements. Each scenario carries its own cost structure.

The Cost of Not Replacing a Tank

One of the most overlooked aspects of oil tank replacement is the price of waiting too long. A leaking tank can lead to environmental damage, soil contamination, and costly cleanups that far exceed the price of replacement. In some cases, homeowners may face fines or insurance challenges if issues aren’t addressed.

By planning ahead, you can avoid emergency situations that drive up costs.

Financing and Budgeting Options

The cost of replacement can feel heavy, but many homeowners find relief through financing options, home improvement loans, or savings plans. Some energy providers even offer rebates or programs to offset the expense.

Planning early helps spread the financial impact over time rather than dealing with a sudden, unplanned bill.

Practical Steps to Manage Costs

- Get multiple estimates – Comparing quotes ensures you’re paying a fair rate.

- Ask about tank options – Materials and designs vary widely in cost and lifespan.

- Plan ahead – Replacing before a failure reduces the chance of costly emergencies.

- Check for rebates – Local programs may help offset costs.

- Consider efficiency – A more efficient tank may save money in the long term.

Why Professional Replacement Is Worth It

While the price of professional replacement may seem high, it ensures proper installation and compliance with local regulations. Cutting corners on cost can lead to problems down the road, making it more expensive in the long run.

Homeowners who view replacement as an investment in safety and reliability often find the cost easier to justify.

Key Takeaways for Homeowners

Replacing an oil tank is never a small expense, but it’s a necessary one. The costs reflect not just the tank itself but the expertise, safety, and care that go into protecting your home.

The average cost to replace oil tank ranges between $3,000 and $5,000, depending on size, material, and location. While this may feel significant, the alternative—dealing with leaks, inefficiencies, or environmental damage—is far more expensive.

By planning ahead, understanding your options, and budgeting smartly, you can handle oil tank replacement with confidence, ensuring your home stays warm, safe, and efficient for years to come.

Running a business successfully requires more than just a great product or service. At the heart of sustainable growth lies a strong financial foundation. Businesses that proactively manage their finances are better equipped to weather uncertainties, seize opportunities, and achieve long-term goals. Understanding the essential strategies to solidify financial health is critical for leaders who want their organizations to thrive.

Understanding the Importance of Financial Stability

Financial stability is more than having enough cash on hand. It involves creating a structure where revenues, expenses, investments, and debt are carefully managed to ensure the business can operate efficiently and grow consistently. Companies that neglect financial oversight risk cash flow problems, poor decision-making, and missed growth opportunities.

A stable financial foundation allows businesses to respond to market shifts, invest in innovation, and maintain operational resilience. Moreover, it provides stakeholders, including investors, employees, and partners, with confidence in the company’s future.

Effective Budgeting and Forecasting

One of the first steps in strengthening a business’s financial foundation is implementing effective budgeting and forecasting practices. A well-constructed budget serves as a roadmap, outlining expected revenues, projected expenses, and strategic investments. Forecasting, meanwhile, allows companies to anticipate changes in the market or internal operations, preparing them to adjust their plans proactively.

By regularly reviewing budgets and forecasts, businesses can identify trends, control costs, and ensure resources are allocated efficiently. These practices not only prevent overspending but also help prioritize initiatives that offer the highest return on investment.

Optimizing Cash Flow Management

Cash flow is the lifeblood of any business. Without sufficient liquidity, even profitable companies can face significant challenges. Effective cash flow management involves monitoring incoming and outgoing funds, identifying potential shortfalls, and implementing strategies to maintain balance.

Techniques such as negotiating favorable payment terms, offering early payment incentives to clients, and managing inventory efficiently can significantly improve cash flow. Businesses that master cash flow management gain the flexibility to invest in growth opportunities and navigate unexpected financial pressures with confidence.

Leveraging Professional Financial Expertise

Even the most diligent business leaders can benefit from external financial expertise. Engaging professionals who specialize in financial strategy can provide insights and guidance that are difficult to achieve in-house. For businesses seeking high-level strategic support without the commitment of a full-time executive, a fractional CFO London can be an ideal solution. These professionals offer tailored financial oversight, helping businesses improve profitability, optimize costs, and implement long-term growth strategies.

A fractional CFO brings an objective perspective, identifying potential risks and opportunities that may not be apparent internally. This expertise allows business owners to focus on core operations while ensuring financial decisions are informed, strategic, and aligned with broader business objectives.

