Selling your home for the first time is an exciting journey, but it also comes with its share of challenges. In places where the real estate market is competitive, it’s important to make your home stand out. First-time sellers may focus heavily on setting the right price or finding the best real estate agent, but another crucial aspect is preparing the home itself. Home remodeling, when done thoughtfully, can add significant value to your property and help attract more buyers. Knowing where to focus your efforts helps you make smart investments that will pay off in the long run.

In this blog, we will share key remodeling tips that will help first-time sellers prepare their homes for a successful sale.

Focus on Curb Appeal

First impressions are everything when it comes to selling a home. The exterior is the first thing buyers will see, and working on your curb appeal can make a world of difference. Simple and cost-effective updates can create a lasting positive impression. Start with tasks like painting the front door, installing new house numbers, or cleaning up the landscaping. Trimming the lawn, adding fresh plants, and updating outdoor lighting can make your home look well-maintained and inviting.

Update the Bathroom

Bathrooms are one of the key areas that buyers pay attention to when considering a home. An outdated bathroom can be a deal-breaker, while a modern and functional bathroom can help sell your home faster. You don’t have to invest in a complete renovation—small improvements like replacing fixtures, updating tiles, or adding fresh caulking can make a big difference.

If your budget allows, consider upgrading elements like the vanity or shower. A well-designed bathroom can increase the overall appeal of your home. For those unsure of where to start, contacting reputable Wheaton bathroom remodelers can be a good start. They can provide expert guidance that aligns with local building codes and weather conditions. Plus, they’ll offer valuable insights into what buyers are seeking, helping you make updates that maximize your home’s value.

Modernize the Kitchen

The kitchen is often considered the heart of the home, and for many buyers, it’s a top priority when house hunting. A full kitchen remodel may not be necessary, but small, targeted improvements can make a big impact. Consider replacing old cabinet hardware, adding a fresh coat of paint to the walls or cabinets, or installing new light fixtures to brighten up the space.

If your appliances are outdated, upgrading to energy-efficient models can also be a great selling point. A modernized kitchen not only looks better but can make the home feel more functional and appealing to prospective buyers. These changes don’t have to be costly, but they can significantly improve the overall impression of your home.

Make the Home Energy-Efficient

More buyers are looking for homes that offer energy efficiency, as it helps reduce utility costs and is better for the environment. Making your home energy-efficient can be a major selling point, and it doesn’t always require big renovations. Consider simple upgrades like adding insulation, replacing old windows, or installing a programmable thermostat. These improvements can increase your home’s value and make it more attractive to eco-conscious buyers.

Energy-efficient homes often sell faster because they promise long-term savings for the new owners. If you can demonstrate that your home has lower utility bills or is equipped with energy-efficient features, it’s likely to stand out in the market.

Declutter and Depersonalize

When showcasing your home to potential buyers, it’s essential to create a space that they can easily envision themselves in. Clutter and personal belongings can distract from the home’s potential. To enhance its appeal, declutter and depersonalize.

Minimize excess furniture, family photos, and personal collections. This will allow buyers to focus on the home’s layout and features. A clean, neutral environment provides a blank canvas for buyers to imagine their own personal touches. Organizing closets, cabinets, and storage areas can also be a selling point, demonstrating the home’s ample storage capacity. This simple yet effective step can significantly impact how buyers perceive your property.

Fix Any Minor Issues

Minor issues like a leaky faucet, chipped paint, or loose door handles may seem small, but they can leave buyers with the impression that the home hasn’t been properly maintained. Before listing your home, take the time to go through each room and fix any minor issues that you may have been putting off. Addressing these small repairs shows that the home is well-cared for and in good condition.

Even if buyers are willing to overlook these issues, they may use them as leverage during negotiations to lower the price. By fixing these problems before listing the home, you present a property that is move-in ready, which can make a big difference in the selling process.

Light It Up

Good lighting is essential to making your home feel open, bright, and welcoming. During viewings, buyers are more likely to connect with a home that feels light and airy. Start by maximizing natural light by keeping curtains open and cleaning windows. In darker areas, add floor lamps or update old light fixtures to brighten the space.

Consider installing energy-efficient LED bulbs, which provide bright light while using less energy. Thoughtful lighting choices can highlight the best features of your home and create a warm, inviting atmosphere that appeals to buyers.

Stage Key Rooms

Staging is an important tool for making your home more appealing to potential buyers. It helps them visualize how they might use the space and creates a welcoming environment. Focus on key areas like the living room, kitchen, and master bedroom when staging your home. Rearranging furniture, adding fresh flowers, or placing decorative touches can make these rooms look more modern and inviting.

Staging doesn’t require a full redesign—small changes can make a big impact. A well-staged home gives buyers the impression that the space is ready for them to move in, which can help it sell faster and potentially at a higher price.

Conclusion

All in all, home remodeling can be a big investment, but it’s one that can pay off handsomely when it comes time to sell. By focusing on key areas like kitchens, bathrooms, and curb appeal, you can significantly increase your home’s value and attract more potential buyers. Keep in mind that you don’t just have to make your home look good, but to make it feel like a place where people want to live. With a little planning and effort, you can transform your property into a desirable and profitable asset.

In Pittsburgh’s real estate market, making thoughtful home upgrades can significantly boost your property’s value. Whether you’re preparing to sell or just want to improve your living space, investing in the right areas is key to maximizing your return on investment (ROI). Buyers today are looking for homes that are both functional and energy-efficient. In this article, we’ll explore key upgrades that can increase your home’s value while appealing to potential buyers in Pittsburgh.

