Managing business finances can be daunting, especially when faced with unexpected challenges and economic uncertainties. However, getting your business finances back on track is essential for long-term success. Whether you’re struggling with cash flow issues, mounting debt, or simply want to improve your financial management, here are some steps to help you regain control of your business finances.

Assess Your Current Financial Situation

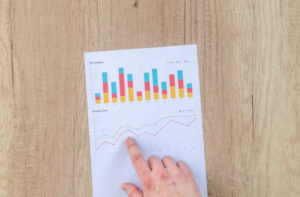

The first step in getting your business finances back on track is to assess your current financial situation. Review your financial statements, including income statements, balance sheets, and cash flow statements. During this assessment, identify areas where you’re overspending, underperforming, or accumulating debt, and be completely honest about it.

Create a Realistic Budget

Once you’ve assessed your finances, create a realistic budget that outlines your income and expenses. A well-thought-out budget will help you allocate resources more effectively and prevent overspending moving forward. Be sure to include all fixed and variable expenses, such as rent, utilities, payroll, and marketing costs, within this, but that your budget is flexible enough to adapt to changing circumstances.

Reduce Unnecessary Expenses

Now you have a budget laid out, identify and eliminate unnecessary expenses that are draining your resources. This could involve renegotiating contracts with suppliers, cutting back on non-essential services, or finding more cost-effective alternatives. Every pound saved can be reinvested into your business or used to pay down debt.

Improve Cash Flow Management

Cash flow problems are a common issue for businesses, but they can be managed effectively. Monitor your cash flow regularly to ensure that you have enough working capital to cover your operating expenses. Consider offering discounts for early payments from customers and negotiate extended payment terms with suppliers. Explore financing options like lines of credit or business loans to bridge cash flow gaps.

Seek Professional Help

Sometimes, getting your business finances back on track may require professional assistance. Consider hiring an accountant or financial advisor to provide expert guidance and help you make informed financial decisions. They can also help you navigate tax planning and compliance, ensuring that you’re taking advantage of all available deductions.

Another way you can get professional help focuses on improving your cash flow. For instance, if you have cash flow problems due to late payments from clients, invoice factoring services can be a valuable tool in your arsenal for getting your business finances back on track. It can help alleviate cash flow problems by providing quick access to funds that might otherwise be tied up in accounts receivable.

Working with a broker, like fundinvoice.co.uk, for invoice factoring can streamline the process and help you find the most suitable factoring company for your business’s needs. These professionals have industry expertise and a network of factoring providers, assisting in negotiating favorable terms, comparing rates, and finding a factoring company that specializes in your specific industry, ultimately saving you time and potentially securing better financial arrangements.

Set Up an Emergency Fund

To protect your business from unexpected financial setbacks, establish an emergency fund. This reserve of cash can help you weather economic downturns, cover unexpected expenses, or seize opportunities when they arise. Aim to set aside three to six months’ worth of operating expenses in your emergency fund.

Focus on Debt Management

If your business is burdened with high levels of debt, it’s crucial to prioritize debt management. Create a debt repayment plan that includes a clear schedule for paying off loans and reducing interest costs. Prioritize high-interest debts first and consider consolidating or refinancing options to lower interest rates.

Improve Revenue Generation

Increasing revenue is another way to strengthen your financial position. Identify opportunities to expand your customer base, introduce new products or services, or raise prices if necessary. Additionally, although it will require an investment, if you set aside more budget for marketing and sales strategies, you can boost your brand’s visibility and attract more customers. To grow, you have to invest.

Invest in Financial Education

Investing in your own financial education can be one of the most valuable steps you take to get your business finances on track. Understanding financial principles, accounting practices, and business economics will enable you to make more informed decisions and be proactive in managing your finances.

In conclusion, getting your business finances back on track requires a combination of careful planning, disciplined execution, and continuous monitoring. By assessing your current situation, creating a realistic budget, reducing expenses, and focusing on debt management and revenue generation, you can strengthen your financial position and set your business on a path to long-term success. Remember that financial stability is an ongoing effort, and staying committed to sound financial practices will help ensure your business’s resilience and prosperity.

It seems like technological advancements are coming much faster than we may have anticipated to a point where it is hard to keep up. Let’s look at Blockchain technology for example.

It was first introduced in 2013 and now it is worth billions of dollars and represents an entire eco-system where apps and games are built on top of it.

Nobody predicted that! And for those ones who did, they’ve made a lucky guess and are now enjoying their millions.

As of now, you probably already know about cryptocurrencies, unless you have been living under a rock.

However, we never knew the potential of such technologies and their use cases in industries like gaming, until now.

Blockchain and crypto games have started to emerge bringing all new features to the table. One of the most interesting features is the ability to own a certain digital good.

This led to the birth of virtual horse racing games, where horse racing enthusiasts can finally become racehorse owners, train and breed horses and compete in online events for money.

Zed Run is one of the first platforms to bring crypto technology and the world of horse racing together. It is a digital simulation where they are also looking into being able to bet on virtual horse races, just like you would do on TwinSpires for the Breeders’ Cup.

But is Zed Run legit, and should you invest in this platform?

Let’s find out.

What is Zed Run?

To put it simply, Zed Run is a blockchain-based game where you can buy, sell breed, and race digital horses. The digital horses come in the form of NFTs (non-fungible tokens) that are recorded on the blockchain and they have different traits just like you’d find diversity in real-world horse racing.

These horses are named Zed Runners, and they have different speeds and other performance characteristics that can be improved over time. In order to participate in the game, you must purchase a horse NFT from OpenSea, which costs less than $10.

The idea is for people to own digital horses, participate in online events, and possibly earn crypto. It is probably the closest thing to becoming a real-world horse owner.

How is the Outcome of a Race Determined?

We’ve all seen online simulation games that are based on an RNG (random number generator) much like Slots in a casino, but Zed Run is different.

The outcome of a race is determined by a few different factors such as race conditions, horse stats, training, and of course some randomness and uncertainty. This is just like the Breeders’ Cup in the real world.

So, there is no way to predict the winner of the race. Your goal should be to own a horse with great stats, which will increase your overall winning chances.

The Good Side of Zed Run

Zed Run might be a good investment for those who are really into horse racing. This is a realistic horse-racing simulation where you get to experience what is like to become a racehorse owner.

On top of that, you can earn some money in the process. In fact, there are multiple ways you can earn money, such as through competing in races, breeding and selling, and stud fees.

Similarly, in real life, if you own a male horse in Zed Run you can put it up in a Stud Farm and people might pay Stud Fee to use your horse in the breeding process.

Things to Consider Before Investing

Since we are talking about crypto-investment, we can all agree that the market has been going through a wild rollercoaster in the past couple of years. This means that the market is volatile and anything can happen.

We went through a phase where NFTs were purchased for millions of dollars that are now worth next to nothing. But nobody can predict the future of NFTs and where the Metaverse is heading.

Another thing to consider is regulations. Most countries are still in the grey area when it comes to crypto regulations, so make sure you get informed about such investments.

Should you invest in Zed Run?

We can all agree that Zed Run is an amazing platform that opens a new chapter into virtual horse racing. However, whether you should invest in Zed Run should be a thoughtful process and depends on your situation, goals, familiarity with this technology, and personal preference.

You need to weigh all the positive and negative sides of this investment and find out whether or not it is the right one for you.

