Its been developing for over a decade. The rise of social media was the first major shift in this direction towards Big Tech functioning like a colonial empire of centuries past. Recent quotes from AI executives like Sam Altman simply expose that the transformation is complete. Big Tech looks at the people of the world the same way the British Empire used to see the people across its worldwide empire. We exist for extraction and are expendable. It is a bleak way to look at things, but I also think its critical to see things in this way as we try to determine the best way to protect our money and happiness in the modern world.

Different Tactics, but Same Attitude

The empires of centuries past were obviously overtly oppressive and weren’t apologetic about extracting resources from their colonies at the expense of the people there. They came in with weapons and subdued the people. These were empires of harsh force, but the end goal was to extract wealth from far off lands where the people could be viewed differently from the homeland.

If the modern world of Big Tech, its obviously not going to be physical oppression that is the tactic used. That is not how the world works now, but also its not the best tactic for extraction of wealth. Its much more lucrative to mine for attention and data. In the digital world, its much easier to colonize consumers than it is to go conquer land for resources.

This attitude of Big Tech has been laid bare recently due to the rise of AI. Now the path for money for many of these companies is to replace the jobs that many people hold. The cold statements that continue to flow from AI company CEOs show a very clear colonial view of the people they would be displacing. They don’t care about the job losses. They are simply talking to their investors in the same way a British merchant would talk about profiting from a far off colony in the 1800s.

The part that comes off so bizarre is that these CEOs are talking about fellow citizens of the same country they inhabit, but that is where the truth comes out. These CEOs inhabit the Silicon Valley and its clearer than ever that they don’t view themselves as part of the greater nation or world at all.

Social Media and the Cultural Takeover

Another major aspect of old colonial rule was imposing the colonial culture on the world. This is still seen in our modern day as aspects of British culture are very prevalent all over the globe. The impact of social media wasn’t necessarily an intentional cultural export, but it has still had the same effect. People are increasingly unhappy at the isolated and polarized world, but at the end of the day that culture serves Big Tech. Isolated, angry people are great for engagement and for impulse purchasing.

I often wonder how much of the current culture is an unintentional consequence of the growth of the digital age or if these companies have worked to steer it in this direction. One thing we definitely do know is that as the culture of tech took over, the companies did not work to stop it and only paid lip service to its challenges. The damage of social media to young people is well documented and the prevalence of scams on Facebook is known to be a large portion of the revenue.

In both of these instances, Big Tech stays in line with what serves the extraction economy and hasn’t really stepped up to shift in any meaningful ways. Due to the financial incentives, no one should expect this trend to change and most likely there will be continued advances in this cultural takeover. It doesn’t help tech companies profit if people leave their phones at home for a long hike or spend an evening playing board games with friends. These things go against the culture that serves the empire. Isolation and anger feed the empire and so we shouldn’t be surprised to see it get worse.

The Never Ending Extraction Economy

Watching sports over the past few months in the runup to the Super Bowl, the Big Tech extraction economy was coming at all of us aggressively. It was constant ads for Doordash, Uber Eats and gambling. At the end of the day, all of these things are designed simply to move money out of communities across the country and into the arms of Big Tech. The key element of this economy is constantly throwing things out that are okay in small doses, but easily get out of control.

Getting Doordash when you are sick or injured is one thing, but it has become another element of the Big Tech cultural takeover. Its increasingly common for people to order food delivery and I know for many families its a sizable monthly bill that they would probably like to see going into investments. Restaurants get squeezed by these services and its also been written about that the money for drives isn’t great either. Doordash and Uber Eats started at a much lower price point with huge subsidies from investors, but now that they have expanded they are continuing to squeeze more money out of the system.

Gambling sites and now prediction markets like Kalshi depend on the fact that a certain percentage of the population will not be able to control their betting which will lead to massive profits. These type of sites are the most clear example of how the Big Tech Empire operates. They offer something that is a trap for a fair amount of people, but its not actually forcing anything so its deemed okay.

As articles flow out each week about the massive challenges facing young people today, I keep thinking about Doordash and Draft Kings and wonder how many people, particularly 20 something men would be in a much better place without having hundreds of dollars siphoned off each month.

The increasing flow of doomer stories about how AI is going to take all the jobs only feeds these extraction methods because its hard to save for a future that looks impossible. Its just life in the Big Tech colonies: steady feed of doomscrolling stories, plenty of images of people looking happier than you and constant ads popping up to give you easy places to blow your money.

Resistance isn’t Futile

As a father of two teenage kids, I think a lot about how the world is moving and what it will look like for then to lead a fulfilling life in a world that is increasingly being bent to the will of Big Tech. However, there is actually more hope than this post has shared up to this point. The biggest point of hope is that Big Tech doesn’t directly oppress the way empires of the past did. Big Tech is simply betting on the fact that enough people will get caught up in its apps to feed its profits. They don’t care about the people avoiding them because there will likely always be enough getting caught.

My wife and I started with limiting our kids screen time and exposure to social media, but I soon realized that i needed something similar for myself. I ended up putting limits on my time on Youtube and X, just to limit how much it was impacting my brain. We have fought to schedule time with friends and always have a book we are reading.

I have a personal crusade against our family using food delivery apps. If the delivery apps are out of the picture, it forces us to do things that are frankly more life giving. Cooking at home is way more healthy and going out to a restaurant is way better for getting into conversation, but both take a lot of effort.

In terms of the final battle against AI, I keep a conversation going with our kids about all the jobs that are going to be around in the future. So many jobs that center on dealing with people or building things in the real world will continue to exist and will frankly thrive in a world with AI. The biggest thing I’m hoping to give them is a picture of a world that will still be a great place to live and that they can build a life in.

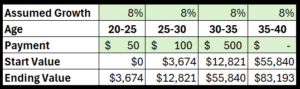

There has been quite a bit of commotion about the fact that the average age of a first time home buyer in the US has risen to 40 based on the latest data available. This average age has been moving up for years as homes become more expensive, but also due to families forming later in life. When this number gets discussed it is mostly from the negative perspective, but it is worth stepping back and looking at this from a fresh perspective. The world is undergoing a major shift as people migrate towards the economic engine cities which come with sky high housing costs. There is also a significant shift towards getting married and starting families later in life.