Focus on Energy Efficiency

Upgrading your home for energy efficiency is one of the most effective ways to increase its value. Buyers are increasingly aware of energy costs and prefer homes that help reduce their utility bills. There are several ways to make your home more energy-efficient, such as improving insulation or upgrading your heating, ventilation, and air conditioning (HVAC) systems. Energy-efficient appliances are another great investment that can appeal to buyers.

One upgrade that offers high value is replacing old, inefficient windows. Installing new windows is an upgrade that pays off in multiple ways. Modern windows enhance your home’s curb appeal but also improve its insulation. In Pittsburgh replacement windows can significantly reduce your energy bills by keeping warm air inside during the cold months and cool air inside during the summer. This upgrade is particularly valuable in Pittsburgh, where the climate makes energy efficiency a top concern for homeowners.

In addition to energy savings, replacement windows can boost your home’s resale value. Buyers appreciate the reduced maintenance costs and increased comfort that new windows provide. In many cases, homes with updated windows can recoup a substantial portion of the window replacement costs when sold.

Boost Curb Appeal with Simple Exterior Updates

First impressions matter, and enhancing the exterior of your home is a quick way to increase its value. Buyers are drawn to homes that look well-maintained and inviting. Simple updates like repainting the exterior, adding fresh landscaping, or installing a new front door can make your home stand out. These upgrades are relatively inexpensive but have a significant impact on how buyers perceive the property.

Replacing old windows is another effective way to improve curb appeal. New windows give the home a modern, polished look while providing practical benefits like better insulation and noise reduction. When combined with other exterior updates, window replacements can greatly improve your home’s overall marketability.

Enhancing outdoor living spaces is a powerful way to boost your home’s value and appeal to buyers. By creating functional areas like a deck, patio, or cozy seating nook, you expand your living space and provide opportunities for relaxation and entertainment. In Pittsburgh’s climate, incorporating features like fire pits, outdoor heaters, or weather-resistant furniture can make these spaces usable year-round.

Simple upgrades like adding outdoor lighting and low-maintenance landscaping can further improve the area’s functionality and visual appeal. Buyers today appreciate homes that offer outdoor living options, and investing in these enhancements can make your property stand out in a competitive market while increasing its overall value.

Kitchen and Bathroom Renovations for Maximum Impact

Upgrading the kitchen and bathrooms is one of the most effective ways to increase a home’s value. These areas are often top priorities for buyers, as they are heavily used and tend to show signs of wear and tear over time. While a full-scale renovation may be costly, there are smaller, targeted improvements that can offer a strong return on investment.

In the kitchen, upgrading countertops, replacing old appliances with energy-efficient models, and updating cabinets can make a big difference without breaking the bank. Even simple updates like new hardware on cabinets or a fresh coat of paint can improve the space. Buyers love kitchens that look modern and functional, and these updates can make your home more appealing without requiring a complete overhaul.

Similarly, bathroom upgrades are highly valued by potential buyers. Installing new fixtures, replacing old tiles, or adding a modern shower can make the bathroom feel fresh and updated. If the space allows, adding extra storage through cabinetry or shelving is another upgrade that will attract buyers. These smaller investments can significantly enhance the look and feel of your bathroom, making it more attractive to prospective buyers.

Focus on Maintenance and Structural Integrity

While cosmetic upgrades like kitchen and bathroom improvements can add value, it’s essential to address the basics of home maintenance and structural integrity first. Buyers want to know that the home is in good condition, free of major issues like faulty plumbing, electrical problems, or a leaky roof. Before considering aesthetic upgrades, make sure the key systems of the home are functioning properly.

Roof replacement, for instance, is a major expense that potential buyers often look out for. If your roof is nearing the end of its lifespan, investing in a replacement can add value and give buyers peace of mind. Similarly, addressing plumbing or electrical issues, updating old systems, and repairing any structural damage will help maintain the overall integrity of the home. A well-maintained house is more likely to sell at a higher price, as buyers prefer properties that won’t require immediate major repairs.

Another important area to address is insulation. Proper insulation reduces energy costs and keeps the home comfortable throughout the year. If your home lacks sufficient insulation, upgrading it can help increase its value and appeal to energy-conscious buyers.

Conclusion

Making strategic home upgrades is a great way to maximize your return on investment while improving the comfort and appeal of your property. Energy-efficient improvements are highly attractive to buyers and can save on utility bills in the long run. By focusing on kitchen and bathroom renovations and maintaining the structural integrity of your home, you can add value and appeal when it comes time to sell. Each upgrade brings you one step closer to creating a home that is functional and desirable to potential buyers.

Maintaining and upgrading commercial properties can significantly improve their value, functionality, and attractiveness.

A well-maintained property attracts tenants and customers while minimizing long-term repair costs. On the other hand, strategic upgrades can keep your commercial space competitive in today’s market.

In this article, we’ll explore key best practices for keeping commercial properties in top condition and making upgrades that bring tangible benefits.

Regular Property Inspections: Preventive Maintenance is Key

The foundation of maintaining commercial properties is regular inspections. Establishing a routine for checking every aspect of the property, from structural elements to mechanical systems, can help detect potential issues before they become major problems.

Conduct quarterly or semi-annual inspections to make sure the building remains in optimal condition.