For years now, cryptocurrencies have hit the world by storm. Bitcoin, in particular, has seen a quick rise in value, and more people are looking to get involved in this exciting new market. Unfortunately, most of those interested don’t know where to start. Luckily for you, this article will share tips on building personal wealth with crypto. Let’s get started.

Buy And Hold On Cryptocurrency

Buying and holding on to cryptocurrency can be a great way to build wealth over time. When done right, it can provide you with the potential for significant returns while diversifying your investment portfolio. There are things to remember when buying and holding cryptocurrency, such as picking the right currency, timing your purchases, and storing your coins safely.

If you pick a currency with good fundamentals and a strong community, you increase your chances of seeing appreciation over time. It’s also important to time your purchases right: buying when the price is low and selling when it’s high.

Finally, storing your coins in a secure wallet is crucial to protect them from hackers. Therefore, you should consider ease of use, security, and whether or not it supports the coins you want to invest in when choosing a wallet. Picking one with the lowest fees is also essential, as you don’t want to lose a large chunk of your profits to transaction fees. You might even want to go one step further and invest in a cold wallet as a means to store your cryptocurrency offline to further protect your coins. If this sounds like something you might be interested in, you could look into someone like the UK’s leading hardware wallet reseller and see what they have to offer.

By following these tips, you can give yourself a much better chance of building wealth through buying and holding cryptocurrency.

Crypto Trading

Many believe that the only way to increase their earnings is to invest in traditional assets such as real estate. However, you can also increase your wealth through crypto trading.

When you trade crypto, you can take advantage of price movements to generate profits. Over time, these profits can add up and help you to increase your wealth. Additionally, trading crypto allows you to diversify your investment portfolio and reduce risk exposure.

Another way to increase your income is through day or swing trading crypto on a platform like Bitcoin Apex. This involves buying coins while low and selling them when high on different exchanges. You can also scalp the markets, a technique where you make small profits through frequent trades.

Moreover, you can invest in ICOs or initial coin offerings. These are new cryptocurrencies that are being created and sold to investors. By buying ICOs, you can get in on the ground floor of a new currency and see a significant return on investment if the currency is successful.

Before you do get started in trading crypto, whether you opt for day trading, swing trading, scalping, or buying ICOs, be sure to do thorough research on how to succeed, as well as the best tools to support you in your trading endeavors. You can do this research online by exploring platforms such as 2dots, or by talking to friends and acquaintances who have valuable previous experience in the crypto world.

Crypto Mining

In addition to crypto trading, crypto mining is another way to build personal wealth with crypto. Crypto mining entails verifying transactions on a blockchain, then adding new blocks to the chain. In return, miners are rewarded with cryptocurrency.

Crypto mining can be profitable, but it requires expensive equipment and a lot of electricity. It also takes time to learn how to do it effectively. For those reasons, it’s not something everyone can or should do. However, if you’re interested in it, plenty of resources are available online to help you learn more.

Crypto Social Media

Are you a social media expert? Great! You can use your skills and earn crypto. There are a few different ways to do this. The best way is by creating content on YouTube, Facebook, Twitter, or Instagram. You can also join an online forum and share your knowledge with others.

If you’re not a social media expert, don’t worry! There are still plenty of ways for you to earn crypto. For example, you can start a blog and write about your experiences with cryptocurrency. Alternatively, you could create a podcast and share your insights with the world.

Staking And Lending

Another easy way to make extra cash with crypto is by staking or lending it out. Both options allow you to earn interest on digital assets without much work.

To stake your crypto, you need to hold it in a wallet that supports staking. Then, the wallet will automatically start earning interest for you. The interest you earn will depend on the coin you are staking and the current market conditions.

Lending your crypto works similarly to staking, but you must use a lending platform like BlockFi or Nexo. On these platforms, you can choose to lend out your crypto for a set period and earn interest on it. The interest rates on these platforms are usually much higher than what you would earn from staking alone.

Both of these options are relatively low risk and can help you grow your crypto portfolio without having to throw in some money.

Conclusion

With the growing popularity of cryptocurrencies, it’s no surprise that more and more people are looking for ways to make ends meet. This article mentions ways to get started in building personal wealth with crypto. You can apply these tips whether you’re a complete beginner or have some experience in the field.

Increasing your credit score is not too hard to do once you know the credit score formula and steps to improve your credit score.

Credit score is another one of those confusing financial concepts. Everyone has a credit score, but not many people actually know how it’s calculated, or how to improve it. Make no mistake, increasing your credit score fast can be tricky, but with the right formula, you can definitely improve your credit score.

In this article, I will discuss what a credit score is, the importance of having good credit, which factors are used in the credit score calculation, and give you 9 actionable steps to improve your credit and increase your credit score.

In addition, I have included some commonly asked questions about credit score at the end of the post.

What is a Credit Score?

A credit score is a number calculated from your credit history. Your credit score is used by lenders to determine your creditworthiness for a mortgage, loan, credit card, etc. Credit scores vary between 300 and 850, with 300 being the lowest credit score and 850 being the highest credit score.

The average credit score in the United States is 687.

The Importance of Having Good Credit

Consider the following situation: you are looking to buy a house and go to the bank for a mortgage loan. The loan officer at the bank types in your information and says, “You have a credit score of 653 and as a result, we will give you a loan at 4%. If your credit score was 700 or higher, we could get you a loan at 3.75%” While 0.25% doesn’t seem like much, it can add up to A LOT more interest over the time you are paying down the loan.

For a $200,000 30-year mortgage loan, a 0.25% interest rate increase will cost an additional $10,000 in interest over the life of the loan! Below is a table with the total interest paid and total cost of a $200,000 30-year mortgage at various interest rates.

| Interest Rate | Total Interest Paid | Total Cost |

| 3.75% | $133,433 | $333,433 |

| 4.00% | $143,739 | $343,739 |

| 4.25% | $154,196 | $354,196 |

One other point is if your credit score is very low (less than 600), some banks and lenders will not even consider extending credit because they believe you are not creditworthy! That being said, you can fix this and increase your credit score.

“A man in debt is so far a slave.” – Ralph Waldo Emerson

Next, let’s talk about the factors that go into determining your credit score, so we can talk about how to use these to your advantage if you’re looking for ways to increase your credit score fast.

Which Factors Determine Your Credit Score?

A person’s credit score is calculated based on a combination of factors.

Payment History (35%)

Payment history looks at if you have made your credit payments on time. Credit reports show the payments submitted for each line of credit, and the reports indicate if the payments were received 30, 60, 90, 120 or more days late.

The best credit quality borrowers have 0 late payments.

Utilization (30%)

Utilization is the ratio of money owed to the amount of credit available. For example, if you have a credit card with a credit limit of $5,000 and you owe $1,000, you have a utilization rate of 20%. An important note here, utilization does not take into consideration loans.

The best credit quality borrowers have a utilization rate lower than 30% of their total credit limit.

Length of Credit History (15%)

As a general rule of thumb, the longer an individual has had credit, the better their score. Credit scores take into account how long the oldest account has been open, the age of the newest account and the overall average.

If you have accounts that have been open for multiple years, you will have a higher credit score. The best credit quality borrowers have a history of 10 years or more.

Credit Mix (10%)

Creditworthy borrowers will generally have a mix of loans and credit lines on their history. These loans and credit lines could be student loans, auto loans, mortgages, credit cards, etc.

A high credit score will have a number of different loans and lines. I have four credit cards and a mortgage, and have had a student loan and an auto loan in the past. The best credit quality borrowers will have at least 15 open accounts.