In this new climate, it is worth simply evaluating if 40 is actually the right age to purchase a first property? Is this the right balance between benefiting from the lower cost to rent in many cities, but ending up in a home that you can eventually pay off.

Life Takes Longer To Launch in the Modern World

Aside from those who work in tech or finance, the process of working up to a solid salary takes some time. Its a balance of getting experience and finding where you can add the most value in whatever profession you choose. Most people have false starts in one way or another. For most of my friends, their 20s was largely a feeling out period of trying out the different aspects of their chosen field or realizing that they needed to shift to something new. This sorting period isn’t expected and is frankly incredibly disappointing to many, but its common.

This aspect of career development seems to be causing Gen Z tons of grief because it doesn’t present a linear path to making the kind of money that fits with owning a home. College is far from an automatic step and it adds on student loans to the equation. When you are fresh out of college and only making $50K a year, it looks impossible, but it just needs space to breathe. For most, 30 is just too young to think about saving enough for a down payment, and that is okay.

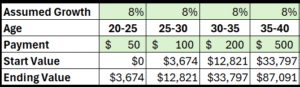

Here are a couple scenarios that show how a person can gradually increase their savings as they grow their income. The first assumes a steady increase between 20-40. It doesn’t look great at 30, but between 35 and 40 the combo of increased savings and compounding really kick in. This is actually pretty conservative returns at 8% a year and it still gets to $87K to put towards a home (or just keep rolling in an index fund).

This next scenario represents a couple who knows they want to have kids and so puts more down in their early 30s, but doesn’t save at all for 5 years when the kids are little. This still puts them in a spot to buy a house as the first kid starts school.

No money goes in from 35-40, but it still gets up to $83K. That is more than enough for a solid down payment in many parts of the country. It also shows that you can get to some decent savings without huge monthly savings rates. These numbers would be very approachable for two incomes renting a reasonable place.

Why Buy a House at all?

If you are in your late 30s and you’ve actually started getting a nice nest egg invested in the stock market it would make sense to just keep riding with that plan. If you want to stay in a big city where homes are extremely expensive then this could be a good idea. The reason to buy a home starts with entering a season of life where you want to be stable for a while.

Real estate has historically been a good investment when held for a long time. If you think you will be moving around and jumping to new jobs, then it doesn’t actually make much sense. If you have school age kids or will in the coming years, then having a stable location becomes much more appealing.

This first aspect of buying a home connects with the needs of the moment, but the most important reason to buy a home relates more to the eventual goal of retirement. If you buy a home at 40, then with some additional principal payments each year you can actually set your sites on paying it off. This is a huge deal for thinking about the shift into living off your investments. If you are still renting at 60 or 65, it puts all of your well being at the hands of your investment portfolio. If you have a paid off house, you have a much lower burden and also a separate source of potential money for the future. Paying off a house is the ultimate hedge on the markets and this shouldn’t be missed even though stocks provide more annual returns.

If you are investing in a 401K and putting some extra on paying off a home, this is in my opinion the best way to get ready for retirement. A paid off house takes much of the risk out of future potential black swan events for the stock market or even the housing market.

Putting Down Roots is Bigger than Just Money

In the previous section I’ve laid out the financial side of why buying one home and paying it off would be valuable from a financial perspective, but there is a more important side to this. The idea of really putting roots down in a community has far more potential benefit than just the financial. If you mentally plant yourself and start paying a home down, then its easier to invest in neighbors and in your local city. This is part of a remedy to the disconnected existence that is so common in modern life. When everyone is passing through its easy to stay aloof, but when you have planted, it can’t help but shift your mentality.

In the culture of the United States, there is a major difference to a neighborhood where most people own their homes and are looking to stay long term. It is incredibly pronounced when you move from a major city where people are highly transient to any smaller metro where people tend to settle down to raise kids.

This is the last major reason that it makes the most sense to target 40 to buy a first home: you need to be ready to settle down. People aren’t settling down to have kids at 28 anymore. Those days are long gone and that is okay. The idea of locking into an area and truly investing in that community is something I hope everyone finds at some point. That is still incredibly connected to buying a home and even though it takes longer these days, it still something worth pursuing.

If you are simply reading the news lately and following social media it would be easy to think that the American Dream has passed us by. The focus is constantly on the increased levels of debt, high house prices and the frozen job market. Stats are skewed to focus on the depressing and there is a growing fatalism in people under 40 that a future with a home and a family is simply not an option.

Obviously, there wouldn’t be all this bad press out there if there wasn’t truth in it. The American Dream is definitely under assault from the forces of inflation and the highest home prices in history. A college degree isn’t seen as an automatic pass to a stable future anymore either.

However, all this negative news is simply exposing trends that have actually been true for quite a while. The journey to the American Dream has been perilous for decades and has to be treated that way to find success. The great lie is believing that success in America has ever really been that easy. There have obviously been seasons where it was simpler to find a home and build a life, but every generation has faced serious headwinds.

Lost in all the focus on negativity is the fact that there are plenty of people quietly carving out a life. It’s not post worthy to figure out a tight budget to stay out of debt during the years when you are paying for childcare. A small home from the 1970s that needs fresh paint and new flooring isn’t something you celebrate outside your friends and family. All the steps that eventually lead to a financial breakthrough in your 40s look like a grind in your 20s and 30s, but if you talk to most retired people you will find that its pretty much always been this way.

The Myth of the Easy American Dream

It has always been a small fraction of people who have access to an easy path to a beautiful home and growing wealth. This is essentially what separates the upper class from the various flavors of the middle class. For the middle class, getting established has been a scrap even for the baby boomers. People in their 70s faces a terrible economy and double digit inflation in the 70s. Wages stagnated all through the 80s and 90s, so while home prices were low it wasn’t incredibly easy to get established. Gen X has been identified recently as the “Real Loser Generation” according the the Economist. This is largely due to the stock market stagnating in the early 2000s which cut them off from accumulating wealth.