Prioritize High-Traffic Areas for Upgrades

One of the most effective ways to upgrade commercial properties is to focus on high-traffic areas such as lobbies, restrooms, and common spaces. These areas play a significant role in forming the first impression of the property.

A fresh coat of paint in lobbies, adding comfortable seating, or improving lighting can make a big difference in the atmosphere of the space. Simple upgrades like modern lighting fixtures and durable flooring can instantly elevate the look and feel of these communal areas without a major financial investment.

Upgrading restrooms should also be a priority, as they reflect on the cleanliness and overall upkeep of the property. Tenants and visitors alike appreciate a clean and modern space. With this in mind, bathroom remodeling becomes one of the most important upgrades to consider.

It enhances the overall functionality and appearance of the facility, showing that you prioritize the comfort and satisfaction of tenants and visitors.

Choosing durable and easy-to-clean materials, such as tiles or vinyl flooring, for these spaces is crucial to making them long-lasting. Incorporating eco-friendly elements like low-flow faucets and energy-efficient lighting can also reduce utility costs while promoting sustainability, which is an attractive feature for many businesses.

Energy Efficiency: Invest in Long-Term Savings

Energy efficiency is an essential component of upgrading commercial properties. Making energy-efficient improvements can yield significant cost savings and enhance the property’s value over time.

Additionally, with the rising demand for eco-friendly commercial spaces, energy efficiency can be a strong selling point when attracting new tenants.

One of the best investments in energy efficiency is upgrading HVAC systems to modern, energy-saving models. Many older systems consume excessive amounts of energy, leading to higher operating costs. Replacing these systems with energy-efficient alternatives will lower utility bills and reduce the property’s carbon footprint.

Lighting is another area where energy efficiency upgrades can make a difference. Switching to LED lights or installing motion-sensor lighting in common areas can significantly reduce energy consumption. These simple upgrades can make a noticeable impact on overall energy savings.

Another option to explore is solar energy. Depending on the location and structure of the commercial property, installing solar panels can reduce dependence on grid power, resulting in lower energy bills.

Though the initial cost of solar installation can be high, the long-term savings and incentives make it a worthwhile investment.

By integrating energy-efficient solutions, property owners can decrease operational costs while also making their properties more attractive to environmentally-conscious tenants.

Landscaping and Exterior Maintenance: Curb Appeal Matters

While the interior of a commercial property is crucial for tenant satisfaction, the exterior plays a big role in attracting visitors. Regular landscaping and exterior maintenance keep the property looking fresh and inviting, enhancing curb appeal.

Keeping lawns well-manicured, maintaining clean and accessible pathways, and adding greenery or flowers can make the property look vibrant and well-cared for. Regular exterior cleaning, such as pressure washing the façade, sidewalks, and parking lots, can remove grime and dirt that accumulate over time.

If your commercial property has outdoor seating areas or a courtyard, upgrading these spaces can offer tenants a more enjoyable environment. Consider adding outdoor furniture, shade structures, or even features like water fountains to create a welcoming atmosphere.

Exterior signage is another important aspect of commercial properties that is often overlooked. Updated and well-lit signage makes it easy for tenants to advertise their businesses while enhancing the overall professional appearance of the building.

By paying attention to the exterior elements, you can create an appealing and welcoming environment that encourages visitors to return.

Technology and Security Upgrades: Keep Up with Modern Needs

The need for security in commercial properties has grown significantly in recent years, and technological advancements have made it easier to upgrade security systems. Installing modern security measures, such as access control systems, video surveillance, and smart locks, can help protect tenants, property, and assets.

For example, cloud-based access control systems allow building managers to grant or revoke access in real-time, enhancing security without the need for physical keys. These systems are particularly useful for large commercial properties that house multiple tenants and have frequent visitors.

Additionally, upgrading to smart HVAC controls and lighting systems can streamline building management while optimizing energy use. Smart thermostats and lighting controls allow property managers to adjust settings remotely, leading to more efficient operations.

Sustainable Upgrades: Future-Proofing Your Property

Sustainability is no longer a trend but a necessity in commercial real estate. Future-proofing your property through sustainable upgrades helps the environment and adds significant value to the building.

Incorporating eco-friendly elements, such as green roofs or energy-efficient windows, can reduce heating and cooling costs. Rainwater harvesting systems and greywater recycling are also gaining popularity as ways to conserve water and reduce utility costs.

Upgrading the building’s insulation is another way to improve energy efficiency. Proper insulation can regulate indoor temperatures more effectively, leading to lower energy consumption and increased comfort for tenants.

Tenants and businesses are increasingly seeking out environmentally-conscious spaces, and sustainable upgrades help you meet those demands. A commitment to sustainability will attract tenants and position the property for long-term success in an ever-evolving market.

Conclusion

Maintaining and upgrading commercial properties is an ongoing process that requires attention to detail, investment, and strategic planning. By focusing on regular maintenance, prioritizing high-traffic areas, investing in energy efficiency, improving curb appeal, enhancing security, and implementing sustainable practices, property owners can keep their buildings competitive in today’s market.

Have you ever found yourself in need of quick cash without the hassle of paperwork and long approval times?

Online loans might be the solution you’ve been looking for. In today’s fast-paced world, convenience is key, and online loans offer a streamlined, straightforward process.

This guide will walk you through everything you need to know about online loans, ensuring you make informed decisions. Discover how online financial funding can provide financial flexibility, and see why more people are turning to digital lending.