Strengthening Financial Reporting and Analysis

Accurate financial reporting and analysis are essential components of a strong financial foundation. Businesses need reliable data to assess performance, measure profitability, and identify areas for improvement. Regular financial reporting, including income statements, balance sheets, and cash flow statements, provides transparency and accountability.

Beyond reporting, analysis is key. By examining trends, comparing actual performance to projections, and benchmarking against industry standards, businesses can make informed decisions that drive growth. Strong financial analysis also supports better investment planning and risk management.

Managing Debt and Capital Effectively

Proper management of debt and capital is crucial for long-term stability. Borrowing can fuel growth, but excessive debt can strain cash flow and limit flexibility. Businesses should carefully evaluate financing options, considering interest rates, repayment schedules, and the potential impact on overall financial health.

Equally important is the management of equity and retained earnings. Allocating capital effectively ensures that funds are available for critical investments, strategic initiatives, and operational needs without jeopardizing financial security.

Building a Culture of Financial Awareness

A strong financial foundation is not solely the responsibility of finance teams or executives. Cultivating a culture of financial awareness throughout the organization ensures that every decision contributes to sustainable growth. Employees at all levels should understand key financial metrics, the importance of cost control, and how their actions affect the company’s bottom line.

Training programs, regular updates, and open communication about financial performance can reinforce this culture. Businesses that prioritize financial literacy empower their teams to make decisions that support overall stability and long-term success.

Preparing for Growth and Uncertainty

Finally, a solid financial foundation prepares businesses for both growth and uncertainty. Companies that manage their finances strategically can pursue expansion opportunities, invest in innovation, and enter new markets with confidence. Simultaneously, they are better equipped to handle economic fluctuations, competitive pressures, or unexpected crises.

Risk management strategies, contingency planning, and maintaining healthy reserves are all part of this preparation. Businesses that anticipate challenges and plan accordingly are far more likely to thrive in both favorable and adverse conditions.

Summing Up

Strengthening the financial foundation of a business requires a combination of planning, expertise, and disciplined execution. From effective budgeting and cash flow management to leveraging professional guidance and building a financially aware culture, each element contributes to sustainable success. Businesses that prioritize these strategies position themselves to navigate challenges, capitalize on opportunities, and achieve long-term stability. With the right approach, the financial health of a business becomes a powerful driver of growth, resilience, and enduring success.

Pete Carroll turned 74 two weeks into his first season as the head coach of the Las Vegas Raiders. That is a pretty wild statement. The Raiders, looking to reset their culture, hired the oldest coach in the NFL. Pete is still youthful, energetic and looks to be ready for at least a few more years at the helm.

Looking back over Carroll’s career, it is interesting to note that most of his highest points have come after his 50th birthday. Carroll took over the USC football program at 50 to rebuild the program and his reputation after being fired by the New England Patriots. At 49, Carroll was recently fired as an NFL head coach for the second time and it would have been easy to see him on the decline. He had seen some major highlights like leading a team to the Super Bowl, but maybe he wasn’t cut out for greatness.

The reasons for Carroll’s legendary career are what make him an incredible model for the modern career. Pete isn’t a prodigy like Sean McVay who reached the heights of their career by age 30. Pete has had ups and downs, but kept growing and learning to flourish after 50.

Pete Wins with People and Builds Culture

The news is currently filled with doomsday stories about AI devastating the job market. Its likely true that there will be a shift in the workforce as AI becomes increasingly adopted, but the greatest skillset that can help someone thrive is the ability to work with people.

Pete Carroll can relate across generations and has been known for his fun, but intense practices since his time at USC. Pete understands how to make the job enjoyable and cultivate positive vibes across the organization. This can be viewed simply as a personality trait, but it seems to be very intentional and thought out. If your job depends on getting peak performance out of dozens of individuals then the most important role of a leader is too keep the culture positive and engage the team.

Even if other coaches are stronger in strategy, no coach is better than Carroll at setting culture. This is likely the #1 reason Carroll is still employed in the NFL when arguably the greatest coach of all time, Bill Belichick, is finishing his career in college.

Pete Keeps Learning and Shifting

This is the most important lesson from Carroll’s career arc, but can be seen across the modern workplace. Change is constant and will catch everyone at times. Changing schemes in NFL offenses that Carroll couldn’t catch up with led to his departure from Seattle, but his ability to shift based on his players is why he is the greatest coach in Seahawks history.