There have been periodic recessions and stock market crashes through the past 50 years and so there have been plenty of periods where it looked equally bleak to the current state if not worse. Its good to talk to retired family about how their early years of marriage and kids because there are a lot of stories of pinching every penny, DIY home projects and worrying about the future.

The true story of the American Dream is that it is a battle. Its a battle to get established in a career, to find a place you want to settle down and for most its scrapping to make it work with kids. This was my parents experience, it was definitely how it went for my family and its what I’ll tell my kids to expect.

Fatalism towards the Future can be a self fulfilling prophecy

The biggest challenge I’m seeing for anyone looking to get established and build a life is that there is so much energy focusing on how impossible everything is. If people don’t believe that they will be able to make smart financial choices pay off, then it makes more sense to live for now. This has led to an epidemic of gambling, hyper risky investing and wasteful spending.

Why not get Doordash all week? Why not have fun putting some money on the football games over the weekend? Thanks to the tech economy, all these whims are easily realized on a phone.

The scary thing is that all of these convenient ways to pull money away are what can sink Gen Z’s future more than just the challenges they are facing in the housing market.

If you add $30K in credit card debt to an existing student load balance, then it can push the situation over the edge.

It’s okay to be figuring things out in your 20s and 30s

So what are people supposed to do? The first thing is to keep moving. Most people feel pretty lost in their career when they are starting out. Entry level roles are a grind and it is tough to see a vision of where things can go. The arc of the modern career is longer than it was in previous generations and that has to be accepted. Feeling pressure to buy a house at 30 simply isn’t realistic for most people. 30 is likely a time to still be getting experience and learning an industry. Its a great time to still be a a major hub city renting a small apartment.

There is so much internet conversation about early retirement or getting out of the 9 to 5, that it can be lost that most people grow their wealth through a normal career path. Its likely not going to make you super wealthy, but making the standard 401K contributions over the course of 30-40 years will most likely set you up for a comfortable retirement.

The key to the early years of a career is to be gaining skills to make you increasingly more marketable and moving around to find opportunities. Its now standard practice, that to get a legitimate raise you need to move to a new company. 3% is a pretty common annual raise and you might get close to 10% for a promotion, but companies will often give a larger bump when you are new. This is a huge reason why people shouldn’t stress to get a home by 30 because its most likely that the potential job that makes a home affordable is going to involve moving to a new city.

40 Might be the Right Time to Buy a First Home

It seems pretty bleak that the median first time home buyer was 40 years old in 2025. However, if you think about what a modern career looks like, this is probably the right age to think about. This allows for keeping expenses lower as you grow your career and focus on investing a bit in the stock market. It allows for easy movement in the critical years for making advancement.

This also is a realistic timeline for when kids may be starting school which is realistically a great time to really put roots in one place for at least 5-10 years. Its really the season of life where it make sense settle in and that takes a lot of the risk out of the volatility that I forsee in the housing market. If you are comfortable staying in a house long term, then its still a great investment.

While the biggest cities are crushingly expensive, there continue to be plenty of areas in the US that are approachable for a couple on a middle class income. As I’ve mentioned in a previous piece, when cities like Buffalo show up on the hottest housing markets, you can bet its people looking for an affordable place to settle down.

Increasingly Challenging, but Possible

I’m writing this piece as someone who was pretty down on my prospects as a 30 year old. My career was still just getting rolling and I already had two young kids. I was like many people today and felt completely behind. I didn’t see a path for the long term, but my wife and I buckled down during the little kid years and stayed out of debt even if we weren’t investing much.

Careers kept moving along and we kept our lifestyle under control and then around 40 things really turned and we’ve seen our ability to save increase dramatically. Now I look back and can see how much those early years were building towards this, but it just doesn’t show up in the bank account in a linear fashion.

I am quite encouraged when I see that Gen Z invests in stocks at a higher rate than older generations because I think there will be many who see themselves get traction in 10 years despite things looking dire in the current moment.

At least here’s hoping.

When Kyla Scanlon coined the term Vibecession, it was in the midst of the pandemic spike in inflation in 2022 and in the years since it has captured the general mood of most of the world. The major shock of that year was the one-two punch of a spike in housing prices in most cities followed by the jump in interest rates. This shock came on top of a gradual uptick in the cost of insurance, groceries and childcare that have made the American Dream seem unattainable.

The internet feeds the world a consistent diet of statistics that show how the averages for house prices, wages and debt for Americans are moving in the wrong direction. If all you see is these numbers it can seem like the battle for a quality life has already been lost. In leading cities like New York, San Francisco or LA, the gap between normal wages and the housing market is beyond reach, but there are many people who are finding places to build a life in less glamorous locations.

Image of Glen Park in San Francisco. Such a cool neighborhood, but also out of reach for most.

The Challenge Starts in the Big Cities

Especially for anyone under 40, the biggest challenge that I’m seeing is that the majority of the career opportunities are in the major cities like Seattle and San Francisco. I can picture the hopelessness of working in your 20s in one of these cities and potentially even earning a decent salary, but never seeing how you can afford a home over $1 million dollars. If you are underemployed and not even working in the field you studied in college, then it would look like an impossible mountain to climb.

Increasingly, the major hub cities in the US are becoming places where people go to get experience and hopefully grow their careers, but simply aren’t where most can settle down. Its been well documented that most of these cities don’t build enough housing and so the math is simply going to be moving in the wrong direction for the vast majority of people.

When a poll found that Gen Z thought they needed over $500K to feel successful, I can’t help but think that this is linked to where Gen Z is currently living. If you are in New York City or San Francisco, this number probably feels right. For anyone living in Buffalo, Omaha or Indianapolis, this number would feel massive.

Big Cities are For a Season, not forever

The one thing that is clear for virtually everyone is that the traditional American Dream of owning a home with a nice little yard and having a couple kids is out of reach in the major coastal cities of America. This is understandably massively discouraging since these cities are really cool places and it would be great if there was a clearer path to making it in the “big city.”