Types of Online Loans

Online loans come in various types, each designed to meet different needs and financial situations. Here are some common types:

Personal Loans

Personal loans are versatile financial tools. They allow borrowers to access a lump sum of money. The repayment is typically through fixed monthly installments over a set period.

A personal loan can cover various expenses. From consolidating debt to financing home improvements, personal loans provide flexibility for many needs.

Payday Loans

Payday loans are short-term loans intended to provide quick cash until your next paycheck. Borrowers typically receive these loans based on their income and ability to repay. The loan amount is usually smaller compared to other types of loans.

Interest rates and fees for payday loans are often higher. These loans must be repaid quickly, often within two weeks or by the next payday.

Auto Loans

Auto loans are specifically designed to help individuals purchase vehicles. These loans allow borrowers to finance the cost of a car, making it more accessible without paying the full price upfront. Typically, auto loans have fixed interest rates and are repaid over an agreed period, often ranging from three to seven years.

Lenders often require a good credit score for approval. Borrowers can choose between new or used car financing, based on their needs and budget.

Home Equity Loans

Home equity loans allow homeowners to borrow against the equity of their home. These loans provide a lump sum of money that the borrower repays with fixed monthly payments. Home equity loans usually have fixed interest rates.

Home equity loans use the home as collateral. This can result in the loss of home ownership if repayments are missed.

Personal Line of Credit

A personal line of credit is a flexible loan option for individuals. It allows borrowers to access funds as needed up to a predetermined limit. This type of loan is ideal for managing cash flow or unexpected expenses.

Borrowers only pay interest on the amount they use. Repayment can vary, providing flexibility in managing financial needs.

The Online Loan Application Process

The online loan application process typically involves several steps. Here’s a general overview:

Research and Compare

Researching and comparing online loans is a crucial first step in the application process. It involves determining which lender offers the terms that best meet your financial needs. Take the time to read reviews and understand the loan products available.

When comparing loans, consider factors such as interest rates and repayment terms. Look at any fees that might be associated with the loan. Be sure to evaluate the reputation of each lender.

Pre-Qualification

Pre-qualification is a preliminary assessment of a borrower’s creditworthiness. It provides an estimate of the loan amount and terms a lender might offer. Pre-qualification involves submitting basic information about income and debts online.

This process does not guarantee loan approval. It helps borrowers understand their borrowing capacity. Pre-qualification is quick and typically doesn’t affect credit scores.

Application Form

Filling out an application form is a necessary step in obtaining an online loan. This process requires applicants to provide detailed personal and financial information. The form typically asks for employment details, income verification, and social security number.

Completing the application truthfully is important to avoid complications. Reviewing the terms and conditions before submission is also crucial.

Documentation

Documentation is a critical part of the online loan application process. Applicants need to submit various documents as part of their application. These documents often include proof of identity, income, and residency.

Accuracy in documentation is key. Ensure all information provided is correct and up-to-date to avoid delays.

Credit Check

A credit check is an essential component of the online loan application process. It involves the lender reviewing the borrower’s credit report to assess their creditworthiness. This process helps determine the interest rates and loan terms offered to the borrower.

The credit check could potentially impact your credit score. It is crucial to ensure that your credit report is in good standing before proceeding with an application. Understanding your credit history can help you anticipate the outcome of the credit check.

Review and Approval

Once a loan application is submitted, the lender reviews it thoroughly. They evaluate the applicant’s creditworthiness and financial situation. The review process determines whether the loan is approved or denied.

If approved, the applicant receives an offer detailing the loan terms. Acceptance of the terms finalizes the approval process, and funds are disbursed.

Offer and Acceptance

After the review and approval process, the lender makes an offer to the borrower. This offer includes specific loan terms such as interest rates, repayment schedule, and fees. It is essential for the borrower to carefully review the offer to ensure it meets their financial needs and expectations.

The borrower needs to accept the terms to move forward. Upon acceptance, the loan is finalized, and the funds are transferred to the borrower’s account.

Managing Your Online Loan

Managing your online loan is important for maintaining financial stability. Create a budget to track your monthly payments. This helps ensure you have enough funds to cover loan repayments on time.

Regularly check your loan statements to verify all transactions. Stay informed about any changes in interest rates or fees. Contact your lender if you encounter any issues or discrepancies.

Unlock the Secrets to Online Loans and Elevate Your Financial Game

Online loans offer a convenient way to access funds quickly. They are designed to meet various financial needs. With an easy application process, they save time compared to traditional loans. Always ensure you understand the terms before applying.

Consider the repayment ability to avoid financial strain. Use online loans wisely to achieve your financial goals effectively. Remember, staying informed and responsible is key when dealing with a financial loan. Choose the right option that suits you.

Was this article helpful to you? If so, make sure to check out our blog for more useful information and resources.

Saving up for the first step on the property ladder can be a daunting step for many in the UK. Property prices and living costs make it difficult to even think about, let alone get the funds together to do it, but it’s not impossible with some planning, saving, and even government grants, which can be very helpful for first-time buyers. In this article, we’ll discuss three ways that buyers can get their foot on the property ladder.

Create a Savings Plan

The most obvious step on this journey, many would say, but one of the hardest at the same time. To buy a property, most purchases will require a deposit that is equal to 10% of the property’s value. It can seem daunting when that figure is in the thousands, but starting early and practicing discipline when it comes to saving can be extremely useful down the line.