Applying for New Credit Accounts (10%)

Let’s say you are a bank and you see someone apply for three credit cards and a mortgage in one week. This probably isn’t good sign. The person who applied for those new accounts probably isn’t in a great position financially, otherwise they wouldn’t need to apply for four credit accounts. As a result, the bank views situations like these as risky.

Inquiries for new credit accounts stay on your credit report for two years. After two years, the inquiries no longer show up on a person’s credit report. Generally, the best credit quality borrowers will have less than four inquiries on their credit report.

9 Tips to Increase Your Credit Score Fast

9 Tips to Increase Your Credit Score Fast

Below are nine tips to help boost your credit score! Some of these tips will take a little time before you see an impact, but others you can take action on immediately to help you increase your credit score fast!

1. Review Your Credit Report and Identify Areas of Improvement

What gets measured gets managed. First, go to AnnualCreditReport.com and request a free credit report from each of the big three credit reporting companies:

- TransUnion

- Experian

- Equifax

By law, you’re entitled to one free credit report each year. After obtaining your report, dive into the details!

Ask yourself the following questions:

- Do I have any accounts with late payments listed? Are these accounts accurate?

- Do I have any unpaid bills listed? Is this information accurate?

- Are there any other mistakes or errors on the report?

- Which factors need improvement? (Payment history, utilization, credit history, credit mix, opening new accounts)

- Do you have late payments?

- Is your utilization rate above 30%?

- Do you need more credit history?

- How many different credit accounts do you have?

- Did you recently open a bunch of new accounts?

Click for more detail on how to check your credit report.

After understanding your current credit situation, you are ready to start improving your credit score! Note: these credit reports will not tell you your credit score for free. If you have a Mint account, you can look at your credit score for free. I’ve found it to be a decent estimation, but slightly lower than real inquiries. You can also see your FICO credit score for free using Discover’s Credit Scorecard tool, which is available to anyone even if you don’t have a Discover card.

2. Correct Any Errors on Your Credit Report

Does your credit report have any errors in your personal information, accounts, or payment history? Are there any missing accounts? Are there any bills which you believe you have paid but the agencies don’t believe you have?

To correct these errors, do the following:

- Contact the credit bureau and the organization that provided the information to the credit bureau

- Both of these parties are responsible for correcting inaccurate or incomplete information in your report under the Fair Credit Reporting Act.

- The credit bureau must investigate the item(s) in question – usually within 30 days – unless they consider your dispute frivolous. Include copies (NOT originals) of documents that support your position. In addition to providing your complete name and address, your letter should:

- Clearly identify each item in your report you are disputing.

- State the facts and explain why you are disputing the information.

- Request deletion or correction.

- Follow up with the organization that provided the information to the credit bureau

- Again, include copies of documents that support your position. Many providers specify an address for disputes. If the provider again reports the same information to a bureau, it must include a notice of your dispute. Request that the provider copy you on correspondence they send to the bureau.

- Expect this process to take between 30 and 90 days.

If you know the error is an error, don’t be afraid to dig in. Make sure to keep all documentation and notes on the subject. This woman sued Equifax for $18 million over an error on her credit report!

3. Never Miss a Payment

35% of your credit score calculation is payment history. Keep it simple! Pay your bills on time!

Seriously, this is the biggest component of your credit score. By staying current on all of your accounts, your credit score will go up over time.

4. Keep Your Utilization Rate Below 30%

4. Keep Your Utilization Rate Below 30%

Your utilization rate makes up 30% of the credit score calculation. Remember, utilization rate is your outstanding balance divided by your credit limit.

If you don’t want to decrease your spending, you can pay down your highest debt, increase your credit limit, or open another line of credit (credit card).

5. Increase Your Credit Limit

Increasing your credit limit will decrease your utilization rate. You can increase your credit limit by calling your credit card company or going in to your bank directly and asking for a credit increase on your credit card or loan. These days many companies make it as easy as requesting a credit increase online right on their website. A good time to do this is when your income has increased – by showing an increase in income, you’re showing that you’re able to theoretically borrow more money responsibly and will more likely be granted the credit limit increase.

Early in 2017, I increased my credit limit $7,500 and saw a 20 point increase in my credit score!

6. Open Another Line of Credit

If you don’t want to increase your credit limit on your current credit lines, you can open another line of credit. There will be a slight hit to your credit score because you are opening a new account, but over time, your credit score will increase because your utilization rate will decrease.

7. Pay Down Your Highest Utilized Account

Paying down your highest utilized account will have a direct impact on your utilization rate. If you have two credit cards, one that is 100% utilized and one that is 10% utilized, the smart move would be paying off the 100% utilized card.

8. Mix it Up

Having a diverse mix of credit accounts shows the credit rating agencies you have a handle on your finances and credit situation. Having a few credit cards, an auto loan, and a mortgage would look much better than only a credit card. That being said, I wouldn’t recommend taking a personal loan out just to build credit… you have to think about interest payments!

9. Stay Consistent

Building your credit will take time (credit history, aka time, is a variable in the credit calculation!) By staying consistent, paying your bills on time, and ensuring errors stay off your credit report, your credit will increase over time.

I’ve been building credit for a few years now. When I started out, my credit score was between 600 and 650. I had a student loan and a credit card. The next year, I bought a house and applied for a mortgage. My credit score was about 680 at that point. The following year, I bought a car and paid off my auto and student loan. Throughout this whole time, I’ve been current on my payments and kept my utilization below 30%. After three years of consistency, my credit score is between 725 and 750.

You can do it! You can improve your credit score!

“A journey of a thousand miles beings with a single step.” – Lao-Tzu

Common Misunderstandings and Questions about Credit Scores

There are a number of common misunderstandings and questions people have about credit score. I will address a few of those misconceptions here.

Am I Building Credit Faster by Keeping a Balance on my Credit Card?

NO. You are not building credit any faster by keeping a balance on your credit card at the end of the month.

If you are keeping a balance on your credit card, this could actually have a negative effect on your credit score (your utilization rate will be higher compared to if you paid it off in full).

PRO TIP: Pay off your credit card in full each month. You aren’t building credit if you have a remaining balance any faster than if you have a $0 balance. In addition, if you have a remaining balance, 20%+ will be tacked on in interest to next month’s outstanding balance.

How will Consolidating Debt Accounts Affect my Credit Score?

It depends on the situation. From a financial standpoint, debt consolidation generally is a good thing. From a credit standpoint, things get a little hairy.

If you have maxed out a few credit cards and you consolidate that debt into an installment loan, your credit score will take a slight hit. Your credit score will decrease because you opened a new account and you have no credit history on that account. After a few months, your credit score will begin to increase because you will be making payments on time, your utilization rate will be lower, and your credit history will be building through that loan.

From a financial standpoint, consolidating debt is generally beneficial. Credit cards generally have 20%+ interest rates. Debt consolidation can reduce the interest rate. As a result, you will pay much less in interest when paying down your debt.

The Mastermind Within is partnered with various financial institutions who specialize in debt consolidation. To see if debt consolidation would make sense for you, you can click here to get connected with these partners.

Should I Work with a Credit Repair Agency?

It depends. There are a few situations where working with a credit repair company may make sense:

- If you have legitimate errors on your credit report and don’t want to fix them yourself

- The main function of any credit repair service is to remove errors from your credit report. These could range from errors in lender reporting to simple errors in your personal information.

