My name is Kalen and my aim is to help free a generation from the chains of dumb money habits destroying lives. I’ve made my fair share of mistakes along the way, but through a slightly obsessive pursuit of financial freedom, I’ve learned a thing or two. Now I’m here to share it. I write about two main things: practical personal finance and dramatically increasing your income.

Learn more ►

Musings from an international school teaching couple about investing wisely, retiring early, and living an adventurous and rewarding life. Learn about our journey towards early retirement and some steps to take to reach financial independence. Follow along on our adventures and be inspired to create some of your own experiences. And discover ways to find purpose during early retirement and how to give back to our world.

Learn more ►

School teaches us everything from the various Capitals of the world to advanced calculus but never touches upon the one thing everyone needs to deal with… MONEY!

Normally, you need to figure out everything from taxes to investing to budgeting on your own. But that’s where Financial Pupil comes in.

Offering easy to implement and relatable advice, Financial Pupil’s purpose is to help educate you about everything money-related so that finance can be fun and exciting for you.

Learn more ►

So many of us in our 50’s, 60’s and beyond find ourselves with meager savings, debt, and few opportunities for a secure retirement. We want to get our financial houses in order, ever at this late date.

Yet we don’t want to sacrifice for years to reach FI. Too late for that! We’re committed to living meaningful, interesting, full, and fun lives – now.

Is it possible?

Follow my journey as I work towards financial independence and explore the changing meaning of “aging well.” I’ll share wisdom from the triumphs and challenges of other late bloomers as well. Together, we can do this!

Learn more ►

I'm a financially independent emergency physician in my mid-40s, married with kids, living in coastal California.

My story of mid-career burnout in medicine was transformed by a financial literacy conversion experience. I pivoted from helpless to in control. I learned to manage my investments. I saved aggressively using smart strategies tailored to high-income professionals.

I write for newbie physicians and other high-income professionals who are motivated but anxious about tackling their finances. I want to provide you blueprints for financial success while helping you avoid the mistakes I made.

I also write for mid-career physicians at a significant personal crossroads (parenthood, burnout, divorce) ready to implement drastic changes that realign values with time. I want to share with you the tools that let me change the axis my life revolved around.

Learn more ►

This is a blog about my journey towards financial independence/retiring early in Australia, with the aim of continuing to earn a high passive income after attaining FIRE. Many blogs in this sphere are focussed on financial independence through extreme savings and a fairly lean income at retirement, and are often directed towards those with a low to average income during working life. Those blogs are still great and that style of FIRE is completely valid! However my aim as a higher income earner is to try to attain financial independence while enjoying the journey there, as well as setting myself up for a very comfortable life after retiring from work – sometimes referred to as FatFIRE, though I prefer the healthier sounding term coined by Aussie HIFIRE. This blog therefore will be about my journey towards this goal – and the optimisation to my lifestyle that will still be necessary to achieve it!

Learn more ►

My name is JC Keen. I am an engineer by profession and an entrepreneur by passion. In an article titled One Thing We Can Learn and Copy From Successful Immigrants I shared that I am an immigrant and grew up in a country where hustling is a way of life.

I have many years of investing experience in areas that include securities, precious metals, timber land, residential and multi-family real estate.

My background and experience ignited in me a passion for entrepreneurship, business, investing, and ultimate the pursuit of financial freedom. Although I have a great career as an engineer, I am constantly looking to expand my business knowledge. But most importantly, I am constantly looking for business and investment opportunities.

Given all of this, I love talking about anything pertaining personal finance. I also love sharing knowledge, as well as mentoring others.

Please join me in the pursuit of knowledge and financial freedom.

Learn more ►

Dividend Power is a blog about building wealth through dividend growth investing. It is about managing your money so that you can save, invest, and achieve financial independence.

Learn more ►

Hi! My name is Steve, and I am an American Expat. The tagline I use on my site is " Sharing Knowledge to Help others Achieve Financial Freedom." I believe as I learn more I want to share more. As a teacher, I want to be able to help people out. The Frugal Expat is a personal finance blog geared to helping people save more, invest more, and reach financial independence.

Learn more ►

Xrayvsn is a personal finance blog site that discusses topics of FIRE, divorce and financial recovery, as well as burnout and its effects. It is written by a physician blogger who recovered from a devastating divorce at the age of 40, was over $850k in debt, and turned his life around to become financially independent in his late 40s.

Learn more ►

Thanks for stopping by. This is a Boomer retirement planning and “wealth” management blog. Whether you’re still working, or are now retired, this blog is for Boomers who want to protect, grow, and manage their nest-egg.