So what is someone in their 20s or 30s supposed to do when the cities with the best jobs are simply impossible to get established in?

For most people living in a major city, its just about making sure you get the value from the city as you look for an offramp to a smaller, less expensive place. Get the amazing experience at a startup or at one of the leading companies in the world, but don’t kid yourself to think that this will be a place you settle.

Even for those who stay in areas like Austin, they end up way out in the suburbs and not in the core. Families just don’t stay in the cities and so the time for relocating is coming for virtually everyone.

The Migration is on to Find a Quality Life Outside the Big City

For people in the phase of life with young kids or getting ready to start a family, the transition out of a major city is increasingly part of the deal. It has really been trending this way for decades, but the recent housing spike and interest rate hikes has made it even more pronounced. This is what makes the recent data from 2025 that put Hartford, CT and Buffalo, NY at the top of the hottest housing markets. This can be coupled with the consistent flow of people to the Carolinas and Texas. Some areas have gotten expensive, but there is still a lot of value even in the suburbs of Austin or Dallas. In these southern markets, the constant construction has actually led to pretty extensive price drops even though people continue to move there in pretty high numbers.

For my family, the move was to my hometown of Spokane, which sits at right about half the housing cost of Seattle. Spokane will never be as cool as Seattle, and we always look forward to trips across the Cascades to experience all that it has to offer. Spokane, like other middle of the road cities across the US, does have all that we need for a quality life. It has just enough and also has enough challenges that it will likely never become a place that wealthy people pour into in droves.

It’s this layer of cities that is the remedy to the Vibecession in my opinion. Its the places that we don’t want to move to in our 20s, but when you have a kid or two and your closing in on 40 then they actually have all that a family could need.

Its not as splashy an American Dream as I’m sure most people want, but its a quality life and its one that many people are quietly finding across the country. They don’t post on social media that they just bought a house in Buffalo, Spokane or the suburbs of Houston, but they are finding footing and quietly building a future.

In a recent article published right before the end of 2025, The Economist described the affordability crisis as “mostly a mirage.” The article includes data about wages and grocery prices which have largely stayed in step with each other over that period coming out of Covid. There is a recognition of the impact of increased interest rates hitting the ability of Americans to buy a house, but overall there isn’t alignment with the sentiment of the popular mood. So what is really going on? Is The Economist seeing through the noise or is there something missing in this assessment?

The Core Issue isn’t Wages vs. Grocery Prices

In its assessment on affordability, The Economist focuses on wages and food prices which makes sense, but misses the core of what is really driving the pain in affordability in America. It is good to note that real wages have been headed in a very encouraging direction over that past ten years. In the overall averages across the country, its appears that wages have kept up with the overall increase in costs. This seems to show that all this noise about affordability is felt, but doesn’t reflect reality.

However, the issue sits outside of these two items. The greater challenge that I hear about from friends and is discussed on social media is the stack of expenses that are now weighing on the middle class. It is the combination of student loans, childcare, health care and now the jump in housing prices that is bringing the angst. This is what is delaying the American dream or simply making it seem impossible for people.

Student loans are particularly challenging because they tend to be higher for people who have pursued an advanced degree. This ends up taking a bite out of higher earners like counselors or physical therapists, and its taking the bite during the years correspond to young kids in the home.

Its this stack of expenses that is beating up the middle class in their 20s and 30s.

The One-Two Punch of the Covid Housing Bump and Interest Rates

The Economist does a good job recognizing the impact of the sharp rise in interest rates on the housing market, but it doesn’t seem to understand the impact of the equally sharp rise in housing prices during Covid. In some metro areas the prices have come back to earth, but in most a good portion of the price gains have remained. This has created a major shift in affordability in the course of a four year period. In a city like Spokane, where I live, this means that young people are looking at drastically different homes for a first purchase then they would have in 2019.

I see this as the major reason that average age of a first home purchase has shifted all the way up to nearly 40 years old. This is the impact of the shifts in the housing market coming out of Covid and its important to understand how significant it really is. The angst comes much more from having to shift life timelines drastically from previous expectations.

- People who hoped to buy homes are priced out

- People who want to rent in a safe area aren’t able to

- Homeowners who would want to buy a larger house are stuck

This one-two punch has shifted down the plans of almost any person who wasn’t already in a long term home on a 3% mortgage. This downgrade is what is disheartening.

The Weird Frozen Job Market is Making People Feel Stuck

While there has been an overall increase in wages over the past 10 years, anyone involved in the job market will tell you that these increases are highly variable. It is common to get a 10-20% raise when moving jobs, but only get a 3-5% bump in the same role. My experience aligns with that of The Economist that the lower end of the pay scale has seen more consistent pay bumps in order to stay maintain their hourly workforce. The challenge comes as you move up into more competitive roles.

The fact that the more substantial increases in pay tend to come with changing jobs has made the challenges in searching for new roles incredibly frustrating. While the rise of Linkedin and Indeed has made the process of identifying new roles easier, there has also been an increase in frustration at how often resumes float out never to be heard from again. It takes a lot of applying to land a new role and this is increasingly a taxing proposition for anyone who needs to make more money to stay on track financially.

In 2025, the job market took a turn due to the political chaos, tariffs and tech layoffs. Now there are less opportunities coupled with the challenges of the new job hunting environment. This isn’t an impossible situation, but its been very frustrating for most people. This is the reality of the affordability crisis. The overall numbers for average wages are going up, but the journey to get those wages is more difficult than many realize.

The Never Ending Attack of Digital Money Syphons

If you watch any program with commercials in the US, you will see a steady flow of adds for food delivery and gambling apps. Add onto this the ever expanding availability of media subscriptions and you have an incredibly challenging situation for the average American. This layer is also challenging because people know that they are choosing to funnel their money into these syphons.

Its not forced, but these convenient options grab away potential savings from people in their 20s and 30s. We are at a peak in the dangerous freedom of unlimited options. Baby boomers had to go to a casino or racetrack to lose their money gambling. Now, most people can do it in a few clicks. The normalizing of the convenience economy means additional money going out of the monthly budget.