In his early coaching career, Pete was able to turn short stints as the head coach of the Jets and Patriots into a winning college program at USC. Carroll seems to have endless positivity, but for the rest of us it is an encouragement to keep taking lessons as we progress in our career because you never know when you’ll have to pivot.

The biggest way that Carroll has learned to shift is in his ability to relate with the successive generations of players. He has shifted into the prototype modern coach. He doesn’t complain about Gen Z, but seems to genuinely enjoy being around a much younger crowd.

The curious thing will be to see if lessons from his time in Seattle will now pay dividends in his final act in Las Vegas. Based on the past, it wouldn’t be wise to bet against Carroll.

Pete is in Great Physical Shape

This is a big part of what keeps Carroll relevant in my opinion. His trademark energy comes from the fact that he has obviously taken care of himself through the years. He didn’t get burned out and out of shape during his successful run at USC and that has made it possible for his later acts.

Its tough to picture younger people taking anyone as seriously later in their career if they begin to wear down and seem more fragile. There is simply a level of physical strength required to stay in the mix.

I don’t aim to be working 60 hours a week into my early 70s, but I would like to be able to continue doing a career I enjoy into those years if its something that brings joy and purpose. The big lesson is that this needs to be a priority in my 40s and 50s while I’m busy with kids and life in order to have the option that Carroll has. I personally don’t want my lack of energy to force me in any direction later in life.

Pete has Found a Career He Wants to Continue

This is a major personal takeaway from Pete Carroll. I personally think it would be nuts to coach a football team, but its awesome to see a guy in his mid 70s who is still working on his terms. He could totally have hung it up and spent his time golfing, but he wanted to keep doing a job he loves.

There tends to be so much focus on early retirement, but I think that more attention needs to be paid by people to preparing for a potential career extending into later years. This can especially apply to careers like architecture or law where it takes decades to gain expertise and there isn’t a level of physicality that would prevent someone from working into their 70s.

People are getting married, buying homes and having kids later in life and so it kind of makes sense to shift the end of working life later too. We can look at it as a loss or we can approach it like Pete Carroll and embrace the challenge of staying in the game. I am personally challenged to emulate the gum chewing Carroll and fight to stay relevant rather than looking to fade out early.

Cryptocurrency has dominated headlines this year. Of course, it’s because President Trump signed the executive order to include cryptocurrency in the investments in 401(k) retirement accounts.

It isn’t surprising that investment in crypto is rising. A report shows that 55 million people in the U.S. now hold crypto. Gen Z investors, in particular, are crazy about crypto. They are allocating 4 times more capital to cryptocurrency.

It’s easy to see why. Cryptocurrency diversifies portfolio, offers a hedge against inflation, and the potential for return is also high. Holding crypto isn’t the only way to benefit from it, however. You can actually put your digital assets to work and earn passive income. How? We’ll share that here.

#1 Lock Up Cryptocurrency in a Blockchain Network

This one’s called staking, and it’s probably the most straightforward way to earn passive income with crypto.

Locking up your cryptocurrency in a blockchain network is often compared to a savings account. You agree to lock up your crypto for a certain period. This helps a blockchain network run its operations and stay secure. In return, the network rewards you.

This process is a key part of what is called the “Proof-of-Stake” (POS) system. It’s a model where users, called validators, lock up their crypto as collateral to verify transactions and create new blocks. The more crypto a validator stakes, the higher their chances of being chosen to validate a new block and earn rewards.

While you can stake with any coin, investors’ confidence is growing in Ethereum. In June this year, over 34.6 million Ethereum, worth nearly $90 billion, was locked in Ethereum’s PoS system. That’s a record high. According to Bit Digital, Ethereum staking generated $560,641 in revenue between December 31, 2023, and March 31, 2025.

So, if you’re seeking a straightforward entry into crypto passive income, staking remains one of the most reliable starting points.

#2 Lend Into Various Decentralized Finance Protocols

Decentralized finance, or DeFi, is a new type of financial system. DeFi lending allows you to be your own bank. Instead of putting your money in a traditional bank for a small return, you lend your crypto directly to others. You earn interest on the loan.

DeFi lending uses lending pools. You, along with other people, deposit your crypto into a pool, locked up in smart contracts. Borrowers then take loans from this pool. In return for your funds, you earn interest.