It’s for Boomers who’ve ever asked:

How do I protect and grow the money I’ve spent a lifetime earning?

How do I make sure I don’t outlive my money?

What’s the best way to increase the size of my nest-egg while I’m still working?

Should I buy long-term care insurance?

When should I take Social Security?

How can I reinvent myself in retirement?

The goal is to provide you with enough information, backed by reputable sources, that you can manage your own financial affairs. I’ll cite and link to these reputable sources.

Learn more ►

I’m a financial independence warrior, extreme minimalist and bitcoin enthusiast (gasp). I reached financial independence through saving, investing and living the magical minimalist lifestyle. I now have the freedom to choose where and how I live my life with little to no concern for money and you can do it too. All it requires is some basic knowledge, a small push, some guts to go against the herd and viola, you are there.

Learn more ►

Today I am financially independent, I run a cool little company (PopUp Business School) with a team of 12, changing the way entrepreneurship is taught globally and I spend my time travelling around the world working with some of the coolest people.

Life wasn't always this way! At school I was the shyest kid you could meet, I struggled talking to strangers, I was paralysed by fear approaching girls, making phone calls or anything else. My family went from wealthy to £millions in debt and we had to do car boot sales (yard sales) at the weekend to raise the money to buy food.

So what changed? This is what I want to share with you and it is going to be in 3 main parts:

entrepreneurship, financial independence, and

making dreams come true.

Learn more ►

We are Todd and Wendy Christensen (aka 50+ and 50-), an average couple on an extraordinary journey from mediocre finances to Financial Independence to Retire Early (FI/RE). As a couple, we don’t want to retire on Social Security and a limited IRA. We have committed to eliminating ALL our debt by our late 50s and early 60s while building passive income streams that will permit us to pursue a meaningful life outside the 8-5 workday.

Learn more ►

I started Banker On FIRE to achieve the following three objectives: Give me a creative outlet from the pressures of my job as an investment banker. Explore, document and debate the various ways to build wealth and achieve financial independence. Help others make better decisions, grow their net worth and live their best life possible

Learn more ►

Hey there, I’m Joel.

I’m 35 and live in Los Angeles.

At first glance I’m just an average guy in every way… Average height, weight, looks, IQ, skills, etc.

But there’s a few things I’ve been doing differently the past few years that have elevated my life to above average:

Every day I’m learning to make better use of my time. I now get up at 5am every morning.

Every day I’m learning to make better use of my money. I’m on a fast track to Financial Independence! Every day I get up at 5am and send a short positive message to friends, family, co-workers and strangers from the interweb.

Learn more ►

This blog is primarily intended to help continue the conversation around personal finance and investing.

There are far better qualified and well researched websites out there, but I hope, if this is one of the first places you land on these topics, it can help point you in the right direction while picking up a few tips and thoughts along the way.

Learn more ►

Over the arc of my life and career a shift started to happen where I realized that I was at the point where I could stop working for other people to get financial independence and start working for myself to achieve happiness. I couldn’t find a good manual for how to do this so I started doing a bunch of reading on my own and this site was born.

Learn more ►

I started We Want Guac after years of itching to share my own experiences. The name itself comes from getting the “extra” in life without feeling guilty about it or like you can’t afford it – the guac at Chipotle being the premier example. I focus on showing people in their early 20s how to get started on the climb to wealth; whether you’re debt-free or have loads of loans, whether you’re a newbie or a little advanced, it doesn’t matter. We’re out to get you to understand everything related to finance: budgeting, investing, income growth, adjusted mindsets, and overarching societal impacts are all discussed at length.

Learn more ►

Hi there! glad to have you on my blog. I am a big fan of personal finance and I am looking forward to sharing everything I know as well as point you to a plethora of resources available at your disposal.

Now, a little bit about me. I was born in Maracaibo, Venezuela in 1980 and I think that makes me a border line millennial with some behaviors from Generation X. I was raised by frugal parents who taught me the value of hard work and saving for the future.I truly believe my journey to FI started with the lessons my parents taught me when I was a kid. I can still remember my dad saying .. “son, when things are going great that is when you should be saving the most because you don’t know when things are going to go bad“. In the context of FI, I can say this has been one of the most important lessons in my life so thanks Dad!

The journey continues but now I plan to bring others on my quest for achieving Financial Independence.

Learn more ►

We are a financially independent family of 3 who reached FI in 2018 at the ages of 32, 30, and 1. We are looking to help others on their path to financial freedom and are here to show there is no cookie cutter way to FI. We are valuists and focus on being mindful, minimalist, and frugal. A happy life does not have to be an expensive life.