- If you have errors that can’t be verified

- A little known fact about your credit report is that every detail in the report needs to be verifiable. If an item cannot be verified, you can get it removed from your report.

- If your lenders are willing to work with credit repair agencies

- Some lenders don’t like working with credit repair services. Some lenders aren’t willing to negotiate. However, for the lenders who are willing to listen, this is a good way for credit repair services to raise your score.

A word of caution on working with credit repair agencies: if you choose to work with a credit repair agency, make sure you pick one with a high reputation. In addition, make sure you pay them ONLY after the work is done. There are a number of companies that will ask for payment up front and not get the job done.

Click for some more information on credit repair agencies.

Will Closing Accounts have an Effect on My Credit Score?

Will Closing Accounts have an Effect on My Credit Score?

Yes. If you close a credit card, your overall credit limit will go down and your utilization rate will go up. In addition, your credit mix and credit history will take a hit. If you close a loan account, your credit mix and credit history will take a slight hit.

My recommendation on whether to close an account or not is to think about your goals and financial situation and make sure it makes sense for you.

If you have a student loan and want to be debt free, don’t worry about your credit score. Destroy that debt!

If it’s a credit card, you can make one purchase a month and pay it off at the end of the month. I have two credit cards that I spend about $25 a month on just to keep the credit history building. In this case, I wouldn’t recommend closing the account.

Start Improving your Credit Score Today!

With the tips above, you will be on your way to a higher credit score fast. Remember: never miss a payment, keep your utilization rate below 30% and have a diverse mix of credit accounts. Over time, your credit score WILL increase.

Lastly, make sure to pay off your credit cards in full each month, and be careful when working with credit repair agencies.

“The most difficult thing is the decision to act, the rest is merely tenacity.” – Amelia Earhart

Which steps have made the biggest impact on your credit score? Did I miss any critical points?

Erik

Tracking your personal finances is the most important task to perform to become wealthy. There are many personal finance metrics to track, but in this post, you’ll learn the top 4 personal finance metrics to track and understand the importance of tracking your personal finances.

Becoming financially successful might seem a little complicated, but it’s not too difficult with the right strategy. The most important thing you can do to become wealthy is to tracking your income and expenses.

However, total income and expense aren’t the only metrics which you should be tracking. Knowing all of your income and your expenses on a monthly basis is a great starting point. However, just tracking our expenses and income doesn’t tell us anything about the way we use money.

Are you a saver? A spendthrift?

Without digging a little deeper into the data, you won’t know whether you’re on the path to success, or if the ship is sinking.

How do you track your finances? What factors are important when it comes to personal financial success.

In this post, I will be sharing with you:

- How to calculate each of these personal finance statistics

- Why each of these metrics are important

- Why it’s important to track your personal finances

- Tools you can use to automate the calculations

Let’s get it tracking!

4 Personal Finance Statistics to Know and Calculate

There are potentially hundreds of financial metrics you could track, but there is beauty in simplicity.

The 4 metrics you need to know for personal financial success when it comes to tracking finances are:

- Net Income

- Gross Expenses

- Savings Rate

- Net Worth

Net Income

Net Income

Tracking your net income over time will give you a picture of what you are working with financially.

Let’s start off with an easy one: net income. What did you make in income, after taxes, for a given period?

The easiest way to do this is by just looking at a recent pay stub.

You’ll see your gross income listed out, which is what you made before taxes.

It should also list out all of your deductions, like FICA, federal, your state tax (if any), etc.

If you have investment income, or have any other freelancing or consulting income, you can find your gross income by adding up what you are paid each month.

Below gross income, if you’re looking at your pay stub, you’ll find your net income, which is the income remaining after all taxes.

Essentially, your net income is what you have to work with each month and year.

If you make $5,000 a month after taxes, then you know you have a maximum of $5,000 you can live on for all of your expenses and saving goals.

Hopefully, over time, this number will go up as you become more experienced and valuable to your clients or employer.

For me, I use income to judge how effectively I used my cash in a given period.

If I received a windfall or had a good quarter consulting, I might have a month where my income increases by $1,000 to $2,000. This sets the stage for increased contributions into savings or my investment accounts.

Tracking net income allows you to plan what to do with that income to best set yourself up for financial success.

You can’t base your financial planning on gross income (for instance, your yearly pre-tax salary number) because you will surely overestimate how much you’ll actually have to work with since taxes will be a chunk of that money you won’t see on a regular basis.

Tracking your net income allows for accurate money management.

Gross Expenses

Your total gross expenses is a very important financial statistic to calculate for yourself.

After income, calculating gross expenses – the total amount of money you spend during a month – will help you identify any weaknesses in your budget.

You can track your expenses however you find most effective. I split my expenses into some broad buckets, and then dive deeper to get a better understanding of where my cash is actually going each month.

- Discretionary Spending

- Food and Drink

- Shopping

- Recreation

- Travel

- Hair

- Home Improvement

- Cash Withdrawal

- Utilities

- Internet

- Gas

- Electric

- Water

- Mortgage/Rent

- Principal on Mortgage

- Interest on Mortgage

- Home Insurance

- Property Taxes

- Private Mortgage Insurance

- Auto

- Gas

- Auto Insurance

- Maintenance

- Auto Loan Principal and Interest

- Parking

- Other Insurance

- Health Insurance

- Dental Insurance

- Umbrella Policy

- Life Insurance

- Other

- ATM Fees

- Other random charges and fees

- Taxes

- Federal

- State

- Social Security

- Medicare

If I had kids, I can imagine having more line items for diapers, clothing, child care, sports, saving for college, etc.

Like I said, you can categorize your expenses anyway you’d like. Personal finance is personal! 🙂

For example, I lump food and drink together. Splitting them up makes sense as well, but I don’t drink as much anymore, and as a result, I simply have kept it as food and drink.

As part of your overall financial picture, tracking gross expenses can reveal areas of improvement (are you spending too much on a cable subscription when you rarely watch TV?). Over time, you can make tweaks and grow to make sure you are on the path to financial success.

Savings Rate

Savings rate is a very important personal finance metric to track.

Once we have our income and expenses for a certain period, we can move on to a slightly more complicated metric: savings rate. No, it’s not too complicated, just some division added to the mix 🙂

A person’s savings rate is the percentage of income which a person saves in a given time period.

Simply put, it can be calculated as (net income – gross expenses) / net income.

Let’s say a person makes $5,000 in a month. They spend $2,500 of it and the rest is saved in their savings account. Then, their savings rate for the month is 50%, or ($5,000 – $2,500) / $5,000.

Now, it gets a little bit more complicated once you start to factor in contributions to investment accounts and principal payoff of debt.

For me, I don’t count these as expenses. With contributions to investment accounts, you aren’t giving your money to someone else, rather you are putting it somewhere else for your future self.

For paying down a debt, I do consider interest to be an expense.

At a minimum, people should aim to save at least 10% of their income. Personally, I’d suggest aiming for 25%+ to help you become wealthy more quickly.

Net Worth

The final piece of financial information to track for your personal finances is your net worth.

The final piece of financial information to track for your personal finances is your net worth.

What is your net worth?

It is your assets minus your liabilities.

What are assets?

Assets are things a person owns which have value. Typical assets include houses, cash, stocks, bonds, cars, precious metals (jewelry, etc.), currencies, businesses – and the list goes on and on.

Next, what are liabilities?

Liabilities are things a person owes, either to a bank, a financial institution, or another person or business. These include credit card balances, mortgages, auto loans, personal loans, liens – and the list here goes on and on as well.