Automated market makers, or AMMs, manage these pools. These allow users to trade assets without a central order book. The protocol charges a small fee for every trade that occurs within the pool. These fees are distributed as rewards to the liquidity providers based on their share of the pool.

DeFi lending protocols have experienced remarkable growth. Their total value locked (TVL) soared from nearly zero at the end of 2020 to a peak of over $50 billion during the market boom of early 2022.

The rewards can be significantly higher than those from staking. You can significantly increase your assets over time if you reinvest rewards.

#3 Hold Revenue-Sharing Tokens

Revenue-sharing tokens are a lot like dividend-paying stocks in the traditional financial world. They are a type of digital asset that rewards holders with a share of a project’s earnings. The payouts usually come from transaction fees or platform revenues. The best part is that you earn them simply by holding the token in your wallet.

Holding these tokens connects you directly to the project’s success. It makes you a part-owner of the ecosystem. When the project does well and generates more revenue, your income from the tokens goes up. This creates a mutually beneficial relationship.

Decentralized exchanges (DEXs), for example, often issue tokens that give holders a slice of the trading fees. Gaming platforms and NFT marketplaces are also adopting similar models. While returns can vary, the idea remains the same: the healthier the ecosystem, the healthier your earnings.

To make smart crypto investments, focus on projects with sustainable business models and genuine revenue streams. Look for platforms with real users, actual trading volume, and transparent financial reporting. Don’t get fooled by projects promising unrealistic returns. If something sounds too good to be true, it probably is.

Do Your Research Before You Start

Staking, DeFi lending, and revenue-sharing tokens each offer a unique way to earn passive income with crypto. They are not created equal, however. Which method is right for you depends on your goals, risk tolerance, and the amount of effort you are willing to put in.

If you prefer a ‘set it and forget it’ approach, staking might be your go-to. But go for DeFi lending if you’re chasing higher returns. And if you like the idea of sharing in a project’s success, revenue-sharing tokens might be right up your alley.

Whatever you choose, start small, do your research, and never invest more than you can afford to lose. With a thoughtful approach, you can put your crypto to work and earn passive income that grows quietly in the background.

Many seniors face the challenge of finding quality senior living options that fit within their budget. The good news is you don’t have to compromise on comfort or safety to enjoy a fulfilling lifestyle.

Today’s world offers numerous opportunities for seniors to live well while being economical. By making smart choices, it is possible to stretch your budget and still find great senior living arrangements. Read on!

Understanding Your Needs

Before exploring options, it’s essential to assess your specific needs. Consider your health, mobility, and social preferences.

Not all senior living arrangements are the same, and choosing one that aligns with your needs can save money in the long run. Keeping your health and lifestyle in mind will guide your choices and help you find suitable locations for senior living.

Explore Subsidized Housing Options

One effective way to maintain a quality lifestyle is to look for subsidized housing options. Programs exist that can help seniors find affordable apartments and homes. Many governments and organizations offer financial assistance for housing, aiming to provide safe and comfortable living environments for seniors.

Consider Shared Living Arrangements

Shared living has become a popular choice in senior living. This arrangement allows multiple seniors to live together, sharing expenses like rent and utilities. By splitting the costs, every resident can enjoy a better quality of life without overspending.

Moreover, shared living fosters companionship and reduces feelings of loneliness. Look for senior living in Hendersonville where there may be opportunities for roommate arrangements. It’s a practical way to save money and make lasting friendships.

Evaluate Your Location

The location of your senior living situation can impact your budget. Urban areas tend to have higher living costs compared to rural areas. Evaluate whether you truly need to be in a city, or if a more affordable rural location would provide a happier and healthier lifestyle.

Take Advantage of Community Resources

Many communities offer resources aimed at helping seniors live affordably. Local organizations might provide free classes, meals, or transportation services. These resources can relieve financial stress and enhance your daily life experience.

For instance, community centers often host events and activities designed for seniors. Engaging in these activities not only enriches your life but can also save you from costly outings. Staying connected to local resources maximizes your budget while enhancing your social interactions.

Assess Your Lifestyle Choices

When it comes to senior living, lifestyle choices can significantly impact your budget. Consider your daily habits, such as dining out, entertainment, and healthcare.

You can save considerably by opting for home-cooked meals instead of frequently dining out. Plus, exploring free or low-cost local events for entertainment can be fulfilling without breaking the bank.