If you don’t know what sort of deposit you need to save in relation to house prices, it is useful to look at what’s on the market. For example, online estate agents in the UK are a good place to start to view house prices in different areas of the country. While they can also remove some of the stress of buying when it comes to it by managing the process from start to finish, taking care of viewings, and even qualifying buyers for sellers. From doing research, buyers can set a realistic savings goal that will help them get their first property.

Take Advantage of Government Schemes

Several schemes in the UK exist to help first-time buyers get a property, making homeownership more accessible. For example, the shared ownership scheme allows you to buy a share of a property and pay rent on the remaining part of it. It also allows you to keep putting money into the property so that eventually you own it outright.

Another scheme that helps first-time buyers is the first homes scheme. Buyers can avail of up to 30% off new properties. There are certain thresholds to meet that are set by the government, but it is a helping hand for many just entering the market.

Manage Your Spending

Managing your total spending is probably a little more difficult than many imagine. However, there are some simple tricks that, over the course of a few years, can save thousands of pounds. Many savers change supermarkets or shop around to find the produce they want at affordable prices. Others sell their transport and begin taking the bus or train to work, while many move home to live with family to avoid paying rent. These are just some suggestions that may work for your situation.

Buying a first property is no easy feat. It can bring with it a lot of stress and saving, but the end reward is worth it. With schemes offered by the government as well as some thorough planning, affording a house doesn’t have to be a pipe dream and can turn into a reality sooner than you may have thought.

Being self-employed is a goal that many people have these days. As more of the businesses are operating online, self-employed seem to be a more attainable goal than looking out for a job.

So, if you are intrigued to start your own business someday, earning a relevant degree can be a huge help in kick-starting your journey with in-depth knowledge and expertise. Not sure which degree program resonates better with your goal? If yes, here are the five most valuable degrees for business owners.

Read on to explore in detail:

1. Business Administration

When it comes to becoming an entrepreneur or business owner, it is crucial for you to get a deep understanding of all the business processes, from developing to running and maintaining. That is why an associate, bachelor’s, and master’s degree in business administration is considered the gold standard for business owners and aspiring executives.

So, if you’re wondering what to do with an MBA degree or BBA, you will be surprised to know that greater career flexibility and in-depth business knowledge can bring along.

Choosing this degree program will help you learn management strategies, business development, human resource management, and finance.

2. Business Management

To some extent, a business management degree is similar to business administration. However, there are some key differences. Business management solely focuses on the human aspect of managing the business rather than focusing on the strategies to achieve organizational goals.

Depending on your future goals, both degrees can be helpful for you. However, if you want to gain expertise in management and plan a good human resource strategy, this degree is the right choice for you to consider.

3. Marketing

In the digital age, where local, global, online, and offline markets are becoming highly competitive, marketing has become an essential tool for businesses. If you want to operate a business successfully, a degree in marketing is the right tool to gain all the necessary skills.

Getting a degree in marketing will help you to identify the target markets, trends, and needs of customers. This way, you can develop a powerful strategy to market your business effectively.

You can utilize the knowledge for your business marketing operations without investing more expenses in hiring a team to market it.

4. Accounting

When it comes to operating a business, keeping the finances on the right track is one of the significant challenges for owners. More than 50% of businesses indeed fail within the first 5 years because of cash flow problems.

That is why getting a degree in accounting can be an asset for financial forecasting, planning, and more. This way, you will have a better understanding of cash flow and accounting principles to save the expense of hiring other professionals.

5. Finance

Finance and accounting may seem similar degrees, but they are different on many levels. A degree in finance can help business owners understand the financial circumstances on a broader level.

The students learn financial analyses and strategy development that will help grow or expand the business opportunities.

Making ends meet as a student is difficult. On the one hand, you have tuition to pay, but even if you’re lucky enough that your school is heavily subsidized, you’ll still have to come up with the money for textbooks and rent. And on the other hand, you want to go out and have a good time, too. When you’re faced with so many expenses, it’s easy to make rash decisions and end up paying for them long after you graduate. The following guide will walk you through the most common money mistakes students make and provide some simple strategies to keep your finances on track while in school.

1. Don’t Ignore Budgeting

A common mistake for students is they don’t keep a budget. Budgeting is very boring, but it’s critical to ensuring that you can live without panicking about your bank account. A budget tells you what’s coming in and exactly what’s going out, so you’re not scratching your head and wondering: ‘Why is my bank account empty two weeks before payday?’

Make a list of your income – a part-time job, scholarship, or financial aid – and track your expenses – rent, groceries, entertainment, etc. Stick to your budget to keep your expenses under control. Ensure you have a little left over for accidental expenses, such as a broken laptop, an emergency flight home, or a tricky essay. You can hire the most trusted essay service to help you with the latter. TopEssayWriting can write any paper for you, no questions asked.

2. Be Careful with Credit Cards

Cards are useful when one has no cash, but become a terrible debt trap if not carefully handled. Many students get caught up using credit cards without knowing how interest works. Several small purchases can grow into an enormous debt if they are not carefully monitored. If you have a credit card, keep the balance low and pay it off monthly to avoid incurring interest charges. Resist the temptation of the credit limit – it’s not a freebie.