This challenge is the easiest to overcome, but needs to be considered because of the havoc it is having on people in their 20s and 30s. All of these apps have become part of the culture and as we’ve seen with credit cards, these new spending norms are hard to undo.

Conclusion

The increase in the grocery bill simply isn’t the core reason for the angst of the affordability crisis. People are frustrated that they can’t get the bill lower, but the main reason is that the stack of housing costs, childcare, student loans and healthcare costs are making it extremely challenging to get on plane financially.

Add onto this the amount of effort it takes to find a better job and actually get hired and you can see why people are discouraged. Its as if people set out on a six mile hike and then found out halfway in that it was actually going to be 12 miles. It is a jarring shift in reality and that is why there is so much discouragement throughout the culture.

Things are rough for many right now across the developed world and it can seem like there isn’t much hope for improvement. Everyone has been hit by a strong wave of inflation which has made daily life more costly and the housing market is reaching a breaking point. The jump in home prices during Covid, followed by the drastic increase in mortgage rates has made home affordability out of reach for most.

Recently, an article about how $140K could be the new poverty line captured the mood, but also put a crushing exclamation point on it. It starts to feel like anyone who hasn’t found a home yet is screwed and that the American Dream is simply running away. The goal of this article is to put forward a few thoughts that help show how the math could start to turn back in our favor for the biggest pain point, the housing market.

Home and Rent Prices are down dramatically across a number of cities

The city that exemplifies this the most is Austin, TX. Its a city I lived in for 6 years and watched explode during the 2010s. I never would have figured that this housing market would cool off, but I also didn’t expect the ridiculous quantity of homes and apartments that would go up. Each trip my family takes back to the city there are new complexes built it doesn’t seem to be slowing too much even with the price drops.

What this drop has shown is that there are limits to the housing madness, but also it gives a roadmap for other cities. Even the construction of luxury apartments has shown to be part of what is bringing the prices down overall. Wealthier people are moving up to the new units, but it creates openings lower down. This creates opportunities for folks down the ladder to find a place.

The cause for hope is that many have thought the need was to build housing for middle class renters, but the reality is even housing that is focused up the income ladder still opens up spots. This cascade can really help people who are in the outlying areas where rents may drop off the most due to cooling demand. Austin has given proof of concept which then puts pressure on other cities to get building if they really care about their citizens.

Image of Moontower Saloon in the affordable 78748 zip code in South Austin

Restaurants and coffee shops continue to spread into the outer neighborhoods of Austin which makes these areas more fun to call home. This trend, coupled with the dramatic drop in prices for both rent and homes in the greater Austin area creates better chances for younger people to get traction.

Smaller, Affordable Cities are Quietly Getting Cooler

The funky bars and cool coffee shops are spreading around Austin, but they are also finding their way into the smaller metro areas around the country. One of the major factors in my families decision to relocate back to my hometown of Spokane, Washington was that it had more and more pockets that reminded us of Austin.

Image of Indaba Coffee Shop in Spokane in the affordable 99205 zip code

Spokane is among the many mid-size cities across the country that don’t inspire much nostalgia from people who aren’t connected to them. These are the sleepy places where people grow up and move to a big city like Seattle or Portland. However, as the years go by, more and more places are popping up that are bringing big city culture into the smaller metros. A reason for this is that the people opening these hip businesses also need to afford a place to live.

I’m sure if I ventured into any of the mid-size metros across the US, I could track down enough trendy spots to keep most people happy. These cities aren’t turning into Seattle or San Francisco, but they have enough. The key is to find a place with enough to make you happy, but not enough to turn into the next Bend or Bozeman. Being a little trashy is perfect to keep the super rich away.

I’m sure there are a ton of people who would puff out their chests to say that a place like Spokane could never compete with Seattle or Austin, but that is a big part of why there is hope here. Places like Spokane will never get the hype of the big cities which will always keep them more reasonable and therefore keep them a place where you can hope to afford a home.

Slow Housing Market Opens the Door for Fixer Upper Deals

I can still remember the chaos of the housing market in the great blitz from 2010 – 2020 where offers were flying and bidding wars were the norm. In that rush, it didn’t matter if a place had bad carpet or needed all the flooring replaced. Prices were just going up and if you wanted to be slow you would just be sitting on the sidelines.

Now the vibe is completely different in most places. Homes aren’t selling as quickly and if they have some issues they can fall further than they should. Its not like things are going to drop into the bargain basement, but things can definitely fall further than they should. Most first time home buyers simply don’t want to deal with the work to bring new life to a home in less than optimal shape.

Additionally, since the numbers for investors are so much less appealing in the higher interest rate environment, there isn’t the competition when homes drop like there was in the past decade.

This is where the terrible vibes for the housing market really give a great opportunity. Most will simply not go looking and so they won’t see where the numbers may actually look really good for an older house that a family is looking to unload. Even in the heated market during Covid, homes that need work still slipped through because people can’t always see the potential. Now that the mood has soured, there is more potential for homes to drop to a spot where it could be right to buy.

Real estate prices are very chaotic and hard to pin down due to the variablity of homes. This can make it very challenging, but it also creates opportunity.

Pete Carroll turned 74 two weeks into his first season as the head coach of the Las Vegas Raiders. That is a pretty wild statement. The Raiders, looking to reset their culture, hired the oldest coach in the NFL. Pete is still youthful, energetic and looks to be ready for at least a few more years at the helm.

Looking back over Carroll’s career, it is interesting to note that most of his highest points have come after his 50th birthday. Carroll took over the USC football program at 50 to rebuild the program and his reputation after being fired by the New England Patriots. At 49, Carroll was recently fired as an NFL head coach for the second time and it would have been easy to see him on the decline. He had seen some major highlights like leading a team to the Super Bowl, but maybe he wasn’t cut out for greatness.

The reasons for Carroll’s legendary career are what make him an incredible model for the modern career. Pete isn’t a prodigy like Sean McVay who reached the heights of their career by age 30. Pete has had ups and downs, but kept growing and learning to flourish after 50.