Learn more ►

Welcome to 20somethingfinance. I am the author, G.E. Miller. Long story short: I went from zero savings and significant debt after graduation, to saving over 85% of my income in just a few years. I am embracing every aspect of a financially responsible, engaged, environmentally-friendly, frugal lifestyle. And I’m chronicling my journey to financial independence on this site. Spoiler: utilizing the ideology and strategies that I write about on this site, I am now financially independent.

20somethingfinance is 11 years old and has become one of the most popular personal finance blogs in all the land. Also – don’t let the name of the blog scare you off. If you’re not in your 20’s, that’s OK. I no longer am either (but the blog is stuck with the name), and 50%+ of the readers here are over age 30 anyways. Learning and sharing knowledge of personal finance is ageless.

Learn more ►

Hey friends, welcome to our blog Burrito Bowl Diaries! Burrito Bowl Diaries is a series of blog posts by a young, humble, hot couple pursuing financial independence through frugality, investing in low-cost index funds and eating lots, and lots of burrito bowls.

Learn more ►

Hi! My name is Lisa. I worked for seven years as a litigator in a law firm in the Washington, DC area. I’m currently on a year long sabbatical. I write about professional women, law, and personal finance.

Learn more ►

I’m Mr. CC, a former seedy underbelly cook and former corporate world geologist. I’m especially a climber. Mrs. CC and I have saved and invested the majority of our income while enjoying a fairly bitchin’ existence, providing a work-optional life in our mid-30s. Do you enjoy thinking outside the box and going against the grain? Good, we’ll have some fun here.

Learn more ►

Hi, I’m Adam. I’m a research chemist by day, a former part-time professional brewer, a husband, and father. I’m also a student of efficiency and continual improvement.

Learn more ►

I am late to the game on financial independence (FI) but have a rough five year plan. It’s rough since I’m not totally sure whether the next phase of my life will involve working full-time or not. More on that in a later post.

My current full-time work is pension and investment advisory work. I advise companies on their pension plans and investment strategies. Does that make me qualified to talk about FI? You can judge that from the content you find here.

I’m fascinated by the huge difference in philosophy and financial strategies between the FI community and the establishment of actuarial thought and institutional investing. In particular, I want to explore in this blog the intersection of these two worlds. Can one inform the other, or will they forever remain neighbors refusing to make eye contact and not sharing cups of sugar?

Learn more ►

My name is Jakob Freele. I have passions for finance, numbers, sports, and animals. A data analyst by trade, it would be a dream come true to become financially free at a young age. Wealthy Whisper is here to help that dream come true for not only myself but others. This website is a journey for all who seek financial freedom and aspire to build wealth.

Learn more ►

My mission is to help others reach financial independence, along with us (we aren’t there yet!), with finance tips and by promoting the type of lifestyle that being financially free can buy (RV life, travel, security, etc.). Partners in Fire isn’t just about the upper-middle class who has the same options that we do. It’s about all of society – and I want even the poorest among us to be able to achieve financial independence.

Learn more ►

This site is focused on the personal finance needs of anyone who is thinking about retirement or early retirement. Anyone who is interested in financial independence and financial freedom will find value here.

Learn more ►

A husband, a dad and a cop who is aiming to reach Financial Independence by 40.

Documenting the journey for our children.

Learn more ►

Bitches Get Riches has a style that differs from every other blog out there. It’s funny, entertaining, informative, and they aren’t afraid to drop F-bombs. If you’re looking to learn more about how to handle your money, this is a blog you need to follow.

Learn more ►

The name “The Fioneers” comes from a combination of: Financial Independence (FI) + Pioneers. We think the name fits well with our deep-rooted love of adventure. It’s also a constant reminder to enjoy the journey. Our motto at the Fioneers is: "The journey should be remarkable as the destination."

Learn more ►

A Journey We Love started as a brainstorm project of Ruby & Peter to help inspire others to live life to the fullest. We’ll try to document everything on A Journey We Love to hold us accountable & to hopefully inspire you that life is fun, and it’s not as expensive as you think it may be: regardless of what your goals are.

Learn more ►

In 2016 we retired early from our corporate jobs to live our dream of traveling. We renovated a few foreclosed homes, turned them into rental properties, and got rid of all our belongings. If things go according to plan, our diverse investments should keep us on the road indefinitely.

Our travel is slow travel in hopes to get to know each country better and enjoy what it has to offer. In each country, we look for at least one volunteer opportunity. These opportunities allow us to give back a little, and they also give us more insight into each country and put us on the path of some pretty awesome people that we meet along the way.