3. Avoid Impulse Spending

Impulse purchases are often the culprits that bring down our budgets. The latest gadget, a pizza, a snack at the cinema … these little ‘treats’ might not seem like a big deal, but they can amount to a significant expense over time. Have a moment of honesty with yourself before you buy something you don’t really need, and certainly don’t buy it if it’s outside your budget. A good strategy is to institute a 24-hour rule for non-essential purchases, meaning that you wait a day and see whether you still want it. If you do, and it’s within your budget, go for it. If not, you’ve dodged a bullet.

4. Understand Student Loans

Student loans can be a great way to finance part or all of your education, but they’re not free money. Some students don’t realize how much they’re borrowing or how long it will take to pay off the debt. Take time to understand the terms of your loans, including interest rates and repayment plans.

5. Save on Textbooks

It is well known that textbooks can be very expensive. However, there are a few ways that you can lower the cost. Avoid buying brand-new textbooks from the campus bookstore.

Here’s a quick list of ways to save on textbooks:

- Buy used or rent textbooks from websites like Chegg or Amazon.

- Check if your school library has copies available.

- Use digital textbooks or share with a classmate.

- Sell your textbooks after the semester ends.

6. Plan for Emergencies

Life happens. Stuff goes wrong. You weren’t expecting an expensive medical bill or that your brakes suddenly needed to be replaced. Having a small emergency fund of a few hundred dollars can save you from having to go into debt to pay for these expenses.

7. Take Advantage of Student Discounts

As a student, you are entitled to many discounts. From computer software subscriptions to college transportation and entertainment, student rates are often slashed in half. All you need is your student ID. Find deals on things you already pay for – streaming services, clothes, or even gym memberships. These savings can really add up.

8. Cook Instead of Eating Out

Eating out is convenient but also very expensive. Even if you just order a coffee every day, it can cost a lot. Try to cook a meal for yourself at home instead. Not only will you save money, but you will also eat healthier. Planning your meals and buying food in bulk will lower your costs even more. And if you have roommates or friends, cooking together can be fun and cheap.

Be Smart with Your Money

With a little forward thinking, you can be a shrewd shopper and smart investor without feeling overwhelmed. Avoid spending money on things you don’t need – including luxuries, junk food, and little treats – and you’ll find that you’re saving more, wasting less, and making the most of your funds. If you avoid the temptations of impulse shopping, excessive credit card use, and ignoring your budget, your finances will be more manageable in the long run. Don’t forget to take advantage of student discounts, plan for the unexpected, and stay on top of those deadline dates. You got this!

The cryptocurrency market has grown rapidly over the past few years, giving rise to countless new coins and trading strategies. For traders and investors, finding a reliable platform for crypto exchange is critical. Whether you’re looking to swap popular tokens or experiment with niche altcoins, having access to a trusted cryptocurrency aggregator like SwapSphera can make all the difference.

SwapSphera offers users a seamless and secure platform to swap crypto efficiently. As more people engage in crypto asset trading, the importance of secure and user-friendly platforms has never been higher.

How to Convert Crypto Effectively

Crypto trading has evolved from simple exchanges of Bitcoin and Ethereum into a vast ecosystem that includes thousands of coins, tokens, and trading pairs. Whether you want to convert crypto to a more stable asset during times of volatility, or you’re looking to capitalize on altcoin season, having a flexible, secure, and efficient platform like SwapSphera makes the process easier.

The platform allows users to quickly execute trades with minimal friction, offering competitive rates and high levels of security. If you are looking to swap crypto, SwapSphera supports various trading pairs and offers real-time market updates.

Explore more about SwapSphera’s services by visitingsite and take advantage of their simple and efficient platform for all your cryptocurrency exchange needs.

Key Features of SwapSphera

- Comprehensive Cryptocurrency Support: SwapSphera supports a wide range of cryptocurrencies, from leading tokens like Bitcoin and Ethereum to popular stablecoins and emerging altcoins. This makes it easier for users to convert crypto based on their preferences or current market conditions.

- Secure Exchange Wallets: SwapSphera prioritizes exchange security by offering secure wallets for users to store their assets while they conduct their trades. With rising concerns over exchange security, SwapSphera provides peace of mind for its users.

- Decentralized Exchange Option: For those who prefer non-custodial exchanges, SwapSphera also provides access to decentralized exchanges, allowing traders to retain full control over their cryptocurrency wallets.

- Real-Time Price Updates: Staying ahead in the cryptocurrency world requires real-time data. SwapSphera offers up-to-the-minute price tracking and rate comparisons, ensuring that you get the best value when making a crypto swap.

Why Choose a Cryptocurrency Aggregator?

The value of a cryptocurrency aggregator like SwapSphera lies in its ability to pool together the best rates from different platforms. Instead of manually checking various exchanges to compare prices, SwapSphera allows you to make quick and informed decisions about your crypto trades. This saves time and often leads to better financial outcomes.

Additionally, aggregators like SwapSphera simplify the process of trading across multiple exchanges. Whether you’re trading high-volume assets or taking advantage of niche market opportunities, having access to multiple markets through a single platform enhances the efficiency of your trades.

Conclusion

Whether you’re a beginner or an experienced trader, having a reliable crypto exchange platform is essential to making informed and secure trades. SwapSphera stands out as a leading cryptocurrency aggregator, providing fast, secure, and flexible services for anyone looking to swap crypto. With a wide range of supported coins, advanced trading features, and top-notch security, SwapSphera is the ideal platform for your cryptocurrency exchanges.

Start trading today by visiting SwapSphera and experience a secure, efficient, and user-friendly way to convert crypto.