Pete Wins with People and Builds Culture

The news is currently filled with doomsday stories about AI devastating the job market. Its likely true that there will be a shift in the workforce as AI becomes increasingly adopted, but the greatest skillset that can help someone thrive is the ability to work with people.

Pete Carroll can relate across generations and has been known for his fun, but intense practices since his time at USC. Pete understands how to make the job enjoyable and cultivate positive vibes across the organization. This can be viewed simply as a personality trait, but it seems to be very intentional and thought out. If your job depends on getting peak performance out of dozens of individuals then the most important role of a leader is too keep the culture positive and engage the team.

Even if other coaches are stronger in strategy, no coach is better than Carroll at setting culture. This is likely the #1 reason Carroll is still employed in the NFL when arguably the greatest coach of all time, Bill Belichick, is finishing his career in college.

Pete Keeps Learning and Shifting

This is the most important lesson from Carroll’s career arc, but can be seen across the modern workplace. Change is constant and will catch everyone at times. Changing schemes in NFL offenses that Carroll couldn’t catch up with led to his departure from Seattle, but his ability to shift based on his players is why he is the greatest coach in Seahawks history.

In his early coaching career, Pete was able to turn short stints as the head coach of the Jets and Patriots into a winning college program at USC. Carroll seems to have endless positivity, but for the rest of us it is an encouragement to keep taking lessons as we progress in our career because you never know when you’ll have to pivot.

The biggest way that Carroll has learned to shift is in his ability to relate with the successive generations of players. He has shifted into the prototype modern coach. He doesn’t complain about Gen Z, but seems to genuinely enjoy being around a much younger crowd.

The curious thing will be to see if lessons from his time in Seattle will now pay dividends in his final act in Las Vegas. Based on the past, it wouldn’t be wise to bet against Carroll.

Pete is in Great Physical Shape

This is a big part of what keeps Carroll relevant in my opinion. His trademark energy comes from the fact that he has obviously taken care of himself through the years. He didn’t get burned out and out of shape during his successful run at USC and that has made it possible for his later acts.

Its tough to picture younger people taking anyone as seriously later in their career if they begin to wear down and seem more fragile. There is simply a level of physical strength required to stay in the mix.

I don’t aim to be working 60 hours a week into my early 70s, but I would like to be able to continue doing a career I enjoy into those years if its something that brings joy and purpose. The big lesson is that this needs to be a priority in my 40s and 50s while I’m busy with kids and life in order to have the option that Carroll has. I personally don’t want my lack of energy to force me in any direction later in life.

Pete has Found a Career He Wants to Continue

This is a major personal takeaway from Pete Carroll. I personally think it would be nuts to coach a football team, but its awesome to see a guy in his mid 70s who is still working on his terms. He could totally have hung it up and spent his time golfing, but he wanted to keep doing a job he loves.

There tends to be so much focus on early retirement, but I think that more attention needs to be paid by people to preparing for a potential career extending into later years. This can especially apply to careers like architecture or law where it takes decades to gain expertise and there isn’t a level of physicality that would prevent someone from working into their 70s.

People are getting married, buying homes and having kids later in life and so it kind of makes sense to shift the end of working life later too. We can look at it as a loss or we can approach it like Pete Carroll and embrace the challenge of staying in the game. I am personally challenged to emulate the gum chewing Carroll and fight to stay relevant rather than looking to fade out early.

The feeling presents in different ways. It is when work requires an increasing commitment due to that new project and you start to feel yourself losing momentum. It can be the washing machine that goes out sending you to a friend or parent’s house to temporarily wash clothes. More subtly it is the grind from kid’s sports, trying to catch up with friends, keep up with work and stay on top of all the random tasks required to keep a home moving.

The amount of things that required decisions and attention in the modern world is simply too much. This is not a scientific situation because the definition of “too much” is so personal. We all have friends who seem to thrive from packed out schedules and I’m open to the idea that their capacity is just higher. For the rest of us, the normal pace of the modern world is constantly hitting against the upper end of our mental bandwidth and its wearing us out.

The Constant Information Push

If you have a job that involves email communication, then this is where this process starts. Its the constant ping of emails throughout your day that keeps your brain unsettled. I hear about this from friends all the time and it definitely seems to be the most soul sucking aspect of may jobs. The ease of email or intra office messaging is not what our brains are built for. It is the biggest reason why many of us feel like we look back at our average workday and wonder what we really got done.

Stacked on top of the work information flow is the texts and social media information flow that sits in our pockets throughout the day. This makes it way to easy to make our break from work information simply a new source of news or friends information. This isn’t a dive into the dark side of social media which is something that plenty has been written on. The issue is more that our breaks from high information flow jobs is just a different channel of digital information.

By the end of a day, our brains have processed so many screens and so much content between work and our phones that it is exhausting. The challenge is that it creates a hamster wheel that gets so easy to continue to hop back on.

Endless Busy Schedules

This section is definitely skewed to reflect the lives of people with school age kids since that is the world I currently inhabit. The thing I hear constantly from friends is about the pace of life and how busy they are. The simple fact is that the normal offering of activities for kids today is way beyond what it was 20-30 years ago. The activities also ramp up in intensity much faster. Kid’s soccer or baseball is much more involved and time consuming for modern parents and increasingly city facilities are tapped out which leads to more travel for practices and games.

Add to this that most careers see a gradual uptick in hours works as one moves from an individual contributor role to management and its simple to see how the squeeze gets put on anyone with a family. This is the biggest place that I see modern life hitting the wallet. Our brains our extended and distracted, but we now sit in the most refined convenience economy in history. The growth of E-commerce and food delivery puts endless pressure to choose a simple option even though it likely costs more than alternatives. Grabbing a quick fast food meal on the way to a practice is pretty much always over $10 now.

This hamster wheel of two working parents and busy kids schedules keeps us in a state of survival mode. In this state, we are also constantly pushed on by a hyper refined consumer economy that is always removing barriers to purchase. Its just not a situation that humans are built to succeed in.

What can we do?