We embrace minimalism and travel with only our backpacks utilizing public transportation. We love the freedom to move when and where at the drop of a hat. Occasionally, as a break from traveling, we house sit. This allows us time to relax, enjoy a home and usually a few pets. We use that time to catch up on our online activities and sometimes binge-watch a series or two.

This blog is about stories from our nomadic life. We hope that our stories provide insight into other cultures and encourage our readers to travel to new places.

Learn more ►

Welcome to Why We Money! We’re Amanda and Alan, a 40-something Midwestern couple unwilling to wait for someday to start living a life we love. Come along with us as we explore ways to find balance, meaning, and joy on our path to financial independence. Together we can learn from and support each other in our journey to richer, more fulfilling lives.

Learn more ►

I’m writing from the position of having already achieved wealth and financial independence, and I want to help you get there too.

My intention is not to re-hash the basics of the FIRE lifestyle or journey. I like to focus on the behaviors and lifestyle factors that drive money decisions.

Learn more ►

Hey there. My name is Zach. I’m 26 years old and I’m passionate about personal finance, weightlifting, and data visualization. I created Four Pillar Freedom to document my journey to financial independence, as well as to share my thoughts and ideas on how to live a rich life.

Learn more ►

Led by Co-Founders and Co-Hosts Brad Barrett and Jonathan Mendonsa, ChooseFI has become home to the largest Financial Independence community in the world. Every podcast episode, video, and blog article is packed with relatable, real-life content crowdsourced from the FI community. Join the guys each week as they share the best life hacks, strategies, stories, tools, and resources to help you take control of your money and get 1% better each day on your journey to FI.

Learn more ►

I created this blog to enlighten, educate, and entertain fellow physicians and other people who may have similar circumstances (high-income, late start, educational debt, etc…). My aim is to help those who want to help themselves and share some unique insights from the perspective of a practicing physician. I hope to leave you informed and inspired to look at life a little differently than you might have before.

Learn more ►

For me, the Budgets Are Sexy blog has always been about the community. Sharing cool ideas, sharing lessons learned, and making money a FUN topic to talk about! I believe everyone’s path to financial independence is slightly different, and I’m excited to share more about mine. And learn about yours!

Learn more ►

One of Afford Anything’s core philosophies is that you should experience adventure at every stage of life, rather than defer happiness until the end. You should enjoy mini-retirements throughout your life; treating work and life like an interval race. You should embark on your epic travels today, while — behind the scenes — you simultaneously lay the groundwork for a permanent escape.

Learn more ►

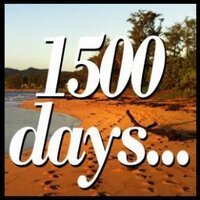

I’m a family guy living in Colorado with my wife and two young children. I studied biology and chemistry in college, but somehow turned into a software developer. From as far back as I can remember, I liked to save and earn money. My goal was to build a portfolio of $1,000,000 by February of 2017; 1500 days from the birth of this blog (January 1, 2013). And hey look, I’ve since retired!

Learn more ►

Hello and thanks for checking out my blog! First off, I go by the moniker "Cubert". Early Retirement, powered by Financial Independence, also known as “FIRE” — that’s the real premise of this blog. My career in technology has had its ups and downs, but for as long as I can remember, I’ve had a nagging itch to take on passion projects. Effectively, I just wanna be my own boss.

Learn more ►

Financial Mechanic brings to mind tinkering with money and learning how to use money as a tool. I wanted to write about my own financial journey to help others hone their own. I hope that by sharing my story, there is one more example for people to use as inspiration on their own financial journey.

Learn more ►

I'm Elyssa, a finance writer and proof that knowing better doesn’t mean doing better. See: my many failed attempts at following traditional financial advice. More than the “what” or “how” of money, financial health hinges on “who" we are with money. So let’s explore our financial selves. Get compassionately curious with me about the financial fears, beliefs, and behaviors that keep us stuck. Uncover daring dreams that motivate us to finally fix our finances. And gain insight and empowerment to ditch one-size-fits-all approaches to carve out your one-of-a-kind financial path.

Learn more ►

Welcome! My name is Chad Carson. I am a real estate investor, world traveler, father of two beautiful children, and husband to my wife & adventure partner.

Learn more ►

Women Who Money is a personal finance site dedicated to providing trustworthy financial information. Our all-female team of money bloggers, authors, and professionals, will help you find answers to all your financial questions and guide you along on your journey to financial independence.

Learn more ►