To calculate your net worth, subtract your liabilities from your assets.

It’s great if the resulting number is positive – this means you have a positive net worth. Your assets are worth more than your liabilities! Great job!

If you have more liabilities than assets, that means you have a negative net worth. Your liabilities are greater in value than your assets.

If you have more debt than assets, there’s no sense in wallowing – it’s time to destroy that debt!

Over time, you want your net worth to be increasing. If you have a positive savings rate, then your net worth will be increasing since you will be increasing the asset side of the equation.

I focus on increasing my net worth over time. In the 3 years, I went from a negative $15,000 net worth (in college with my student loan), to a positive $125,000 net worth.

My assets include my house, my car, my cash, my IRA and 401(k), and my business. I have a mortgage, a HELOC, and 4 credit cards which I pay off faithfully in full each month.

To increase my asset base, and continue to grow my net worth, I’m focusing on contributing to my retirement accounts, paying down a little bit extra on my mortgage each month, and growing my business.

Knowing your net worth is crucial to tracking your finances. Focus on growing your net worth and you’ll be on your way to financial success.

Some Other Favorite Personal Finance Metrics

One of the great things about having blog readers is being able to ask them about their strategies for financial success. A number of people contributed when asked how they track their finances each month:

Diego, a good friend and avid The Mastermind Within reader said the following:

A steady and overachieving monthly and yearly savings rate is the key for me.

I love it – savings rate is truly a great indication of where you are!

The Grounded Engineer, a fellow blogger, says he used to compete with a friend to see who could save more:

I used to look at what other people were doing. For example, one of my best friends and I would see who’s 401(k) had the larger balance. It was fun and we are both competitive, so it worked out great because we were both saving a significant amount of money. My friend has slowly succumbed to lifestyle inflation, and hasn’t been able to keep pace. I’m trying to get him on the financial independence bandwagon, but I have been unsuccessful in my attempts.

I’ve never seen that in practice! I’m glad you have kept up with your contributions!

Cynthia, another reader and friend of mine, said:

We track net worth over time. If net worth is going up over time, we are happy.

I couldn’t have put it any better myself!

The community members agree: tracking personal finances through knowing your savings rates and tracking your net worth over time will lead to financial success.

5 Personal Finance Softwares and Tools for Millennials

Tracking your finances over time is critical for financial success.

What gets measured, gets managed.

Not everyone is a spreadsheet or Microsoft guru. Luckily, there are many softwares and tools out there to help automate and track your finances over time.

I love spreadsheets and developing new algorithms and ways to calculate and track what I’m doing in my life. Technology is something I love, and as a programmer and statistician, I’m able to play with different technologies at work every day!

There are six tools I want to highlight that are critical for your financial success. These tools range from simple spreadsheets to calculators to full blown applications:

- Mint

- Personal Capital

- Mad Fientist Financial Independence Calculator

- Financial Mentor’s Calculator

- Different Personal Finance Blogger’s Spreadsheets and Tools

Mint

The pinnacle of free web and mobile applications, Mint is at the front of everyone’s mind. I love it because I can input 95% of my accounts, and it allows me to see my net worth in real time.

With Mint, you are able to connect all of your bank accounts, retirement accounts, debt accounts, and see all of the balances and information in a neat and tidy fashion.

I use Mint in tandem with my personal income statement spreadsheet. Mint is a great starter application for people who are looking to get their finances in order.

Personal Capital

Tracking your investments over time can be a struggle. You sell a little bit of this stock, and buy some of that bond. We aren’t all programmers and developers, and can’t track our profit and loss and portfolio value over time easily. That’s where Personal Capital comes in.

Personal Capital is like Mint, but has much greater capability for tracking investments over time.

With Personal Capital, you will be able to see your exposure to different asset classes, as well as get your income and expenses over time.

Personal Capital is a great tool to add to your finance tracking portfolio.

Mad Fientist Financial Independence Laboratory

How far are you away from financial independence? With the Mad Fientist Financial Independence Laboratory, you can know right now!

This web application allows you to enter in your monthly financial data and it automatically charts your progress to FI. It’s an easy to use and cool application.

In addition to being able to use your current expenses, you can forecast using your future expenses to see what financial independence will look like.

Check it out here: Mad Fientist Laboratory.

Financial Mentor

Financial Mentor has eighty financial planning and personal finance calculators on their site.

Eighty! That’s insane. Many of these are pretty simple, but it’s still pretty cool to see all of them in one spot. Plus, they are free!

Hopefully there is one for you. Check these calculators out here: Financial Mentor Calculators.

Other Bloggers Spreadsheets and Tools

Since I started blogging, I’ve seen a number of bloggers posting their own spreadsheets and tools. I love seeing what other people have created, as there are many, many smart people in the world, and everyone has a unique take on life.

Three bloggers that have tools I’ve been recently using are Life and My Finances, Physician on FIRE and ChooseFI.

Derek from Life and My Finances, has a collection of spreadsheets, all for free! I actually ended up drawing inspiration for my Debt Destruction tool from Derek’s debt snowball calculator! Check him out here: Life and My Finances.

Physician on FIRE has a great spreadsheet as well. As a doctor, he knows a thing or two about finance as well! Check him out here: Physician on FIRE.

Finally, the ChooseFI Vault has a great wealth of information. If you love their podcast, then you’ll definitely want to check out the vault here: ChooseFI Vault.

The Importance of Tracking Your Personal Finances

Tracking your personal finances and knowing where you are financially is so important to financial success.

But why?

I have two friends: Jack and Jill. Jill tracks her income and expenses, and Jack doesn’t track his income and expenses.

Jack and Jill work at the same company and are in the same team, both making $5,000 a month.

Jill, the Tracker

Jill, the tracker, wants to retire someday, and a few years ago, she started putting away $500 a month into an investment account. Now, she is married and just gave birth to her first kid. As a result, her expenses have gone up but she still has kept in mind this goal of saving for retirement.

Before having her child, she was spending $500 a month on food and drink with her husband. Now, since they have another mouth to feed, she realized that their combined food spending would about $750 a month if she kept eating out. Instead, she changed her habits and started bringing her lunch from home a few days a week.

With this simple change, and even with an extra mouth to feed, Jill is still only spending $500 a month on food, did not alter her lifestyle too much, and is still on track for retirement.

Jack, the Non-Tracker

Jack, the non-tracker, wants to retire soon, but doesn’t know where he is at on a monthly basis. He puts $500 into his retirement account because he heard that it was a good idea on some radio show. In addition to this, he has been saving on average a few hundred dollars a month in cash which he adds to one of his investment accounts here and there.

Recently, he got married as well, and recently gave birth with his wife to a newborn. His expenses have increased, but he is not really sure how much.

One of the things he loves is watching football, and in particular, going to games at the local stadium. Even with his newborn, he still wants to go to games.

With the increased expense of having a kid, his cash savings goes to 0, and now he isn’t getting those additional savings.

A few months later, he realizes he can’t make his usual investment account contribution and is a little puzzled, “oh well, I guess we just bought a few more diapers than I thought, I’ll make the investment next month.”

His next investment is never made because he has no idea how much cash he is saving each month.

Who’s going to be more successful in the long run?

Who is going to be more successful financially in the long run? Jack, the non-tracker, or Jill, the tracker?

I’m going to guess Jill is going to be more successful financially.