It can feel like we are trapped in a death spiral especially when modern media is also battling for attention with doomsday headlines. However, the first step in battling against the current state of overstimulation and overspending is simply to start seeing it for what it is. I would compare it to rafting in strong rapids. If you are simply expecting a passive, pleasant ride then you are bound to feel tossed about and off kilter. If you know that you need to be actively avoiding rocks and fighting to be in a safe position then it could be enjoyable.

Here are some ideas for slowing the pace down to help your brain:

- Keep work email off your phone

- Have set times to put your phone away each day

- Be intentional to remove inflammatory content from social media feeds

- Read a paper book for a bit each day

- Talk to your kids about choosing a few activities to focus on

- Have a morning routine that resets you (definitely without a phone in hand)

Here are some thoughts for helping for fighting overspending:

- Make a plan to limit trips to the store

- Keep shopping apps off your phone

- Keep a stock of staple foods for busy days

- Only use food delivery if someone is sick or injured

- Review spending at the end of each month (Easier said than done, but so illuminating)

Fighting the Good Fight

I have seen content increasing in different aspects of this same topic around food, busyness, loneliness and other topics, but the primary theme is always similar. The modern world is too much for how we are wired as humans. It hits us with too much information, too many calories and is engineered to perfection to extract money from us.

The crazy thing is that nothing is forced. If we are paying attention and fighting to improve our day to day then its more than possible to flourish. Hope this article gives you some encouragement in this department.

The challenge facing first time home buyers is well documented at this point. The gap between the median income and median home price continues to widen. This presents an increasing challenge to anyone looking to save up a down payment and purchase a home of their own. It is easy to think about giving up this goal, but if you can shift your mindset it can help keep the door open.

In the book, Moneyball by Michael Lewis, Billy Beane finds himself in a similar situation as the General Manager of the Oakland A’s baseball team. The A’s have the lowest payroll in the league and some how they are expected to compete with teams like the New York Yankees and Boston Red Sox that have orders of magnitude more money to spend. It is a terribly unfair situation and yet Billy Beane and the A’s found a way to be competitive and even make the playoffs.

The Art of Winning at an Unfair Game

The subheading of Moneyball sums up the challenge of buying a home for most people in the United States. The cost of housing has risen dramatically and in recent years interest rates have also shot up which creates a massive challenge for the average person.

In building a baseball team, Billy Beane broke the components of what the team needed to produce down to basics and then figured out how they could approach meeting those needs different than everyone else. He had to work differently to be successful and that is how people need to function if they are going to be able to enter the housing market.

Am I in the Right City?

The housing market in the US is incredibly varied. In San Francisco, $1 million may not even get you in the game. In St. Louis, $400K could get you a reasonable sized home in one of the nicest neighborhoods in the city. The average home in St. Louis is under $300K.

I see people moving to Spokane from Seattle all the time because prices in Eastern Washington are approximately half of what they are in the core of Seattle. There are just cities that represent the New York Yankees in our Moneyball analogy. The big coastal cities are just not in the equation unless you are making some serious money or have built massive equity from owning property for a while. This is the first place the Moneyball mindset has to come in. If you want to buy, you have to be realistic about whether this will require a move to a lower priced metro area.

It is worth exploring new areas with a similar job market if you don’t have a vision for what another city could look like. I have seen numerous extended families relocating to Eastern Washington from California so that the kids can buy a home as they start a family. It really sucks that so many awesome coastal cities like San Francisco and Seattle are so unaffordable, but it’s something that needs a sober perspective if you are going to be able to make a real plan for the future.

Your Winning Purchase Needs to Be a Little Different

The biggest thing that is encouraging about home buying despite that challenges is that you don’t need to find a home each week or even a few times a year. You only need to do it once every five to ten years (or once period if you are lucky). This is what puts the odds a bit more in the favor of a young couple who knows their area and is open to what their future could look like.

People are all different and so if you can try a house on and imagine a life that you would truly enjoy despite bad paint or an old kitchen then you are in a good zone. This is also a big reason to look in a place you enjoy and can see the value in that the masses may not see the same way. It’s an odd quirk of modern life that people seem to love standing in lines. They do it for hot, new restaurants, but they also do it in the housing market. The best schools and top neighborhoods end up inflated when areas that are a slight step down are consistently much more affordable.

If you have Moneyball mindset then you can see that there are amazing homes and potential neighbors in these “other” areas and you can escape the crowd. If you can live life in a smaller footprint or with one bathroom then you will continue to find opportunities. Just changing a Zillow search to include 2 bedroom or one bathroom homes can unlock potential opportunities that most people are not even looking at due to the standard desire for a 3 bed 2 bath home.

In Austin, just being an extra 10 minutes away from the super hip areas can drop prices dramatically. If you want some fun on Zillow, compare home prices in 78704 (Ultra Hip) to 78748 (Still great, but no hype). The difference is massive even to be slightly outside the core of the city. If you know your city, you can find some of these imbalances that many will miss.

Anchor in What You Really Need

How many cool restaurants do you really need to enjoy your life? If we are honest, it’s not that many. The kids at the schools rated 9 or 10 aren’t the only ones who are learning and happy. Sometimes the highest rated schools have a whole set of challenges that come with a hyper competitive culture. If parents in the area are engaged with the school, then having a super high rating isn’t the difference between success or failure for your kids. Once again, if you know your city and can talk to people at the schools, you may find that there is a real gem that school ranking websites will never identify.

I think it’s safe to assume that there are cool neighbors in virtually all neighborhoods and it only takes connecting with a few to bring a new area to life. For me, having projects to work on over time has always brought enjoyment and a deeper connection to the property. I would have never developed my love of gardening and landscaping if I wasn’t forced into it by our first home. My biggest Moneyball move has been to buy houses with yards that were in complete disrepair. The look of the overgrown property drove many away, but I saw it as having a blank slate to work from.

Buying a house is similar to building a baseball team in that there is tons of variability in the options out there. If most people have one a similar vision in mind, then there will be houses that fall through the cracks just like there were promising baseball prospects for Billy Beane. For the person that can remain flexible in their search, the possibility of finding a winner is feasible. Even though the housing market nationally is as challenging as ever, you only need to find one good house to make it a win.