Make a Budget and Stick to It

Creating a budget is a crucial step in achieving quality senior living without overspending. Outline your monthly income and expenses. Include housing, food, transportation, healthcare, and leisure activities in your budget.

Seek Financial Advice

If managing a budget feels overwhelming, consider seeking advice from financial advisors specializing in senior living. They can provide personalized guidance that aligns with your financial situation and goals. This support can help you make informed decisions and understand the available options for quality living.

Quality Senior Living on a Budget: Live a Fulfilling Life

Quality senior living on a budget is achievable through smart choices. By understanding your needs, considering shared accommodations, evaluating locations, and utilizing community resources, you can enjoy a comfortable and fulfilling lifestyle. Remember to make a budget and take advantage of financial advice when needed.

For more helpful tips, check out the rest of our site today.

Unexpected events often reveal the true value of items we take for granted. A single misplaced document or a moment of carelessness can create lasting consequences, from halted travel plans to family disputes. While theft is an obvious threat, many households underestimate the everyday risks of fire, water damage, or even accidents within their own walls.

Modern safes are no longer reserved for collectors or business owners. Compact and affordable, they provide a simple way to safeguard essentials that often slip through the cracks of daily organization. Beyond jewelry or cash, documents, digital drives, and even prescription bottles gain reliable protection, reducing stress and offering peace of mind when uncertainty strikes.

Papers That Should Always Be Locked Away

Important records often sit in vulnerable places, stacked in drawers or left on shelves where damage or theft can wipe them out. Passports, Social Security cards, and birth certificates belong in locked storage to avoid complications during urgent situations. Property deeds, mortgage contracts, and vehicle titles carry equal importance, providing both privacy and quick access when documentation is suddenly required.

Fire-rated lockboxes and compact gun safes provide strong protection for paperwork that cannot be replaced. Pairing these options with practical organization makes storage even more effective. Labeled folders, a dated inventory, and a simple checklist prevent confusion, allowing anyone retrieving records to do so quickly and without stress.

Valuables Beyond Jewelry That Carry Real Risk if Lost

Family heirlooms and collections often carry emotional and historical weight far beyond their monetary value. Fragile items like coins, stamps, or keepsakes risk damage from humidity, light, or careless handling, making them vulnerable in everyday storage. A compact safe with removable trays and silica packs offers controlled protection, keeping such pieces preserved, organized, and secure for future generations.

Short-term valuables can also pose long-term risks when left unprotected. Emergency cash, gift envelopes, or financial reserves are easy targets during household changes or burglaries. Keeping them sealed in labeled envelopes within a secure safe eliminates the temptation of accidental spending while reducing the risk of theft. Clear organization guarantees funds remain accessible only when truly needed.

Digital Property That Deserves Physical Protection

Family photo archives, tax returns, and scanned documents often live on small drives that end up forgotten in drawers. When water, fire, or theft strikes, those files vanish permanently, leaving memories and important records irretrievable. A safe with fire resistance and cushioned trays shields these fragile devices from heat and moisture while cutting the risk of unauthorized access. Organized placement turns a chaotic pile into a retrievable system.

Passwords and account recovery tools require the same level of security. Hardware keys, printed codes, and encrypted USB tokens are easy to lose but difficult to replace. Storing them with a spare phone or laptop in a locked safe prevents disruption, while rotating one encrypted offsite copy quarterly balances convenience with resilience.

Household Items That Could Be Misused if Left Out

A toddler finding a pill bottle on a coffee table can turn an afternoon into chaos. Prescription meds like painkillers, stimulants and sedatives, plus loose vitamins, attract curious hands or visiting guests. Spare keys hidden outside are easy to copy; sharp hobby blades and solvent cans cause accidental harm when reachable. A small lockable safe keeps hazardous items out of sight and away from children and visitors.

Keeping prescriptions in original bottles inside the safe, stashing spare keys in a sealed pouch and locking hobby blades in a dedicated bin, plus a quarterly check to discard expired meds, cuts household risk and protects items intended for occasional use.

Occasional-Use Essentials That Need a Secure Home

Important travel plans can collapse when documents or funds are misplaced at the wrong moment. Boarding passes, itineraries, and official papers risk theft or damage if stored loosely in drawers. Placing them in a waterproof, labeled envelope inside a secure safe keeps everything intact until needed. This small habit reduces last-minute panic and keeps personal information private.