She knows exactly where her money is going at the end of the day. Jack on the other hand does not.

I hope this example helps paint a picture of why it’s important to track your income and expenses over time.

You never know when life is going to rear it’s ugly head and throw some unexpected expenses at you – but with proper tracking, you can navigate these rough roads much easier!

Grow Wealth Over Time Through Tracking and Consistency

Keeping track of how you are doing financially WILL lead to personal finance success.

With these four metrics in hand, you will be ready to take on the world of personal finance. Tracking your income and expenses, savings rate, and net worth over time will help you understand where you are financially, what you can improve on, and how to take action.

Calculating these ratios and metrics are not difficult – basic addition, multiplication and division will suffice.

With these tools in your financial toolbox, I know you’ll be well on your way on achieving your financial goals and dreams.

“Your level of success will rarely exceed your level of personal development, because success is something you attract by the person you become.”

The Miracle Morning, by Hal Elrod, is all about waking up early to supercharge your performance throughout the day.

In The Miracle Morning, Hal discusses how the average person does not devote the necessary time to personal development. By waking up early and carving out time to work on themselves, people can become the best versions of themselves.

If you aren’t a morning person, Hal gives a strategy for increasing your “Wake up Motivation Level”. His strategy includes setting intentions before bed (last thought in the night = first thought in the morning), moving your alarm clock across the room, brushing your teeth, drinking a full glass of water, and getting dressed in your workout clothes.

S.A.V.E.R.S.

Once you are awake, Hal’s morning program is called S.A.V.E.R.S. and stands for:

- S = Silence (Mediation / Prayer / Reflection)

- A = Affirmations.

- V = Visualization.

- E = Exercise.

- R = Reading.

- S = Scribing (Journaling / Writing)

Hal suggests spending time in each of these 6 areas. Depending on the morning, you can spend as little as 6 minutes on all 6 sections or take as long as you want to complete all 6.

For me, I spend about 10 minutes on the first 3, 10 minutes on exercise (some body weight exercises and stretching), 30 minutes on reading (Goal of reading 75 books for 2017), and 10 minutes on Scribing. The importance of the completing each of these tasks is outlined in the book. I hope to focus more on Silence and Visualization in the coming months.

“Our outer world is a reflection of our inner world.” If we are at peace with our inner being, we will be at peace with the world around us.”

Before reading The Miracle Morning, I was waking up around 7:30 AM, getting to work at 8:30 AM, and while I was performing well, I wasn’t achieving greatness. After a month of the S.A.V.E.R.S. program, I’m waking up at 6:30 AM, getting some personal development time in, and getting to work at 8:30 AM. I’ve noticed my mind is sharper and I’m able to focus with a greater intensity than before.

Remarkable Quotes and Passages from The Miracle Morning

Some memorable quotes and passages from The Miracle Morning:

- Find time for personal development each day.

- Your level of success will rarely exceed your level of personal development, because success is something you attract by the person you become.

- Every time you choose the easy thing, instead of the right thing, you are shaping your identity, becoming the type of person who does what’s easy, rather than what’s right.

- Now matters more than any other time in your life, because it’s what you are doing today that is determining who you’re becoming, and who you’re becoming will always determine the quality and direction of your life.

- The moment you accept total responsibility for everything in your life is the moment you claim the power to change anything in your life.

- If you don’t control your habits, your habits will control you.

- Don’t wait to be great.

- If you want your life to improve, you have to improve it yourself.

Our Recommendation for The Miracle Morning

I recommend The Miracle Morning to anyone looking to supercharge their performance and improve their life. Like I mentioned above, The Miracle Morning is a quick read, has many motivational quotes and passages, and gets you fired up to improve your life!

Readers: are you a morning person? What is your strategy for personal development?

Yesterday morning, I sat down with The Alchemist and 6 hours later finished it. Wow, what a book. I’ve read a fair number of books in the past few years, but none of them have kept me on the edge of my seat like The Alchemist.

The Alchemist is a story about a boy who is searching for his “Personal Legend”. Essentially, a person’s “Personal Legend” is that person’s purpose, destiny, calling, etc. The boy realizes he is being called by the world to go find his “Personal Legend”. The Alchemist tells the tale of the boy’s journey.

If you’re a fan of this timeless story, you might be interested in discovering books like The Alchemist. These books explore similar themes of self-discovery, destiny, and the pursuit of one’s dreams. Whether you’re looking for another spiritual journey or a tale that inspires deep reflection, these books are sure to resonate with you.

Summary of The Alchemist

In the beginning of The Alchemist, the boy has a dream about treasure and he goes to see a gypsy about it. The gypsy tells the boy the treasure is by the Pyramids of Egypt. After his meeting with the gypsy, in which is didn’t like, he meets a peculiar character who introduces himself as the King of Salem. The King know all about the boy’s past and present, and tells him he should go searching for the treasure. The King speaks of each person’s Personal Legend and that by going to search for the treasure, the boy can realize his Personal Legend.

In addition to speaking of each person’s Personal Legend, the King talks about language of omens. “Everything in life is an omen. There is a universal language , understood by everybody, but already forgotten.” Omens are signs of the world and if interpreted and watched for, can enable humans interact and communicate with the world and non-human beings. Omens are very important for people trying to realize their Personal Legend.

Initially, the boy is a little bit hesitant, but then he then sets off on an epic journey that spans from Spain to Egypt. Along the way, he is confronted with different challenges and has to overcome them. He has to deal with thieves, to learn about being a crystal merchant, learn the ways of the desert, and speak the language of the world. At the end, he finds his treasure, but only because he followed through in trying to find his Personal Legend.

Remarkable Quotes and Passages from The Alchemist

Here are some quotes and passages which had an impact on me:

- “It’s this: that at a certain point in our lives, we lose control of what’s happening to us, and our lives become controlled by fate. That’s the world’s greatest lie.”

- “When you want something, all the universe conspires to help you achieve it.”

- “… people need not fear the unknown if they are capable of achieving what they need and want. We are afraid of losing what we have, whether it’s our life or our possessions and property. But this fear evaporates when we understand that our life stories and the history of the world were written by the same hand.”

- “That’s the principle that governs all things. In alchemy, it’s called the Soul of the World. When you want something with all your heart, that’s when you are closet to the Soul of the World. It’s always a positive force. Everything on earth is being continuously transformed, because the earth is alive and has a soul. We are part of that soul, so we rarely recognize it working for us.”

- “Courage is the quality most essential to understand the Language of the World.”

- “Listen to your heart. It knows all things, because it came from the Soul of the World, and one day it will return there.”

- “Tell your heart that the fear of suffering is worse than the suffering itself. And that no heart has ever suffered when it goes in search of its dreams,, because every second of the search is a second’s encounter with God and with eternity.”

- “What you need to know is this: before a dream is realized, the Soul of the World test everything that was learned along the way. It does this not because it is evil, but so that we can, in addition to realizing our dreams, master the lessons we’ve learned as we’ve moved toward the dream. That’s the point at which most people give up. It’s the point at which, as we say in the language of the desert, on ‘dies of thirst just when the palm trees have appeared on the horizon’.”

- “Your eyes show the strength of your soul.”

- “Love is a force that transforms and improves the Soul of the World. When I first reach through to it, I thought the Soul of the World was perfect. But later, I could see that it was like other aspects of creation, and had its own passions and wars. It is we who nourish the Soul of the World, and the world we live in will be either better or worse, depending on whether we become better or worse. And that’s where the power of love comes in. Because when we love, we always strive to become better than we are.”