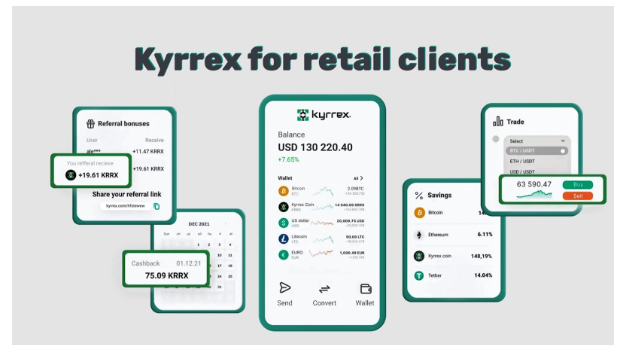

In the era of digital economy, cryptocurrencies are becoming an integral part of the financial landscape. The Kyrrex platform offers a comprehensive set of services that allows users, both private and corporate, to effectively manage their digital assets. Kyrrex is not just a crypto platform, but a complete ecosystem that combines cutting-edge technology and secure solutions. Let’s take a look at Kyrrex’s core services in the new format.

Cryptocurrency trading: fast and efficient

One of Kyrrex’s key services is a global trading platform for working with major cryptocurrencies such as Bitcoin, Ethereum, Litecoin and others. The platform supports high liquidity and minimal latency, making trading fast and reliable.

- Intuitive interface: The trading platform is designed for users of all skill levels – from beginners to experienced traders. Ease of use is combined with access to advanced analysis tools.

- Advanced trading tools: Experienced users can take advantage of charts, indicators and technical analysis to optimize their trading strategies.

- High liquidity: Fast execution of trades and low commissions maximize the benefits of cryptocurrency trading.

Fiat and digital asset management

Kyrrex offers the unique ability to manage both cryptocurrencies and traditional fiat assets on one platform. This allows users to make international payments, convert currencies and easily switch between the two.

- Fiat Currency Support: Kyrrex supports fiat currencies such as dollar, euro, pound sterling and others. This allows users to quickly fund their accounts and transfer funds.

- International transfers: The ability to send and receive funds to different countries makes the platform convenient for both individual and corporate customers.

- Easy conversion: Quick and favorable conversion between cryptocurrencies and fiat money allows users to manage their assets efficiently.

Security at the highest level

For Kyrrex, security is a priority. The platform utilizes state-of-the-art technology to protect users’ assets and data. This is especially important in the world of cryptocurrencies, where the risks of cyberattacks remain high.

- Multi-factor authentication: Kyrrex uses two-factor authentication to secure user accounts. Accounts cannot be accessed without additional verification.

- Data Encryption: All information is encrypted, which guarantees the confidentiality of transactions and users’ personal data.

- Cold asset storage: The bulk of user assets are stored in cold wallets, which provides additional protection against hacker attacks.

Innovative financial products

In addition to trading, Kyrrex offers users unique financial products that help multiply their capital. These products are suitable for both private investors and large companies.

- Staking: Users can earn rewards for holding cryptocurrencies on the platform. Staking provides passive income opportunities without active trading.

- Profitable Deposits: Kyrrex offers deposits with competitive interest rates, allowing users to earn income from depositing funds on the platform.

- Investment programs: For large investors, the platform offers specialized investment programs with individual strategies.

Payment solutions for the future

Kyrrex is actively developing payment solutions that make the use of cryptocurrencies in everyday life a reality. The platform plans to release products that allow users to easily spend cryptocurrency on purchases and services.

- Crypto Payments: In the near future, users will be able to pay for purchases with cryptocurrencies through partners and stores that accept digital assets.

- Cryptocurrencies: Kyrrex is developing cryptocurrencies that will make using cryptocurrencies as easy as regular debit and credit cards.

- Global Availability: Kyrrex’s payment solutions will be available worldwide, allowing users to use cryptocurrency without restrictions.

Personalized services for every customer

Kyrrex understands that every customer is unique and offers solutions that meet individual needs. Specialized services are available for private users and institutional clients.

- Customized Investment Strategies: For large investors and companies, Kyrrex develops customized asset management strategies and long-term investment plans.

- Tools for private users: Easy-to-use tools for personal finance and portfolio management are available to every client of the platform.

- Round-the-clock support: Kyrrex provides users with prompt technical support that is always ready to help with any questions.

Future technologies: blockchain and artificial intelligence

Kyrrex not only follows trends, but also creates them. The platform is actively implementing blockchain and artificial intelligence (AI) technologies that improve asset management efficiency and enhance transaction security.

- Blockchain: All transactions in the system are executed using blockchain technology, which ensures their transparency, immutability and reliability.

- Artificial Intelligence: Kyrrex uses AI to analyze the market and provide users with personalized investment recommendations. This allows for more informed and well-informed decisions.

Conclusion

Kyrrex is more than just a cryptocurrency platform, it is a comprehensive solution for asset management in today’s digital economy. With a wide range of services, high security standards and innovative financial products, Kyrrex is leading the cryptocurrency platform market. Whether you are a private user or an institutional investor, Kyrrex offers solutions to help you effectively manage your assets and achieve your financial goals.

Kyrrex is your trusted partner in the world of cryptocurrencies and financial technology.