Seasonal or occasional-use gear presents similar risks. Camera bodies, lenses, chargers, and receipts lose value when left in damp or cluttered spaces. A sealed, protective case within a safe preserves condition and organization. Seasonal cash kept in a marked envelope helps avoid accidental spending, while a consistent storage method creates clarity for every family member year after year.

Protecting valuables is less about luxury and more about preparation. A reliable safe turns vulnerable items—documents, keepsakes, digital archives, medications, or spare keys—into organized assets ready when needed most. Fire resistance, thoughtful storage, and consistent upkeep replace disarray with confidence. Families gain both peace of mind and practical security, knowing that vital items are shielded from theft, accidents, or sudden emergencies. Treating protection as a consistent practice rather than a one-time effort builds resilience. Over time, this habit safeguards not just possessions, but also stability and clarity, offering households lasting reassurance in both predictable routines and unpredictable moments.

Most people plan their estates by writing a will, but only 31% of Americans have one, and only 11% have a trust, according to Trust & Will.

Writing wills is common when planning for the welfare of your loved ones. But for some, trusts are also a useful option to consider. Both tools help make sure your wishes are followed. In retrospect, they do work in different ways and come with their costs and benefits.

For example, when looking at will vs. trust in California, it’s important to know that a will usually goes through probate. This process can be time-consuming and costly. In contrast, trusts avoid probate and keep matters more private for you.

Here are the differences between trusts and wills to help you decide which one is the better option for your plan.

Understanding Trusts and Wills: Key Differences

In estate planning, it is paramount to distinguish major differences between the two. A will is a legal instrument by which one assigns their property upon death. Wills take effect after death and undergo a process called probate, which can take some time and may become public.

According to https://www.mdestateplanninglaw.com/, in many instances, a trust may be even more beneficial to ensure a smooth transition and limited government involvement upon one’s passing.

A trust will let you control your property during your lifetime and allow for the smooth transition of such assets to the beneficiaries in case of probate. They even hold great control over when and how their assets will be distributed.

The knowledge of differences with respect to trusts and wills will help you in discerning the best option for a given family need, so it matches with how you envision that need being fulfilled and gives the family members a feeling of belonging and safety.

Advantages of Using a Trust

While trusts and wills are both part of estate planning, the establishment of a trust offers certain benefits that more tightly control the actual asset transfer. To begin with, a trust allows assets to transfer more smoothly, bypassing the long probate process that usually accompanies wills.

This feature could be crucial since your loved ones would otherwise have to wait for their inheritance. In terms of privacy, trusts offer protection since they do not reach public records, unlike wills. Trusts allow you to define the conditions for your heirs’ inheritance, preventing them from managing it directly.

Trusts keep their assets out of creditors’ reach and possible claims; this offers peace of mind. The creation of a trust shifts the power in your hands to mold the reflection of your legacy according to what you value most.

Disadvantages of Trusts Compared to Wills

Despite the offer of advantages, trusts also bear certain disadvantages when compared to wills that you may want to consider. First, trusts can be complicated and time-consuming to establish, and you might feel as if you have to run blindly into crashing waves of legal assistance.

If you want a simple way of protecting your loved ones, a will may be easier. Smaller families usually need smaller trusts, but even small trust arrangements need ongoing trustee management-and that might be too much to bear in case you are interested in a hands-off approach.

If you haven’t funded it properly, the trust simply does not work in its own way, thus leaving your estate exposed. Emotionally speaking, a will becomes sentimental, giving you an avenue through which to formally declare your wishes with full disclosure and sincerity.

Financial Considerations: Costs of Trusts vs. Wills

In choosing between trust or will, you must first understand your financial considerations. From the viewpoint of establishing the trust and the higher prices it usually carries, attorney fees may vary greatly.

You need to think about the funding costs of the trust, the periodic maintenance, and potential tax considerations. On the other hand, wills are often initially less expensive. But they must still go through probate, which can take longer and be costly for the surviving family members.

Long-term savings and avoiding probate fees would weigh in favor of trust. Still, you must weigh these considerations against your particular financial situation and family considerations.

So setting some ideas into the costing will leave you in a position to draw a practical conclusion that gives others a feeling of belonging and security.

Making the Right Choice for Your Estate Planning Needs

Look at your unique situation when deciding on the best estate planning option. You must first evaluate your assets, family dynamics, and long-term goals. If minimizing probate is the priority and privacy is important, a trust would generally be the option in consideration. A will could be better for cheap options, such as in a simple estate.