- “No matter what he does, every person on earth plays a central role in the history of the world. And normally he doesn’t know it.”

My Recommendation

The Alchemist is a must read. The takeaways for me include living in the moment, never getting too high or too low, and realizing all things happen for a reason.

Have you read The Alchemist? What did you think?

At work today, one of the higher up employees in the mortgage group was retiring. This could be in response to the mortgage business struggling to grow and continue their success, or it could be in response to his old age and wanting to be done with work. Either way, it got me thinking: will student loans be the catalyst to the next recession? How important is the student loans crisis?

Specifically, I want to think about this in terms of mortgages and buying houses. When the economy is going strong, houses are being built and bought, and families are being started. With student debt racking up, many people will have to put off buying a house or buy a less attractive house. To let everyone know, I don’t want to strike fear in anyone’s mind, or try to be a predictor of the future. What I hope to do is cultivate thought by running some numbers.

Let’s get some stats before we go into the numbers:

- The average American is graduating college with a student debt of $28,950.

- The average American makes $45,478 after graduating college.

- Mortgage companies are comfortable lending out loans as long as people stay under 36% debt to pre-tax income.

- I am going to use this House Affordability Calculator to illustrate my examples.

Let’s start by assuming a few things. Let’s assume that mortgage rates for a 30 year mortgage stay at about 4.5% for the next few years, student loan interest rates are about 7%, and wages grow at roughly 3% each year. Also, we require at least 5% down payment. We will also assume no prepayments of student loans.

First we need to calculate student loan payments. Most student loan payment plans are over a 10 year period. The estimated payment for a 10 year repayment plan is $349.49 a month. Next with a salary of $45,478, we have $3789.83 in pre-tax income per month. In addition, we are assuming no auto loans, no credit card debt, and no other debts (which most people have a least 1 or more of these).

So, our average American is already sitting at a 9% debt to income ratio the first year out of college. Let’s plug some of these figures into the House Affordability Calculator. Below are the results:

This analysis is slightly concerning to me. In Minnesota, a nice 3 bedroom/2 bathroom house in a nice area goes for at least 250k. For the average single person to afford a $250k house, you would need to save up a 20% down payment of $50k in cash and have an income of $55k. This wouldn’t happen until at least year 8, or when the average single person is 30. However, with the national personal savings rate hovering around 5-6%, good luck to the average single person getting to $50k in cash in 8 years!

What this analysis shows me, is that owning rental property will be important in the future as more people are forced into renting (lenders may not want to give loans to younger people due to higher debt-to-income ratios). However, you never know, a correction may happen, rates drop, housing prices drop, and many people could start buying houses!

A few questions I’m pondering on after doing this analysis:

- Will smaller lenders loosen their lending policies to keep mortgage origination going even if the prospective borrowers are less than optimal?

- Will property prices start to come down slightly as more people go to renting?

- Will the economy start to perform well due to new policies put into place by the newly elected politicians, pushing houses higher as people have higher wage growth?

There is a lot that can possibly happen. I guess we will have to wait and see.

What do you think about this analysis and topic? Will student loans weigh on the economy significantly? Will the benefits of student loans outweigh the negatives? Let me know what you think in the comments; I would love to know what you are thinking.

Erik

What is growth? What is learning? How can we become more intelligent in life to know more, be more and do more? Being smarter, being more intelligent, and knowing more can help us reach out goals and dreams faster. How can we do this? In this post, you will learn 15 ways to become more intelligent in life.

What if you could easily solve any problem you encountered? How would it feel to know more, and be able to navigate difficult situations with ease? What would you do if you were smarter and more intelligent?

Becoming smarter and more intelligent in life has many benefits.

Whether you are trying to reach a specific goal, or just looking to become more well rounded in life, becoming more intelligent will help you on your journey to success.

Being able to comprehend complex ideas, understanding how things work, having the ability to show empathy, and having a good vocabulary are all parts of being smarter and having a higher level of intelligence.

All of this is great, but, how do we become more intelligent? What is intelligence? Why does being smart matter?

In this post, we will talk about what intelligence is, why being smart is important, and you’ll learn 15 ways to become more intelligent in your life to improve your chances of becoming successful.

What is Intelligence and Why is Being Smart Important?

First, let’s talk about what intelligence is, and why being smart is important.

Intelligence can be defined many different ways.

To me, intelligence is the ability to learn, the ability to understand, the ability to problem solve, and the ability to grow.

There are many types of intelligence, and some common ones could be described as practical intelligence, creative intelligence, emotional intelligence, and analytical intelligence.

Practical intelligence is “street smarts” or “common sense”, creative intelligence is “abstract thinking”, emotional intelligence is “handling the emotions of yourself and others”, and analytical intelligence is “book smarts”.

Why is being smart important?

This might be obvious, but being smart and being intelligent:

- can open many doors in life

- is attractive to potential partners

- is attractive to potential employers

- unlock new skills and abilities in your day to day activities

- can help you reach your goals

With this in mind, let’s now move on to the 15 ways you can become more intelligent in your life.

“Your level of success is rarely exceeded by your level of personal development, because success is something you attract by the person you become.” – Hal Elrod

15 Ways to Become More Intelligent in Life

Do you want to become smarter? How can you become more intelligent in life?

Growing, improving, and learning are all pieces of becoming more intelligent.

However, there is also a mindset shift that must happen if you want to become smarter.

Through this mindset shift, you will start to change as a person, change your daily habits, and grow – not only your brain, but also as a person in many ways.

Becoming smarter will help you unlock new avenues and opportunities in life, and bring success as you get to your full potential.

Below are 15 ways to become more intelligent in life. If you want, you can click on a link below to go directly to the section with that step, or you can scroll down to read them in order.

- Stand on the Shoulders of Giants

- Redefine Learning

- Become Curious in Everyday Life and Ask Questions

- Get Enough Sleep and Rest Every Night

- Spend Time Exploring a New Place

- Conduct Experiments and Get Outside Your Comfort Zone

- Do Something Creative Each Day

- Exercise

- Eat Healthy Foods to Give Your Brain the Necessary Energy it Needs

- Surround Yourself with Books from Different Eras and With Different Topics

- Do What You like and Try to Get Better at it

- Learn a New Language and Learn in that Language

- Live Intentionally and Take Responsibility for Your Life

- Teach Others How to Do Something

- Make Learning a Part of Your Every Day Life

Let’s dive into the details of each of these steps to become smarter below.

1. Stand on the Shoulders of Giants

“If I have seen further than others, it is by standing upon the shoulders of giants.” – Isaac Newton

First and foremost, if you want to become smarter, it’s important to recognize those who have came before us who have achieved great successes.

The quote above from Isaac Newton refers to the fact that when we are just growing up and becoming more knowledgeable, we are like dwarfs – we aren’t very tall and we cannot see very far. This is similar to when we are kids – we don’t know much and have much to learn.

However, if you stand on the shoulder of a giant, you can see for miles. If we read from those who were successful, we can gain insight into how we can become more successful in our lives.

If you want to become smarter, read about some of the amazing people of our past and present, and you can gain a piece of their experience for yourself.

For example, a few years ago, I read about Jeff Bezos and some of the story of Amazon. 20 years of events, information, and thoughts were condensed into a book which I read in just a few weeks.

Before, I didn’t know anything about the inner workings of Amazon and how Jeff Bezos thought on a short and long term basis.