Entrepreneurship is a rewarding but demanding journey, characterized by unique financial challenges that require specialized strategies. Unlike traditional employees and business owners, entrepreneurs often face fluctuating income, high-risk investments, and limited time for personal finance. These factors can make managing wealth challenging and long-term financial stability difficult.

This article will examine the unique challenges entrepreneurs face in managing their wealth and offer practical solutions.

1. Managing Cash Flow Variability

One of the most significant challenges faced by entrepreneurs is fluctuating income. Seasonal business cycles, market conditions, and project-based work can lead to unpredictable cash flows.

To effectively manage cash flow variability, business owners should:

- Build a cash reserve.

- Implement robust financial forecasting.

- Use cash flow management tools.

Additionally, cash flow hedging can be a valuable tool for managing variability in future expected cash flows. According to PwC, a cash flow hedge involves using a derivative instrument to lock in the amount of a future cash inflow or outflow. This can be particularly useful for businesses exposed to market fluctuations or uncertain future transactions.

2. Balancing Business and Personal Finances

Entrepreneurs often struggle to separate personal and business finances. This can cause confusion, mismanagement, and legal problems. To manage their finances effectively, entrepreneurs must clearly separate personal and business accounts. Additionally, keeping detailed financial records for both personal and business activities is crucial for financial management and tax compliance.

Another important strategy is to work with a financial advisor who specializes in wealth management for entrepreneurs. A financial advisor can guide you in setting clear boundaries between personal and business finances, helping to create a structured approach to managing both.

C.W. O’Conner Wealth Advisors notes that wealth management services provided by financial advisors offer tailored advice on asset allocation, investment planning, and tax strategies. These services ensure that both personal and business financial goals are met efficiently.

3. Tax Planning and Optimization

Business owners often face complex tax regulations that can significantly impact their bottom line. Effective tax planning is essential to minimize tax liabilities and maximize wealth.

For instance, according to CPA Practice Advisor, the IRS has been increasing its focus on cryptocurrency taxation. Entrepreneurs who own cryptocurrencies should be aware of the tax implications of digital transactions and consult with tax professionals to ensure compliance.

Smart investors can use the volatility of cryptocurrencies to minimize their taxes through loss harvesting. This strategy involves trading a cryptocurrency that has lost value for another asset, capturing the loss for tax purposes. By repurchasing the original asset without a waiting period, entrepreneurs can reduce their overall tax liability.

Consult with a qualified tax advisor to understand the specific tax implications of your entrepreneurial activities and implement effective tax planning strategies.

4. Retirement Planning for Entrepreneurs

Entrepreneurs often face unique challenges when it comes to retirement planning. Limited access to traditional retirement plans and inconsistent contributions can make it difficult to accumulate sufficient savings for a comfortable retirement.

According to Investopedia, small business owners bear the responsibility for their own retirement planning, as well as that of their employees. While selling the business could provide retirement funds, this outcome is not guaranteed and can vary widely in value.

To secure retirement savings, entrepreneurs should consider setting up various retirement accounts. Options include a SIMPLE IRA, SEP IRA, traditional or Roth IRA, and a Solo 401(k). Each plan offers different benefits. A SIMPLE IRA and SEP IRA allow for higher contribution limits and are relatively easy to manage. Meanwhile, a Solo 401(k) provides substantial contribution opportunities during high-income years.

Establishing these accounts helps ensure steady retirement savings despite the irregular income typical of entrepreneurship. By proactively managing retirement plans, entrepreneurs can work towards a financially secure retirement.

5. Estate and Succession Planning

For entrepreneurs, ensuring a smooth transition of business and personal assets is crucial.

According to Bloomberg Law, recent legal decisions have highlighted the importance of strategic planning. A notable US Supreme Court ruling required life insurance payouts to be included in estate tax valuations.

This decision, involving the company Crown C Supply Co., underscores the need for careful consideration of how such assets are handled in succession planning. Estate lawyers must now reevaluate their strategies to minimize tax liabilities and ensure compliance.

To overcome these challenges, entrepreneurs should create a comprehensive estate plan, including a will and trust, to manage the distribution of personal assets effectively. Additionally, creating a detailed succession plan for the business guarantees that ownership transitions smoothly and maintains operational continuity.

Working with estate planning professionals can help address these complexities and secure the financial future of both the business and personal assets.

Frequently Asked Questions

What is the biggest killer of wealth?

The biggest killer of wealth is excessive debt, particularly consumer debt for depreciating assets. High-interest payments on these “wants” rather than “needs” drain resources, reducing available capital for investment or savings and hindering your wealth’s potential growth.

What is the biggest secret to wealth?

The biggest secret to wealth is disciplined saving and investing. Consistently allocating a portion of your income to investments and maintaining a long-term perspective can compound your wealth over time. Living below your means further contributes to creating financial security and growth.

What is the smartest way to build wealth?

The best approach to accumulating wealth is long-term planning, strategic investing, and regular saving. Diversify investments, minimize debt, and regularly review financial goals to maximize returns. Adopting a disciplined approach to budgeting and investing ensures steady growth and financial security over time.

Conclusion

By managing cash flow variability, balancing business and personal finances, and optimizing taxes, entrepreneurs can create a solid financial foundation. Additionally, planning for retirement and succession, along with seeking professional guidance, helps them achieve their long-term goals.

Remember, wealth management is an ongoing process that requires continuous attention and adaptation. Taking proactive steps and seeking expert advice will help business owners navigate the complexities of their financial lives and build a prosperous future.