Consider your loved ones next. Trusts provide more control over receiving inheritances, thereby providing them with assurance and security. Do not feel shy about consulting estate planning lawyers, for they can put you through the alternatives.

The most worthwhile choice is the option that aligns with your core beliefs and provides emotional support for your family.

The stage is set. You’re sitting at a candlelit dinner for two. The chef prepared your favorite dish, and the evening ended with dessert. Then you turn to your beloved, their eyes reflecting the warm glow of the flame. “Honey, we need to talk about finances.”

Talking about money isn’t a very romantic start to spending the rest of your life with your partner. It’s the looming elephant in the room. Despite the evolution of society as a whole, 62% of adults still find it uncomfortable bringing up the conversation. And yet, for couples jumping into marriage, it should be as effortless as talking about love.

An investment advisor says that financial clarity is as important as emotional honesty in a long-term relationship. Because the biggest fights among couples aren’t about where to spend Thanksgiving, but financial differences, according to Psychology Today.

Why Money Talks Matter Before You Merge

Money isn’t only about dollars; it’s about values, habits, and long-term plans. The New York Times notes that couples who avoid these talks often discover mismatched financial expectations later, leading to unnecessary conflict.

That’s why wealth management experts suggest a major life transition preparation plan that tackles financial transparency before the ink dries on your marriage certificate. Any significant life change should be tracked, including changes in mental and physical health.

Whether you’re talking debt, credit, or investments, a marriage is a partnership, and a financial plan should reflect that. Richard P. Slaughter Associates recommends partnering with a firm to develop a personalized strategy that focuses on your unique situation.

The Pre-Merge Checklist

Before combining accounts, gather your financial puzzle pieces.

Full Disclosure

List debts (student loans, credit cards, car notes), share assets (savings, retirement accounts), and yes, reveal those credit scores.

According to Investopedia, your credit histories affect big joint decisions such as qualifying for a mortgage.

Talk Goals Early

Define both shared and individual priorities, like buying a home, paying off loans, or traveling. Aligning these before you consolidate money helps you avoid surprises later.

Understand Each Other’s Style

Are you a saver, while your partner spends like payday lasts forever? Reader’s Digest offers practical tips for stopping money fights, starting with understanding your different money personalities.

Different Ways to Combine Finances

Not all couples need the same system. Pick one (or a mix) that works for you.

Separate Accounts

You each keep your own, and maybe share one for bills. Investopedia states that this can help maintain independence but requires coordination.

Joint Accounts

All income and expenses flow through one pot. This simplifies bill-paying. However, it can also feel restrictive if your spending habits differ.

The Hybrid

A crowd favorite: share one account for bills and goals, keep individual accounts for personal spending. U.S. News explains that this approach is the most flexible option, making it easier to balance teamwork with autonomy.

Did Someone Say Prenup?

We had to bring it up. Here’s where most get it wrong: prenuptial agreements aren’t exclusive to the wealthy.

Bloomberg reports that with most people choosing to settle down later in life, many enter marriage with their own assets and investments. A law expert tells the publication that prenups keep a record of what each spouse brought into the marriage.

In the event of a divorce, the absence of a legal prenuptial agreement can cause more heartache and pain. You’ll regret not having the conversation sooner rather than later.

Financial Habits That Keep the Peace

Even with the best system, money harmony depends on daily habits.

Regular Check-Ins

Think of them as financial date nights (minus the candlelight). Review budgets, track progress, and adjust as life changes. This can help prevent resentment and surprises.

Automate Where Possible

Set up automatic bill payments and savings transfers. Less room for “Oops, I forgot” arguments.

Agree on Purchase Thresholds

Decide what amount requires a joint discussion. Maybe $200, maybe $500. Reader’s Digest suggests clear ground rules prevent those “You bought what?!” moments.

Common Pitfalls to Avoid

The most in-sync couples can trip up. Look for the following red flags:

- Hidden debt: If one partner isn’t upfront, you’re both paying the price later.

- Unequal contributions without fairness: If one earns significantly more, splitting bills 50/50 may not feel sustainable. Consider proportional contributions instead.

- Credit consequences: Late payments on joint accounts affect both partners’ scores.

- Skipping retirement planning: Newlyweds often focus on immediate costs (such as the wedding and housing) and overlook long-term goals.

And if needed, don’t be afraid to bring in a financial planner. Sometimes a neutral third party makes all the difference.