However, after, I now understood more about their business and what it means to become one of the biggest and most influential companies in the world.

For you, if you want to become smarter, it’s time to read and learn from the giants of the past.

2. Redefine Learning

“I keep challenging myself. I see life almost like one long university education that I never had – every day I’m learning something new. – Richard Branson

What is learning? Is it something you do at school? Is it something that stops after college? Is learning something that needs a textbook, or is it anything that stimulates our brains?

To me, learning is something anyone can do. Learning does not require a book, and certainly continues after school.

The most successful people in the world are continuously learning – they are constantly reading, coming up with new ideas, talking with other successful people, and growing.

To become smarter, you need to redefine learning.

First, learning is not something that need a teacher for and you definitely do not need a book to learn. Learning can happen anywhere and at any time!

Second, learning is a process that will bring both successes and failures. Learning is not a linear path to becoming an expert.

Rather, learning is the process of going from not knowing a lot to becoming knowledgeable and proficient in a certain area. Learning takes time, but, through experimentation, you can become more intelligent in a subject.

3. Become Curious in Everyday Life and Ask Questions

One of the first steps to becoming smarter is to realize that their are gaps in your knowledge and improving your understanding of various things will be beneficial for you in the future.

Being closed minded and living in an echo chamber is not helpful for achieving your goals.

It’s okay to say “I don’t know” and look to answer the questions you have.

Having a growth mindset and looking to learn a little bit each day is critical if you want to become more intelligent.

You cannot know more if you don’t poke around curiously for the answer.

Realize that in each interaction you have, you can learn something or pick up a new tip. If you stay doing the same thing everyday, that’s all you are going to get.

If you change things up, you can start to make improvements and correct the mistakes you’ve made in the past.

Even if these questions are just clarifying a situation, they can make all the difference in your understanding and lead to becoming more intelligent as you now know of more of the full picture.

4. Get Enough Sleep and Rest Every Night

Getting enough sleep and rest each day is a key part of growth and learning.

Just like your muscles, you need to allow your brain a rest and time to grow.

There have been many studies looking at learning, memory and the quantity and quality of sleep a person receives.

When we get enough sleep, we are able to perform at a higher level, but if we are sleep deprived, we are more forgetful and do not perform at our best.

When trying to learn, it’s important to get enough sleep – whether this is 6 hours, 8 hours, or 10 hours is up to you to figure out.

The point here is that your brain is just like your muscles. You need to mix it up and give it a rest to see optimal gains.

5. Spend Time Exploring a New Place

When you were a kid, did you ever go to a new place and have the best time of your life? Exploring, making new connections, and discovering this new place were some of the best times and always very fun.

As an adult, I’ve done this as well from time to time in my own city and state, and think it’s still as exciting and stimulating as when I did it as a kid.

Going to a new place and just walking around, exploring, and leaving all expectations at the door can be freeing. Doing this can allow your brain to make new connections and exercise in different ways.

I’ve also experienced this by going to new stores or restaurants in different areas of the city I live in. For example, just going for a coffee at a different coffee shop (pre-COVID) and sitting there watching those around you interact can be something different and new.

The point of learning is to give you brain new stimuli and to allow it to grow over time.

With exploration and experimentation, you can will challenge your brain to grow.

6. Conduct Experiments and Get Outside Your Comfort Zone

Here’s something to internalize: the only way you are going to grow is by getting outside your comfort zone.

Testing your assumptions, making mistakes, and correcting your errors will lead to more successes over time.

However, without those experiments, you will not have learned what to do in situations that require change and adjustment, and for this, you will be lacking intelligence in that area.

What do I mean by conducting experiments?

Conducting experiments could be as easy as reading a book about communication and testing some of the greetings in the book on people in real life to see their reaction.

Maybe you read about a new way to say “what’s up” (this is a dumb example, but it’s still an experiment!)

You say this new way to say “what’s up” and the person talking to you lights up with excitement and proceeds to tell you about their life.

This would be positive feedback to your experiment and if you want to continue to see success, you can keep using this phrase.

Again, this is just an example. However, for you, you should figure out which areas of life you want to improve in, start experimenting and learning, and over time, you’ll become more intelligent in those areas.

7. Do Something Creative Every Day

Becoming smarter involves activating different parts of your brain. As mentioned above, intelligence comes in different flavors, and creative intelligence is one of those different flavors.

Doing something creative each day will help you become smarter and more intelligent.

Whether that’s:

- making music

- writing in a journal

- designing a website

- painting a picture

- doing photography

- cooking a meal

- sewing a new piece of clothing

all that matters is you are activating and exercising the creative part of your brain.

8. Exercise

Just like diet, exercise is another important piece to becoming smarter.

For me, I try to do a little bit each day. I enjoy doing bodyweight exercises, biking, walking, rock climbing, and playing basketball with friends.

I don’t have a gym pass, and don’t subscribe to the thought that you need to be a meat head to be getting the full benefits of exercise.

Instead, doing a little bit each day, 30-60 minutes of activity will be good for your health and wellness.

Getting your blood pumping will help with brain activity – and through this, you’ll allow your brain the necessary stimulation to help you with your learning goals.

9. Eat Healthy Foods to Give Your Brain the Necessary Energy it Needs

Have you ever heard of the saying, you are what you eat?

Putting garbage into your body will result in having a garbage physique and mental state.

If you want to become smarter, giving your brain and body the proper nutrients and energy it needs to very important.

Getting your diet right is a piece of learning because food is what fuels you to take action on your goals and to continue to improve in life.

Everyone will be different in what kind of food they can eat, but getting your diet right involves eating healthy foods and drinking a lot of water.

For me, eating healthy means eating a high fat, high protein diet with a lot of fruits and vegetables mixed in.

Also, for my health, I’ve experimented with fasting and do intermittent fasting, and also I’ve had to figure out if there was any additional supplementation that I needed to obtain the proper mix of vitamins and minerals.

Eating right will help you get to your peak performance in learning and action, which will in turn help you become smarter and more successful.

10. Surround Yourself with Books from Different Eras and With Different Topics

Would you rather be an expert in one subject, or a jack of all trades?

Some of the smartest people in the world are so smart because they can pull from their experiences in a wide range of situations and apply a different solution to the current problem.

Reading both fiction books and non-fiction books with different topics will expose you to different ideas and help you become more intelligent.

I’ve found that some of the best life messages came from books where I didn’t think I’d get much value out of it before reading the book.

With this, it’s important to not live in an echo chamber and read about things outside your usual area of expertise to fill in your gaps of knowledge.

11. Do What You Like and Try to Become Better at it

I have a question: would you rather spend time doing things you like, or do things you don’t like?

The answer is clearly that you would rather do things that you enjoy doing…

Becoming smarter can be done if you approach the things you like doing with the thought of “how can I get better at this?”

For example, I love playing golf. Over the past few months, I’ve been researching how I can hit the ball straighter wen I want to hit it straight, or how I can add spin if I want the ball to curve.

This has taken a lot of practice and time to learn how my body can affect the swing of the golf club, but over time, I’ve become more self-aware of my hands, arms and body when I swing, and I’ve improved.

While I’m still improving, I’ve become smarter in golf and now I’m better than I was before.

What do you enjoy doing?

If you love cooking, how can you make your food taste better? If you love running, how can you get faster, or run more without causing injury?

Through answering these questions, you’ll become smarter in what you are doing, and become more intelligent.

12. Learn a New Language and Learn in that Language