I hope this serves as some encouragement that there is opportunity out there still in this world and you can find a great spot to call your own if you know how to look differently.

In this article I want to focus on a different portion of the path to American Abundance outside of the major cities. I recently listened to an episode of the Ezra Klein show that featured congresswoman Marie Gluesenkamp Perez, who is the representative for Washington state’s third congressional district.

The focus of the podcast was on how a democrat like Gluesenkamp Perez is handling the policies of President Trump since her district voted for the Republican president in the last election. Its a tricky situation to be in politically, but Gluesenkamp Perez maintained a simple focus throughout the interview and that focus is what I want to write about.

I recently read the book Abundance by Ezra Klein and Derek Thompson, and so the perspective of restoring lost productiveness was in my brain. Klein and Thompson focus on what the liberal political movement needs to do to become a force for productivity instead of being an obstacle to it. Their focus is largely on the coastal cities where they have spent time. I very much appreciated their perspective on what can be done to build more homes, energize scientific discovery and restore industry. The questions I’ve had is what this looks like for areas outside the major cities.

The Future of American Abundance Will Start Small

Gluesenkamp Perez brings an interesting perspective to this Abundance conversation because she is from rural Southwestern Washington which includes Vancouver and a number of small towns. As a resident of Spokane in the Eastern part of Washington, I related to her perspective on what it means to move forward economically for areas outside the major coastal cities.

The first aspect of where this Abundance starts small is with businesses that are local in nature. Gluesenkamp Perez discussed the auto shop that she and her husband run. The reason that businesses like this will be the future is that they can’t be replaced by AI and won’t be targeted by larger corporations. Its not the type of business that will make its owners incredibly wealthy, but it can provide for a great life.

The other thing that comes through in the interview is that Gluesenkamp Perez is focused on building the trust of the people in her community. The constant focus of major media on new technology can cause us to forget that a trustworthy business is an amazing asset. It’s the kind of strength that takes time to develop but also can’t be replicated and replaced.

I am a believer that there will continue to be opportunities for local businesses particularly when it comes to fixing cars, working on homes or meeting other practical needs in a community. There are so many people retiring from these types of professions, and they will be growing in many areas as people move out of larger cities.

My wife works as a realtor in Spokane and as the city grows there is a constant need for contractors. We’ve seen several successful businesses start up and gain footing the past few years. The best part is that in smaller communities like Spokane or rural Southwestern Washington, these careers can provide an income to buy a home and start a family.

American Abundance Will Need to Be Scrappy

The simple reality for most Americans is that getting on stable footing financially in your 20s and 30s is much harder than we anticipated coming into adult life. It’s as if we set out on a 5-mile hike only to realize it was 14 miles and went up the side of a mountain. This is another area where Gluesenkamp Perez offered a great perspective that I believe is part of helping people get through the slog to begin to build wealth.

She was matter of fact about encouraging her child to play outside and was willing to share that her appliances were purchased second hand. What makes Gluesenkamp Perez so refreshing is that she’s proud of these realities. I could relate given that my wife and I almost exclusively purchased our furniture on Craigslist for the first 10 years of our marriage and we did all our home projects ourselves in Austin as we scraped by with young kids.

The lie that seems to weigh on so many people today is the expectation that this journey would be easier or that it wouldn’t require us to be scrappy to save money and stay out of debt as we pushed through our late 20s and into our 30s. I loved to hear someone who embraces people who work with their hands and on the value of passing appliances through communities (provided they are actually built well). However, if we are prepared for the fact that we will need to buy fixer upper houses, find second-hand furniture and think creatively to get through these years then it can help us keep momentum for the journey.

I have worked in aerospace and pharmaceutical manufacturing for most of my career and the jobs I’ve seen these industries create are another example of how I see scrappiness being the future. I’ve had friends who started as welders, inspectors and production technicians work their way into promising careers, buy homes and flourish. There is an amazing value in people who can perform challenging technical work and problem solve with equipment in modern manufacturing. This hands-on experience then opens opportunities to move on to management or working with the quality group in these highly regulated industries. These types of jobs need to be celebrated in a community and that is something it was clear that Gluesenkamp Perez understood. Jobs like this are available all over the country, often in communities that are relatively affordable like Grand Rapids, St. Louis or Indianapolis.

The question is whether people will value moving towards these manufacturing roles that are available and have to longer term vision to see where it can take them.

American Abundance will Require Embracing Local Community

My favorite part of the tone that Marie Gluesenkamp Perez set in her interview with Ezra Klein was that she wholeheartedly embraced the views and needs of her community. She obviously knew what people were thinking and had spent time talking to them. She was part of the fabric.

When she discusses the challenges of poverty and drug use in her community it was not at a distance, but they were people in her community in need of help. One of the challenges from the book Abundance was when the government spends money on problems, but nothing really comes as a result. There is a disconnect when it is all just numbers on a page. Personal connection and people serving their communities will always lead to more change even if it is small in scale.

Ever since Covid threatened the restaurant industry, my wife and I have had a stronger realization that the coffee shops and cafes that we love aren’t just an automatic part of the scenery. Especially in a smaller city like Spokane, these places need people to think about time and money spent as an investment in order to survive. This is a major balancing act for a frugal finance blogger like me who is constantly looking at the budget, but my wife has been a great balance in this area. She promotes her work mostly through giveaways to local businesses. It ends up giving a boost to coffee shops, bakeries or small restaurants. It also encourages our network to get out and learn about their local businesses.

As we move into our 40s and see our disposable income rise, we definitely try to keep this type of thinking in mind. There is a never-ending flood of convenience at our fingertips and so it takes intentionality to ensure some of the that money goes into our local community. This also ensures that we continue rubbing shoulders with our neighbors and hopefully ensuring small businesses can continue hiring.

I don’t know what the future holds for Spokane or Southwestern Washington where Marie Gluesenkamp Perez calls home, but I do believe that her perspective is cool to see and gives me hope for the future of American Abundance.